Table of Contents

- Understanding Technical Analysis in Forex

- Core Concepts of Technical Analysis

- Popular Technical Analysis Indicators

- Technical Analysis vs. Fundamental Analysis

- Applications of Technical Analysis

- Benefits of Technical Analysis

- Limitations of Technical Analysis

- Conclusion

Trading in the forex market involves exchanging currencies in pairs, aiming to profit from fluctuations in their value. The market is fast-paced and requires a solid grasp of price behavior, strategies, and analytical tools to make informed decisions. Among the most commonly used methods for predicting price movements is technical analysis.

Technical analysis is the study of historical trading data, including price trends, volume, and volatility, to forecast future market movements. It is widely used by traders of all experience levels. In this guide, we will cover the fundamentals of technical analysis, explore key indicators, discuss essential concepts, and explain how traders can apply these tools effectively.

Understanding Technical Analysis in Forex

In forex, technical analysis is the practice of forecasting future price movements of currencies based on historical market data, focusing mainly on price and trading volume.

While fundamental analysis evaluates an asset’s intrinsic value using economic and financial factors, technical analysis depends entirely on historical price action. The core assumption is that prices move in identifiable trends. By examining historical price charts and patterns, traders aim to anticipate potential future movements.

Core Concepts of Technical Analysis

Before exploring specific indicators, it’s crucial to understand the foundational concepts that guide technical analysis. These principles are key to interpreting trends and price behavior:

Price Action

Price action represents the movement of an asset’s price over time and serves as the backbone of technical analysis. It is based on the idea that all relevant information about an asset is reflected in its price. Traders study price action using methods such as candlestick patterns—where each candlestick shows the opening, closing, high, and low prices for a given period—and chart patterns, which visually represent price trends and signal potential future movements.

If you want, I can also rephrase the rest of your full document in the same style so it reads smoothly and professionally. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Trends

A trend represents the overall direction in which an asset’s price is moving. Trends can be classified as:

- Uptrend (Bullish): An uptrend occurs when prices form higher highs and higher lows, indicating a general rise in price.

- Downtrend (Bearish): A downtrend is identified by lower highs and lower lows, suggesting that prices are generally falling.

- Sideways Trend (Range-Bound): Sideways trends happen when prices move within a horizontal range, reflecting market indecision.

In technical analysis, the underlying assumption is that once a trend is established, it is likely to continue until a significant reversal occurs.

Support and Resistance

- Support: Support is a price level where a falling asset tends to stop declining due to strong buying interest. It acts like a “floor” that prevents further downward movement.

- Resistance: Resistance is a price level where an asset’s upward movement tends to halt due to selling pressure, functioning as a “ceiling.”

Recognizing these levels helps traders make strategic decisions about when to enter or exit a trade. For instance, if the price approaches a support level and shows signs of bouncing back, a trader may consider taking a long position.

If you want, I can also rephrase the next section on Technical Indicators in the same concise and professional style. Do you want me to continue?

Support and Resistance

Volume

Volume refers to the total number of shares or contracts traded over a specific period. It serves as an indicator of the strength behind a price movement. A rising volume during a price change signals strong market conviction, whereas declining volume may suggest that the momentum is weakening.

I can also merge it smoothly with the earlier section on trends and support/resistance if you want a continuous, cohesive flow for your guide. Do you want me to do that?

Volume

For example, if a currency pair breaks through a resistance level accompanied by high trading volume, it often indicates strong conviction behind the price movement.

Time Frames

Technical analysis can be applied across multiple time frames, ranging from one-minute charts to monthly charts. The selected time frame can greatly influence trading strategies. Short-term traders tend to focus on minute-by-minute charts, while long-term investors may analyze daily or weekly charts.

Different trading styles often correspond to different time frames:

- Day Traders: Use shorter time frames (1-minute to 15-minute charts) to spot quick trading opportunities.

- Swing Traders: Analyze hourly or daily charts to capture larger price movements over several days or weeks.

Technical Analysis Indicators

Technical analysis uses various indicators—statistical tools that help traders evaluate market conditions and make informed decisions. Some of the most commonly used indicators in forex include:

- Moving Averages (MA): A moving average smooths out price data into a single flowing line, helping traders identify the trend direction by filtering out short-term price fluctuations.

If you want, I can also rephrase the next sections on RSI, MACD, and Bollinger Bands in the same clear style so your guide reads seamlessly. Do you want me to do that?

Moving Averages (MA)

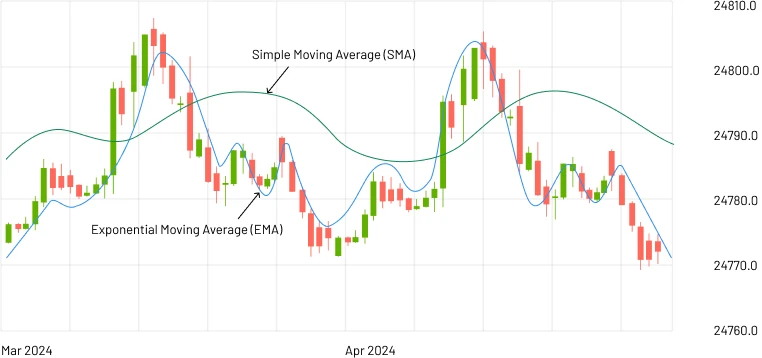

There are two main types of moving averages:

- Simple Moving Average (SMA): Calculated by taking the average of an asset’s price over a specified period.

- Exponential Moving Average (EMA): Similar to the SMA, but gives more weight to recent prices, making it more responsive to recent price changes.

Relative Strength Index (RSI)

The RSI is an indicator that measures the speed and magnitude of price movements, helping traders identify overbought or oversold conditions.

It ranges from 0 to 100, reflecting the following:

If you want, I can continue rephrasing the RSI levels and other indicators like MACD and Bollinger Bands to keep your guide consistent and professional. Do you want me to do that?

Relative Strength Index (RSI)

- RSI above 70: Signals that the asset may be overbought.

- RSI below 30: Indicates that the asset may be oversold.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following indicator that illustrates the relationship between two moving averages of an asset’s price. It is composed of:

I can continue rephrasing the MACD components and explanation next if you want. Do you want me to do that?

Moving Average Convergence Divergence (MACD)

- MACD Line: Represents the difference between the 12-day EMA and the 26-day EMA.

- Signal Line: A 9-day EMA of the MACD line.

Traders monitor crossovers between these two lines to identify potential buy or sell signals.

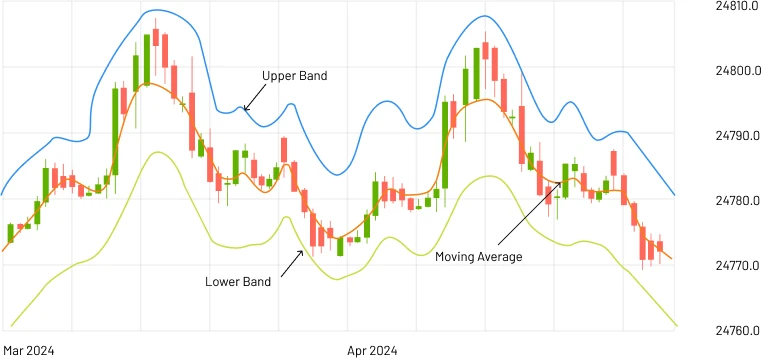

Bollinger Bands

Bollinger Bands are made up of three lines: a simple moving average (SMA) and two bands plotted two standard deviations above and below it. They help traders gauge market volatility. When prices reach the upper band, it may signal overbought conditions, while touching the lower band could indicate oversold conditions. The bands widen and contract in response to changes in market volatility.

I can also rephrase the section on Fundamental Analysis vs. Technical Analysis next for consistency if you want. Do you want me to do that?

Bollinger Bands

Fibonacci Retracement

Fibonacci retracement helps traders identify potential reversal points by plotting horizontal lines at key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, 100%) based on an asset’s previous high and low prices. These levels often act as support or resistance, aiding in forecasting potential price movements.

Stochastic Oscillator

The stochastic oscillator compares an asset’s closing price to its price range over a specific period. Similar to the RSI, it signals overbought or oversold conditions but on a different scale (0–100). Readings above 80 indicate overbought conditions, while readings below 20 suggest the asset is oversold.

Fundamental Analysis vs. Technical Analysis

The main distinctions between fundamental and technical analysis include:

| Factor | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Focus | Examines economic indicators, financial statements, and broader market conditions | Focuses on historical price data and market trends |

| Timeframe | Typically used for long-term analysis based on economic cycles | Primarily applied for short-term trading, concentrating on price movements |

| Tools & Indicators | Uses economic reports, earnings data, and other financial metrics | Uses price charts, technical indicators, and patterns |

How Technical Analysis is Used

Technical analysis guides forex traders in several ways:

- Identifying Trends: Traders examine price charts to determine market direction and create strategies based on uptrends, downtrends, or sideways ranges.

- Entry and Exit Points: By combining multiple indicators, traders can time their trades. For example, approaching a support level with high volume and an oversold RSI may signal a buying opportunity.

- Risk Management: Chart patterns and technical signals help gauge market sentiment, aiding in controlling risk exposure.

- Setting Price Targets: Previous highs, lows, and Fibonacci levels are commonly used to establish realistic targets.

- Understanding Market Psychology: Patterns like head and shoulders, double tops, and triangles reflect collective trader behavior, helping anticipate potential reversals or trend continuations.

Advantages of Technical Analysis

Key benefits include:

- Visual Interpretation: Charts, patterns, and graphs provide an intuitive view of trends, support/resistance, and market behavior.

- Flexibility: Can be applied across various markets and timeframes to suit different trading styles.

- Short-term Forecasting: Effective for intraday or short-term trading strategies, helping traders capitalize on small price movements in liquid pairs like EUR/USD.

- Risk Management: Supports setting stop-losses, take-profits, and other measures derived from charts and indicators.

- Objective Framework: Provides a data-driven approach that reduces emotional decision-making and promotes disciplined trading.

Limitations of Technical Analysis

Despite its benefits, technical analysis has some drawbacks:

- Subjectivity: Interpretation of charts and indicators can vary among traders.

- Market Noise: Short-term fluctuations can create false signals.

- Lagging Indicators: Many indicators respond after price moves, potentially causing missed opportunities.

- Limited Scope: Does not account for external events like economic or political developments.

- Not Foolproof: Losses can occur, so combining technical analysis with sound risk management is essential.

Conclusion

Technical analysis is an essential tool for forex traders, offering valuable insights into price movements, trends, and market behavior. While it requires practice to master, understanding its principles allows traders to develop effective strategies.

However, recognizing its limitations and pairing it with strong risk management is crucial. Whether you are a beginner or an experienced trader, proficiency in technical analysis can improve trading decisions and enhance confidence in navigating the forex market.

If you want, I can also condense this entire guide into a more concise, beginner-friendly version that’s easier to read without losing important details. Do you want me to do that next?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: