Managing risk is essential in the fast-moving world of forex trading. It provides a structured approach to handle uncertainty, protect your capital, and increase the likelihood of successful trades.

Types of Risks in Forex Trading

Market Risk

Market risk arises from the volatility of a currency’s value. Forex prices fluctuate due to economic data, geopolitical events, and monetary policy changes. For instance, shifts in interest rates can influence a currency’s demand and supply, driving price movements.

Leverage Risk

Using leverage through margin accounts allows traders to control larger positions with limited capital. While this can amplify profits, it also magnifies losses if the market moves against you. Traders can determine required margin and position sizing with tools like a margin calculator.

Liquidity Risk

Liquidity risk occurs when it’s difficult to buy or sell a currency pair without impacting its price. Low trading volumes or insufficient market participants can lead to slippage or poor trade execution. Major and minor pairs are generally liquid, but exotic pairs may carry higher liquidity risks.

Emotional and Knowledge-Based Risks

A lack of understanding of the forex market or trading driven by emotions such as fear, greed, impatience, or overconfidence can undermine risk management strategies, leading to costly mistakes.

Forex Risk Management Tools

Traders can mitigate risks using a variety of strategies:

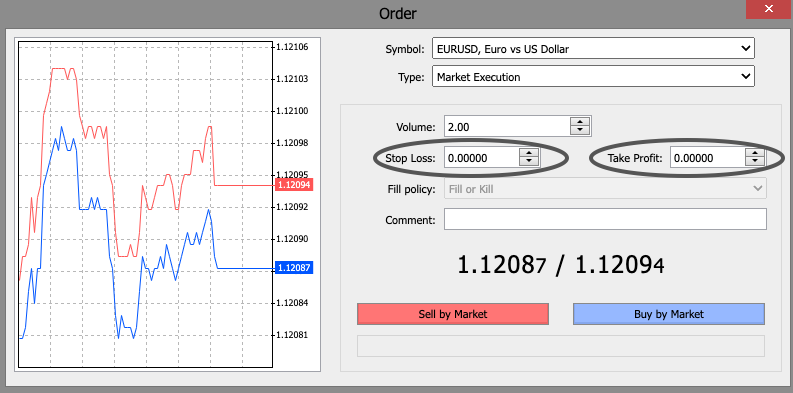

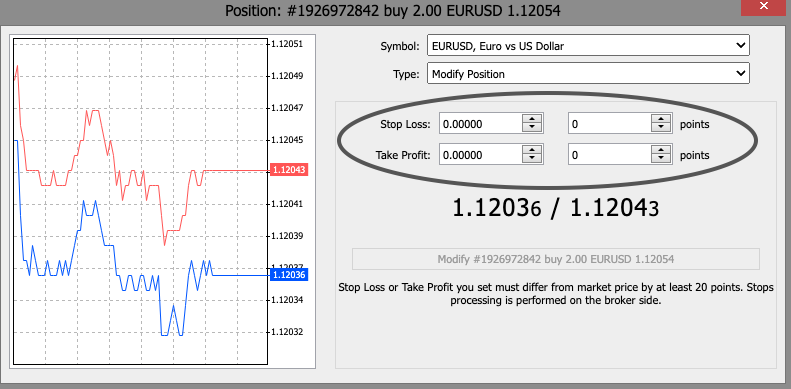

- Stop Loss Orders: Automatically close a trade at a predetermined price to limit potential losses.

- Take Profit Orders: Automatically close a trade when a target profit is reached.

These tools help manage trades without requiring constant monitoring. On platforms like Deriv MT5, traders can set stop loss and take profit levels both when opening a trade or by adjusting an existing position.

These strategies form the foundation for disciplined trading and help protect capital while navigating the uncertainties of the forex market.

Position Sizing

Position sizing involves deciding how much capital to allocate to each trade. It helps ensure potential losses stay within limits appropriate to a trader’s risk tolerance.

Best practices for position sizing include:

- Assessing your personal risk tolerance

- Using a position sizing calculator

- Considering the volatility of the currency pair

- Applying fixed fractional sizing to risk a consistent percentage of capital per trade

- Scaling into positions gradually

- Accounting for correlations with other trades or markets

- Monitoring leverage usage

- Periodically reviewing and adjusting your position sizing strategy

The goal is to strike a balance: your position should be large enough to generate meaningful profits, but not so large that a single trade could threaten your account. Mastering position sizing takes practice, but over time it can help manage risk and optimise returns.

Diversification

Diversification means spreading trades across multiple currency pairs with low correlations to reduce overall portfolio risk. The main benefit is that losses in one pair may be offset by gains in another.

Traders should aim to diversify across major, minor, and exotic pairs. For example, trading EUR/USD and GBP/USD together provides limited diversification because they are positively correlated. Adding exposure to uncorrelated exotic pairs such as USD/TRY or USD/ZAR improves diversification.

This principle can extend beyond currencies to a multi-asset portfolio. Many traders analyse correlations between currencies, stocks, commodities, and other assets to construct a portfolio that maximises returns for a given level of risk.

Continuous Learning

Ongoing education is key to managing trading risks. Staying updated on market developments encourages adaptability and continuous improvement, which is especially important when creating and refining trading plans.

Building a Forex Trading Plan

A trading plan is a structured guide for trading currency pairs with discipline and focus.

To create one, traders should:

- Set clear goals aligned with financial objectives, risk tolerance, and available capital

- Choose a trading style (e.g., scalping, swing trading) and timeframe

- Define entry and exit rules using indicators, chart patterns, or analysis

- Incorporate risk management tools such as stop losses and take profits

Evaluating Performance

A robust trading plan requires ongoing review and refinement. Traders should analyse both winning and losing trades to identify patterns, strengths, and areas for improvement. Evaluation should go beyond net profit/loss and include metrics like risk-reward ratio, profit factor, drawdowns, and the Sharpe ratio.

Performance should be monitored across different timeframes—daily, weekly, monthly, quarterly, and yearly—to assess consistency. Comparing results across market conditions and asset classes helps identify the best strategies for various environments. Honest reflection on mistakes and missed opportunities is critical for improvement.

Setting measurable goals to improve risk metrics and maintaining a detailed trade journal helps with evaluation. Sharing insights with mentors or a trading community can provide additional perspective.

New strategies can be tested on a demo account, which simulates live trading with 10,000 USD in virtual funds, allowing traders to refine their approach risk-free.

If you want, I can also condense this into a more concise, easy-to-digest version for beginners while keeping all the key points. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Employing risk management tools and following a clear trading plan can improve the chances of successful forex trades while reducing the effects of unfavorable market moves. Regular assessment and continuous refinement are essential for steadily enhancing trading skills.