Gold’s history as a form of monetary value dates back over 5,000 years. In ancient times, it was used to mint coins, and even gold dust served as a means of payment. As global production increased, some nations adopted gold (Au) as a temporary national currency. Eventually, the gold standard emerged—linking the value of money to a fixed quantity of gold.

After the gold standard was abolished, gold’s role as a primary payment medium diminished, replaced by paper fiat currencies and, more recently, cryptocurrencies. Today, gold functions mainly as an investment asset—a safe-haven instrument used to diversify portfolios and hedge against market risks. In trading, gold (XAU) serves various purposes, including speculative trading, long-term investment, and reserve accumulation.

The key players in the global gold market include central banks, the IMF, commercial banks, stock exchanges, investment and exchange-traded funds, individual traders and investors, gold-producing companies, and industrial consumers.

Read on to learn how to trade spot gold prices and invest in gold markets for profit.

Topics Covered

- Gold Futures Markets

- Day Trading Gold

- Best Gold Trading Strategies

- Trading vs. Investing: Key Differences

- How to Trade Gold

- Example of a Forex Gold Trading Strategy

- Gold Trading Hours

- Pros and Cons of Gold Trading

- Regulation and Compliance

- Live Gold Futures Chart

- Choosing the Right Gold Broker

- Gold Trading FAQ

Gold Futures Markets

There are several ways to profit from trading gold. Physical gold is typically held for long-term investment, while gold futures contracts suit short-term trading strategies.

Gold futures are exchange-traded contracts between a buyer and a seller, allowing them to take a long or short position on gold at today’s price, for settlement at a future date. These contracts may be deliverable (involving actual metal delivery) or cash-settled (based on price differences).

If, by the contract’s expiry, gold prices rise, the buyer profits from having purchased it at a lower price. Conversely, if prices fall, the seller gains.

Besides futures, there are other derivatives tied to gold—such as options and spread bets—but futures trading remains the most widely used, offering high liquidity and simplicity. Traders can buy or sell futures before expiration, making them a versatile and efficient instrument in gold markets.

Would you like me to make it sound more academic/formal (for a report or paper) or more engaging and readable (for a website or blog)? I can adjust the tone accordingly.

Minimum Deposit Requirements for Gold Futures Trading

The minimum deposit required to enter the gold futures market varies depending on the type of contract, profit targets, and risk management strategy. A standard lot for trading gold on major exchanges—such as the London Metal Exchange (LME), New York Mercantile Exchange (NYMEX), or Shanghai Gold Exchange (SGE)—is 100 ounces.

To open a minimum position of 0.001 lots, traders typically need around $2,000 USD. However, this figure does not include additional funds that should be reserved to cover potential losses.

While leveraged trading can be used to increase exposure, leverage on stock and commodity exchanges is generally lower than in Forex trading—averaging around 1:20.

For traders seeking a lower entry threshold, E-Mini contracts offer an attractive alternative. These represent 0.1 of a standard lot, yet the minimum deposit requirement for trading gold futures usually remains in the $1,000–$2,000 USD range.

Day Trading Gold

Before delving into the specifics of intraday gold trading, it’s important to understand the difference between a full lot in Forex currency pairs and a full lot in the XAU/USD pair. Knowing how a Forex broker calculates tick value and tick movement allows traders to estimate potential daily profits based on the average size of daily candlesticks.

In Forex trading, the gold price (XAU/USD) shown on trading platforms or technical analysis charts represents the price per troy ounce of gold.

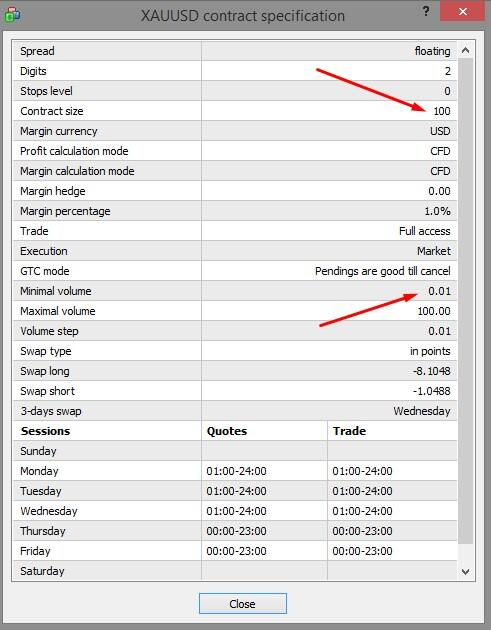

One troy ounce equals 31.1 grams, and one standard lot corresponds to 100 troy ounces. The minimum trade size in Forex is typically 0.01 lots. All this information is available in the contract specifications of your trading platform.

To view the gold (precious metal) contract specifications in MetaTrader 4 (MT4), follow these steps:

- Click on the View menu and select Symbols.

- Find the XAU/USD pair and click Show.

- Go back to the View menu and select Market Watch.

- Right-click on the XAU/USD pair and choose Specification to view the contract details.

Would you like me to make it sound a bit more technical (for a trading manual) or more beginner-friendly (for an educational guide)?

How to Calculate the Gold Pip Value in Forex

To determine the pip value of gold (XAU/USD) in Forex trading, follow these steps:

- Check the contract size: According to the contract specifications, one standard lot equals 100 troy ounces.

- Identify the pip size: Gold quotes typically have two decimal places. Therefore, 1 pip = 0.01.

- Calculate the pip value: 100 (contract size)×0.01 (pip size)=1 USD100 \text{ (contract size)} \times 0.01 \text{ (pip size)} = 1 \text{ USD}100 (contract size)×0.01 (pip size)=1 USD Thus, a 1-pip movement in the gold price equals $1 USD per standard lot.

For example, if you buy 0.01 lots (1 troy ounce) of gold at $1,800, and the price rises to $1,805.35, the move equals 535 pips.

At 0.01 lots, each pip is worth $0.01, resulting in a $5.35 profit. For a full lot, this translates to a $535 profit.

Comparing XAU/USD and Currency Pairs

For reference, the EUR/USD pip value is calculated as:100,000 (contract size)×0.00001=1 USD100,000 \text{ (contract size)} \times 0.00001 = 1 \text{ USD}100,000 (contract size)×0.00001=1 USD

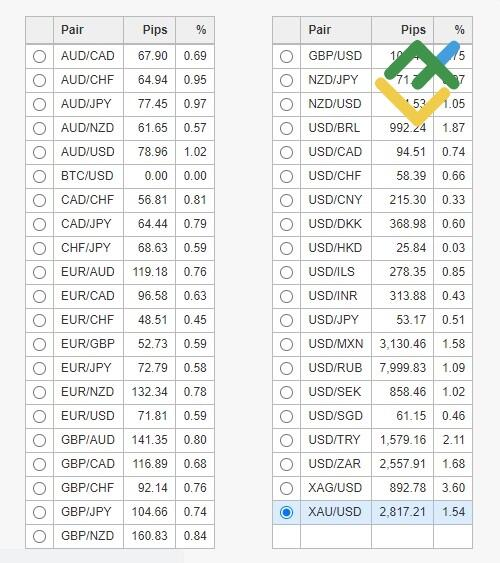

The average daily range for XAU/USD in a calm market is 1,000–1,500 pips, while for EUR/USD it is 800–1,000 pips. However, note that the spread (difference between bid and ask prices) is typically higher for XAU/USD.

Key Takeaways:

- Volatility: XAU/USD’s intraday volatility is comparable to that of currency pairs when gold markets are stable and not affected by major news.

- Scalping: Gold shows relatively low volatility on one-minute charts, making it less suitable for scalping. However, it generally exhibits stronger and more consistent trends with fewer intraday reversals.

- Day Trading: Trading gold on H1–H4 timeframes can yield profits similar to Forex trading. Still, gold is highly sensitive to fundamental factors, and its daily range can expand to 2,500–3,000 points, sometimes moving sharply against open positions.

Recommendations for Trading XAU/USD

- Trade with the trend: Enter positions in the direction of the prevailing daily trend, ideally near the beginning of the trading day. If two or three consecutive daily candles show the same color, the hourly chart often reveals a continuing trend.

- Follow fundamentals: Identify major market drivers and avoid exiting trades prematurely during minor corrections.

- Watch correlated assets: Gold often moves in tandem with silver and platinum, and shows positive correlation with oil and negative correlation with the USD. Tools like the gold–silver ratio can help develop correlation-based trading strategies.

Best Gold Trading Strategies

Every trading plan should start with a clear objective. A gold trading strategy is built around your financial goals, risk tolerance, and investment horizon. Define the following:

- Target profit: Set realistic goals, preferably as a percentage of your total deposit. Compare it to the average annual return of gold to gauge feasibility.

- Investment amount: Decide how much capital you are willing to allocate.

- Investment duration: Determine whether you prefer short-term trading for liquidity or long-term investing with reduced access to funds.

- Trading style: Choose between active trading (your main activity) or passive investment.

- Risk level: Align your risk exposure with your chosen strategy.

For long-term investments, Mutual Funds and ETFs are appropriate options. For a management fee of up to 0.5%, professionals handle the investment on your behalf.

For short-term opportunities, consider futures contracts or CFDs in the Forex market.

Active Trading Strategies

Scalping

Scalping is seldom used for gold (XAU/USD) due to its relatively low short-term volatility. While this approach is effective for highly liquid currency pairs, gold’s brief price fluctuations can be unpredictable. Nevertheless, some traders employ scalping during major economic announcements, when volatility spikes and short-term opportunities emerge.

Would you like me to reformat this into a sectioned article layout (with clear headers, bullet points, and examples) suitable for publishing on a trading education website or blog?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Medium- and Long-Term Strategies

Medium- and long-term gold trading strategies involve holding XAU/USD positions for several days to several weeks. This approach performs best in strongly trending markets, where price movements are more predictable.

One disadvantage, however, is the accumulation of swap fees (overnight financing costs), particularly when trading large volumes. These charges can gradually erode profits. Despite this, medium- and long-term trading remains a suitable choice for investors who prefer a less active, hands-off approach while maintaining market exposure.

Indicator-Based Strategies

Indicator-based strategies for XAU/USD rely heavily on technical analysis tools.

- ATR (Average True Range) helps measure market volatility.

- Oscillators such as RSI and Stochastic are used to identify overbought or oversold zones and potential entry points.

These strategies are versatile, working effectively for both intraday and swing trading setups. They provide structured signals, helping traders make data-driven decisions.

Price Action Strategy

Price Action trading is highly effective with XAU/USD because gold tends to exhibit smooth, well-defined price movements and clear support and resistance levels. Patterns like flags, triangles, and pennants often form during trend continuation phases.

While technical indicators may serve as confirmation tools, Price Action trading primarily depends on visual chart interpretation—identifying market structure, momentum, and candlestick behavior.

Fundamental Analysis-Based Trading

Trading gold using fundamental analysis focuses on macroeconomic and geopolitical influences. Gold prices react strongly to economic data, central bank policies, and investor sentiment.

- A rally in equity markets often decreases demand for gold.

- Concerns about recession, inflation, or geopolitical tension typically increase gold’s appeal as a safe-haven asset.

Fundamental traders monitor correlations between gold and major currencies, indices, and commodities. The Market Sentiment Indicator can also be used to assess overall investor mood and potential turning points.

Social Trading

Social trading allows traders to participate in XAU/USD markets even without prior experience. Through copy-trading platforms, you can automatically mirror the trades of experienced professionals.

This method is ideal for those seeking passive income or wishing to learn from others’ strategies. When selecting a trader to follow, consider their track record with gold, risk tolerance, and long-term performance.

5-Minute Gold Trading Strategy

The 5-minute XAU/USD strategy targets quick, small-scale price movements within a short time frame. It relies on candlestick pattern recognition, breakout levels, and rapid signals from EMA and RSI indicators.

This approach requires focus, discipline, and quick execution, making it best suited for high-volatility periods, such as during major economic announcements.

Gold and U.S. Dollar Inverse Correlation Strategy

Gold (XAU/USD) and the U.S. dollar (USD) typically move in opposite directions—a stronger dollar tends to push gold prices down, and vice versa.

A strategy built around this inverse correlation involves monitoring the U.S. Dollar Index (DXY), interest rates, and key U.S. economic data. By analyzing these factors, traders can better anticipate price reversals and entry opportunities, particularly during times of monetary policy changes or currency market instability.

Moving Average Crossover Strategy (Short-Term)

The moving average crossover strategy is a popular short-term trading approach for XAU/USD. It uses two moving averages—one short-term (e.g., 9-period) and one long-term (e.g., 21-period).

- When the short-term MA crosses above the long-term MA, it signals a potential buy opportunity.

- When it crosses below, it may indicate a sell signal.

This strategy works best in trending markets and helps traders avoid false entries during sideways or ranging conditions.

Key Characteristics of XAU/USD Trading

- Strong fundamental influence: Gold is highly sensitive to Federal Reserve policy, global economic trends, geopolitical tensions, and macroeconomic statistics, all of which can trigger new market trends.

- Moderate long-term risk: Compared to currency pairs, gold generally carries lower long-term investment risk.

- High liquidity: Gold offers excellent liquidity across most trading instruments. Physical gold is an exception but can still be liquidated quickly, albeit with a higher margin cost.

When to Buy Gold

Unlike currency pairs that are tied to specific trading sessions, gold is traded continuously. For example, EUR/USD typically shows the highest volatility during the European session, with reduced activity during the Asian session.

In contrast, XAU/USD trading volumes remain steady across all sessions, making gold a flexible instrument suitable for traders around the clock.

Would you like me to make this version sound more academic and formal (for a financial publication) or more conversational and accessible (for a trading blog or guide)?

Seasonal Patterns in Gold Prices

Some studies based on statistical data since 1975 suggest a seasonal trend in gold spot prices. According to this analysis, gold (Au) typically reaches its lowest price in March, while the highest prices are often observed in January and September.

From this, we can infer that March is generally the best time to buy gold (open long positions), whereas September tends to be the optimal time to sell.

Technical Analysis Signals

Key technical analysis indicators can help identify favorable entry and exit points for gold trading:

- Moving Average Crossovers: When a fast-moving average (MA) crosses above a slower one, it indicates a potential uptrend.

- Trend Indicators: Tools such as ADX and Alligator help confirm trend strength and direction.

- Volatility and Oscillators: Use the ATR (Average True Range) to assess volatility and oscillators like RSI or Stochastic to identify overbought or oversold zones.

- Breakouts of Key Levels: Pay attention to breakouts of support and resistance zones, Fibonacci retracement levels, and chart patterns like flags, triangles, or channels.

(For more details, see the guide “What Is Fibonacci Retracement? How to Trade Gold Online Using This Indicator.”)

These examples illustrate some of the most common signals used to determine when to enter long or short positions on gold. In general, technical analysis for XAU/USD works much like it does for currency pairs—the main task is to adjust your trading strategy and indicator settings for gold’s unique behavior.

Fundamental Analysis Signals

Gold is highly responsive to macroeconomic conditions, market sentiment, and global events. Key factors include:

- Global Economic Trends:

Periods of economic stagnation or crisis usually boost gold prices, as investors seek safe-haven assets. For instance, during the COVID-19 pandemic in early 2020, fears of a global GDP decline and falling corporate profits drove gold to new all-time highs. However, by August 2020, optimism surrounding vaccine development led investors back to equities, and gold prices dropped over 10%. - Macroeconomic Data:

Short-term movements often depend on economic reports—such as inflation rates, industrial output, and GDP forecasts. Positive data tends to reduce demand for gold as investors move funds back into riskier assets. - Market Corrections:

A decline in gold prices can present a buying opportunity, as the metal historically tends to recover over time. The key is to endure short-term drawdowns until prices rebound.

It’s important to note that fundamental signals don’t always align with market movements. For example, the sharp gold price drop in 2013—the steepest in 30 years—was driven by unexpected events:

- Economic instability in India, one of the world’s largest gold consumers.

- The Cyprus financial crisis, which exposed the risks of government bond investments.

These developments triggered a panic withdrawal from gold ETFs, accelerating the sell-off as investors opted for cash rather than safe-haven assets.

Is It Time to Buy Gold Now?

If XAU/USD has pulled back significantly from its all-time highs, it may present a favorable buying opportunity. Historically, such retracements have often preceded renewed upward trends.

How to Buy Gold

There are several ways to invest in gold, depending on your risk tolerance and goals:

- Physical Gold:

You can buy certified gold bars or coins only through licensed banks, which provide documentation confirming authenticity, fineness, and weight. - Gold Without Delivery:

Some specialized companies offer gold purchases stored securely in their own depositories. However, this carries custodial and counterparty risks. - Gold Certificates and Deposits:

Certain banks issue gold certificates or gold-backed deposit accounts, offering a safer alternative to holding physical metal. - Gold CFDs (Contracts for Difference):

The most accessible way to trade gold with low risk and minimal capital is through CFDs. You don’t own the physical asset, but you can buy or sell positions instantly with a few clicks.

How to Trade Gold on the LiteFinance Platform

To start trading XAU/USD on LiteFinance, follow these steps:

- Open an Account:

Navigate to TRADE FOREX → ACCOUNT TYPES.

Choose an ECN account for the lowest spreads. A minimum deposit of $50 with 1:100 leverage is sufficient to trade a minimum lot of 0.01. - Verify Your Account:

Complete the verification process to activate live trading. Alternatively, you can test strategies on a demo account without registration or verification. - Access the Trading Terminal:

Open the platform and select the XAU/USD pair under the Metals tab to begin trading.

Would you like me to make this version more SEO-optimized (for web publication) or more formal and concise (for a financial report or eBook)?

- Analyze the Gold Price Chart

Look for the following signals before entering a trade:

- Oscillator signals: The oscillator lines enter the oversold zone, then reverse and begin moving back toward the mid-range, indicating a potential upward correction.

- Trend confirmation: Trend indicators and charting tools confirm that the price is moving in the desired direction.

- Breakout signal: The gold price breaks out of a flat (sideways) channel, suggesting the start of a new trend.

- Reversal candlestick patterns: Patterns such as Engulfing, Pin Bar, or other reversal formations appear on the chart, signaling a possible trend change.

Example: After a short-term uptrend, gold enters a consolidation phase, forming a horizontal price channel that highlights the range before the next breakout.

Would you like me to make this version more technical (for a trading manual) or more reader-friendly (for a blog or tutorial)?

Channel Breakouts and Trend Reversals

A breakout above a horizontal channel typically signals the beginning of an uptrend. The breakout candlestick—and the one that follows at the start of the new trend—should have larger bodies than the candles formed during the previous sideways movement. This indicates strong buying momentum.

The end of an uptrend is often confirmed by a bearish Engulfing pattern, where the body of a falling candlestick completely engulfs the previous bullish one. After this, a Doji candlestick may appear, reflecting market indecision and the balance of power between buyers and sellers. The next red (bearish) candle following the Doji serves as confirmation of a trend reversal.

Long-Term Gold Investment Perspective

Gold can be considered a safe long-term investment when viewed over a 10–15 year horizon. On daily charts, however, price movements fluctuate in both directions, making short-term trading more volatile. To trade effectively, it’s essential to identify strong trends or profit from trend reversals—provided that the spread size allows it.

Keep in mind that day trading gold carries higher risks than long-term investing.

Gold Buying Tips

- Follow the trend and market sentiment: Always align trades with the prevailing direction of the gold market.

- Monitor spreads and swap rates: In CFD trading, medium-term positions can be less profitable due to overnight swap charges—unless a strong trend has been identified.

- Track global fundamentals: Macroeconomic or geopolitical events, including crises or unexpected developments, can drive sharp short-term price increases.

When to Sell Gold

1. Long-Term Investing Signals

Sell gold when:

- The price has broken through a previous all-time high, but momentum is slowing.

- Economic indicators suggest lower inflation, GDP growth, and a resolution of geopolitical tensions that previously supported gold’s rise.

- A price reversal exceeding 2–3% confirms weakening momentum.

2. Short-Term Trading Signals

Exit or consider selling when:

- The fundamental driver of the recent rally has lost strength.

- Candlestick bodies shrink and the price starts to move sideways after an uptrend.

- Reversal candlestick patterns (e.g., Engulfing, Shooting Star) appear.

- Oscillators cross the mid-range (0–100) and move toward the overbought zone.

- The price reaches a strong resistance level.

For long-term and fundamentally driven positions, rely on market forecasts, correlated assets, and tools like the Market Sentiment Indicator, which reflects majority trader positioning.

Using Trailing Stops to Manage Trades

A trailing stop is an effective exit strategy for protecting profits.

- When the price breaks out of a flat range and moves in your favor, open a position in the trend direction.

- Once the minimum profit target is reached, close half of the position and protect the remainder with a trailing stop.

- The trailing stop distance can be set using the ATR (Average True Range) to match current volatility or placed below the recent swing low or support level.

If you miss the reversal point and your position shows a drawdown exceeding 20%, avoid closing it hastily. Considering that gold’s average annual return is around 5–15%, patience often pays off—prices may eventually return to previous highs.

Trading vs. Investing in Gold

Trading involves active speculation through frequent buy and sell transactions, sometimes several times per day. Longer-term trading strategies may hold positions for a few days or weeks.

Investing, on the other hand, means buying gold for the long term—typically 5 to 10 years or more—to preserve wealth and protect against inflation, while also seeking steady appreciation.

Advantages and Disadvantages of Trading

| Advantages | Disadvantages |

|---|---|

| Ability to profit from price movements in both directions. | Higher commission costs due to frequent trading. |

| Potentially profitable when based on solid fundamental analysis. | Low short-term volatility limits opportunities; scalping is often ineffective. |

| Wide choice of instruments, including gold CFDs, options, futures, and spread bets. |

Advantages and Disadvantages of Investing

| Advantages | Disadvantages |

|---|---|

| Minimal need for technical or fundamental analysis and less time commitment. | Funds are tied up for long periods. |

| Long-term profit potential — historically, gold tends to rise to new highs after corrections. | Limited investment options; CFDs and futures are less suitable due to fees and swaps. |

| Lower intermediary risk — physical gold stored at home or in a custodian bank has minimal counterparty risk. | Higher storage and insurance costs. |

| Relatively lower yield compared to riskier assets. |

Both methods offer unique benefits and drawbacks. The optimal choice depends on your risk tolerance, investment horizon, and profitability goals.

Comparing Gold Investment Options

| Instrument | Type | Complexity (1–easy, 3–hard) | Storage Costs | Management Costs | Exchange Fees / Commissions | Entry Price (1–low, 3–high) | Leverage | Regulated |

|---|---|---|---|---|---|---|---|---|

| Gold Bullion | Investing | 1 | Yes | No | No | 2 | No | No |

| ETFs | Investing & Trading | 3 | No | Yes | Yes | 3 | No | Yes |

| CFDs | Trading | 2 | No | No | Yes | 1 | Yes | Yes |

Notes:

- ETFs can serve both trading and investing purposes. While some funds are designed for long-term investors, others are used for short-term speculative trading.

- Complexity reflects the required time, experience, and understanding of financial instruments.

- Storage costs apply to physical gold; depository fees are included in exchange trading costs.

- Management costs represent the commission charged by the fund management company.

For more details, refer to the article “How to Invest in Gold Markets.”

How to Trade Gold

There are two main ways to trade gold — on exchange markets or in over-the-counter (OTC) environments.

Over-the-Counter (OTC) Trading

OTC or off-exchange gold trading includes:

- Forex gold CFDs

- Binary gold options

- Gold deposits or physical metal purchases through banks

In OTC markets, trades are made without physical delivery. A well-known example is the OTC London Market.

Exchange Trading

The exchange gold market offers a wider variety of instruments:

- Gold futures and options, which can be deliverable (physical gold) or cash-settled at contract expiration.

- Exchange-Traded Funds (ETFs) that invest partially or entirely in gold.

- Shares of gold mining and refining companies (e.g., Barrick Gold Corporation).

Would you like me to make this version SEO-optimized for web publication (using headings, keywords, and meta-friendly phrasing) or formatted for a print or PDF trading guide (with formal structure and concise style)?

Let’s take a closer look at the main ways to invest and trade gold, along with their respective advantages and drawbacks.

How to Trade Gold Bullion

Individual investors have several options when it comes to investing in physical gold (bullion):

- Buying Gold Bars from a Bank

- Pros: Security and authenticity are guaranteed when purchasing from a licensed bank.

- Cons: The markup on physical gold sales can be as high as 20%, and proper storage conditions are required. In addition, many countries impose luxury taxes or VAT on gold purchases.

- Purchasing Investment Gold Coins

- Pros: Gold coins can appreciate not only with the price of gold but also due to collectible (numismatic) value.

- Cons: Not all coins rise in value quickly, and the markup can range from 15% to 30%. Buying coins on the secondary market involves greater risks, as investors must independently verify their authenticity and condition.

- Opening a Bank Gold Deposit

There are two main types:- Physical gold deposit: You deposit physical gold and receive interest payments in cash.

- Gold-linked cash deposit: You deposit money tied to the current gold price.

- Pros: Gold is securely stored by the bank.

- Cons: In most cases, these deposits are not covered by insurance in the event of bank insolvency.

- Buying Gold Jewelry

- Pros: Combines investment with personal use — jewelry has aesthetic value and may appreciate as gold prices rise.

- Cons: Jewelry is often bought back at scrap prices, leading to potential losses of up to 50% due to high retail markups and craftsmanship costs.

- Purchasing Physical Commodity Futures Contracts

- Pros: Allows direct participation in the exchange gold market with the option of physical delivery.

- Cons: Due to minimum delivery volumes, transport, and storage expenses, this method is typically suitable only for companies or manufacturers that use gold as a raw material.

Who Should Invest in Physical Gold?

Investing in physical gold is most appealing to long-term investors who prefer stability over active trading. It’s best suited for those planning to hold their investment for 10 years or longer, aiming to preserve capital and hedge against inflation rather than seeking quick speculative profits.

Would you like me to continue rephrasing the next section — for example, about ETFs or gold CFDs — in the same professional style and structure?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

CFDs (Contracts for Difference) are off-exchange financial instruments that allow traders to speculate on the price movements of gold without owning the physical asset. When trading XAU/USD CFDs, an investor can:

- Buy (go long) a contract and sell it later at a higher price.

- Sell (go short) at the current price and profit when the price declines.

CFD trading is typically available through Forex brokers rather than traditional exchanges.

Advantages of Trading XAU/USD CFDs

- Low entry threshold: You can start trading with as little as $50–$100, much lower than the margin required on the exchange market.

- Minimal fees: You only pay for the spread and swap—there are no exchange or custody fees, and you don’t need Qualified Investor status.

- High liquidity: Trades can be opened and closed anytime from anywhere with an internet connection.

Trading gold CFDs is an accessible option for traders with limited capital but strong analytical skills and the willingness to engage in active trading. However, CFDs are high-risk instruments, and it’s important to understand the potential for significant losses.

Steps to Trade XAU/USD CFDs:

- Choose a reliable broker, open an account, and complete verification.

- Fund your account with at least the minimum deposit (some brokers offer cent accounts for beginners).

- Review trading conditions — leverage options, minimum trade size, and contract specifications.

- Analyze the gold chart, place your trades, and manage your positions effectively.

How to Trade Gold Options

Gold options, including binary options, involve predicting whether the price of gold will rise or fall by the time the option expires.

- If your prediction is correct, profits range from 50% to 90% of the invested amount.

- If the prediction is wrong, you lose the full amount invested.

Advantages of Trading Binary Gold Options:

- Simplicity: You only need to forecast whether the price will go up or down by expiration. If you identify the start of a trend correctly, your chances of success are very high.

- No stop-losses or spreads: There’s no need for ongoing position management.

- Fast returns: Turbo options can yield results in as little as 60 seconds.

- High potential profitability: Advanced options like “Ladder,” “One Touch,” or “Range” can offer returns exceeding 100%.

Binary options are often seen as an entry-level tool for beginners due to their straightforward structure.

How to Trade Gold Options:

- Select a binary options broker, register, and verify your account.

- Perform technical and fundamental analysis on XAU/USD across multiple timeframes.

- Open a gold option trade: Set the expiration time, investment amount, and direction (higher/lower).

- Some brokers also allow early option closing to manage risk.

How to Trade Gold ETFs

An ETF (Exchange-Traded Fund) is a fund that invests in specific assets—such as stocks, commodities, or indices—and issues shares that trade on exchanges like regular stocks.

Gold ETFs invest either fully or partially in gold assets, including physical gold, gold futures, or related securities. When you buy ETF shares, you effectively invest in gold indirectly. While ETF prices don’t always move identically to XAU/USD or futures, they generally follow the same overall trend.

Advantages of Investing in Gold ETFs:

- Built-in diversification: ETFs are managed portfolios that automatically balance their holdings, so you don’t need to do it manually.

- Professional management: The fund’s managers handle rebalancing and asset allocation.

Disadvantages:

- Higher entry barrier: Typically requires an investment of $1,000 or more and, in some cases, Qualified Investor status.

- Tax implications: In some countries, ETFs that invest in physical gold are subject to a “luxury tax” or higher tax rates of 25–30%, compared to 15–20% for other investment types.

Example: SPDR Gold Shares (GLD)

The world’s largest gold ETF, SPDR Gold Shares, was established in 2004. Its holdings are 100% backed by physical gold bars, totaling over 1,230 tons, stored primarily in London. The fund charges a 0.4% annual management fee.

Would you like me to continue with the next section — e.g., “How to Trade Gold Stocks or Mining Companies” — in the same clear and professional format?

Other notable gold ETFs include iShares COMEX Gold Trust and iShares MSCI Global Gold Miners ETF.

How to Invest in ETFs

- Choose a broker that provides access to the exchange where gold ETF shares are traded.

- Review trading terms carefully: the process for buying and selling securities, brokerage and depository fees, exchange commissions, minimum investment requirements, etc. Lists of major ETFs can be found on analytical platforms like Investing.com.

- Purchase the ETF shares through your broker’s platform.

Investing in gold ETFs is generally best suited for professional investors with capital of $1,000 or more.

How to Trade Gold Stocks

An alternative to investing directly in gold or gold derivatives is to buy shares in gold mining companies. The logic is simple: when gold prices rise, the profits of gold mining companies increase, often resulting in a rise in their stock prices.

Advantages:

- Potential to earn dividends if the company distributes profits.

- Possibility to buy shares at a relatively low price, reducing the minimum transaction volume.

- Higher volatility compared to direct gold trading instruments, which can offer short-term profit opportunities.

Disadvantages:

- Significant risk of company bankruptcy.

- Exposure to microeconomic factors such as management errors, internal conflicts, or weak competitive positions, which can negatively impact stock prices.

Examples of Gold Mining Companies:

- Newmont Goldcorp

- Barrick Gold

- AngloGold Ashanti

LiteFinance: How to Trade Gold Stocks

Trading shares of gold mining companies can be a useful method for diversifying risk, particularly for professional investors with sufficient capital to access the exchange markets.

Example Forex Gold Trading Strategy

This strategy combines fundamental analysis with technical tools. Since XAUUSD is generally less volatile than currency pairs, it is easier to identify consolidation zones, support, and resistance levels on the chart.

- Analyze the daily chart:

If you want, I can also rephrase the following sections about technical analysis and step-by-step trading strategies so it flows seamlessly with this professional style. Do you want me to do that?

In August 2020, the XAUUSD price reached its peak amid the pandemic. However, as coronavirus cases gradually declined and news of vaccine development emerged, investors regained confidence and began withdrawing funds from safe-haven assets, including gold. The daily chart now displays a clear long-term downtrend, marked by five successive highs, along with a horizontal channel.

During May-June, gold prices moved sideways within this channel. Currently, a similar pattern is forming: the price bounced off the channel’s lower boundary, moved upward, and then reversed downward from the upper boundary, suggesting a likely continuation of the downward trend.

Gold Trading Strategy Variations:

- Daily Chart Short Position:

- Open a short trade on the daily chart with a take-profit target at the support level.

- Expected holding period: 7–10 days.

- H1 Chart Short Trade:

- Switch to the H1 chart to identify the start of the intraday downtrend.

- Enter a short trade for a few hours and close it before swap charges apply.

When the short position was opened (29 March 2021), the news background was neutral. According to the economic calendar, no major events are expected to significantly impact the daily gold price in the coming week. Therefore, the daily downtrend is likely to continue toward the support level, though intraday fluctuations in both directions are possible.

XAUUSD real-time price chart in the Forex market:

If you want, I can also rephrase this to make it even more concise and strategy-focused for traders, highlighting actionable steps. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Gold Trading Hours

The global exchange market operates 24/7, with trading sessions in different regions overlapping. When one exchange closes, another is already open, ensuring continuous trading. However, trading activity levels vary depending on the active session. Below is an overview of the main exchanges where gold and related instruments are traded online:

- London, UK: 08:00 – 17:00 GMT

- New York, USA: 13:20 – 18:30 GMT

- Mumbai, India: 04:30 – 18:00 GMT

- Dubai, UAE: 04:30 – 07:30 GMT

- Jakarta, Indonesia: 02:30 – 10:30 GMT

- Islamabad, Pakistan: 05:00 – 13:00 GMT

These schedules serve as a reference for strategy development, helping traders identify periods of high and low market activity. Note that trading hours can change due to daylight saving time adjustments, national holidays, and exchanges remain closed on weekends.

If you want, I can also create a clear visual timetable for gold trading sessions, which makes it easier to see overlapping hours. Do you want me to do that?

Pros and Cons of Gold Trading

Pros:

- Gold retains its value over time, supported by consistent demand from the production sector.

- Over the long term, gold prices generally trend upward, often influenced by inflation. As fiat currencies lose value relative to commodities, gold remains a popular asset.

- The XAUUSD trend is relatively predictable using fundamental analysis. During periods of economic uncertainty—when stock markets stagnate, inflation exceeds forecasts, or global GDP declines—XAUUSD tends to increase in value.

Cons:

- Short-term volatility is relatively low. XAUUSD is less suitable for scalping or intraday strategies because minute-to-minute and daily movements are smaller and slower than those of currency pairs.

- To achieve higher returns, traders often need to take on more risk by increasing leverage due to low volatility.

- Long-term returns can be modest. The average annual return on XAUUSD over the past 20 years was 25.85%, while returns over the last 5 years were around 6% per year. Between 2013 and 2020, the yield was negative.

Despite these drawbacks compared with currencies and stocks, gold remains a safe-haven asset that helps balance portfolio risks and protect retail investor accounts.

Gold Trading Advice

- Active traders: Use currencies and stocks as primary assets. Include XAUUSD (gold stocks, futures, or ETFs) at 10–15% of your portfolio to diversify risks and hedge against market downturns.

- Short-term traders: Focus on fundamental analysis. Enter trades at the start of trending movements triggered by key news and exit at the next visible reversal.

- Traders with significant capital: Explore derivatives markets and invest in ETFs.

- Traders with small capital: Open a Forex account and trade gold CFDs to take advantage of low commissions and real market liquidity.

- Long-term investors: Consider physical gold, such as bullion, with a 10–15 year investment horizon.

- Short-term, inexperienced investors: Invest in diversified mutual funds or start with a demo account to gain experience before committing real money.

Regulation of Gold Trading

Regulatory structures vary by country, mainly in the hierarchy of authorities, their connection to central banks, and requirements for brokers and individual traders.

- USA: The Securities and Exchange Commission (SEC) is the primary regulator of financial exchanges. It has authority to initiate legal proceedings independently. The SEC is considered one of the strictest regulators globally; non-residents can access the US stock market only through sub-brokers or subsidiaries. CFD trading is heavily restricted in the US.

- United Kingdom: Gold trading is regulated by the Financial Conduct Authority (FCA). Brokers holding an FCA license undergo annual independent audits, submit financial statements, and maintain required capital levels.

Gold Futures Overview

The XAUUSD began a rapid upward trend in the early 2000s. Over the past 20 years, gold has delivered a cumulative return of 530%, despite experiencing significant drawdowns during the period.

If you want, I can also condense this into a concise “guide” format with clear bullet points for pros, cons, trading strategies, and regulation—it will be easier for readers to scan quickly. Do you want me to do that?

Gold Price Trends and Yearly Returns

The table below illustrates the historical price trends of gold and the year-over-year changes in value:

| Date | Price (USD per troy ounce) | Yearly Change (%) |

|---|---|---|

| 01.01.2000 | 283.20 | – |

| 01.01.2001 | 265.60 | -6.21 |

| 01.01.2002 | 282.10 | 6.21 |

| 01.01.2003 | 368.30 | 30.56 |

| 01.01.2004 | 402.20 | 9.20 |

| 01.01.2005 | 421.80 | 4.87 |

| 01.01.2006 | 570.80 | 35.32 |

| 01.01.2007 | 652.00 | 14.22 |

| 01.01.2008 | 922.70 | 41.52 |

| 01.01.2009 | 927.30 | 0.49 |

| 01.01.2010 | 1083.00 | 16.79 |

| 01.01.2011 | 1333.80 | 23.16 |

| 01.01.2012 | 1737.80 | 30.29 |

| 01.01.2013 | 1660.60 | -4.44 |

| 01.01.2014 | 1240.10 | -25.32 |

| 01.01.2015 | 1384.60 | 11.65 |

| 01.01.2016 | 1161.90 | -16.08 |

| 01.01.2017 | 1291.80 | 11.18 |

| 01.01.2018 | 1439.40 | 11.43 |

| 01.01.2019 | 1384.00 | -3.85 |

| 01.01.2020 | 1618.00 | 16.91 |

| 01.01.2021 | 1850.30 | 14.36 |

| 01.01.2022 | 1820.10 | -1.63 |

| 01.01.2023 | 1920.00 | 5.49 |

| 01.01.2024 | 2060.50 | 7.31 |

| 01.01.2025 | 2340.00 | 13.57 |

- All-time high: XAU/USD reached $4379.22 per troy ounce on 17.10.2025, significantly above the prices listed above.

- Current gold rate (real time): $3971.08 per ounce

XAUUSD Current Forex Rates:

- Sell: 3979.56 USD

- Buy: 3979.78 USD

- Market sentiment: 58.9%

- 1-day change: -1.14 (-45.91%)

Live Gold Price Chart:

The XAUUSD price chart can be viewed online in real time for the most up-to-date trading information.

If you want, I can also reformat this into a concise visual summary with a chart-ready version for easier reading and presentation. Do you want me to do that?

Choosing the Right Broker for Gold Trading

Individual traders usually cannot access international financial markets directly due to limited capital or technical resources. Therefore, an intermediary is necessary. For investment purposes, this could be a bank or an investment management company offering mutual funds. Active trading, however, requires a broker—a firm with access to exchanges, liquidity providers, or ECN platforms.

Most brokers are quite versatile. For instance, a stock broker typically provides services for trading futures, options, stocks, and derivatives, not limited to gold. They offer access to exchanges where a variety of instruments, including gold derivatives, can be traded.

OTC brokers operate similarly, granting access to liquidity providers—usually major global investment banks—and sometimes ECN platforms. ECN platforms are digital trading networks connecting traders worldwide.

While brokers vary in the instruments they offer due to internal policies and technology, all of them generally provide XAUUSD CFDs. Rarely, brokers may offer synthetic pairs, such as XAU against oil or other currencies.

Key Considerations When Choosing a Broker for XAU/USD

- Spread and Account Type:

- Gold’s short-term volatility is relatively low, so a minimal spread is essential.

- Floating spreads are usually lower than fixed spreads. An ECN account with a 0-pip spread is ideal for XAUUSD trading.

- Order Execution Speed:

- For retail ECN accounts, an execution speed of up to 50 ms is considered good.

- Execution speed and spreads can be checked in MT4 using a script.

- Leverage:

- Higher leverage can be beneficial but must be used according to risk management rules.

- Avoid using leverage in a way that exceeds acceptable risk per trade or overall account exposure.

- Passive Trading Options:

- Copy trading or subscribing to MetaQuotes community signals in MT4 is a significant advantage.

- No Additional Fees:

- ECN accounts typically charge a fixed commission per lot. Avoid brokers that impose extra fees, including withdrawal charges.

- Transparency:

- Terms and conditions should be clear and straightforward.

- Evaluate licensing, regulatory compliance, and the professionalism of support services.

Above all, trading should be convenient for you. Start with a minimum deposit or a demo account to test the platform. For instance, LiteFinance offers a demo account that you can try without signing up.

Gold Trading FAQ

- Is gold suitable for Forex trading?

- How do you trade gold?

- Can beginners trade gold?

- How can I trade gold on Forex?

- How much capital is required to trade gold in Forex?

- What is the size of 1 lot of XAUUSD?

- What is the best indicator for gold trading?

Useful Links

- Trade with a reliable broker here—either independently or by copying successful traders worldwide.

- Use promo code BLOG to receive a 50% deposit bonus on LiteFinance; enter it during account funding.

- Telegram chat for traders: https://t.me/litefinancebrokerchat – share signals and trading experience.

- Telegram channel with analytics, Forex reviews, training materials, and more: https://t.me/litefinance

XAUUSD Live Price Chart

- Timeframes: M1, M5, M15, M30, H1, H4, D1, W1

- Zoom options: 1D, 1W, 1M, 3M, 6M, 1Y, ALL

If you want, I can also turn this into a concise beginner-friendly guide for gold trading that keeps all the key points but reads faster. Do you want me to do that?

he views expressed in this article are those of the author and do not necessarily represent the official stance of LiteFinance broker. The information provided here is for informational purposes only and should not be interpreted as investment advice under Directive 2014/65/EU.

This article is protected by copyright law and constitutes intellectual property. Copying or distributing it without permission is strictly prohibited.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: