Trendlines can be powerful tools for trading when used correctly. In this post, I’ll share three highly effective trendline strategies with you.

Before diving in, keep in mind two essential principles for drawing and applying trendlines:

1. A valid trendline requires three touchpoints

You can connect any two points on a chart, but a trendline only becomes confirmed and active once a third touchpoint validates it.

2. Avoid cutting through candlestick bodies

It’s fine if your trendline crosses candlestick wicks, but it should never cut through the bodies.

If you want, I can also make it even more engaging for traders with a punchier, guide-style tone. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

The more touchpoints a trendline has, the stronger it becomes for employing a break-and-retest strategy. In the example below, the trendline shows at least 3–4 valid touchpoints. When the breakout occurred, the market experienced high volatility, causing the price to hover around the trendline for some time.

How early a trader enters a trade depends on their risk appetite. An aggressive trader might enter as soon as the price touches the trendline, while a more cautious trader may wait for the price to move away and show clear momentum in the trade’s direction.

There’s no absolute right or wrong—entry timing ultimately comes down to the individual trader’s style and preferences.

If you want, I can also condense it further into a punchy, easy-to-digest version for quick trading guides. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

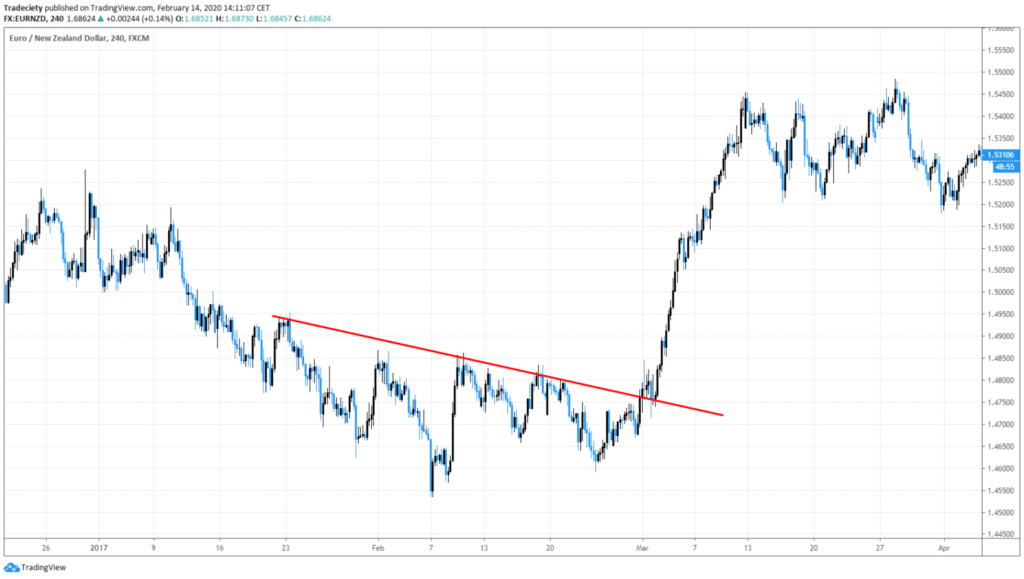

#2 Trendline Flag

While Break & Retest setups are often used for reversal trading or early trend-following, flag patterns fall under regular or late trend-following strategies.

When trading flags, you first identify an established trend and then wait for a period of consolidation or a pullback. If the pullback can be defined using a trendline, it becomes possible to trade the flag once the price breaks the trendline and resumes movement in the direction of the prevailing trend.

In the example below, the price was initially in a downtrend before pausing and forming a flag defined by the trendline. This pattern provides insights into market behavior: while the initial downtrend was strong with a rapid price decline, the subsequent bullish flag showed only weak buying interest. Comparing the intensity of the trend versus the flag helps assess the likelihood of a trendline break. In this case, the downtrend was much stronger than the bullish flag, indicating a higher probability of the trend continuing downward.

You can also overlay a longer-term moving average on your charts when trading flags. Using the 50-period MA, for example, helps identify the long-term trend, so traders focus only on flag patterns that suggest a continuation in that trend direction.

In the example below, the price was trading below the moving average, signaling a downtrend. The flag pattern represented a temporary pause, and the subsequent break of the trendline confirmed that the downtrend was resuming.Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

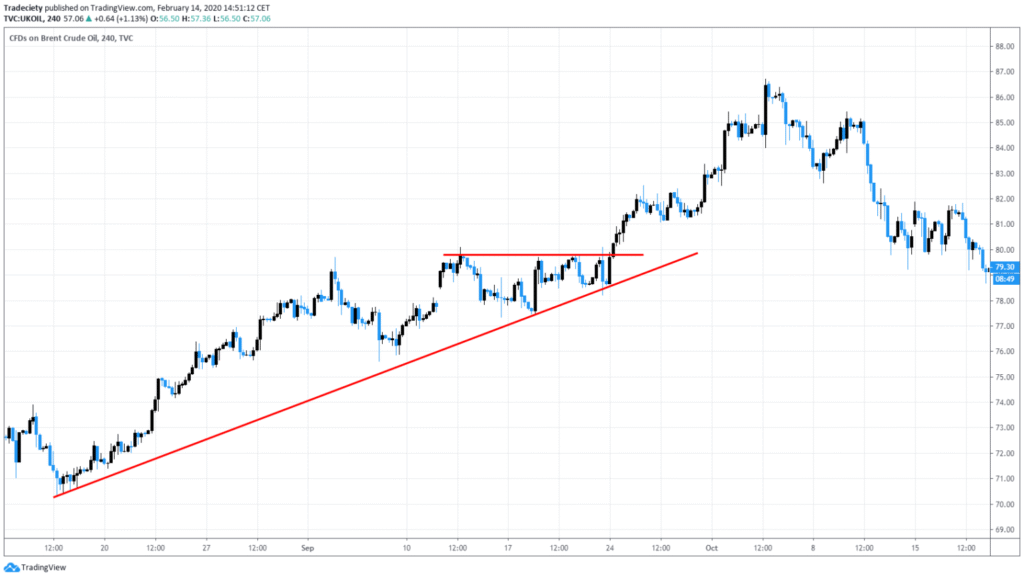

#3 Trendline Bounce

Trendline bounces are another form of trend-following strategy. Unlike flag patterns, here the trendline isn’t primarily used to time entries but to identify areas where it acts as support or resistance.

In the example below, the price bounced off the trendline for the third consecutive time, confirming its validity. Traders can then look for additional technical patterns around the bounce to time their entries. In this case, a horizontal resistance level formed near the trendline bounce, providing a reference point for trading after a breakout.

For this strategy, traders can choose their level of risk: a conservative approach might place the stop loss just below the trendline, while others may position it slightly below the resistance level.

As always, there’s no single “correct” approach—it depends on the trader’s risk tolerance. I’ve previously shared techniques for setting stop losses in detail.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Here’s a rephrased version of your text:

Trendline bounces can also be applied using a multi-timeframe approach. Once a long-term trendline is identified, as shown in the screenshot below, a trader can zoom into lower timeframes to fine-tune trade entries using other technical tools and concepts.

Next, we’ll examine the lower timeframe setups for the two trendline bounce scenarios highlighted with red arrows.

If you want, I can combine all your trendline strategy sections into a single cohesive guide with smooth transitions between multi-timeframe analysis, bounces, flags, and break & retest strategies. This makes it more reader-friendly. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

On the left, we observe the first bounce (first arrow). The price action here was quite messy, making it unlikely that a trade entry would have been taken.

On the right, the price formed a Head and Shoulders pattern, and by using an additional short-term trendline, a trader could have timed the entry more effectively.

A multi-timeframe approach can help traders enter trades earlier and potentially identify setups with a higher reward-to-risk ratio. That said, it’s also possible to trade the trendline bounce directly on the higher timeframe if a favorable candlestick pattern appears.

If you want, I can also rephrase the entire trendline strategy article so that all sections flow seamlessly and read like a professional guide. Do you want me to do that?

Trendlines can be valuable tools for traders, and many consider them more reliable than traditional horizontal support and resistance levels.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: