In Forex, as in many areas of life, knowledge is the foundation of success. To become a skilled trader, mastering technical analysis is essential, and understanding technical indicators plays a major role.

Indicators like the MACD, RSI, and Stochastic aren’t as intimidating as they may seem. In this article, we’ll break down some of the most popular technical indicators and show you how they can assist in making smarter trading decisions.

Most widely used Forex indicators are based on price data, sometimes incorporating volume, tick volume, or other market-specific information depending on the trading platform.

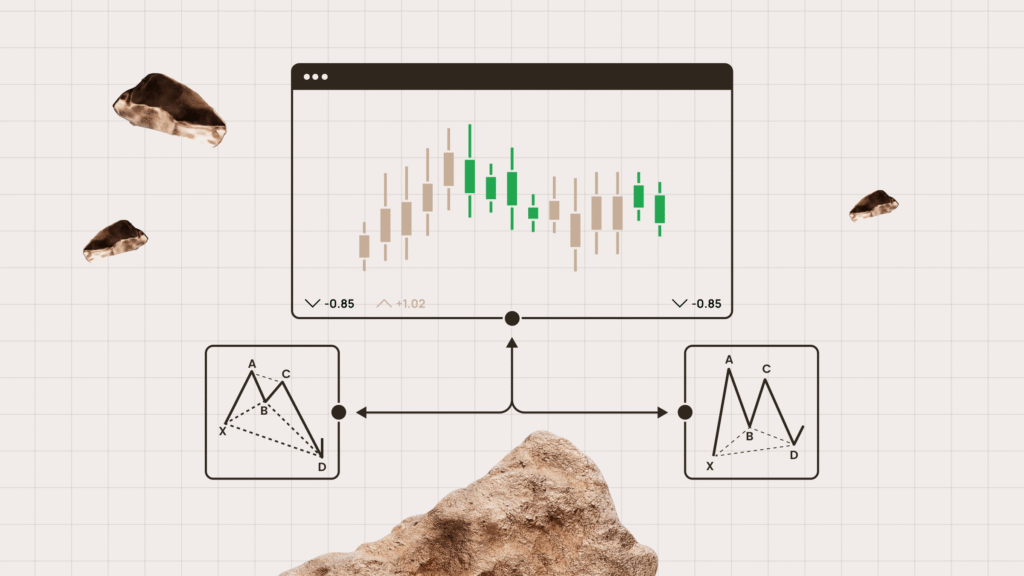

Choosing the Best Technical Indicators for Forex Traders

It’s important to match indicators to market conditions, otherwise you risk chasing false signals.

Trending markets (Moving Averages, MACD, ADX, Ichimoku):

When the market is moving steadily upward or downward with momentum, you need tools that help you stay in the trend without exiting too soon. Moving averages smooth price action and show the overall direction, while MACD and ADX confirm trend strength.

Ranging markets (RSI, Stochastic RSI, Bollinger Bands):

Sometimes price oscillates between support and resistance levels without breaking out. Oscillators like RSI and Stochastic RSI indicate when price is overbought or oversold, and Bollinger Bands highlight the boundaries of the range.

Volatile markets (ATR, Bollinger Bands):

In choppy markets, managing risk is key. The Average True Range (ATR) shows the typical price movement, while Bollinger Bands expand and contract with volatility, helping you gauge when conditions are heating up.

| Market type | Indicators | Purpose |

|---|---|---|

| Trending | MA, MACD, ADX, Ichimoku | Follow and confirm the trend |

| Ranging | RSI, Stochastic RSI, Bollinger Bands | Identify reversals at support or resistance |

| Volatile | ATR, Bollinger Bands | Adjust stops and profit targets |

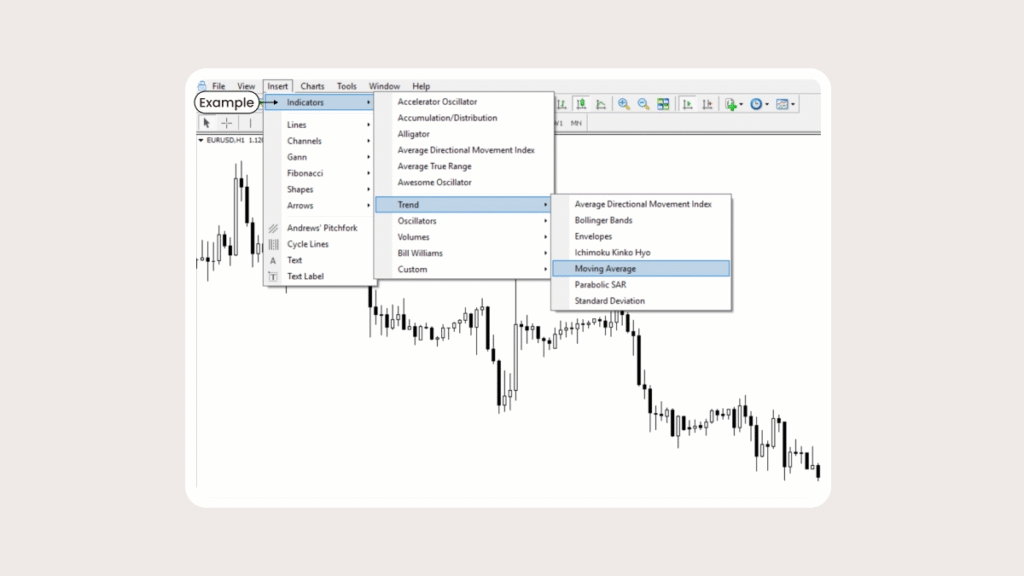

1. Moving Average (MA)

Moving averages help identify and follow trends. They plot the average price over a chosen period, smoothing out short-term fluctuations to highlight the main trend. While they don’t predict future prices, they clarify market direction: prices above the MA suggest a bullish trend, while prices below indicate a bearish trend.

The Moving Average: A Fundamental Tool in Trading

Understanding Moving Averages in Trading

A moving average (MA) takes price data over a specific period, calculates the average, and turns it into a smooth, easy-to-read line. This simplification can reveal patterns that aren’t obvious at first glance. MAs also help assess risk, understand market volatility, and pinpoint potential entry and exit points.

Traders worldwide rely on moving averages as a cornerstone of their technical analysis.

Types of Moving Averages

1. Simple Moving Average (SMA)

Add up the closing prices over a chosen period and divide by the number of periods. SMAs help identify long-term trends by filtering out short-term fluctuations. Their drawback is that they react slowly, sometimes missing rapid market shifts or signaling too late.

2. Exponential Moving Average (EMA)

EMAs give more weight to recent prices, making them more responsive to current market conditions. This allows traders to enter trends earlier, though it can also lead to more false signals during choppy markets.

3. Weighted Moving Average (WMA)

WMAs strike a balance between SMA and EMA by weighting prices across the period while emphasizing the most recent data.

Choosing the Right Moving Average

- SMA: Ideal for long-term investors seeking a broad view of trends, such as a 200-day SMA.

- EMA: Suited for day traders who need to capture short-term price movements, like a 10-day EMA for Forex or crypto.

- WMA: Useful for intermediate-term traders who want both accuracy and clarity.

Experiment with different MAs and timeframes to find the combination that fits your trading style.

How Moving Averages Enhance Trading Strategies

1. Identifying and Confirming Trends

MAs reveal the market’s direction. In an uptrend, prices stay above an upward-sloping MA; in a downtrend, prices remain below a declining MA. For example, if gold prices rise above a 100-day MA, a trader might interpret this as bullish sentiment. Using the MA as confirmation can help prevent overreacting to minor pullbacks.

Pairing short-term and long-term MAs can improve confidence: if a 20-day EMA stays above a 50-day EMA, the trend is likely intact.

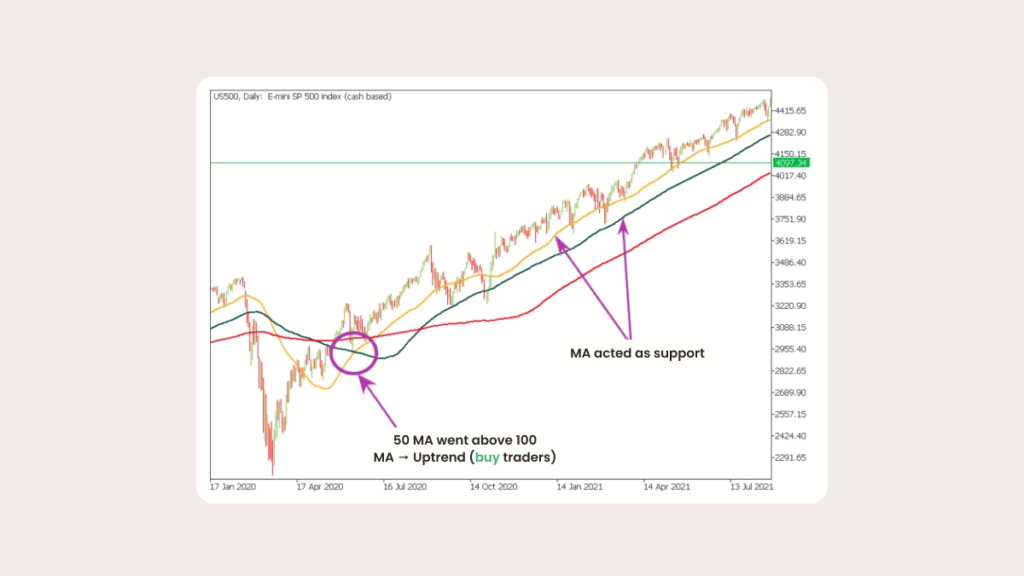

2. Acting as Dynamic Support and Resistance

In trending markets, prices often return to an MA before continuing the trend. A Forex trader might wait for EUR/USD to pull back near a 50-day MA before entering a long trade. Essentially, MAs can serve as moving support or resistance levels.

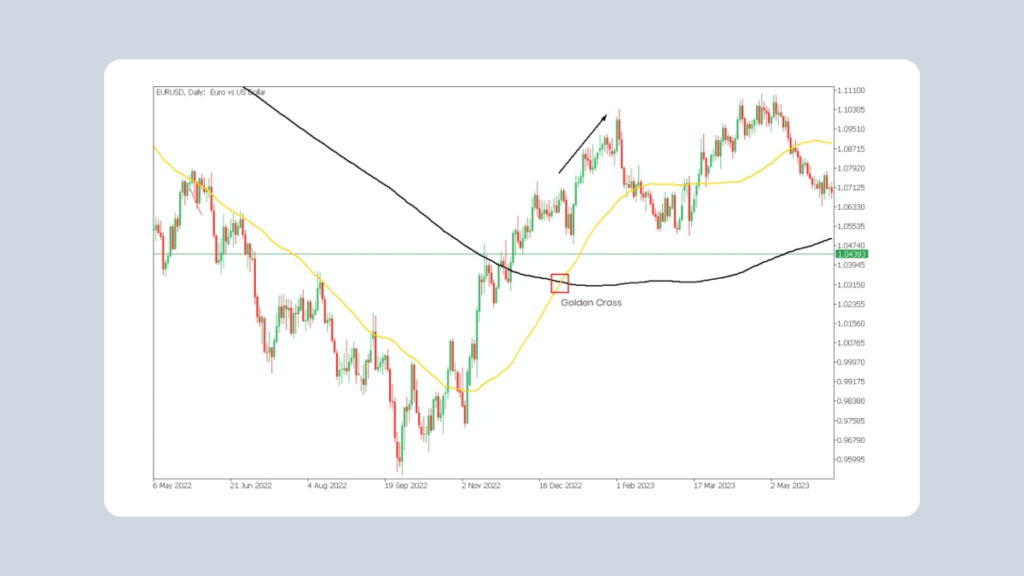

3. Crossovers

Crossovers of different MAs can generate trade signals:

- Golden Cross: When a short-term MA (e.g., 50-day) crosses above a long-term MA (e.g., 200-day), it is typically a bullish signal, indicating a potential buy opportunity.

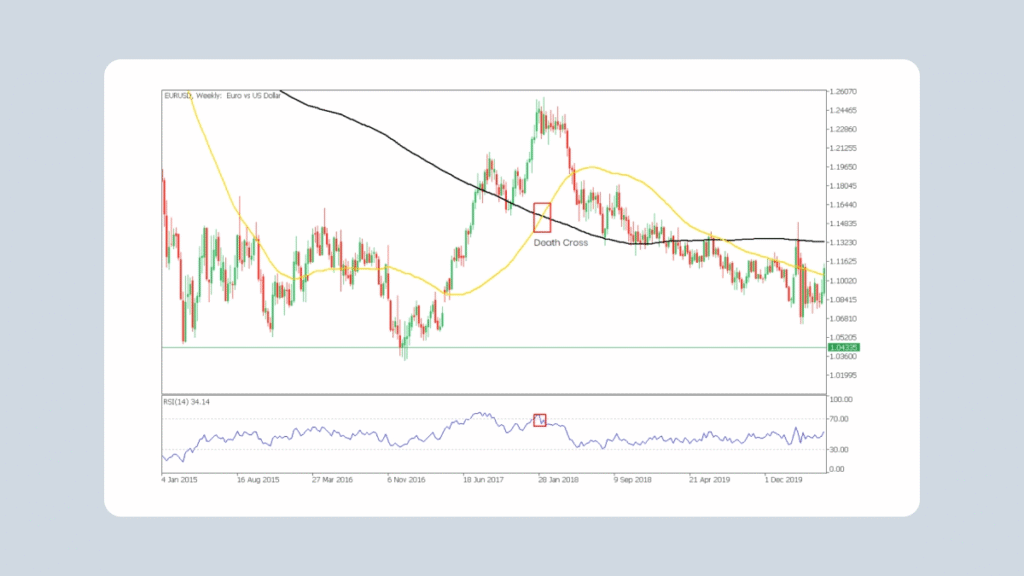

Death Cross

When the short-term MA drops below the long-term MA, it signals a potential downtrend—traders often take this as a cue to sell the asset promptly.

Advanced Moving Average Techniques

For traders looking to elevate their use of moving averages, these advanced strategies offer greater precision and deeper market insights.

Moving Average Envelopes

Envelopes place upper and lower bands around a moving average, set as a percentage above and below the MA line. Traders use these bands to spot overbought or oversold conditions. For instance, if price repeatedly touches the upper band, it may indicate an overextended market, signaling a potential pullback.

Moving Average Ribbon

A moving average ribbon plots multiple MAs—say, 5-day through 100-day—on the same chart. This visual tool helps assess trend strength and anticipate reversals. A ribbon that fans out and slopes upward suggests a strong uptrend, while a contracting ribbon signals the trend may be losing momentum.

Dual Moving Average Strategies

Pairing different moving averages can refine trading signals. For example, using a 20-day EMA with a 50-day SMA: when the shorter EMA crosses above the longer SMA, it’s a buy signal; when it crosses below, it indicates a potential sell or short opportunity.

Practical Example

A trader applying moving average envelopes to crude oil futures might set bands 3% above and below the 200-day SMA. If the price spikes above the upper band, it signals overbought conditions and a potential selling opportunity as the market cools.

Combining MAs with Other Indicators

Moving averages work well alongside other tools, enhancing accuracy and reducing false signals.

- MACD: Built on EMAs, the MACD complements MAs perfectly. A bullish MACD crossover aligning with a golden cross in the moving averages provides a strong buy confirmation, while bearish alignment reinforces a potential downtrend.

2. RSI

Pairing moving averages with the Relative Strength Index (RSI) adds a momentum perspective. For example, if a 20-day MA crosses above a 50-day MA while the RSI is below 30, the oversold condition increases the likelihood of a meaningful upward reversal, giving traders greater confidence to enter a long position.

3. Bollinger Bands

Bollinger Bands incorporate volatility by surrounding prices with upper and lower bands. If prices break above the upper band following a bullish MA crossover, it signals strong upward momentum. Conversely, contracting bands combined with an MA breakout suggest that a significant price move may be approaching.

Practical Applications

Forex Strategy

Imagine a trader analyzing the USD/JPY pair. A 20-day EMA alongside a 50-day WMA indicates an uptrend. When the 20-day EMA crosses above the 50-day WMA and price stays near the upper boundary of moving average envelopes, it presents an optimal buying opportunity.

Stock Scenario

Consider a biotech stock consolidating just below its 200-day SMA. Following a series of positive news releases, the price breaks above the 200-day SMA on strong volume, signaling a breakout rally. Traders could use this as a chance to go long, confident that momentum will continue pushing the stock higher.

Limitations of Moving Averages

Despite their usefulness, moving averages have drawbacks. Because they rely on historical data, they are lagging indicators and often signal trends after they have already started.

In range-bound or sideways markets, MAs can be misleading, as prices may cross the average repeatedly without establishing a clear trend.

To address these issues, traders can use longer timeframes to filter out noise, combine MAs with other indicators like volume analysis for better insight, or incorporate fundamental analysis to create a more comprehensive trading strategy.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Pros:

- Highlights the direction of a trend.

- Helps detect potential trend reversals.

- Indicates possible support and resistance levels.

Cons:

- Lags behind the current price since it’s based on historical data, making it slower to reflect rapid market changes.

Tips:

- The main types of moving averages are Simple (SMA), Exponential (EMA), Linear Weighted (WMA), and Smoothed.

- EMAs place more emphasis on recent prices, allowing quicker reactions to market shifts.

- SMAs filter out short-term noise, offering a clearer view of long-term trends.

Settings & Timeframe Tips

- Default periods: 20, 50, 100, and 200 for SMAs or EMAs.

- Shorter MAs (10–20 periods) are better suited for intraday trading but can produce more false signals.

- Longer MAs (100–200 periods) on daily or weekly charts help filter out market noise.

- Common mistake: overcrowding a chart with too many MAs, which can create confusion.

2. Relative Strength Index (RSI)

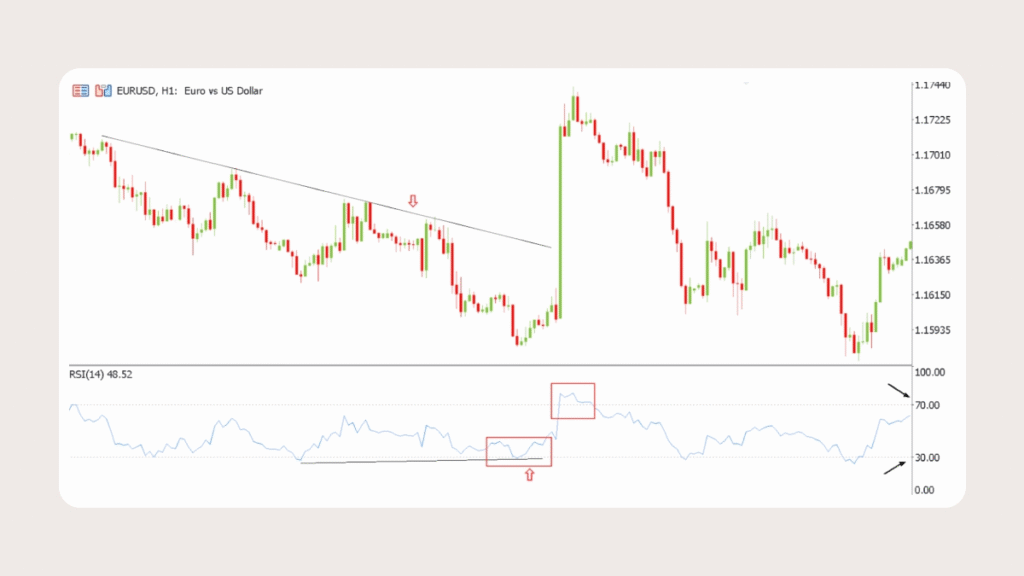

The RSI is a momentum indicator that measures the speed and magnitude of price movements, indicating when a market may be overextended.

- Overbought: RSI above 70 suggests buyers may start taking profits, potentially pushing prices down.

- Oversold: RSI below 30 indicates sellers may be exhausted, allowing prices to rebound.

- Divergence: If price hits a new high but RSI forms a lower high, momentum is weakening and a reversal may occur. The opposite applies in a downtrend.

Settings & Timeframe Tips – RSI

- Default period: 14

- Classic overbought/oversold levels: 70/30; in strong trends, consider widening to 80/20

- Best applied on H1 to daily charts

- M5–M15 charts tend to be too noisy

- Common mistake: selling when RSI >70 or buying when RSI <30 without considering the overall trend

Pros of RSI:

- Simple to interpret: a line moving between 0 and 100

- Helps identify potential reversals and exhaustion points

- Combines well with trend indicators like moving averages

Cons of RSI:

- In strong trends, RSI can remain overbought or oversold for extended periods, leading to premature entries

Summary:

RSI offers a quick view of momentum and potential turning points. Use it to filter entries and exits, but always confirm with another tool, such as a trend or volatility indicator.

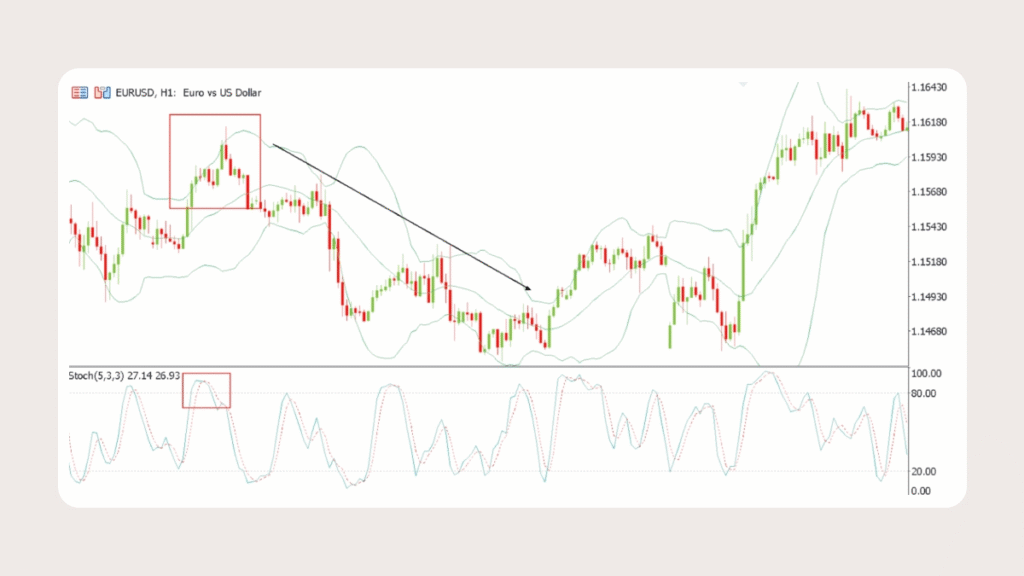

Stochastic Oscillator – Momentum and Reversals

The Stochastic Oscillator is another momentum indicator that compares a closing price to its recent high and low, providing early signals of potential reversals through overbought/oversold levels and line crossovers.

How to read it:

- Values above 80 indicate overbought conditions; upward momentum may be weakening

- Values below 20 indicate oversold conditions; selling pressure could be easing

- Watch for crossovers:

- Fast line (%K) crossing below slow line (%D) in overbought territory may signal a sell

- %K crossing above %D in oversold territory may suggest a buy opportunity

Settings & Timeframe Tips – Stochastic Oscillator

- Default settings: 5, 3, 3 (%K and %D)

- Overbought: above 80; Oversold: below 20

- Best applied on M15 to H4 charts for timing short-term reversals

Pros:

- Reacts quickly to changes in momentum

- Effective for spotting short-term reversals

- Works well in sideways or range-bound markets

Cons:

- Can generate false signals during strong trends

- Requires confirmation from other tools to avoid whipsaws

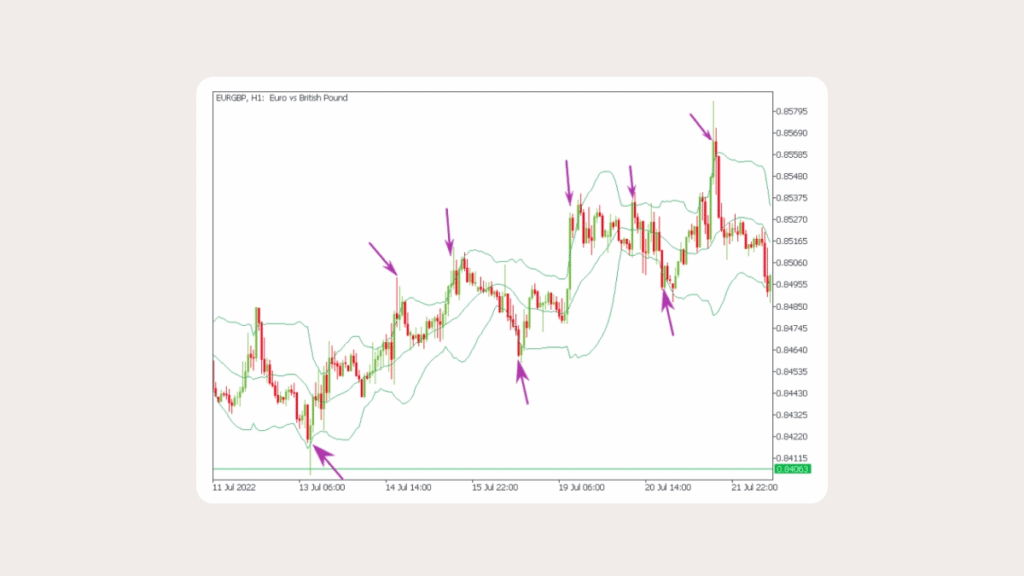

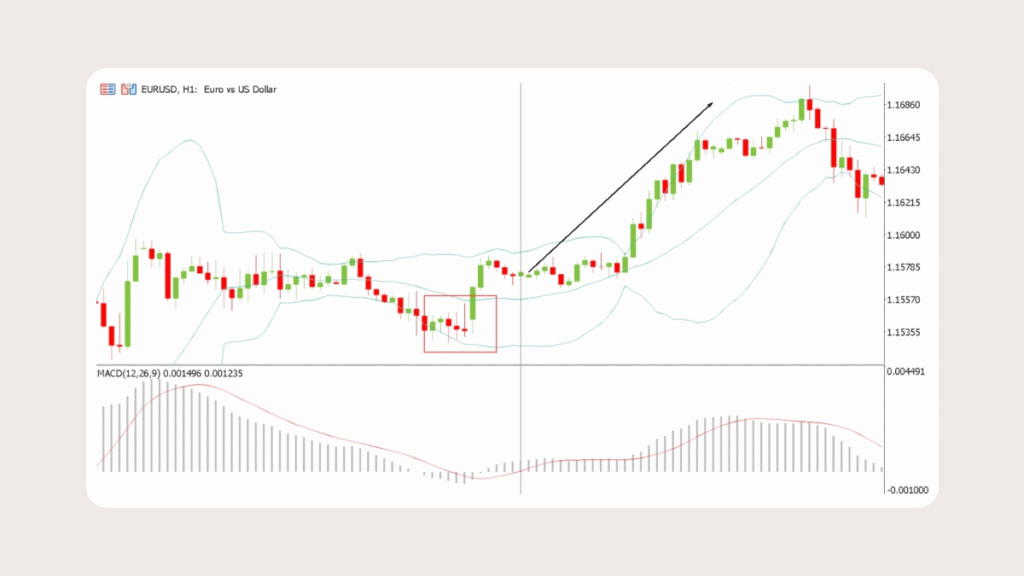

Bollinger Bands

Bollinger Bands consist of three moving average lines that measure market volatility. The middle band is typically a 20-period SMA, which shows the trend direction. The upper and lower bands are set two standard deviations above and below the middle band, representing volatility levels. Prices tend to revolve around the middle line. When the bands widen, volatility is increasing; when they narrow, a volatility surge often follows.

Pros:

- Useful in sideways markets, as the bands act as dynamic support and resistance

Cons:

- Less effective in trending markets

- Should be used in combination with other indicators for confirmation

How to read Bollinger Bands:

- Prices near the upper band suggest overbought conditions; a reversal may follow

- Prices near the lower band suggest oversold conditions

- In ranging markets, touches of the bands often indicate exhaustion and potential reversals

- In strong trends, price can “walk the band,” and a break may signal trend continuation

- Always confirm with a trend filter or momentum indicator before acting

Settings & Timeframe Tips – Bollinger Bands

- Default: 20-period SMA with 2 standard deviations

- Best used on H1 to daily charts; very low timeframes often produce false breakouts

- Common mistake: assuming every touch of the bands signals a reversal

3. Average True Range (ATR)

The ATR measures market volatility, showing how much price typically moves over a set period. Traders often use it to set stops and manage risk because it automatically adjusts as market activity changes.

How it’s calculated:

For each bar, the ATR takes the largest of:

- Today’s high minus today’s low

- Today’s high minus yesterday’s close

- Yesterday’s close minus today’s low

This “true range” is then averaged over a chosen period (commonly 14). ATR only measures volatility — it does not indicate direction.

How to read it:

- Rising ATR: price swings are increasing

- Falling ATR: market is calming down

- Avoid placing stops too tight; e.g., if EURUSD ATR = 50 pips, a 10-pip stop will likely be triggered by normal fluctuations. Using 1–2× ATR is generally safer.

- ATR above 25 often signals strong trending conditions; below 25 suggests a weak or sideways market.

Settings & timeframe tips:

- Default: 14 periods

- Can be used on any timeframe

- Works best when combined with a trend tool to set stops that withstand normal pullbacks

Pros:

- Adapts naturally to market volatility, helping with stop placement and position sizing

- Applicable across any market and timeframe

- Simple line chart for easy reading

Cons:

- In quiet markets, finding good stop levels can be challenging

- Does not provide trade signals on its own; best used alongside other indicators

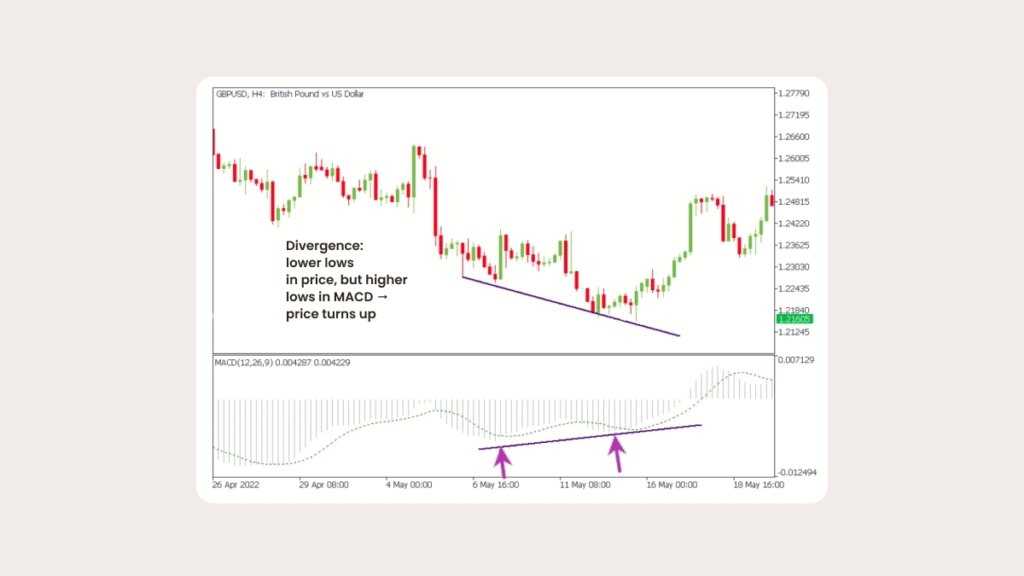

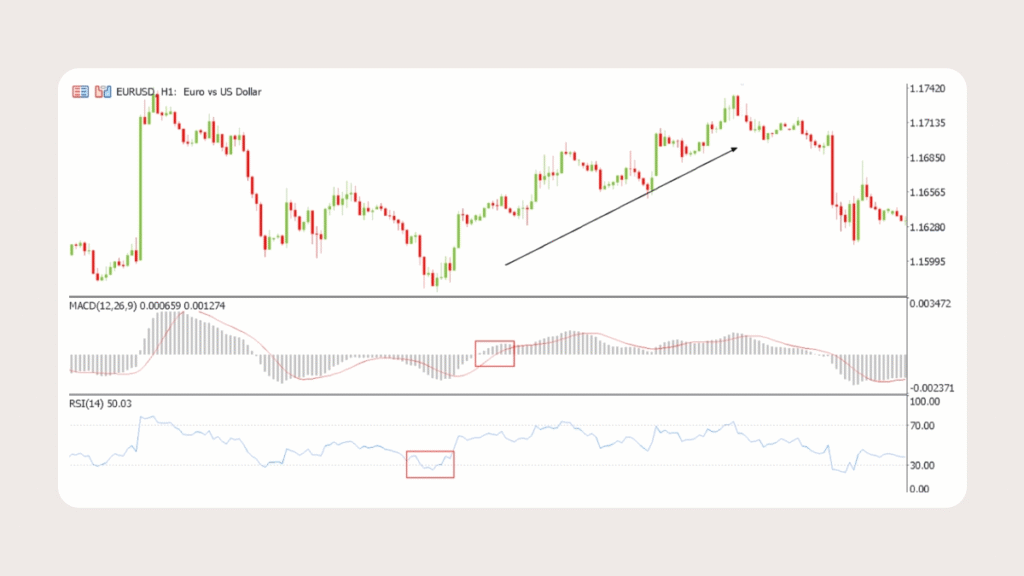

4. MACD (Moving Average Convergence/Divergence)

MACD is a momentum oscillator that measures the strength behind price movements, helping traders identify when the market may be due for a correction. It’s most effective when combined with other confirmation tools.

Components:

- MACD line: difference between 12-period EMA and 26-period EMA

- Signal line: 9-period EMA of the MACD line

- Histogram: bars showing the gap between the MACD line and the Signal line

How to read it:

- Dramatic rises/falls: Sell when histogram bars decline after a big rise; buy when histogram bars grow after a sharp fall

- Crossovers: Buy when the histogram crosses above the Signal line; sell when it falls below

- Zero line: MACD above zero indicates bullish strength; below zero indicates bearish strength

- Divergence: If price rises but MACD falls (or vice versa), the move may lack strength and could reverse soon

MACD is valuable for spotting momentum shifts, trend confirmations, and potential reversals, but it’s most reliable when combined with other technical indicators.

Settings & Timeframe Tips – MACD

- Default: 12, 26 EMAs with a 9-period EMA as the signal line

- Best used on H1 charts and higher

- Noisy and less reliable on M1–M5 charts

- Common mistake: depending solely on crossovers without considering the overall trend

Pros:

- Can be applied in both trending and ranging markets

- Learning MACD makes it easier to understand other oscillators

Cons:

- Being a lagging indicator, some signals appear late and may not coincide with strong market moves

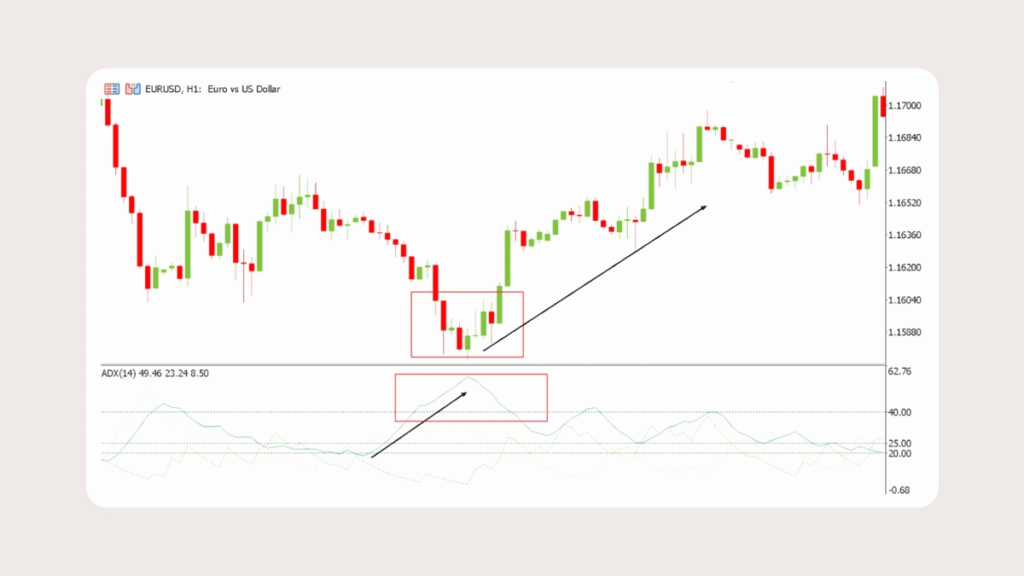

5. ADX (Average Directional Index)

The ADX measures trend strength, using two auxiliary lines: +DI and –DI, which track upward and downward price movements. The ADX itself is a smoothed average of the difference between these lines.

How to read it:

- ADX < 20: Market is weak or range-bound

- ADX > 25: A trend is beginning to form

- ADX > 40: Trend is strong, momentum is accelerating

- Falling ADX: Indicates the trend is losing strength, even if price continues in the same direction

The ADX is useful for determining whether the market is trending or ranging and helps traders adjust strategies accordingly.

Settings & Timeframe Tips – ADX

- Default setting: 14 periods

- Readings above 25 indicate a trending market; readings below 20 suggest sideways movement

- More reliable on H4 and daily charts than on shorter timeframes

- ADX measures trend strength only—it does not indicate direction

Pros:

- Helps filter trades: skip setups when ADX is below 20 in flat markets

- Confirms breakouts: a rising ADX during a breakout increases the likelihood of a sustained move

Cons:

- Does not indicate bullish or bearish direction; combine with tools like moving averages or MACD

- Can be slow to react due to its use of smoothed averages

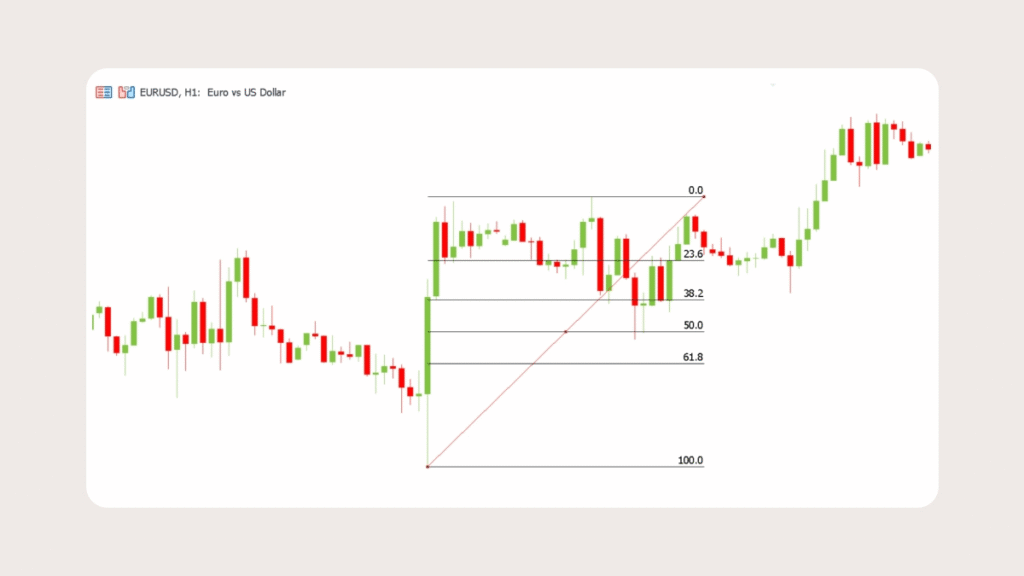

6. Fibonacci Retracements and Extensions

Fibonacci retracements are horizontal lines plotted on a chart to highlight potential support and resistance levels. They are derived from the Fibonacci sequence, with key levels at 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Prices often pause, reverse, or find support/resistance near these levels.

How to use them:

- Uptrend: After a strong rally, retracement levels indicate where buyers might re-enter the market

- Downtrend: Following a selloff, retracement levels can mark areas where sellers may step back in

- Focus especially on the 38.2% and 61.8% levels for potential reaction points

Extensions:Once a pullback is over, Fibonacci extensions project possible targets for the next move. Common levels are 127.2%, 161.8%, and 261.8%. Many traders use these as natural take-profit zones when riding a trend.

Settings & Timeframe Tips – Fibonacci

- Default retracement levels: 23.6%, 38.2%, 50%, 61.8%, 78.6%

- Extension levels: 127.2%, 161.8%

- Applicable on all timeframes, but more reliable on H4–Daily chart swings

Pros:

- Easy to use and understand

- Strong signals when aligned with other indicators like moving averages, Bollinger Bands, or prior support/resistance

Cons:

- Subjective, as results depend on which swing points you select

- Not reliable as a standalone tool

7. Ichimoku

The Ichimoku system combines multiple indicators into one framework, showing trend, momentum, and support/resistance at a glance. It consists of:

- Kijun-sen (Baseline): Reflects the medium-term trend, acting as a balance point for the market

- Tenkan-sen (Conversion Line): Shows short-term trends and reacts quickly to momentum shifts

- Senkou Span A & B (Cloud/Kumo): Project future support and resistance levels

- Chikou Span (Lagging Line): Compares current price with past levels to assess momentum

How to read Ichimoku:

- Price above the cloud → bullish market; below → bearish; inside → consolidation

- Tenkan-sen crossing Kijun-sen → potential buy or sell signal

- Cloud edges serve as dynamic support/resistance

- Thick clouds indicate strong barriers, while thin clouds suggest weaker support/resistance

Example 2: Bollinger Bands + MA — Identifying Breakouts

- Narrowing Bollinger Bands often indicate an upcoming breakout.

- If the price breaks a band in the same direction as the moving average, the breakout is more likely to sustain momentum.

Example 3: Bollinger Bands + MACD — Filtering False Signals

- A touch of the outer Bollinger Band can signal either exhaustion or a continuing trend.

- Use the MACD to confirm: fading momentum suggests caution, while accelerating momentum increases the likelihood of a valid breakout.

Example 4: RSI + MACD — Confirming Momentum

- The RSI shows when the market is overbought or oversold, while MACD crossovers confirm genuine shifts in momentum.

- For instance, a strong buy signal occurs when the RSI moves out of the oversold zone and the MACD produces a bullish crossover.

Example 5: Ichimoku + RSI — Trend with Momentum Check

- Ichimoku identifies the trend by showing whether price is above or below the cloud, while RSI signals when momentum is overextended.

- For example, if the price is above the cloud, the trend is bullish, but an RSI reading above 70 suggests waiting for a pullback before entering.

Example 6: Stochastic + Bollinger Bands — Precision Reversal Timing

- Bollinger Bands indicate price extremes, while the Stochastic oscillator pinpoints when momentum shifts.

- For instance, if the price hits the upper band and the Stochastic crosses down from overbought, it signals a potential short entry.

Example 7: ADX + MA — Filtering for Strong Trends

- The moving average indicates market direction, while the ADX measures trend strength.

- Consider entering trades only when the price is above the MA and ADX is above 25. Avoid signals when ADX is below 20, as the market is likely ranging.

Risk Warning: Even when indicators are combined effectively, no setup guarantees success. Always use stop-losses and take-profit levels. Indicators can guide your decisions, but disciplined risk management is what protects your capital.

Leading vs. Lagging Indicators

Indicators can either give early warnings or confirm moves that are already in progress. Understanding their role helps you choose the right tool for the situation.

Leading Indicators

- Give early signals before a price move occurs.

- Help anticipate potential reversals or breakouts.

- Useful in range-bound markets or at key turning points.

- Examples: RSI, Stochastic, Fibonacci retracements.

- Limitation: In strong trends, they can give false reversal signals.

Lagging Indicators

- Follow price action and confirm trends that are already happening.

- Smooth out market noise and highlight trend direction.

- Examples: Moving Averages, MACD, Bollinger Bands, ADX, Ichimoku.

- Limitation: You may miss the optimal entry point since confirmation comes later.

Using Both Together

A leading indicator can highlight a potential setup, while a lagging indicator confirms its strength.

- Example: RSI shows oversold conditions (leading signal), and MACD indicates an uptrend (lagging confirmation). Together, they strengthen the case for a long trade.

Choosing the Right Indicator

| Use Case | What to Check | Best Indicators |

|---|---|---|

| Trend Direction | Is the market moving up or down? | Moving Averages, MACD, Ichimoku |

| Trend Strength | Is the trend strong or weak? | ADX, Ichimoku |

| Momentum & Exhaustion | Is momentum fading? | RSI, Stochastic, MACD |

| Volatility | How much does price move on average? | ATR, Bollinger Bands |

| Support & Resistance | Where might price pause or reverse? | Fibonacci retracements, Ichimoku Cloud, Bollinger Bands |

| Breakouts | Is a big move coming? | Bollinger Band Squeeze, ADX, Moving Averages |

| Stop & Target Sizing | Where to set stops and take profits? | ATR, Fibonacci extensions |

Managing Risk

Even the best setups can fail without proper risk management. Every trade should include clear rules for stops, targets, and position sizing.

Position Sizing: Risk only 1–2% of your account on a single trade.

Stops: Place them beyond clear structure levels, such as swing highs/lows, Bollinger Bands, Fibonacci retracements, or Ichimoku Cloud edges.

Profit Targets: Aim for at least a 2:1 reward-to-risk ratio, using logical exit points like Fibonacci extensions, opposite Bollinger Bands, or key support/resistance zones.

Common Mistakes When Using Indicators

- Relying on a Single Indicator – Combine at least two complementary tools (e.g., trend + momentum).

- Ignoring Market Conditions – Oscillators may give false signals in strong trends; use the right indicator for the current market type.

- Over-tuning Settings – Avoid curve-fitting past charts. Stick to standard defaults unless you have a solid reason.

- Expecting Predictive Power – Indicators guide, but do not predict the future. Always confirm with price action.

- Overcrowding Charts – Too many indicators cause confusion. Focus on 2–3 covering trend, momentum, and volatility/structure.

FAQ

- Best indicators for beginners: Moving Averages, RSI, MACD.

- How to combine indicators: Use different types (trend, momentum, volatility) rather than overlapping signals.

- Do settings need adjustment: Defaults work well; only adjust with understanding.

- Common mistakes: Over-reliance on indicators or ignoring price context.

Key Terms

- Overbought: Price has risen too fast; often leads to a pullback (RSI >70, Stochastic >80).

- Oversold: Price has fallen too fast; may bounce (RSI <30, Stochastic <20).

- Divergence: Price and indicator move in opposite directions, suggesting weakening momentum.

- Standard Deviation: Measures volatility; used in Bollinger Bands.

- Retracement: Temporary pullback in a trend before continuation (e.g., 38.2% Fibonacci).

- Extension: Fibonacci levels beyond 100%, often used for profit targets (e.g., 127.2%, 161.8%).

- Support: Price level where buyers step in.

- Resistance: Price level where sellers push back.

- Lagging Indicator: Confirms trends after they occur.

- Leading Indicator: Gives early signs of potential reversals.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: