Multi-Timeframe Trading: A Superior Approach — Plus 5 Proven Strategies

Multi‑timeframe trading is a technique where traders combine different chart timeframes to enhance decisions and refine chart analyses. The goal is to trade long‑term signals by applying them on shorter timeframes, thereby improving trade precision and profitability.

Usually, traders employ one higher timeframe and one lower timeframe. The higher timeframe provides the overall market trend and sentiment, helping you establish a directional bias—whether bullish, bearish, or neutral. Then, you use the lower timeframe to time your entries and manage trades in harmony with that higher timeframe bias.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Top-Down vs. Bottom-Up Approaches

A common mistake is working from the lower timeframe first (a bottom-up approach). This can lead you to:

- Trade against the higher timeframe trend because you never verified it, or

- Force your higher timeframe analysis to match your already chosen lower timeframe setup, ignoring bigger-picture signals.

That’s why the top-down method is preferred. Start your analysis on the higher timeframe to understand the trend, sentiment, and key levels. Then, descend to the lower timeframe to pinpoint trading opportunities that align with that broader view.

Choosing Timeframe Combinations

When starting with multi‑timeframe trading, keep things simple by using just two timeframes:

| Higher Timeframe | Lower Timeframe | Trading Style |

|---|---|---|

| Weekly | Daily or 4H | Swing trading |

| Daily | 4H or 1H | Shorter-term swing trading |

| Daily | 30 min or 15 min | Intraday trading |

| 4H | 30 min or 15 min | Fast-paced intraday |

| 1H | 15 min or 5 min | Standard day trading |

| 1H | 5 min or 1 min | Scalping / ultra short-term |

Pick one combination and stick with it for at least 30–50 trades before switching. Changing timeframes too often leads to inconsistency and noise.

5 Multi‑Timeframe Strategies

#1 Levels – Breakout

.One of the most commonly used higher timeframe concepts is one of support and resistance levels. Traders who make use of support and resistance levels on the higher timeframe typically either look for a bounce or a break of a long-term horizontal level.

The image below shows the Daily timeframe level with a strong resistance level marked. The trader identifies the level on their higher timeframe and after the break, he goes to his lower timeframe to look for trading bullish opportunities.

Higher timeframe support and resistance levels carry more importance which is why you should always look for your levels on your higher timeframe.

The image below shows the 1H timeframe after the break of the resistance level. The price trended higher after the breakout and the trader would have done well to adopt a bullish sentiment and look for bullish trend-continuations.

#2 Levels – Bounce

Instead of looking for a higher timeframe breakout, traders can also choose to look for a bounce off a support or resistance level when the level holds.

In the image below, the strong resistance level has been holding multiple times on the higher 4H timeframe. As long as the price is not able to close above the level, a trader might adopt a bearish trade sentiment; especially after seeing the signal of deceleration (smaller candlesticks).

The higher timeframe bearish bias can be used to look for short trading opportunities on the lower timeframe.

The lower 15-minute timeframe shows an interesting Head and Shoulders chart pattern right underneath the 4H resistance level. With the higher timeframe bearish bias in mind, a trader might have a trading plan to short the market after the successful breakout (or retest) of the neckline.

The price fell sharply after the breakout and retest of the Head and Shoulders pattern. The strong higher timeframe resistance level and the deceleration candle allowed the trader to adopt a bearish bias early on, while the lower timeframe helped the trader to time the short trade effectively.

Trading signals on a lower timeframe allow the trader to optimize the holding time and also the reward:risk ratio because the trade usually has a closer stop, and a more aggressive entry while utilizing a wider target based on the higher timeframe context.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

#3 Highs and lows – Fakeouts

Instead of using long-term support and resistance levels, some traders use local highs and lows for their multi-timeframe trading strategy.

The overall approach is hereby similar to the previously discussed support-and-resistance level strategy.

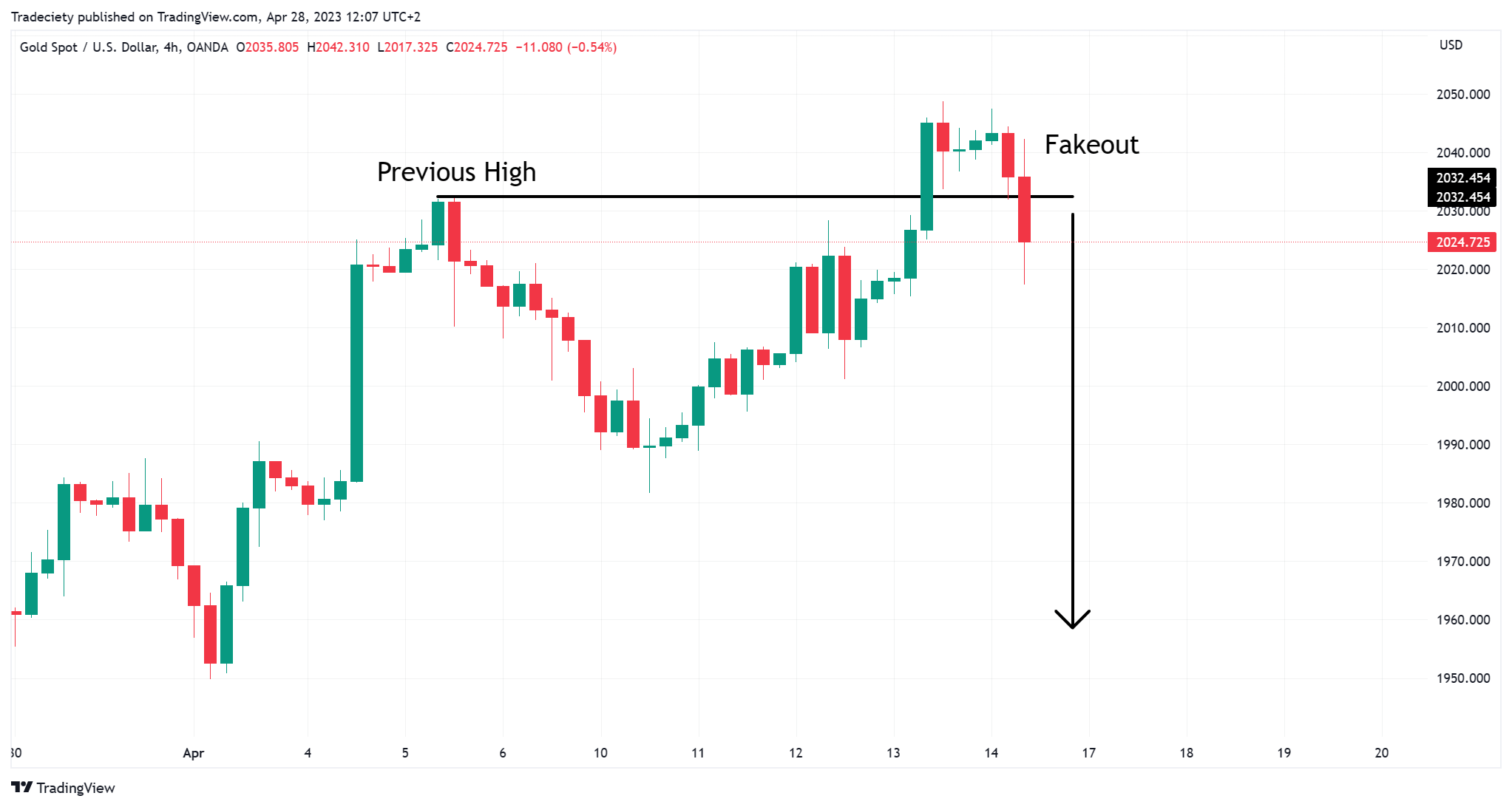

First, the trader is looking for a strong previous high (or low). In the image below, the price first overshot the previous high before strong bearish momentum entered the market and the price fell back below the high. In technical analysis, we refer to such a pattern as a fakeout (or trap) because the initial breakout is failing and trapping long-positioned breakout traders.

This higher timeframe signal is providing us with a bearish bias that we will carry over to our lower timeframe.

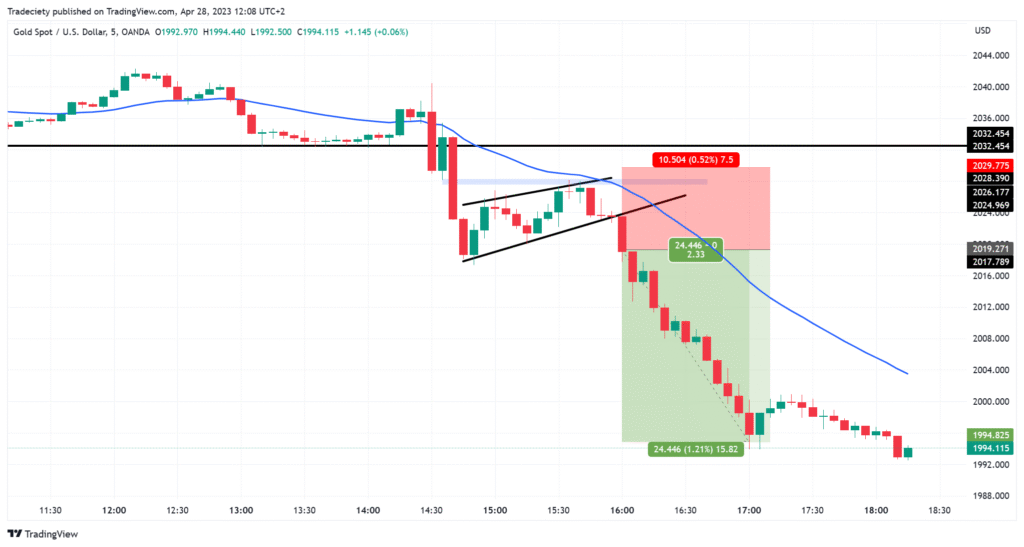

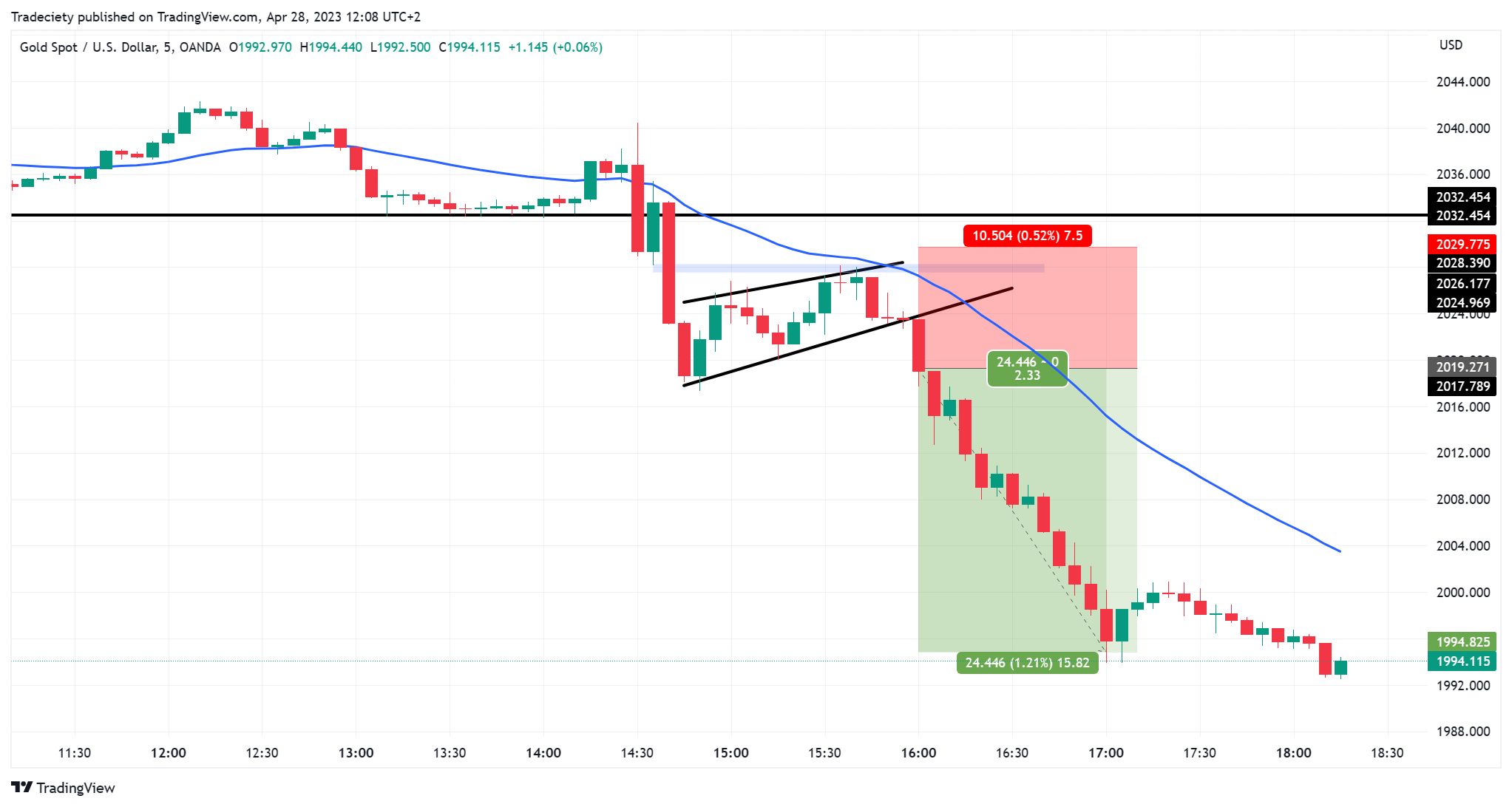

On the lower timeframe, the price is building a flag breakout pattern shortly after the fakeout signal (black horizontal line). Flags are among the most popular trend-continuation patterns. The break of the flag trendline typically signals the entry for a trend continuation.

The downtrend unfolded after the flag breakout.

By using a top-down multi timeframe approach, traders can improve their strategy parameters such as reward:risk ratio, and the holding time of their trades.

Trading the fakeout directly on the higher timeframe usually results in significantly longer holding periods. By using the lower timeframe to time the entry and the exit, the holding time can often be reduced to an absolute minimum. The shorter the holding time, the fewer additional risk factors – such as news events or overnight exposure – the trader has.

#4 Candlesticks

Candlestick trading is a very popular trading approach, but it often lacks robustness when traders solely rely on a single candlestick. To improve the signal quality, traders can apply a multi-timeframe approach to candlestick signals.

The image below shows a bullish engulfing candlestick on the higher Daily timeframe. At the same time, the price is in an overall bullish uptrend. Furthermore, the bullish candlestick also occurs right at the 30 EMA (moving average). Many traders use moving averages for their trend-following pullback trading.

The candlestick signal fits well into the trend narrative. After identifying the engulfing candlestick, a trader can now move to a lower timeframe to look for bullish trading signals into the higher timeframe bias.

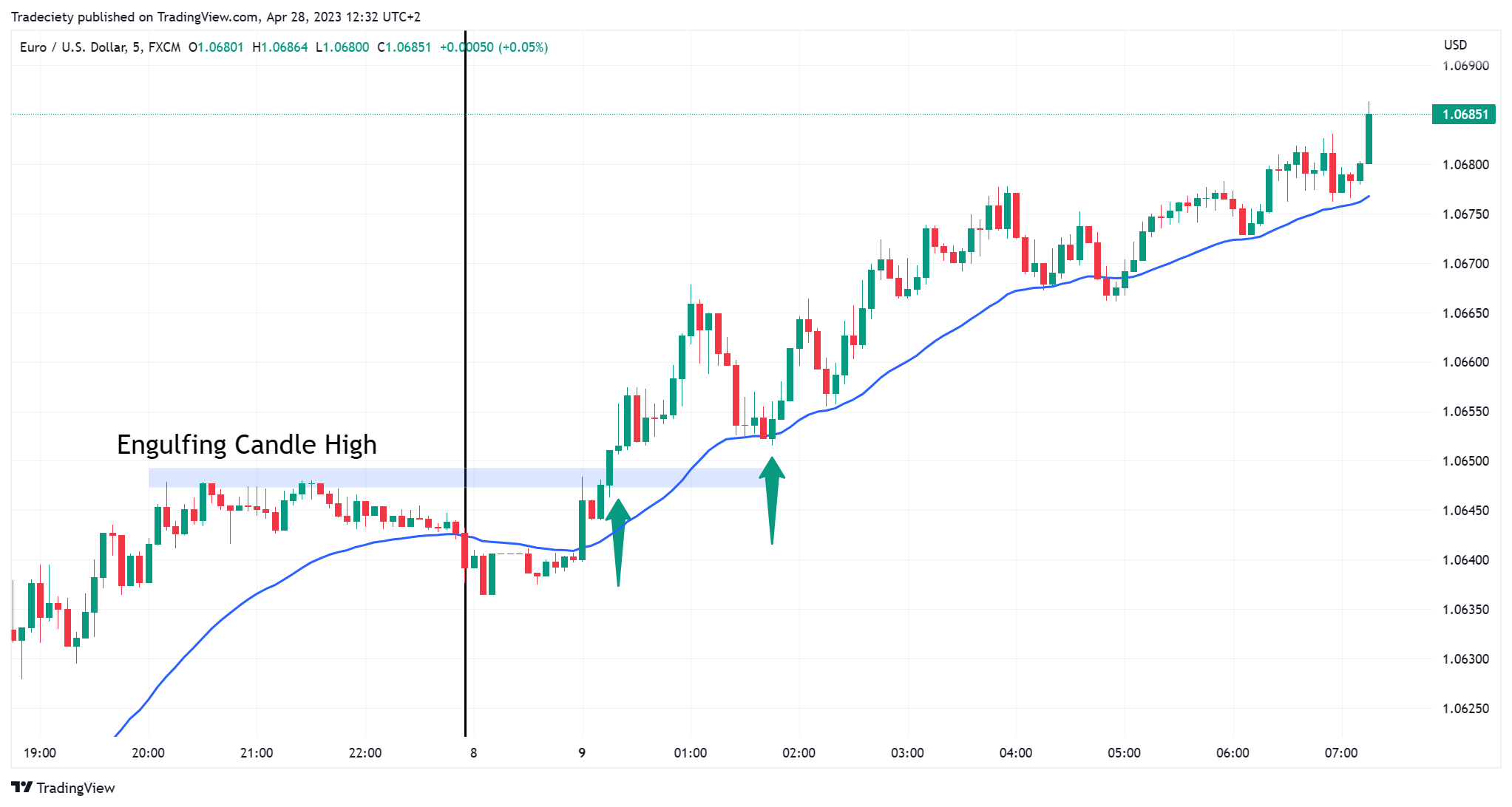

The image below shows the lower 5-minute timeframe. The blue zone on the left marks the high of the Daily engulfing candlestick. After the breakout, the price trended higher. A trend-following trader might have been able to execute a successful breakout long trade to capture the bullish momentum.

Whereas some traders might just trade the Daily signal blindly, a multi-timeframe approach allows the trader to find the perfect entry price and benefit from the short-term momentum that the engulfing candlestick signals.

#5 Patterns

Instead of looking for single candlesticks on the higher timeframe, traders can also use complex chart patterns as their signal for a higher timeframe bias.

In the image below, the higher 4H timeframe shows an overall bearish trend with a sideways flag pattern. The trendline describes the lower boundaries of the flag pattern.

After the breakout, the price is returned to the trendline to perform a retest. When the price reaches the trendline, the candlestick signals deceleration – the candlestick turns and shows bearish momentum. This signal could be used to move to a lower timeframe with a bearish bias in mind.

At the time of the higher timeframe retest signal, the lower 5-minute timeframe forms a triple top range pattern. Lower timeframe patterns are ideal when it comes to trading plan creation because they offer a clear and objective entry point. For a short trading plan, the trader waits for a bearish breakout below the low of the pattern.

A breakout then signals a trade entry. In this case, the trader is going with the higher timeframe trend and also with the lower timeframe breakout momentum. Both timeframes are perfectly aligned.

After the breakout, the price fell sharply. The long-term trend continued and with the lower timeframe signal, a trader might have been able to execute a high reward:risk ratio trade.

Endless possibilities

By no means are the introduced trading approaches the only ones for multi-timeframe trading; they just serve as a source of inspiration to create your own multi-timeframe trading strategy.

There are no limitations when it comes to building a multi-timeframe strategy and traders can make use of all types of trading tools and concepts. Be it price action, classic chart patterns, or indicator signals, all combinations are possible.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: