Table of Contents

- Introduction

- Key Forex Terminologies

- Currency Pairs

- Pip (Percentage in Point)

- Lots

- Leverage and Margin

- Spreads

- Stop-Loss and Take-Profit

- Importance of Understanding Forex Terminology

- Tips for Learning Forex Terms

Introduction

Grasping the terminology of Forex trading is essential for navigating the market effectively. While Forex trading is dynamic and full of opportunities, it can also feel overwhelming for beginners. To trade successfully, understanding the “language” of the market is crucial. Whether you’re a newcomer taking your first steps in Forex or an experienced trader looking to refine your skills, this guide serves as a reliable resource. The article breaks down key terms, offering traders the knowledge needed not just to participate, but to excel in the Forex market.

If you want, I can also rephrase the section on Basic Forex Terminologies to match this style for a smoother, beginner-friendly guide. Do you want me to do that next?

Basic Forex Terminologies

Forex trading revolves around the buying and selling of currencies in a global marketplace. To effectively navigate this vast and dynamic market, it’s important to understand some fundamental forex terms that form the backbone of trading:

Currency Pairs

A key concept in forex trading is the currency pair, which serves as the foundation for market analysis and trading decisions. Currency pairs represent the value of one currency relative to another, and they play a crucial role in determining exchange rates and influencing market charts.

In the forex market, currencies are always traded in pairs. Each currency pair consists of two currencies: the base currency and the quote currency. The base currency is the reference point, while the quote currency indicates how much of it is needed to purchase one unit of the base currency. Understanding currency pairs is essential for analyzing price movements and executing trades effectively.

If you like, I can continue rephrasing the Pip, Lots, and Leverage sections in the same clear, beginner-friendly style to complete the guide. Do you want me to do that?

Pip (Percentage in Point)

A pip, short for Percentage in Point, is one of the most fundamental concepts in forex trading. It is a unit of measurement used to express the change in value between two currencies. In most currency pairs, a pip refers to the fourth decimal place (0.0001), representing the smallest possible movement in the exchange rate. For currency pairs involving the Japanese Yen, one pip equals 0.01.

Grasping the concept of pips is crucial for traders, as it allows them to accurately estimate potential profits or losses. For example, if a trader buys a currency pair and its value increases by 100 pips, they can calculate their gain by multiplying the number of pips by the value of each pip.

I can continue rephrasing the Lots, Leverage, and Spreads sections next in the same clear, beginner-friendly style. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Lots

In forex trading, a lot refers to the volume or quantity of a currency pair that a trader buys or sells in a single transaction. Lot sizes help determine the scale of a trade and the potential impact on profit or loss. There are several types of lot sizes:

- Standard Lot: A standard lot equals 100,000 units of the base currency. For example, buying one standard lot of EUR/USD means purchasing 100,000 euros.

- Mini Lot: A mini lot is one-tenth of a standard lot, representing 10,000 units of the base currency. Trading one mini lot of EUR/USD means trading 10,000 euros.

- Micro Lot: A micro lot is one-tenth of a mini lot, or one-hundredth of a standard lot, representing 1,000 units of the base currency. Trading one micro lot of EUR/USD means trading 1,000 euros.

The choice of lot size directly influences both risk and potential returns. Larger lot sizes offer higher profit potential but carry greater risk, while smaller lots reduce risk but yield smaller gains or losses.

Traders typically select lot sizes based on their risk tolerance, account balance, and trading strategy. Proper management of lot size is essential to avoid overleveraging, which can lead to significant losses if the market moves against a position.

If you want, I can also rephrase Leverage and Margin in the same beginner-friendly style next. Do you want me to do that?

Leverage and Margin

Leverage is a fundamental concept in forex trading that allows traders to control larger market positions with a relatively small amount of capital. It is a tool provided by brokers that lets traders borrow funds to potentially amplify both gains and losses. In essence, leverage multiplies a trader’s initial investment—known as the margin—to increase their exposure to currency pairs.

Margin is the amount of money a trader must deposit with their broker to open and maintain a trading position. It acts as collateral, ensuring that the trader has sufficient funds to cover potential losses. The margin requirement is typically expressed as a percentage of the total position size.

If you want, I can continue rephrasing Spreads and Stop-Loss and Take-Profit in the same beginner-friendly style so the entire guide is cohesive. Do you want me to do that?

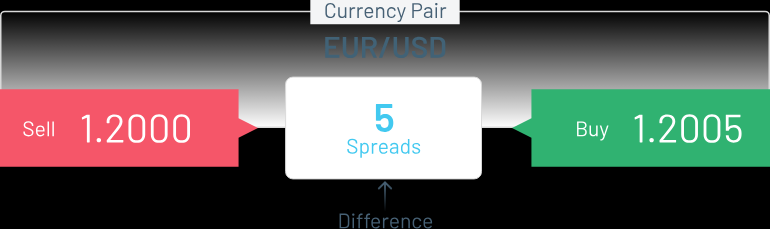

Spreads

In forex trading, a spread is the difference between the buy (ask) price and the sell (bid) price of a currency pair, typically measured in pips. It can be calculated by subtracting the bid price from the ask price. The ask price is the amount a trader pays to open a long (buy) position, while the bid price is what a trader receives when opening a short (sell) position. Essentially, the spread reflects the cost of entering a trade.

Unlike some other markets, forex spreads are often variable, meaning they can change frequently throughout the trading day due to market conditions. This gives rise to tight spreads (low cost) and wide spreads (high cost). Traders generally favor tighter spreads, as they reduce trading expenses and make entering and exiting positions more cost-efficient.

I can also rephrase Stop-Loss and Take-Profit in the same style so your guide maintains consistency. Do you want me to do that next?

Wide spreads usually occur when the market is highly volatile or lacks sufficient liquidity. For example, during major news releases or events that create uncertainty, spreads can expand significantly. Conversely, in highly liquid markets with low volatility, spreads tend to be tighter, making trading more cost-efficient and appealing to traders.

Types of Spreads:

Fixed Spread: In this type, the difference between the ask and bid prices remains constant, regardless of market conditions. Fixed spreads are predictable, allowing traders to estimate their trading costs easily. However, they may still be wider during periods of extreme market volatility.

Variable Spread: Variable spreads fluctuate according to market conditions. They tend to be narrower when liquidity is high and can widen during periods of volatility or reduced liquidity. Traders often prefer variable spreads because they can offer lower trading costs under favorable conditions.

Additionally, there is a concept called a floating spread, which is a type of variable spread that continuously adjusts as market conditions change. Floating spreads are highly flexible but can be unpredictable, reflecting real-time market dynamics.

If you want, I can also rephrase Stop-Loss and Take-Profit next so your section on spreads and trade management flows seamlessly.

Stop-Loss and Take-Profit

A stop-loss is an order placed by a trader with their broker to limit potential losses on an open trade. It is set at a specific number of pips away from the entry price and can be applied to both long and short positions. Stop-loss orders are a key component of risk management, helping traders control losses and protect their capital.

Similarly, a take-profit is an order given to a broker to automatically close a trade when it reaches a predetermined profit level. This ensures that gains are secured without the need for constant monitoring of the market.

If you want, I can also rephrase “Why Understanding Forex Terminologies is Crucial” to maintain consistency with your style.

Why Understanding Forex Terminologies is Essential

The Forex market has its own unique set of terms and jargon. Successfully navigating this highly liquid financial market requires a solid understanding of its basic concepts. Before diving into trading, it is crucial for traders to familiarize themselves with the terminology used in executing trades. Since the FX market is accessible to anyone with an internet connection, misinformation and confusion can easily occur, making a strong grasp of forex terms essential for making informed decisions.

Tips for Learning Forex Terminologies

Practice Through Demo Trading

Demo trading, also called paper trading or virtual trading, allows traders to gain practical experience in the Forex market without risking real money. It provides a simulated trading environment where investors can test strategies, practice techniques, and observe market behavior in real-time. The goal is to offer a safe space for experimentation, enabling traders to refine their skills before committing actual capital in live markets.

Conclusion

In summary, understanding these foundational concepts is critical for anyone entering the Forex market. Depending on the type of trading, some terms may be more relevant than others. Forex trading is complex and demands continuous research, practice, and awareness to achieve success.

If you like, I can also rework the “Table of Content” section to match this more concise and reader-friendly style.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: