Forex Leverage Explained: Turning Small Capital into Big Opportunities

Forex trading offers a unique advantage: you don’t need a large deposit to get started. That advantage comes from leverage—the tool that allows small capital to control much larger positions in the market.

In simple terms, leverage in forex means borrowing money from your broker to open trades larger than your actual deposit. With a smart approach, leverage can accelerate the growth of a small account—but misused, it can quickly lead to significant losses.

Understanding how leverage works, when to use it, and how to manage the risks is crucial. Brokers like Dominion Markets provide high leverage, tight spreads, and low latency, making them a strong choice for traders seeking efficient, fast execution.

How Forex Leverage Works

Leverage lets you control a bigger position than the money you put down. For example, if your broker offers 100:1 leverage, you can manage $100,000 worth of currency with just a $1,000 deposit. The broker covers the difference, while you only need enough margin to open and maintain the trade.

Think of leverage like a power tool: it can make your trading much more efficient—but one wrong move can cause serious damage.

Key Points About Forex Leverage:

- Trade large positions with a small deposit

- Broker provides the borrowed funds

- Margin is required to open and maintain trades

- Leverage multiplies both profits and losses

- Proper use enhances capital efficiency

- Misuse can wipe out an account

- It’s a tool—not a shortcut

- Smart traders always manage risk with stop-losses

Why Forex Offers High Leverage

Forex markets are massive and highly liquid, meaning there’s almost always a counterparty for your trade. Price changes are often small, so large positions are needed to generate meaningful profits.

Leverage allows traders to amplify small price movements into significant gains without committing the full capital upfront. Other markets, like stocks, typically cap leverage at 2:1, while futures may go up to 15:1. In forex, brokers can offer 50:1, 100:1, or even 500:1 leverage. For instance, Dominion Markets provides up to 500:1 leverage, giving traders maximum flexibility without compromising execution speed or pricing.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Why Forex Offers High Leverage

High leverage, such as 500:1, gives traders significant flexibility. It allows you to open larger positions without committing your entire account, which can be especially helpful when managing multiple trades or responding quickly to market movements. However, the key to using leverage effectively is control.

Just because 500:1 is available doesn’t mean you need to use it all. Think of leverage as a tool that expands your options, not a green light to overextend. Traders who carefully scale position sizes and manage risk can harness high leverage to their advantage without jeopardizing their account.

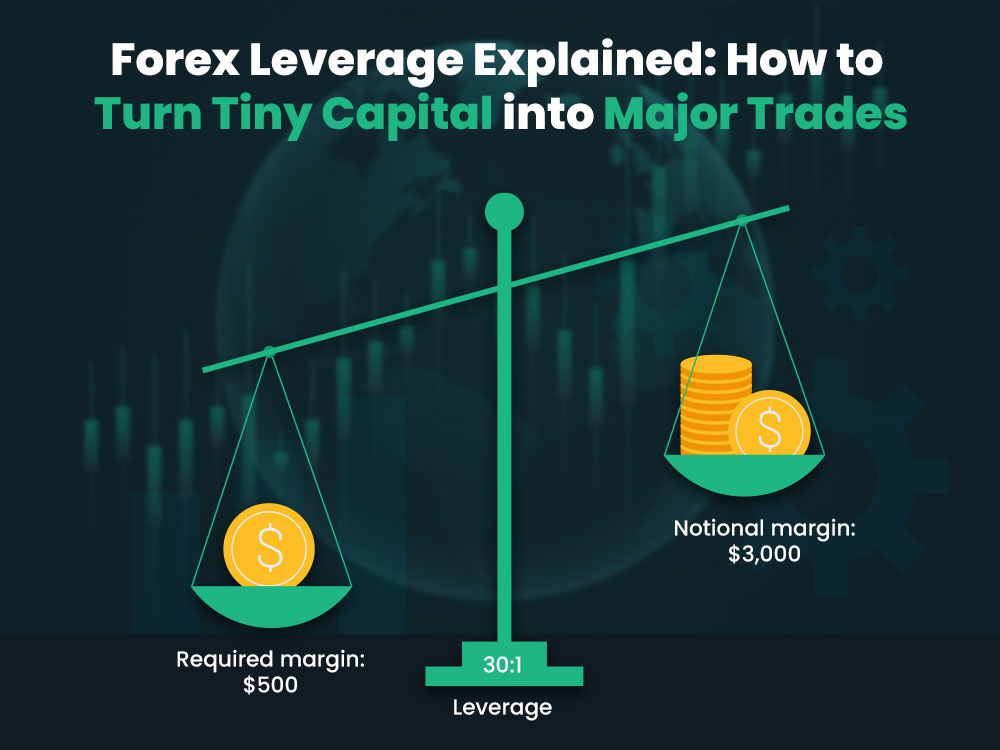

Margin and Leverage: How They Work Together

Margin and Leverage: How They Work Together

To use forex leverage, you need margin. Margin is the money you set aside to open a trade—it’s essentially your “skin in the game.”

For example, if you want to open a $100,000 position with 100:1 leverage, you only need $1,000 in margin, which is 1% of the total trade size.

The formula is straightforward:

Leverage = Trade Size ÷ Margin

So, if your margin is $500 and your trade size is $50,000, your leverage is 100:1.

Key Points on Margin and Leverage:

- Margin is the upfront deposit required to open a trade.

- Leverage allows you to control a larger position than your deposit.

- Higher leverage reduces the margin needed.

- Leverage magnifies both potential profits and losses.

- Using margin wisely helps protect your account from rapid losses.

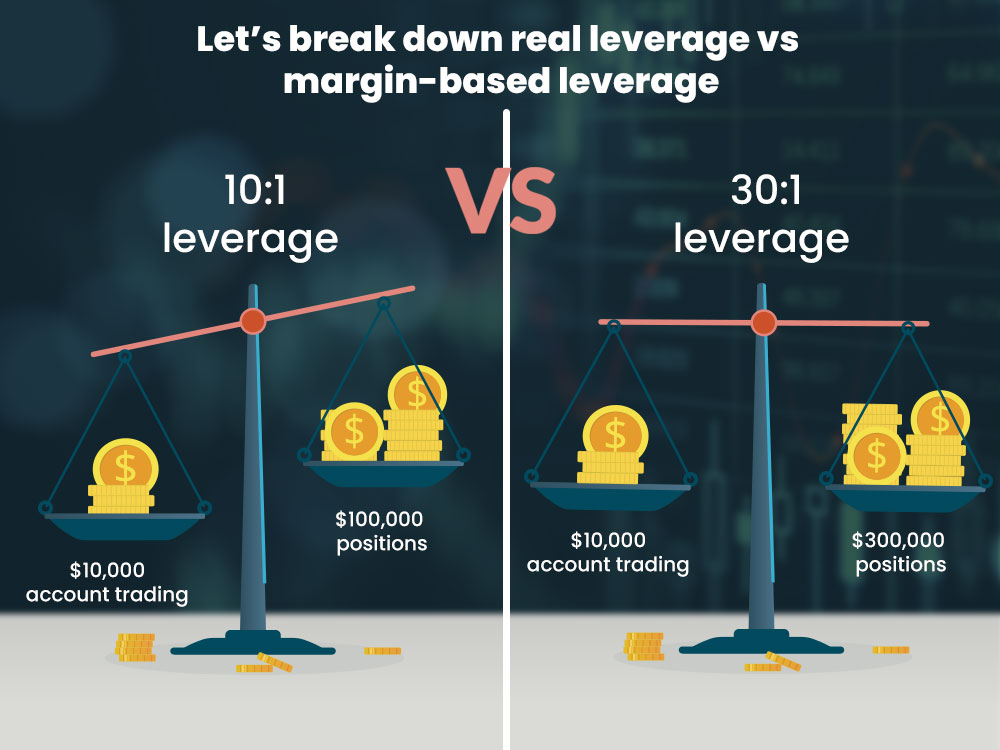

Real Leverage vs. Margin-Based Leverage

There are two types of forex leverage: margin-based and real leverage.

- Margin-based leverage is what your broker displays. It’s calculated based on the margin required to open a trade.

- Real leverage reflects the leverage you’re actually using, based on your total capital and how much you risk.

Formulas:

- Margin-Based Leverage = Trade Size ÷ Margin Required

- Real Leverage = Trade Size ÷ Total Trading Capital

Traders often use less than the maximum allowed margin. Real leverage provides a more accurate view of account risk, as high real leverage can quickly deplete your funds if trades move against you.

Real Leverage vs. Margin-Based Leverage

Imagine you have $10,000 in your account. Opening a trade worth $100,000 means you’re using 10:1 real leverage. If you open a $300,000 trade instead, your real leverage jumps to 30:1, putting much more of your account at risk.

Combining leverage with reliable forex indicators—like moving averages or RSI—can improve your trade timing. These tools help identify better entry and exit points, making your use of leverage more precise and less reactive.

How Leverage Impacts Profit and Loss

Leverage amplifies both gains and losses. For instance, a $100,000 trade moving just 1% results in a $1,000 change. If the market moves in your favor, that’s a profit—but if it moves against you, it’s a significant loss.

This is why risk management is critical. Smart traders use stop-loss orders and limit risk to 1–3% of their account per trade.

Key Points on Profit and Loss with Leverage:

- Small price moves can result in large account swings.

- Stop-losses protect against major losses.

- Position sizing is crucial when using high leverage.

- Only risk what you can afford to lose.

High Leverage = High Risk

Consider two traders with the same $10,000 account:

- Trader A uses 50:1 leverage to open a $500,000 trade.

- Trader B uses 5:1 leverage to open a $50,000 trade.

If both lose 100 pips, Trader A loses $4,150 (41.5% of their account), while Trader B loses $415 (4.15%). Same market move, vastly different outcomes.

Excessive leverage can quickly destroy an account. That’s why many professional traders use lower leverage than allowed. Practicing in a safe environment—using forex simulators—helps you test strategies, understand leverage, and build confidence without risking real money.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Using Leverage the Right Way

To use forex leverage effectively, you need a well-thought-out plan:

- Set Stop-Losses: Always have a safety net in place.

- Know Your Risk: Never risk more than you can afford to lose on a single trade.

- Use Smaller Positions: Reduces pressure and helps you focus.

- Monitor Real Leverage: Track the actual leverage you’re using, not just what the broker shows.

- Avoid Revenge Trading: One loss doesn’t justify taking bigger risks next time.

When used correctly, leverage can amplify returns while keeping risk under control. Many traders also rely on indicators like Supertrend to confirm trend direction, which is crucial when deciding how much leverage to apply. Combined with a solid trading plan, tools like Supertrend improve timing and reduce second-guessing.

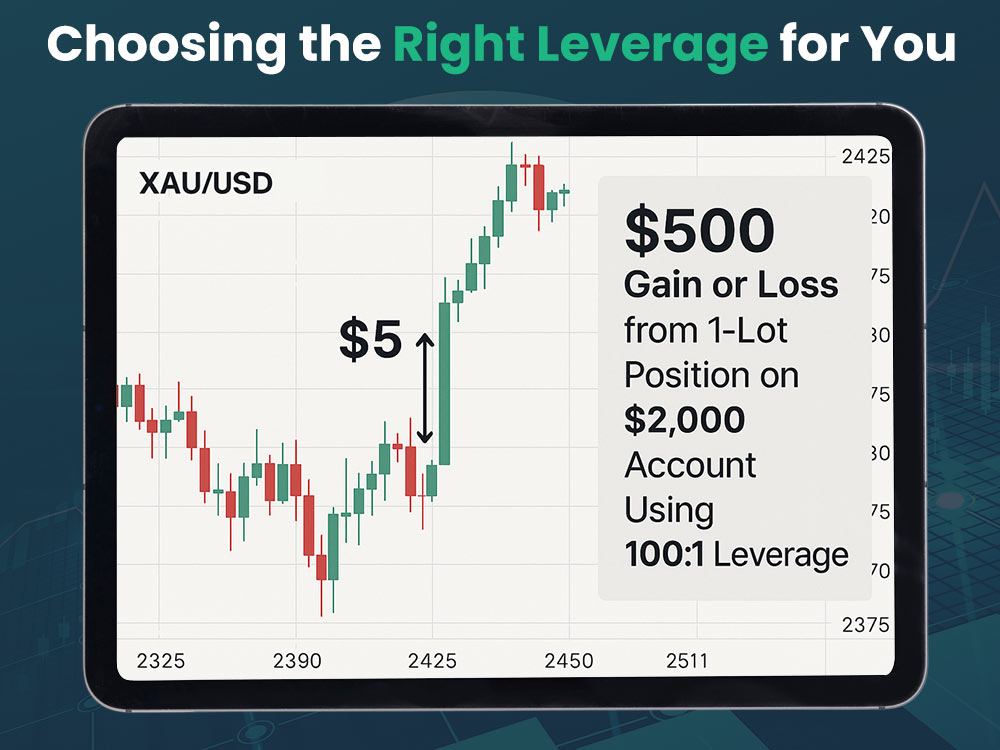

Choosing the Right Leverage for You

There’s no universal “best” leverage level—it depends on your goals, experience, and risk tolerance.

- Beginners: Stick to 5:1 or 10:1 leverage. This provides room to learn without risking your account.

- Advanced Traders: Higher leverage may be used, but only with strict risk controls in place.

The most successful traders focus on consistent, small gains rather than chasing huge wins. They treat leverage as a tool to enhance trading, not as a gamble.

When selecting a broker, research high-leverage options to find the right fit—but always prioritize risk management first.

Choosing the Right Leverage for You

Consider this example: You have a $2,000 account and trade XAU/USD (Gold vs. US Dollar) using 100:1 leverage. You open a 1-lot position worth $100,000. If Gold moves up by just $5, that small shift nets you $500—25% of your account—if the trade moves in your favor. But if it moves against you by the same amount, losses come just as quickly. This is why platforms like MT5, which offer flexible lot sizing and precise trade control, are popular among traders.

Final Thoughts

Forex leverage is one of the market’s most powerful advantages. It allows you to control large positions with relatively little capital—but it works both ways.

Used recklessly, leverage can hurt your account. Used wisely, it becomes a powerful trading tool.

- Understand how leverage works.

- Track your real exposure.

- Keep risk manageable.

Choosing the right broker also makes a difference. With Dominion Markets, traders benefit from speed, flexibility, and value—key factors for maintaining control and executing trades effectively.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: