Sometimes beginners find it challenging to know when to buy or sell assets. Experienced traders rely on trading signals and technical indicators, including candlestick patterns, which can suggest whether the market is likely to rise or fall soon. One such pattern is the Hanging Man, which typically appears during a bullish market and signals a potential shift toward a bearish trend.

The Hanging Man Candlestick: Meaning and Importance

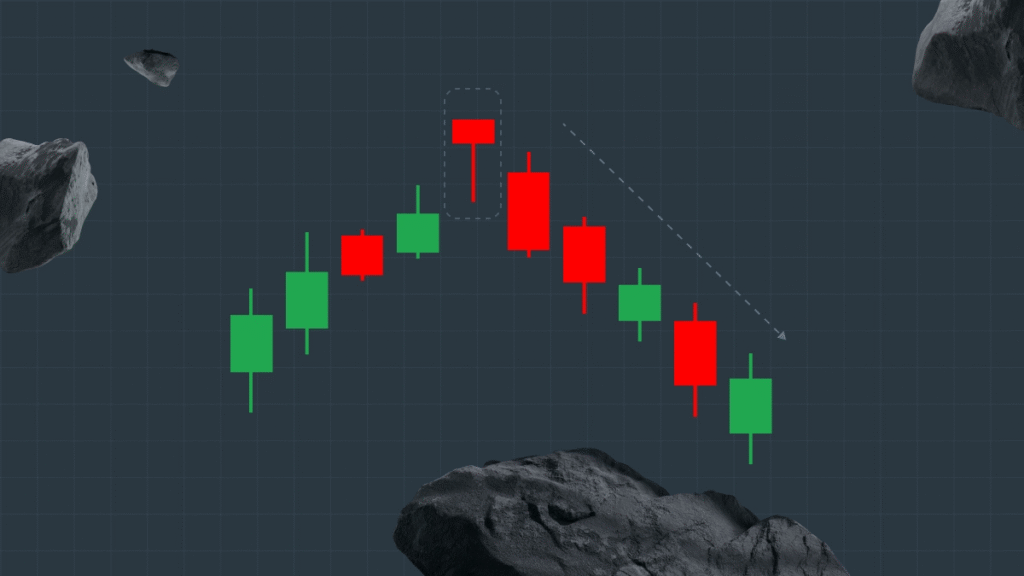

The Hanging Man appears at the top of an uptrend and serves as a warning that the market may reverse and start declining.

This candlestick is defined by:

- A small body, showing that the opening and closing prices were close.

- A long lower shadow (wick), indicating that the price fell significantly during the session before recovering.

The pattern gets its name because it visually resembles a figure with long legs. At first glance, it may not seem alarming, as the price hasn’t dropped dramatically. However, the long lower shadow signals that sellers dominated during the session, and the existing bullish trend is losing strength. A subsequent bearish candle after the Hanging Man confirms the potential reversal. The pattern is particularly significant after a long rally or near resistance levels.

The Psychology Behind the Candle

To understand why the Hanging Man signals a reversal, consider what happens during the session:

- Buyers initially push the price higher, continuing the uptrend.

- Sellers step in and drive the price sharply down.

- By the close, buyers recover some of the loss, but not enough to regain control.

The small body combined with the long lower shadow illustrates a market losing momentum. The signal is stronger after a clear uptrend or near a resistance level, and weaker when trading volume is low or the market is moving sideways.

How to Identify a Hanging Man

Look for these key features:

- A candlestick with a small body and a long lower wick.

- The candle appears at the peak of an uptrend.

- The following candlestick is bearish, confirming the potential reversal.

Identification Criteria

For a candle to qualify as a Hanging Man:

- Lower shadow: At least twice the length of the real body, showing that sellers pushed the price down sharply before buyers pulled it back.

- Body: Small and positioned near the top of the candle’s range.

- Upper shadow: Little to none; a long upper wick weakens the pattern.

- Trend context: Must appear after an uptrend; without a prior bullish move, it loses its significance as a reversal warning.

Hanging Man Checklist

- Lower shadow ≥ 2× body

- Small body near candle’s high

- Minimal upper shadow

- Appears after a clear uptrend

- Next candle closes below the Hanging Man’s low for confirmation

Red vs Green Hanging Man

- Red Hanging Man: Price closes below its opening level, indicating sellers are in control. This is considered a clear warning, like a yellow traffic light.

- Green Hanging Man: Price closes above its opening level, suggesting buyers regained some control. It requires more observation and caution before trading.

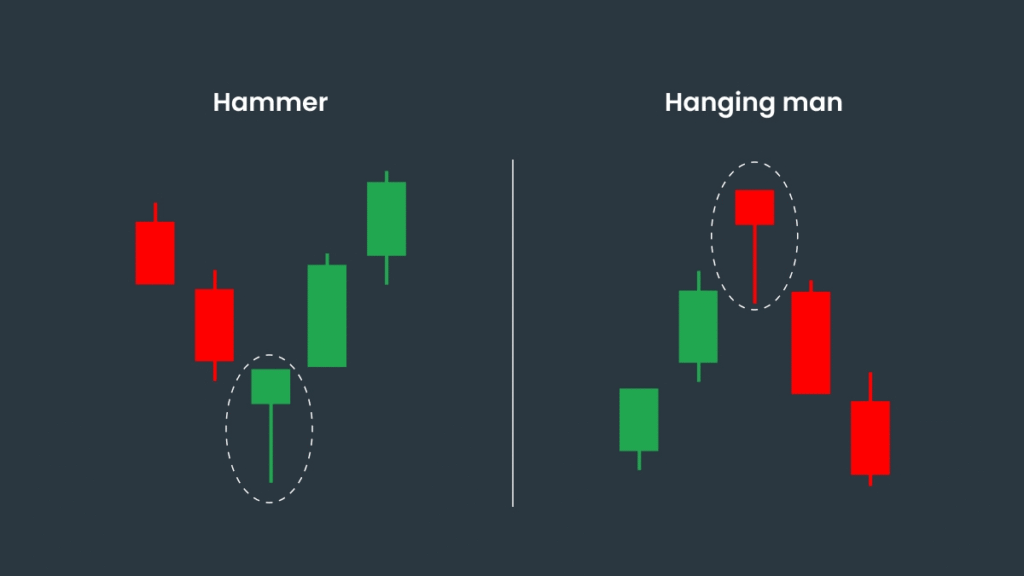

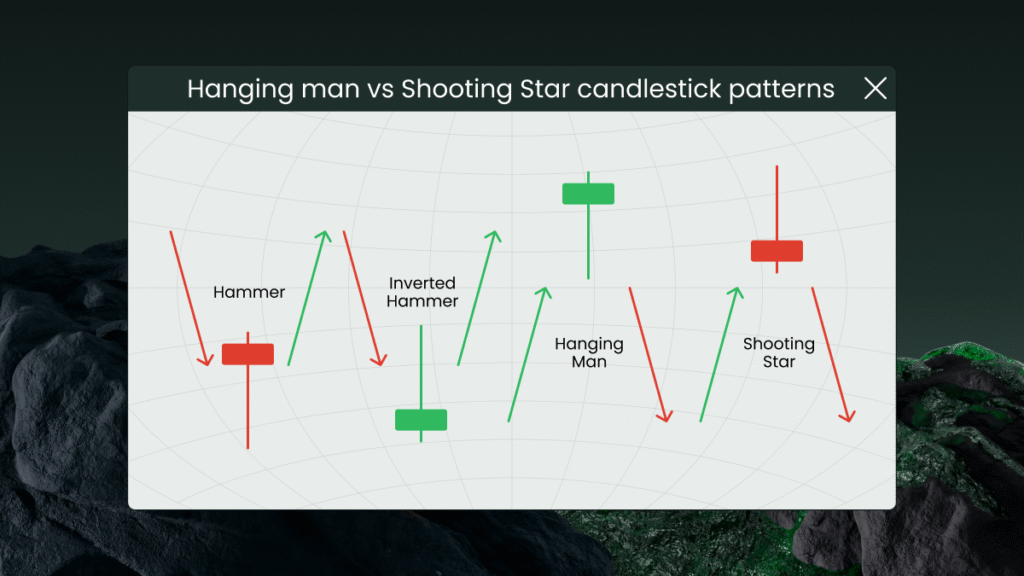

The difference between a Hanging Man and a Hammer candlestick

A candlestick pattern often confused with the Hanging Man is the Hammer. The key difference lies in where the pattern appears on the chart:

- Hanging Man: Appears at the top of an uptrend, signaling a potential market decline.

- Hammer: Appears at the bottom of a downtrend, indicating a possible reversal to bullish momentum. This happens when sellers push prices lower, but buyers step in and drive the price back up, suggesting the market may start rising.

To avoid confusing the two, always consider the preceding trend.

| Pattern | Appears After | Wick Direction | Possible Signal |

|---|---|---|---|

| Hanging Man | Uptrend | Lower wick | Bearish reversal |

| Hammer | Downtrend | Lower wick | Bullish reversal |

Inverted Hanging Man Candles

Some traders refer to a candlestick with the wick above the body as an Inverted Hanging Man, but this term is not widely accepted in technical analysis. This pattern is often mistaken for a Shooting Star, which forms after an uptrend and has:

- A long upper shadow

- A small body at the bottom

- Little or no lower shadow

Avoid calling this pattern an Inverted Hanging Man.

Comparison of Similar Candlestick Patterns

| Pattern | Signal Type | Context | Meaning |

|---|---|---|---|

| Hanging Man | Bearish reversal | After uptrend | Sellers pushed prices down, buyers stepped in (long lower wick). Indicates weakening buying pressure and potential trend exhaustion. |

| Shooting Star | Bearish reversal | After uptrend | Buyers drove price higher, but sellers regained control, closing near the low. Signals strong rejection of higher prices and potential downward move. |

| Hammer | Bullish reversal | After downtrend | Sellers drove price lower, buyers pushed it back up. Suggests the downtrend may be ending as demand returns. |

| Inverted Hammer | Bullish reversal* | After downtrend | Buyers pushed price higher but couldn’t hold it (long upper wick). Shows early buying interest; upward momentum must be confirmed by the next candle. |

*Note: The Inverted Hammer is a weaker bullish signal and requires confirmation from the following candle.

Occurs Only in Uptrends

Knowing when to pay attention to the Hanging Man and when to ignore it is essential. This pattern is a reversal signal that only matters after an uptrend.

- If it appears during a downtrend or sideways market, it loses significance.

- While its reliability depends on market conditions, timeframe, and other indicators, analysts generally consider the Hanging Man a fairly reliable reversal tool—especially when confirmed by additional signals.

Pay attention to the Hanging Man when:

- It forms after 3–5 consecutive bullish (green) candles.

- It appears near a resistance level.

- Other confirmations are present, such as an overbought RSI.

Ignore the pattern when:

- There’s no clear prior uptrend or the market is moving sideways.

- The candle has a long upper shadow.

- It forms on low trading volume.

- The body is in the middle of the recent price range rather than near the top.

Timeframes and Session Context

Higher Timeframes:

- More reliable on 4-hour or daily charts because they reflect broader market movement.

Shorter Timeframes:

- On 5- or 15-minute charts, the pattern appears frequently, but most signals are unreliable due to market noise.

Session Timing:

- In Forex, a Hanging Man forming near the end of the London or New York session is more meaningful than one during slower periods.

- For stocks or indices, a gap up followed by a Hanging Man near resistance is typically bearish.

Note: In unstable or highly volatile markets, the Hanging Man is unreliable.

How to Trade the Hanging Man

The Hanging Man should never be traded in isolation. Combine it with indicators like RSI for confirmation.

1. Identify the Trend and Pattern:

- Look for a small-bodied candle with a long lower shadow in an uptrend.

2. Entry:

- Wait for confirmation: the next candle must close below the Hanging Man’s low.

- Open a sell position just below this bearish candle.

3. Stop-Loss:

- Place it above the high of the Hanging Man.

- If the body is small, consider the last resistance level for risk/reward-based placement.

4. Take-Profit:

- Use the risk/reward ratio, the next support level, or the previous low.

- Optionally, take partial profits as the trade moves in your favor and trail the stop to lock in gains.

Confirmation Rules

- Next Candle: The following candle should close lower with a bearish body for a reliable signal.

- Volume: Higher-than-average volume during the Hanging Man or confirmation candle signals sellers stepping in.

- Supporting Indicators: Trendlines, moving averages, and resistance zones nearby increase reliability.

- Risk/Reward: Always calculate before entering; aim for a favorable ratio.

Risks and Limitations

- False signals: Can occur even during a strong uptrend.

- Limited information: The pattern alone gives a narrow view; use additional tools for confirmation.

- Low volume: Ineffective in thin markets.

- Volatile markets: The pattern is unreliable during high volatility.

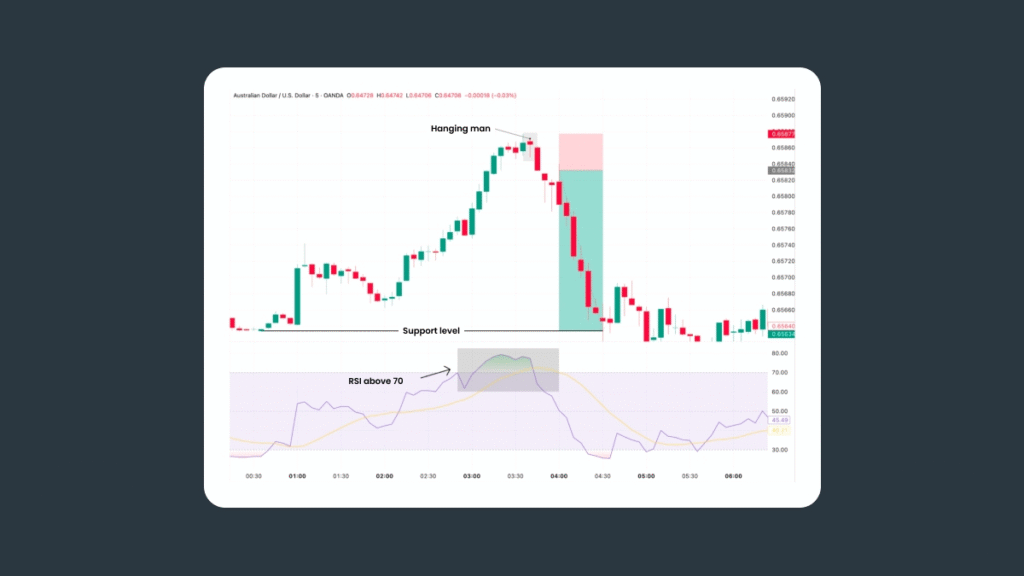

Example: AUDUSD Hanging Man Trade

- Entry: Formed on an uptrend near a resistance level (e.g., 0.65877) and followed by a bearish candle.

- RSI: Above 70, indicating overbought conditions.

- Stop-Loss: Just above the high of the Hanging Man (e.g., 0.66000).

- Take-Profit: Nearest support level around 0.65531.

Never Trade the Hanging Man in Isolation

The Hanging Man should always be used alongside other tools and indicators. Relying on it alone increases the risk of false signals.

Glossary

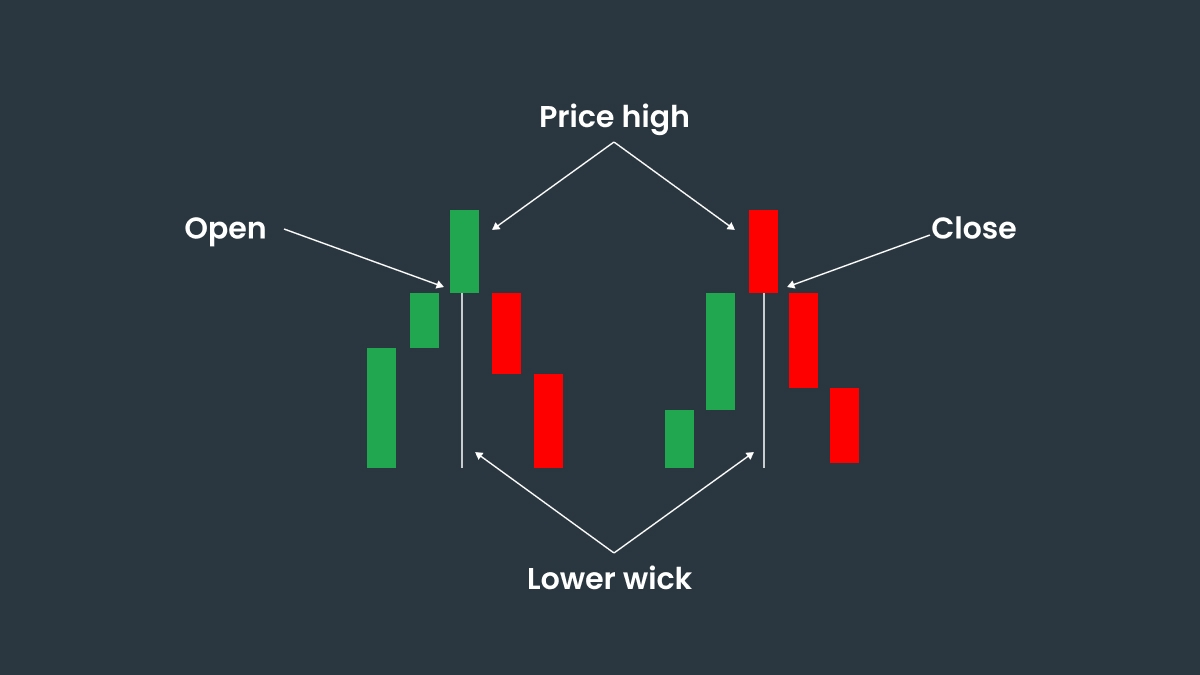

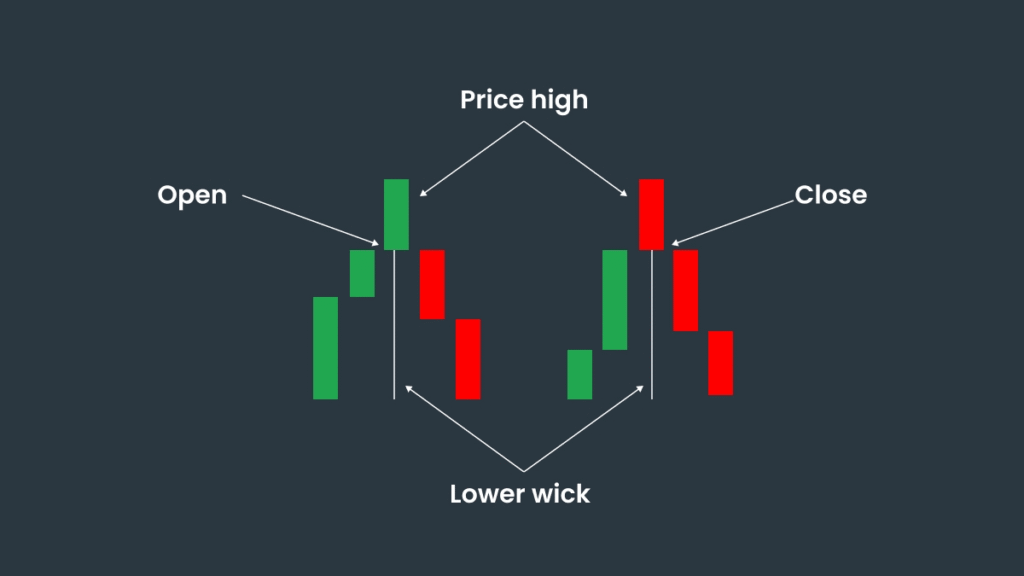

Real Body:

The thick, colored portion of the candlestick, representing the difference between the opening and closing prices. A small body indicates minimal price movement, while a long body shows strong control by buyers or sellers.

Shadow (Wick):

The thin line above or below the body, showing how far the price moved beyond the open and close during the session.

Trend:

The overall direction of the market. An uptrend forms when prices make higher highs and higher lows. A downtrend occurs when prices consistently make lower lows.

Confirmation Candle:

The candlestick that follows a pattern, validating or strengthening its signal.

Resistance Level:

A price zone where an uptrend often slows or reverses because sellers step in.

Support Level:

A price zone where a downtrend typically stops as buyers begin to enter.

FAQ: Hanging Man Candlestick Pattern

Does the candle’s color matter?

Not significantly. Both red and green Hanging Man candles can be valid. Red is often viewed as slightly stronger, but shadow length, body position, and confirmation are far more important.

How often does it appear?

It occurs fairly frequently, but most instances are weak or invalid. Focus only on those that appear after a clear uptrend and near resistance levels.

Is it profitable on its own?

No. Like all candlestick patterns, the Hanging Man works best when paired with confirmation signals such as the next candle’s close, volume, RSI, or trendlines. Using it alone often leads to false signals.

How reliable is it compared to other patterns?

The Hanging Man is a helpful warning of a potential reversal but not the strongest reversal pattern. Its reliability increases on higher timeframes (H4 or D1) and when combined with other confirming indicators.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: