The Federal Reserve cut its benchmark interest rate by 25 basis points to a range of 4.00%–4.25% last night, marking the first reduction since December 2024 and hinting at the possibility of two more cuts before year-end.

In its statement, the FOMC highlighted that “inflation has moved up and remains somewhat elevated,” signaling that price pressures are still a concern. At the same time, the labor market shows signs of slowing, with the committee noting that “job gains have slowed, and the unemployment rate has edged up but remains low.”

Market Reactions:

- 📈 Dollar: Strengthened, reflecting caution and a commitment to controlling inflation.

- 📉 Equities (S&P 500, Nasdaq): Sold off, as investors were hoping for a clearer easing path.

- 🥇 Gold: Fell, tracking the stronger dollar.

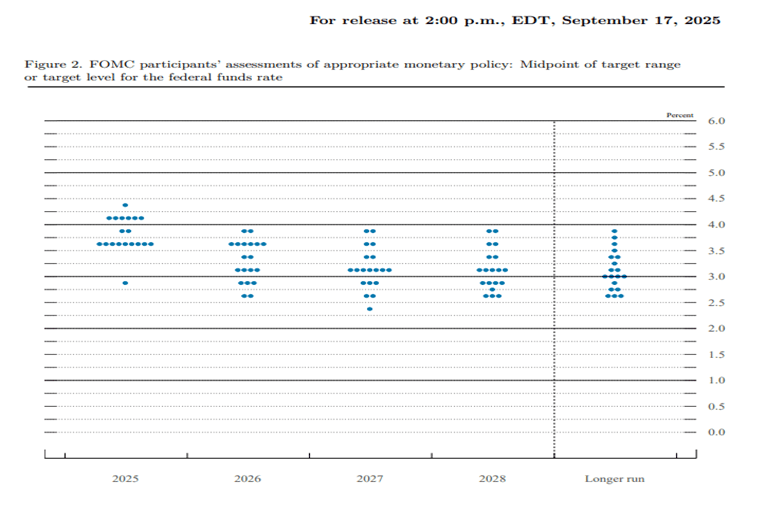

Dot Plot Insights

The Fed’s “dot plot,” officially the Summary of Economic Projections (SEP), shows where each FOMC member expects the federal funds rate to be at the end of this year and beyond. Key takeaways from the latest release include:

- 🔹 Divergent Views: Committee members displayed a wide range of opinions on future rates, reflecting the challenges of balancing slowing jobs growth with persistent inflation. One official even forecast a more aggressive pace of cuts than the majority.

- 🔹 Median Expectation: Despite differences, the median projection points to at least two additional rate cuts by year-end, providing a baseline that markets often focus on.

- 🔹 No Guarantees: The dot plot represents probabilities, not commitments. Chair Jerome Powell emphasized that projections are data-dependent and may change with new economic developments.

- 🔹 A Lone Dissent: Stephen Miran voted for a more aggressive 50-basis-point cut, highlighting internal debate over managing a softening labor market amid elevated inflation pressures.

If you want, I can also make a more concise, market-ready version that’s punchy for readers who just want the key points. Do you want me to do that?

Key Takeaways:

✅ The Fed implemented a modest rate cut while maintaining a cautious, inflation-focused approach.

✅ Markets should anticipate gradual, data-driven adjustments rather than a swift cycle of rate reductions.

✅ Expect short-term volatility across equities, currencies, and commodities as traders interpret the Fed’s stance on its dual mandate.

The Fed’s future actions aren’t predetermined. Their approach remains “data-dependent,” meaning each inflation report, jobs release, and economic indicator will be closely analyzed for signals on the next move.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: