Trading strategies are crucial for any trader aiming to make consistent profits, as they provide a structured approach to decision-making. In this guide, we’ll explore one of the key reversal and continuation patterns in the stock market: Opening Range Breakouts (ORB). We’ll cover its history, provide practical examples, and share useful tips for applying it effectively.

What Are Opening Range Breakouts?

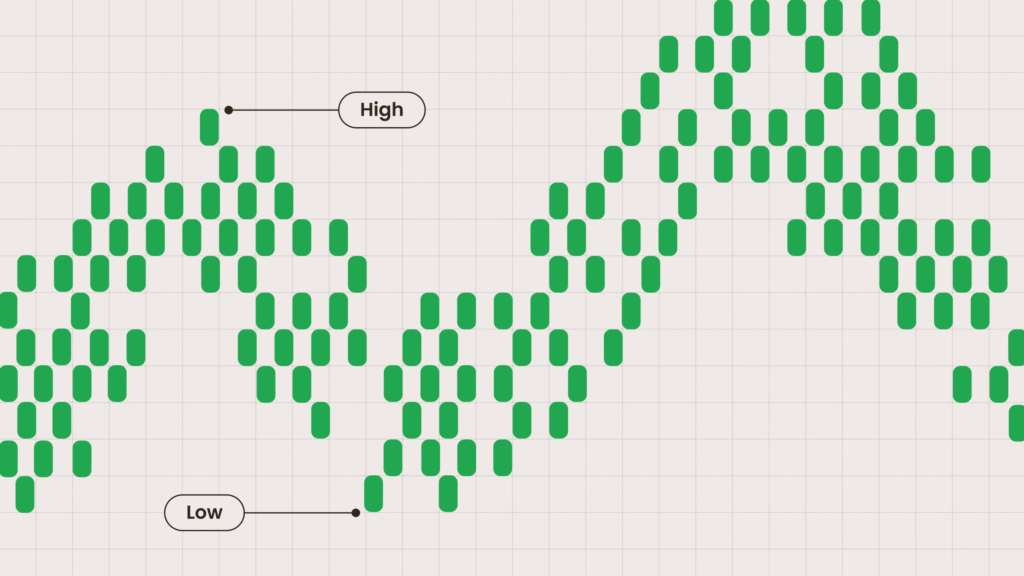

An Opening Range Breakout (ORB) is a trading setup that focuses on the high and low prices established during the first few minutes after the market opens—typically the first 15 minutes.

A breakout occurs when the price closes beyond either the high or low of this initial range, signaling a potential trade in the direction of the momentum.

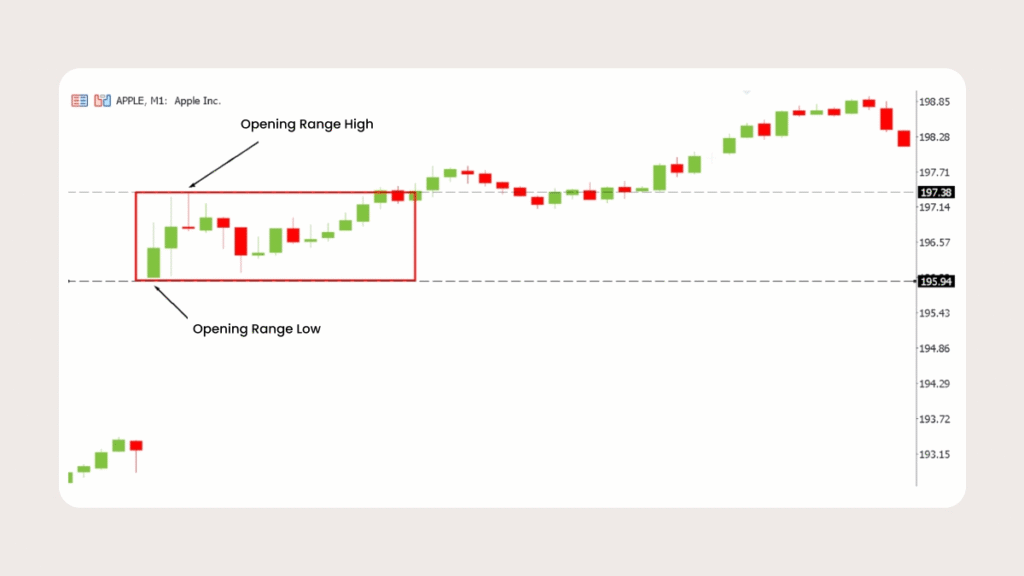

For example, if you’re analyzing Apple stock, you would define the 15-minute opening range from the market open to 15 minutes afterward. The key levels to watch are the highest and lowest prices within that time frame. A move beyond these levels may indicate a trading opportunity in the breakout direction.

Visualizing the first 15-minute high and low helps make this concept clearer.

You can see that the trading session often starts with a price gap. To define the 15-minute opening range, use 15-minute candles. Once the range is established, traders can switch to lower timeframes (1–5 minutes) to fine-tune entries and stops. After the opening range is set, the focus shifts to identifying breakout opportunities.

ORB analysis tends to work best in markets with clearly defined opening and closing times, such as stocks. For example, the US stock market opens at 09:30 Eastern Time (ET), which corresponds to 15:30 in much of Europe.

Keep in mind that the US observes Daylight Saving Time (DST), moving clocks forward in spring and back in fall. Since the dates change annually, always check the current ET before trading.

Market Hours & Time Zones

Opening Range Breakouts are based on the first 15–30 minutes after the market officially opens. For US equities, this is 09:30 ET.

- Daylight Saving Time (DST): ET alternates between EST (UTC-5, winter) and EDT (UTC-4, summer). Always verify the correct time if trading from abroad.

- Conversion: 09:30 ET is either 14:30 or 13:30 UTC depending on DST.

For other markets, the same principle applies: reference the local official open. For example, the London Stock Exchange opens at 08:00 local time, and Frankfurt at 09:00. Using an incorrect time zone can invalidate your opening range levels.

Using ORB in Different Markets

ORB is easiest to apply to stocks because US equities have a fixed open at 09:30 ET. However, it can also be used in futures and Forex, which trade nearly 24 hours a day. The key is defining what counts as the “opening session.”

- Stocks (Equities): Use the first 15–30 minutes after 09:30 ET to mark highs and lows. Volume and volatility surge at the open, making breakouts more reliable.

- Futures (ES, NQ, etc.): Since futures trade almost all day, traders often choose the stock market’s 09:30 ET open or commodity opens (e.g., 08:00 ET) as the session start, when liquidity is high.

- Forex: No single global open exists. Traders often use:

- London open (03:00–04:00 ET) for EUR/GBP pairs

- New York open (08:00–09:00 ET) for USD pairs

- Asian open (07:00–08:00 ET) for JPY/AUD/NZD pairs

- Crypto: With a 24/7 market, traders may use the 00:00 UTC daily candle or local exchange opening times with notable volume spikes.

The concept remains consistent: identify an early-session range when liquidity is high, then trade the breakout. The main difference lies in selecting the proper “opening window” for each market.

History of ORB

The Opening Range Breakout strategy originated in floor trading, where pit traders monitored the first minutes to gauge market sentiment. Over time, it became formalized and is now a common intraday approach in stocks, futures, and Forex. ORB evolved naturally through active trading rather than being attributed to a single inventor.

Notably, trader Sheldon Knight used the percentage difference between N-day highs and lows to define ranges. However, a simpler approach often works best: using price action during the opening minutes rather than relying on historical averages.

Measuring the Opening Range Size

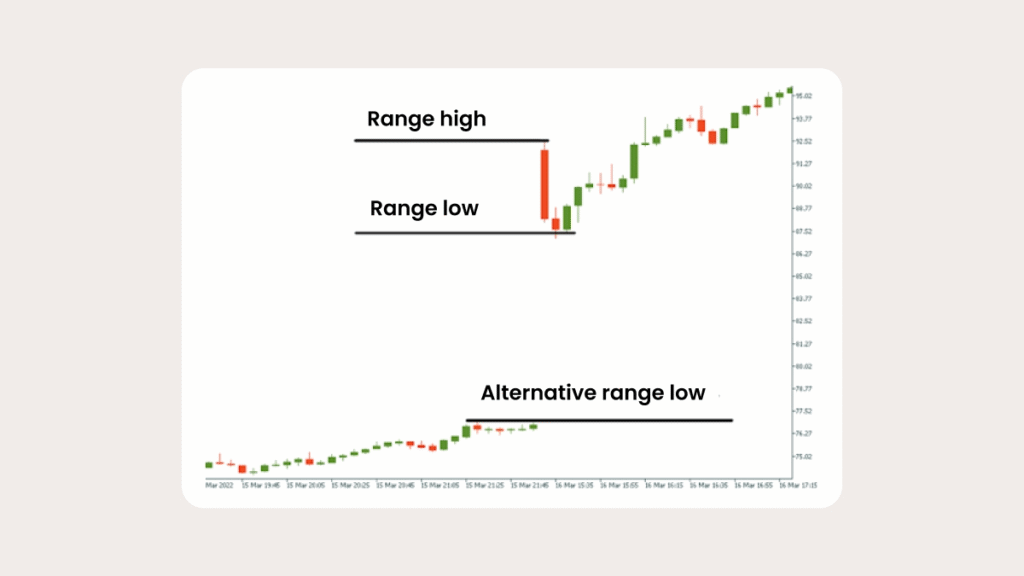

The size of the opening range is determined by the high and low within the chosen time window.

To calculate the ORB, identify the highest and lowest prices within a specified period after the market opens, typically the first 30 minutes or first hour of trading.

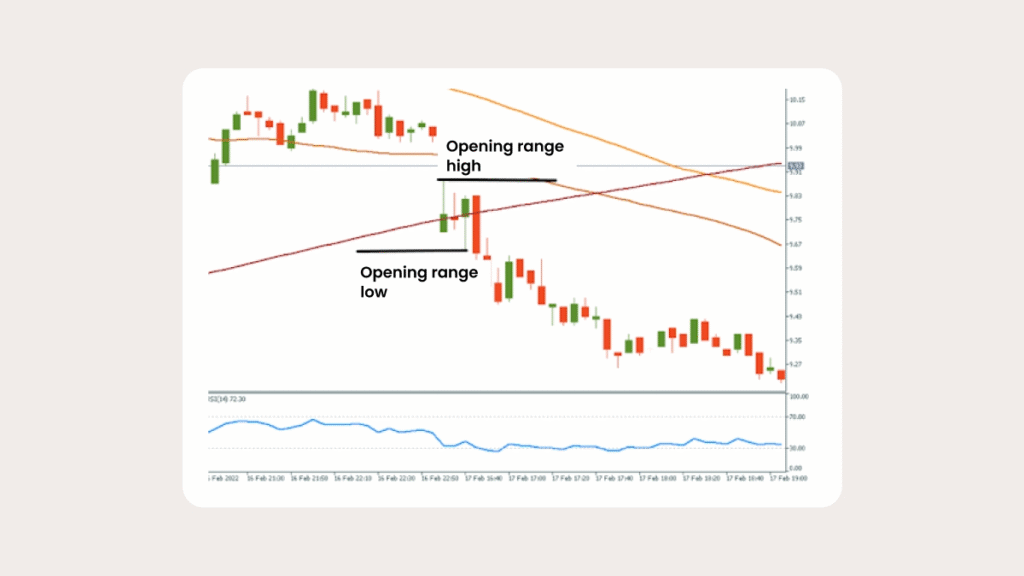

During this timeframe, focus on the day’s high and low. It’s also important to consider pre-market highs and lows, as these levels often influence price movement once the market opens. Below, the same chart is shown using this measurement approach.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Step-by-Step: Calculating and Plotting the Opening Range

You don’t need any special tools to determine the opening range — it’s straightforward:

Formula:

- Opening Range High = highest price during the first N minutes (e.g., first 15 minutes after the open)

- Opening Range Low = lowest price during the first N minutes

- Range Width = High – Low

On MT4/MT5:

- Open a 1-minute or 5-minute chart for your chosen stock, future, or currency pair.

- Highlight the first 15 or 30 minutes after the official market open.

- Identify the highest and lowest prices within this time frame.

- Draw horizontal lines or a box: top line = High, bottom line = Low.

- Monitor the chart for a breakout above or below this range, ideally confirmed by volume.

Once the opening range box is drawn, it serves as your key reference for the day. A breakout above or below this range acts as your potential trade signal.

Quality Filters for ORB Setups

Not every opening range breakout is worth trading. Without proper filters, you risk chasing low-quality signals where the price chases back and forth, stopping you out. Check these three criteria before entering an ORB trade:

1. Range Width

The opening range should be wide enough to indicate a meaningful move.

- A good guideline is at least 0.2% of the stock’s price.

- Example: If a $100 stock forms a $0.10 opening range, that’s too narrow and prone to false breakouts. A range of $0.20–$0.30 is generally more reliable.

2. Volume Confirmation

Look for a noticeable surge in volume on the breakout.

- Breakouts with low volume often fail quickly.

- The breakout candle should show significantly higher volume than the average of the range candles.

- Strong volume indicates institutional participation; without it, the move may lack momentum.

3. Daily Market Bias

Align your ORB trades with the broader market trend.

- For long trades: ensure the stock is above its daily VWAP, near pre-market highs, or in an uptrend.

- For short trades: look for weakness below VWAP, near pre-market lows, or within a bearish market environment.

- Trading against the higher-timeframe trend reduces your odds of success.

Key Takeaway: A clean breakout alone isn’t enough. Only trade ORBs that meet all three conditions: sufficient range width, strong breakout volume, and alignment with the larger market trend.

ORB Trading Strategy

The strategy involves several steps:

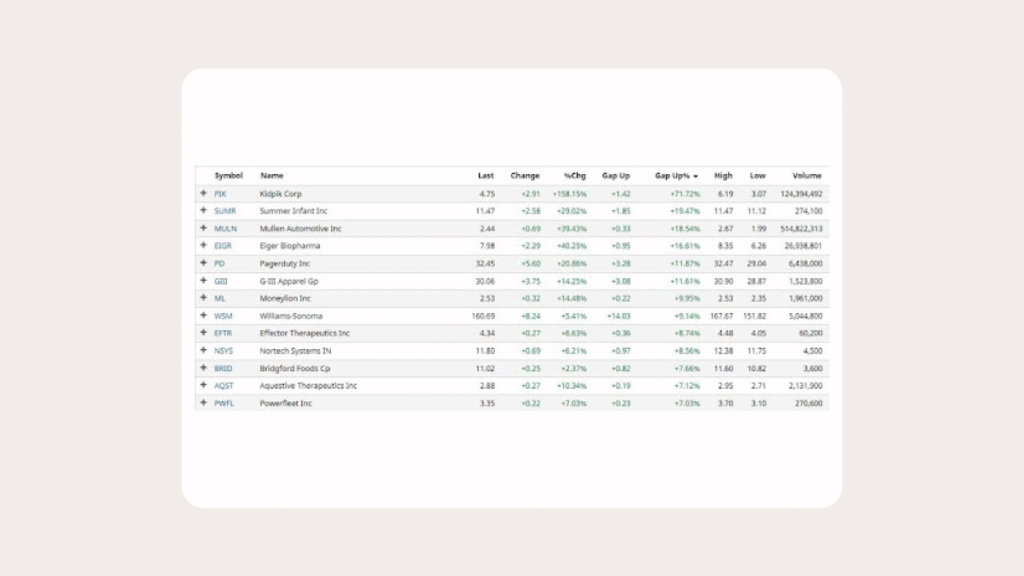

- First, look for price gaps in stocks. Free gap scanners are available online to help identify candidates.

- You can also watch tutorials like our “Gap and Go” video to learn more about finding potential trades efficiently.

Once you’ve identified a suitable gap, open the stock’s chart and wait for the trading session to begin. For US stocks, trading starts at 16:30 GMT+2 from September to March, and 16:30 GMT+3 from March to September.

Based on your chosen timeframe, wait for the first 4–6 candles to close—traders often use five-minute candles. Then, identify the high and low of the range, just as we demonstrated earlier.

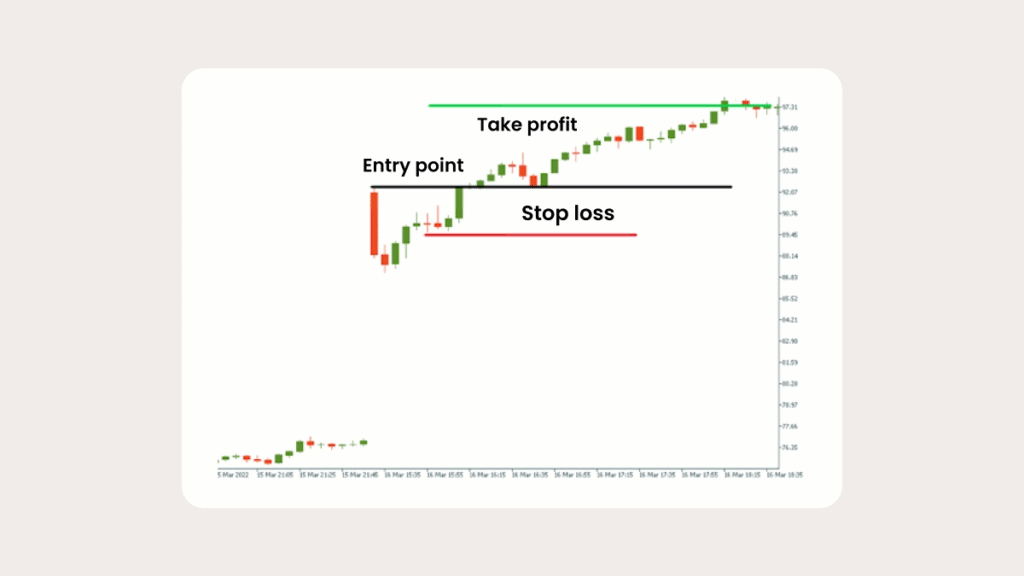

When the price breaks out of the range, enter the trade in the direction of the move. Place your stop-loss within the range—below the range high for long positions and above the range low for short positions. For proper risk management, the take-profit is typically set at twice the distance of the stop-loss.

Stop-Loss Placement Options

- Inside the range (tight stop): Place your stop just inside the opening range. This reduces risk but increases the chance of being stopped out by normal market noise. Best for low-volatility stocks or smaller positions.

- Full range stop (conservative): Set your stop just beyond the opposite side of the opening range. This gives the trade more breathing room but requires a smaller position size. Ideal for highly volatile stocks.

- Midpoint stop (balanced): Position the stop at the 50% mark of the opening range. This is a compromise between tight and wide stops.

Profit Targets and Exit Strategies

- Fixed R-multiple: Aim for a profit 1.5–2 times your risk. For example, risking $100 means targeting $150–$200. Many traders take partial profits at 1R and let the remaining position run.

- Partial exits: Lock in some gains on the first strong move, then adjust the stop to protect profits while keeping the trade open.

- Time-based exit: If the breakout hasn’t gained momentum within 30–45 minutes, close the trade rather than waiting for a full reversal.

- End-of-session exit: If holding until the market closes, reduce position size in the final hour when liquidity can drop and volatility rises.

Position Sizing

Proper position sizing is as important as stop placement:

- Fixed fractional risk: Risk a set percentage of your account per trade (commonly 1%).

- Formula:

Position Size = (Account × Risk %) ÷ Stop Size - Example: $10,000 account, 1% risk = $100. With a $0.50 stop, buy 200 shares.

- Formula:

- Maximum daily loss: Limit daily losses to 2–3% of your account. Stop trading if this threshold is reached to prevent compounding losses.

Key takeaway: ORB trading is flexible. Your stops and targets should reflect the stock’s volatility, your risk tolerance, and account size. Consistency in risk management is more important than chasing large wins.

Common Mistakes and How to Avoid Them

- Trading narrow ranges: Tiny opening ranges produce false signals. Use a minimum filter (e.g., 0.2% of price or volume spike).

- Chasing breakouts: Avoid entering late; wait for the breakout candle to close or for a pullback.

- Ignoring volume: Breakouts without strong volume rarely succeed. Compare breakout volume to opening bars.

- Trading against the trend: Align trades with the higher-timeframe trend to increase success.

- Holding through news events: Earnings or news can invalidate ORBs. Avoid holding trades during major announcements.

- Oversized positions: Large positions increase stress and risk. Start small until confident in the strategy.

- Skipping stop-losses: Never trade without a stop; it can turn a small loss into a large one.

Bottom line: Be patient, apply filters, and journal every ORB trade. Tracking setups that fail helps prevent repeated mistakes.

Tips for Better Trading

- Take partial profits at +1R or halfway to the target. This reduces exposure and protects gains, while keeping a portion of the trade active. Always use a stop-loss to make the trade risk-free.

- Only enter trades you’re confident in to maintain focus.

- Wait for a candle to close beyond the opening range to avoid false breakouts.

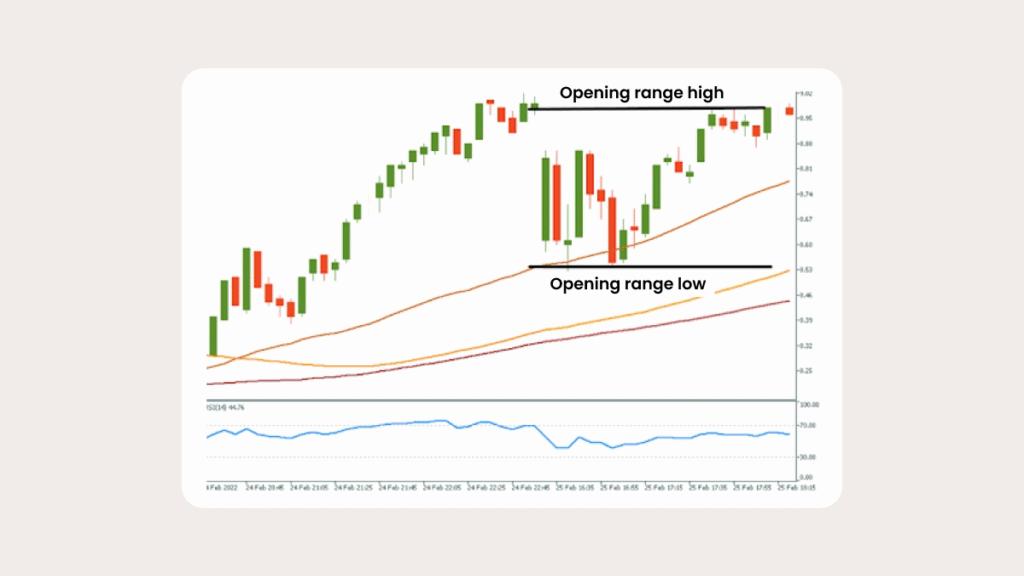

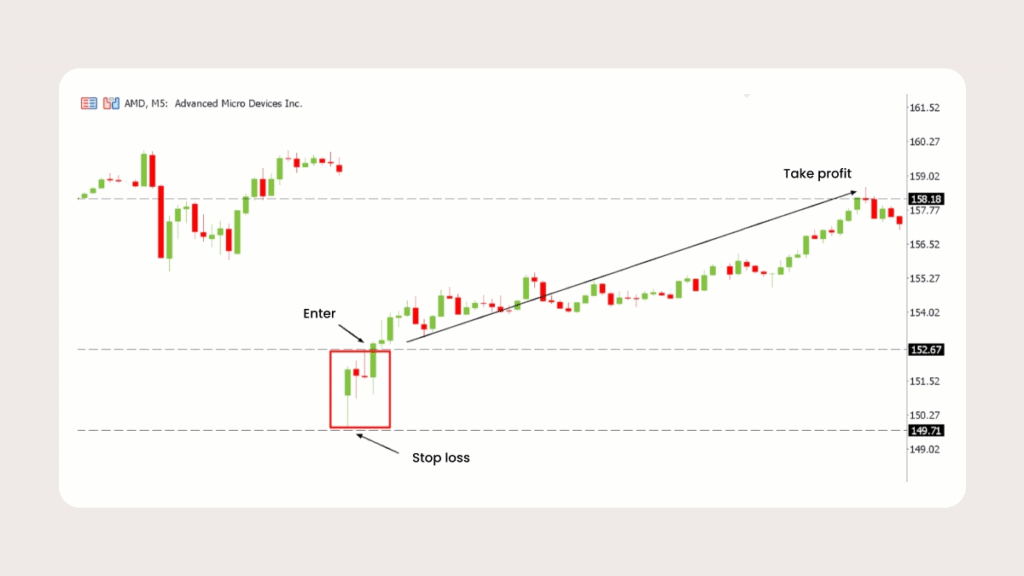

Bullish ORB Example

On a 5-minute chart, AMD formed a 15-minute opening range between $149.70 and $152.67 (red box). This range represented the initial battle between buyers and sellers.

At 09:45 ET, price broke above $152.67 on strong volume, signaling bullish momentum. Enter long, placing a stop just below the range at $149.70. AMD then trended higher, reaching $158.18 by late afternoon — nearly a 2:1 reward-to-risk ratio.

Takeaway: A bullish ORB occurs when price breaks the opening range high with strong volume. Placing stops below the range and targeting logical resistance levels provides a structured approach to trading early momentum.

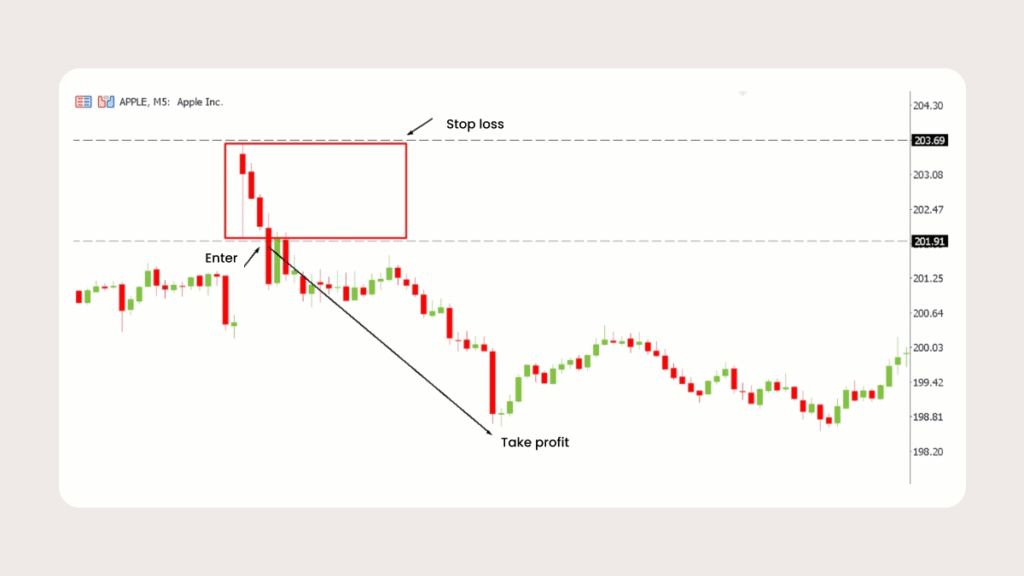

On this 5-minute chart, Apple opened and established an initial range between approximately $201.91 and $203.69 (red box), reflecting the morning balance between buyers and sellers.

When the price broke below $201.91, sellers gained control, creating a short entry opportunity. The stop-loss was set just above the range high at $203.69 to manage risk.

The price then moved down toward the $198.50 area (take-profit arrow), yielding roughly 1.5R relative to the risk. This illustrates a clear and straightforward bearish ORB setup.

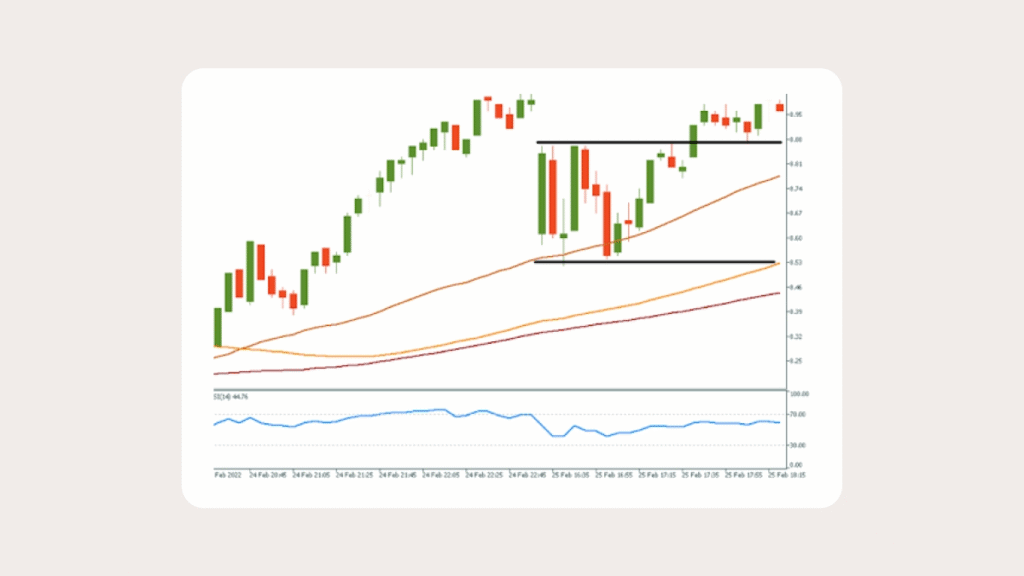

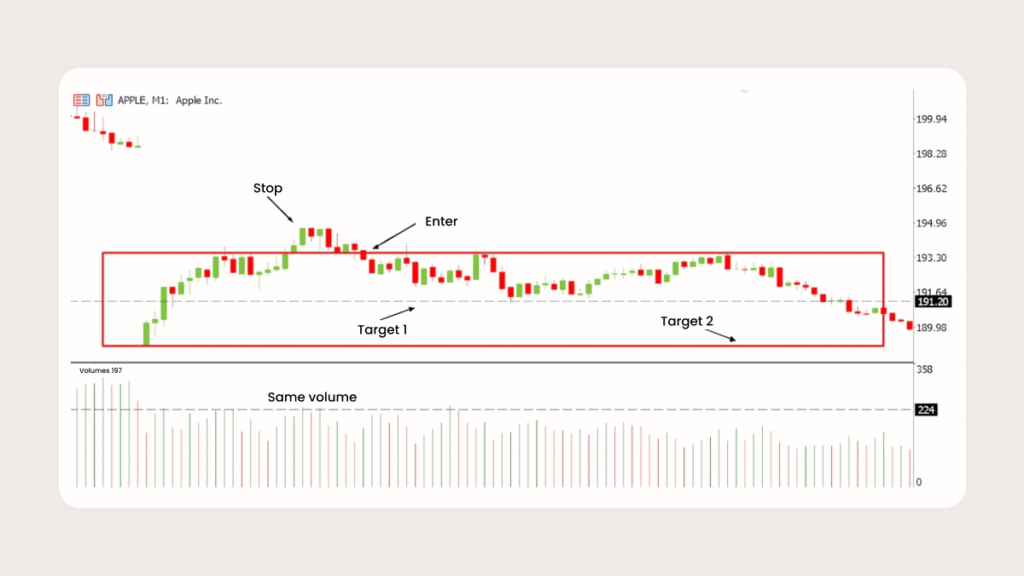

Pullback Entry After a Breakout

Not every opening range breakout results in a clean move. A common scenario is shown on this 1-minute Apple chart, where the opening range is marked in red.

The price initially broke above the range, but volume remained low — the bars below indicate flat volume, signaling a potential warning.

Shortly after, the price fell back into the range, confirming a failed breakout. This presented a short trade opportunity at the pullback entry point (Enter), with a stop placed just above the failed high (Stop).

From there, the move unfolded downward:

- Target 1: Midpoint of the range, ideal for taking partial profits.

- Target 2: Opposite side of the range, completing the failed ORB pattern

Key Takeaway:

When a price breaks the opening range without strong volume, the breakout often fails. Recognizing this allows you to trade the reversal with clearly defined risk and reward levels.

Backtesting & Setting Expectations

Before risking real capital, test the ORB strategy on historical data. Use at least 1-minute intraday charts to accurately capture the opening range and breakout behavior. Establish a consistent testing framework:

- Time windows: Experiment with different opening ranges (first 5, 15, or 30 minutes) to see which works best.

- Range filters: Apply minimum range thresholds (e.g., ≥0.2% of price) to avoid weak signals.

- Exit strategies: Compare fixed targets, trailing stops, and time-based exits.

- Volume confirmation: Track whether trades with above-average volume perform better.

Expect results to vary depending on the ticker, market cycle, and volatility. No backtest produces a perfect equity curve; the goal is to understand how the strategy behaves in different conditions. This knowledge helps you trade with realistic expectations and identify which ORB variations—bullish, bearish, failed breakouts, pullbacks—fit your style best.

FAQ: Opening Range Breakout Trading

When is the best time window for ORB trades?

Most traders use the first 15–30 minutes after the market opens (09:30–10:00 ET), when volatility and volume are high, forming a clear opening range.

How should I handle large opening gaps?

If a stock gaps far beyond the prior day’s range, be cautious—gaps often trigger fake breakouts. Wait for volume confirmation or a pullback before entering, rather than chasing the initial move.

How long should I hold an ORB trade?

There’s no fixed rule. Many hold for 30–90 minutes or until momentum fades. Others exit by the end of the session. Use fixed R targets, time-based exits, or partial profits as part of your plan.

Can I backtest the ORB strategy?

Yes. Use 1–5 minute historical data to simulate trades. Test different opening windows (15 vs. 30 min), range filters, and stop/target rules. Avoid overfitting the strategy to a single stock or period.

Is ORB suitable for small accounts?

Yes, if you keep risk small (e.g., 0.5% of your account per trade) and trade liquid stocks to reduce slippage. Small accounts benefit from tight stops and high-liquidity tickers.

ORB Terms Explained

- Opening Range (OR): High and low during the first 15–30 minutes after the open; forms the basis for breakout signals.

- Opening Drive: A strong early move that sets the tone for the trading session.

- Gap: Price difference between the prior day’s close and the current day’s open. Large gaps can make ORB breakouts less reliable.

- Range Width: Distance (in price or %) between the opening high and low, used to filter tradable setups.

- Midpoint: The 50% level of the opening range, sometimes used for stops or intraday support/resistance.

- Failed Breakout (Failed ORB): Price breaks the opening range but quickly reverses inside, often triggering stops.

- Pullback Entry: Waiting for price to break out and then retrace to the breakout level or VWAP before entering.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: