Weekly Market Outlook: 10–14 November

Monday, 10 November

Over the weekend, significant progress was made toward ending the U.S. government shutdown—the longest in U.S. history. Late Sunday, the Senate passed a test vote 60-40 to advance a spending bill funding the government through 30 January 2026. Eight Democrats backed the Republican proposal, which also included protections for federal workers dismissed during the shutdown and a later vote on certain healthcare subsidies.

The final Senate vote is still required, followed by approval from the House and signature from President Donald Trump. The shutdown, now in its 40th day, is the 15th since 1981, the second under Trump, and is estimated to have cost tens of billions in lost GDP.

Markets reacted positively: S&P 500 futures rose 50 points (+0.7%), Nasdaq 100 futures gained 325 points (+1.3%), and Dow futures climbed 150 points (+0.3%).

Tuesday, 11 November

With U.S. federal data releases halted, attention turns to international indicators:

- UK Unemployment Rate: Expected to rise slightly to 4.9% from 4.8%, reflecting continued stability in the labor market.

- Germany ZEW Economic Sentiment Index: Forecasted to edge up to 41.0 from 39.3, signaling cautious optimism among investors.

Wednesday, 12 November

- Germany HICP (YoY): Inflation is anticipated at 2.3%, unchanged from the prior reading. Historically, when German inflation meets expectations at this level, the DAX tends to show muted gains as markets reassess monetary policy expectations.

Thursday, 13 November

- UK GDP: The week’s key release. Recent readings have been mixed: Q2 grew 0.3% q/q, July was flat, and August rose 0.1% m/m. Weaker-than-expected GDP can weigh on GBP and raise concerns about potential BoE easing, while modest upside surprises may provide temporary support. Traders will closely watch for clues on the UK’s growth trajectory and interest rate outlook.

Friday, 14 November

- China Industrial Production: Expected to grow 5.5% YoY (down from 6.5%). As the industrial sector accounts for roughly one-third of GDP, this report is a key gauge of economic health. A weaker-than-expected print could pressure the yuan and regional risk sentiment, while stronger numbers may boost risk assets.

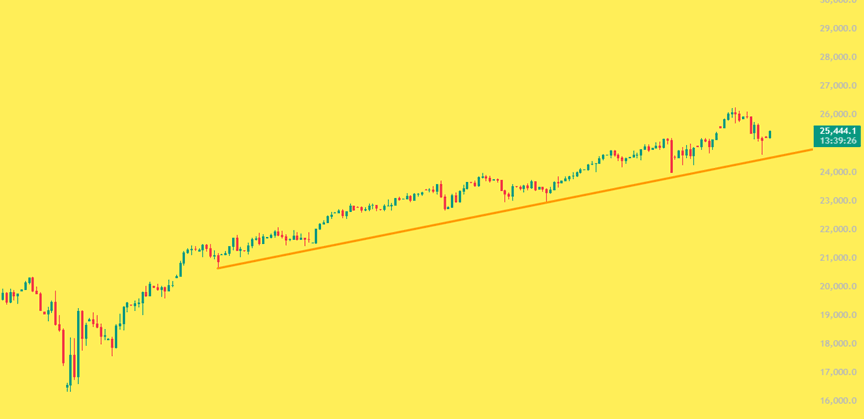

Technical Outlook: Nasdaq

The Nasdaq has swung approximately 1,500 points over the past two weeks. The broader uptrend remains intact as long as the trendline holds.

Key Levels:

- Support: 25,000 / 24,500

- Resistance: 25,530 / 25,710

If you want, I can also create an even tighter, “newsletter-ready” version that highlights only the most market-moving events and levels for quick reading. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Microsoft

The daily chart shows a well-defined double top pattern. Over the past two weeks, the stock has fallen approximately 10% and is now testing the neckline. A decisive break below this level could spark notable selling pressure.

Key Levels:

- Support: 490 / 445

- Resistance: 512 / 525

I can also make a slightly more concise, newsletter-style version if you want it to be punchy for quick reader scanning. Do you want me to do that?

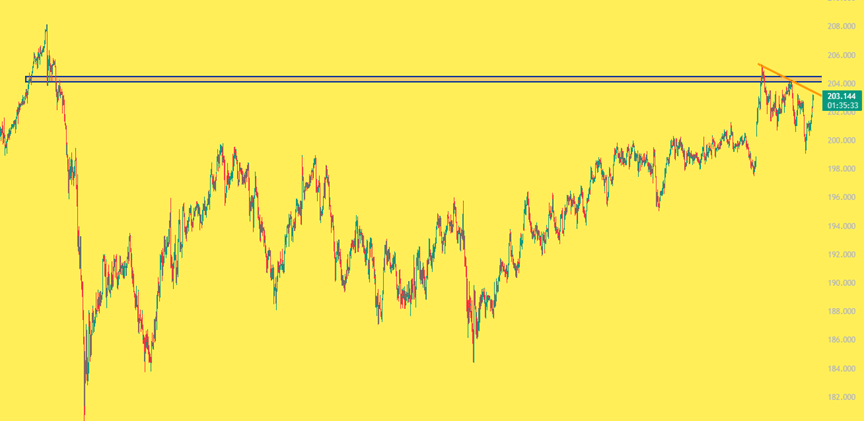

GBP/JPY

After last month’s trend reversal, the pair is forming a series of lower highs, illustrating a classic bearish pattern. This bearish outlook would be negated if the pair breaks above 205.50, establishing a new high.

Key Levels:

- Support: 201.80 / 200

- Resistance: 203.30 / 204.10

Disclaimer

The content of this article is intended for general informational purposes only and should not be considered financial or investment advice. Markets can be volatile, and past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making any financial decisions. We are not liable for any losses or damages resulting from the use of this information.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: