Why I Don’t Trade the News

Today’s article draws on my 14 years of personal trading experience. Over the course of my career, I’ve come to the conclusion that news trading and fundamental analysis are entirely unnecessary. Steering clear of news and economic indicators is a controversial stance in the trading world—some traders rely solely on fundamentals, others use a combination of technical and fundamental analysis, and some focus purely on technicals.

I am fully in the technical (price action) camp. I strongly believe that a market’s price action reflects all the information a trader needs. I don’t trade the news or rely on fundamental analysis, and I credit this approach as a significant factor in my trading success. This article shares my experience from analyzing and trading markets over the past 14 years and is aimed at helping you remove much of the unnecessary clutter that may be negatively impacting your trading every day.

Technical vs. Fundamental Trading

If you’re new to trading, the “technical vs. fundamental” debate can feel overwhelming. You’ll eventually need to make a decision because the sheer number of variables across technical and fundamental analysis is impossible to track—and more importantly, it’s unnecessary. Overloading yourself with this information can actually hinder your trading success.

After reading this article and exploring my other lessons on news trading, I hope you’ll critically evaluate what truly makes sense for your trading style. I firmly believe traders need to choose either technical or fundamental analysis—not both. Trading, perhaps more than any other profession, is prone to over-complication, and overthinking is what leads to poor trading decisions.

By eliminating news and fundamental analysis, you can clear much of the mental clutter that causes overthinking and over-complicating. This simplification allows for a cleaner, more focused approach to the market, reduces “stupid” trading mistakes, and lessens the temptation to overtrade. At the end of the day, everything that affects a market is ultimately reflected in its price action. Observing the charts over time will show you that price often moves ahead of news or acts independently of it—proving that the chart itself is all the information you really need.

Price Action Is a Leading Indicator

There’s a lot of chatter in the trading world about the so-called “Big Boys”—those who trade massive lot sizes or work for banks and large firms. While some of the hype is exaggerated, one thing is true: these traders often have access to information and market influence that smaller retail traders don’t. They can sometimes move the market and even act on information before it hits mainstream news outlets.

But here’s the key point: it doesn’t matter if the “Big Boys” see the news before you, at the same time, or after. Because of the size of their trades, they influence price action regardless. As a smaller trader, your edge comes from understanding what they’re doing—and the best way to do that is by reading price action.

At Learn To Trade The Market, we believe that price action is the most reliable way to analyze markets, define opportunities, and identify trade setups. Price dynamics—not world events like geopolitical conflicts—ultimately dictate where the market is headed. Financial media wants you to think otherwise, insisting there’s always a fundamental reason behind price movements. Entire industries thrive on making traders focus on economic reports and world news, but they often ignore the most critical factor: price action itself.

The reality is that major events are usually already priced in. The “Big Boys” anticipate these events and trade based on expectations, not the news itself. What really matters is how market participants perceive the impact of news, which is reflected in price action. By the time the news breaks, it’s often “old news,” and the market has already moved—hence the old Wall Street saying: “Buy the rumor, sell the fact.”

Price Action in Practice

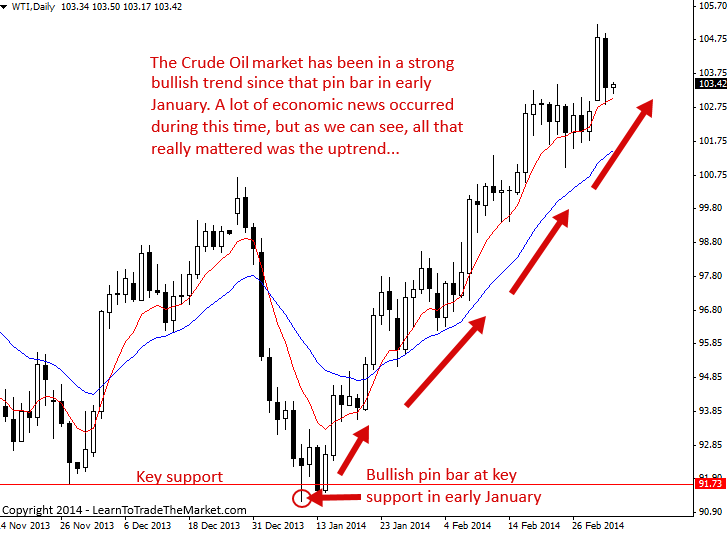

Recent examples illustrate why price action leads the news. Over the past two months, both Oil and Gold have demonstrated clear trends that preceded major news stories. For instance, during the geopolitical tensions between Russia and Ukraine over Crimea, both commodities were already trending higher before the story dominated headlines.

Similarly, the January Non-Farm Payrolls (NFP) report was forecast at 185k but came in at 113k. Conventional thinking would suggest that weaker jobs data is bearish for stocks and riskier currencies. Yet, the Dow and other indexes pushed higher afterward—another clear example of why the news often doesn’t matter.

Crude Oil: A Case Study

Since mid-January, Crude Oil has maintained a strong uptrend despite numerous global news events—both positive and negative. For a price action trader, the trend itself is what matters. Ignoring the news prevents second-guessing and allows you to trade confidently with the trend, rather than being distracted by media noise that often contradicts what the chart is already showing.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Gold – Continues Its Climb Despite News and Analyst Opinions

The gold market provides yet another clear example of why news often has little impact on price action. As shown in the chart below, gold has been on a strong bullish trajectory since December 31, 2013. Over the past two months, many economic reports and analysts’ opinions suggested a bearish outlook for gold, implying it should move lower. Yet, these predictions proved irrelevant. What truly drives the market is the perception of value among participants—particularly the major players. Over the last two months, they clearly viewed gold as undervalued, pushing it steadily higher.

Ignore the News to Avoid Two Common Trading Mistakes

Relying on news and fundamentals can lead traders into two major pitfalls:

1) Letting news sway your open positions

Whenever you’re in a trade, consuming news will inevitably influence your decisions, whether you realize it or not. Even if the price action and technical setup haven’t changed, reading contradictory news can tempt you to second-guess your trade. It’s a flawed assumption to think that a single news item can dictate market direction—markets are affected by thousands of variables at any given moment, and the few pieces of news you see are largely irrelevant.

The key is to stick to your trading method and plan. Intervening in trades based on news usually disrupts your strategy, and even if it occasionally works in your favor, it reinforces bad habits. The only valid reason to adjust a trade is if the underlying price action itself changes.

2) Letting news justify staying in a losing trade

News can also trick you into holding onto a bad trade longer than you should. Traders often search for reports or “supporting evidence” to convince themselves a failing trade will recover. This can lead to risky behaviors like moving stop losses further out, removing them entirely, or adding new positions as the market moves against you—all based on the hope that an “expert report” will save the trade. In reality, this almost always results in far larger losses than if you had ignored the news and followed your plan. Losses are part of trading, but trying to use news to avoid them usually makes matters worse.

In summary:

Eliminating news entirely from your trading routine prevents both of these mistakes. Make ignoring the news a conscious habit and a formal part of your trading plan. Otherwise, a “quick glance” at financial media can easily turn into an uncontrollable news obsession—the financial news is everywhere, after all.

Conclusion

Many of you may have experienced much of what I’ve discussed here, yet you might still feel unsure. That’s normal—sometimes in trading, as in life, you have to make a decision even without complete conviction. Successful traders are like people committed to fitness: sticking to a diet and exercise plan requires discipline and cutting out distractions—too many beers, fast food, laziness. Trading works the same way—you must remove unnecessary clutter. Trying to absorb and act on everything in the news will quickly destroy your trading account.

You may not fully agree with me yet, but trading requires a belief system—you can’t subscribe to everything. You have to decide how you want to operate as a trader.

Based on my experience, following both news and technicals inevitably leads to confusion and financial setbacks. I firmly believe that focusing on price action alone is far more effective than chasing fundamentals and news. A trader benefits more from analyzing a limited set of reliable data than from letting every piece of market information shape their decisions.

My hope is that today’s insights inspire you to make a real shift in your trading mindset. By focusing solely on price, you’ll clear mental clutter, reduce confusion, and make more disciplined decisions. It won’t be easy, but the next time you encounter financial TV or magazines, resist the urge to get sucked into unnecessary noise. To learn more about trading purely through price action and ignoring the news, check out my price action course for a deeper guide.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: