Gold trading isn’t straightforward, as this precious metal behaves differently from other commodities or Forex currency pairs. Nevertheless, there are several proven strategies that can help you navigate the market successfully.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

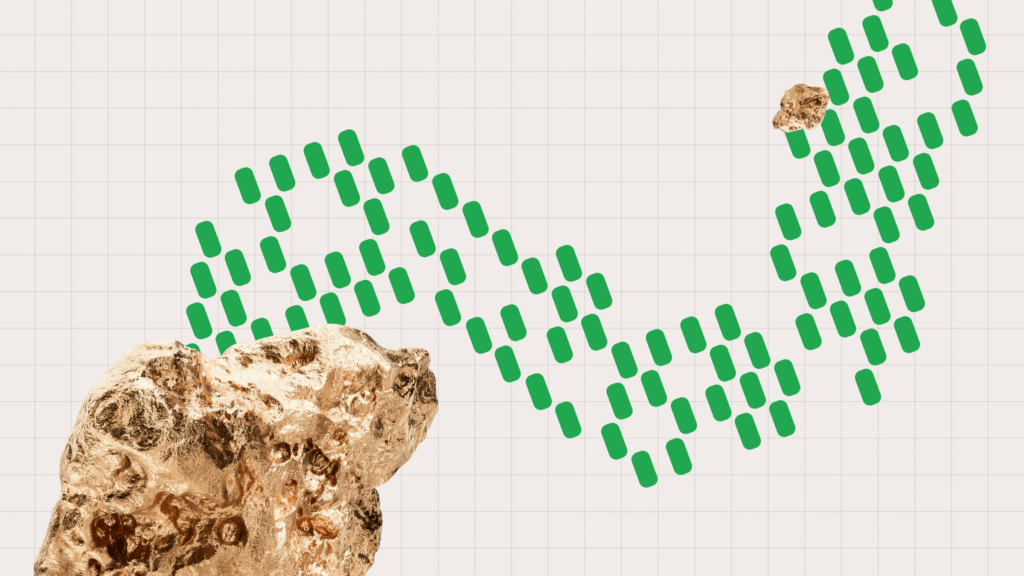

Main factors influencing gold prices”

Understanding What Drives Gold Prices

Before implementing trading strategies, it’s essential to know what truly influences the gold market. The main drivers include:

- US Dollar Strength: Gold is priced in USD, so a stronger dollar generally pushes gold lower, and a weaker dollar tends to lift gold prices.

- Real Yields: Falling real yields (bond yield minus inflation) make gold more attractive, while rising yields reduce its appeal.

- Inflation and Monetary Policy: High inflation and dovish central bank policies often support gold as a hedge, whereas hawkish interest rate hikes can pressure gold prices.

- Central Bank Demand: Purchases or sales by central banks directly impact global demand and long-term trends.

- Geopolitical Instability: Wars, sanctions, terrorist attacks, and political uncertainty push investors toward gold as a safe-haven asset.

- Market Risk Sentiment: Fear-driven events, such as stock sell-offs, banking crises, or recessions, often drive money into gold.

- News Events: Key economic releases like CPI, NFP reports, and FOMC decisions can cause sharp, short-term price movements.

Understanding these factors helps traders decide whether to follow news, trade correlations, or leverage seasonal trends.

Technical Setups for Trading Gold

Charts are vital for timing entries and exits. Traders often rely on technical setups, including:

- Support and Resistance: Identify key levels across multiple timeframes. Watch for breakouts, and pay attention to round numbers like 3900 or 4000, which can act as psychological levels.

- Indicators: Tools like moving averages, RSI, and MACD help assess momentum and potential reversals. For example, an upward MACD crossover combined with an oversold RSI may signal rising buying pressure.

- Candlestick Patterns: Patterns such as Hammers or Inside Bars near significant levels can indicate a potential shift in sentiment, offering better entry and exit timing.

Successful traders rarely rely on a single indicator. They combine technical signals with dollar trends, bond yields, and central bank policy for a more complete market view.

Key Market Participants

Gold prices are influenced by various players:

- Central Banks: They hold gold in reserves. Buying tends to support prices, while selling can depress them, often affecting long-term trends.

- Hedgers: Producers, miners, and jewelers hedge against price fluctuations to stabilize profits. For example, mining companies may sell futures contracts to lock in prices for future production, which can create short-term selling pressure.

- Speculators and Traders: Retail traders, hedge funds, and investment firms trade to profit from price movements. Their activity, especially around news events, can increase volatility.

- ETFs and Institutions: ETFs hold physical gold to back shares. When investors buy ETF shares, gold demand rises; when they sell, gold is released, influencing prices. Institutional flows can significantly shift market sentiment.

Gold Trading Instruments

There are several ways to trade gold, each with unique characteristics, costs, and risks:

- Spot Gold (XAUUSD): Buy or sell gold against the USD at the current price. Offers tight spreads, high liquidity, and margin trading. No expiry date. Risk: Prices can swing sharply during major sessions or news.

- Gold Futures: Agree on a price now and settle later. Traded on exchanges like COMEX, with contracts typically covering 100 troy ounces. Pros: Deep liquidity, long/short positions. Cons: Requires more capital and has expiration dates.

- Gold ETFs: Track gold prices and trade like stocks. Ideal for long-term investors. Examples: SPDR Gold Shares (GLD), iShares Gold Trust (IAU). Pros: Easy access, no storage issues. Cons: Management fees, no high leverage.

- Gold Mining Stocks: Shares of gold-mining companies, e.g., Newmont (NEM) or Agnico Eagle (AEM). Often move with gold prices but are influenced by company-specific factors. Can provide leveraged exposure to gold.

Trading Gold Based on News and Fundamentals

Gold reacts to political, economic, and global events. Prices can fluctuate sharply before settling, so patience is crucial. For instance, equity market declines often boost gold, providing potential long opportunities.

Correlation Strategy:

Gold typically has a strong negative correlation with the US dollar—when the USD strengthens, gold weakens, and vice versa. Watching this relationship can reveal early trading signals, though confirmation is essential before entering a trade.

If you want, I can also rewrite this as a concise, step-by-step gold trading guide that traders can use quickly without reading the full text.

Do you want me to do that?

Checklist for Trading Gold Using Dollar Correlations

- Set Up Your Charts

Open the gold chart (XAUUSD), the US Dollar Index (DXY), and a USD currency pair like USDJPY on the same timeframe, such as H1. - Identify Key Levels

Mark important support and resistance levels on all charts. Watch for breakouts and note instances when gold and the dollar move in opposite directions. - Analyze Candlestick Patterns

Use candlestick formations to gauge potential price direction. Typically:

- A breakout higher in DXY or USDJPY signals possible gold weakness.

- A breakout lower often indicates potential gold strength.

- Set Stop-Loss Orders

Place stops just beyond the most recent swing high or low, or behind a clear support or resistance level. - Determine Profit Targets

Aim for at least a 1:2 risk/reward ratio. You can also take partial profits at the next key level. - Monitor and Cancel if Needed

If gold doesn’t respond within two or three candles after a dollar move, or if real yields diverge, cancel the trade.

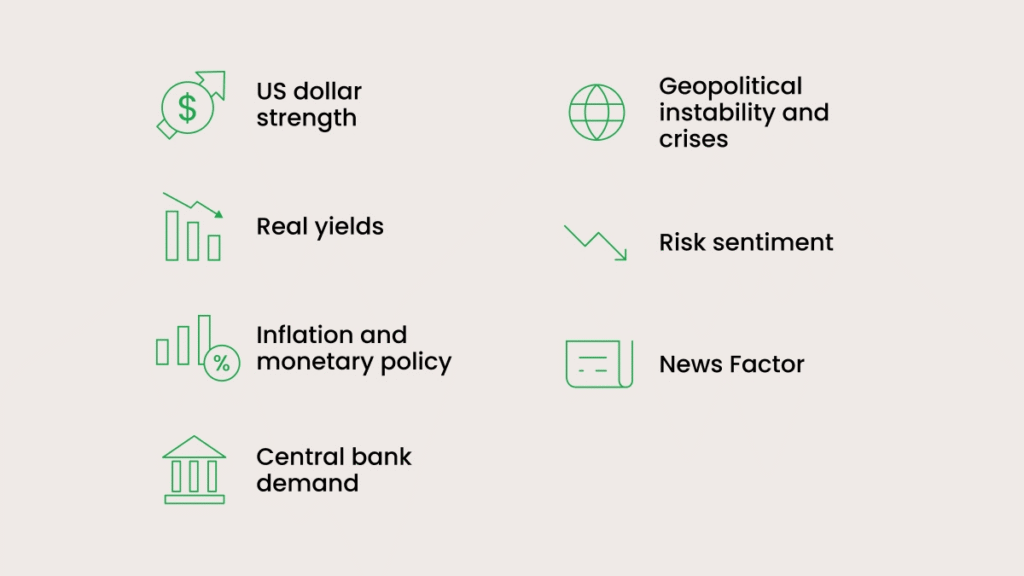

Example of Using the Strategy

Open both the gold chart and a USD cross-currency chart (like USDJPY) on the same timeframe. Identify key support and resistance levels on each chart and monitor for breakouts.

For example, you might spot a resistance level on the USDJPY chart but no obvious support on gold. If USDJPY breaks above resistance, it can indicate USD strength, which may serve as a sell signal for gold. Conversely, if USDJPY moves lower, it can suggest potential gold strength.

The bearish candlestick on the H1 USDJPY chart may indicate that the dollar is weakening, which could signal a potential upward move in gold. However, it’s crucial to confirm this with additional indicators—such as trend direction, support and resistance levels, or momentum tools—before making a trade.

Gold often shows a positive correlation with AUDUSD, as Australia is one of the world’s largest gold producers. Rising gold prices can boost Australia’s export revenues, strengthening the AUD, while falling gold prices may weigh on the currency. That said, this relationship is not always consistent. AUDUSD is also influenced by global risk sentiment, interest rates, and Chinese demand for Australian exports. Decisions by the Reserve Bank of Australia (RBA) can further affect this correlation; for instance, RBA rate cuts may weaken the AUD even if gold prices are stable or rising. In the example below, lower Australian interest rates coincided with both weaker gold and a softer AUD, but no correlation is guaranteed, as market conditions are constantly evolving.

If you want, I can also condense this into a short, trader-friendly version that highlights the key points for quick analysis. Do you want me to do that?

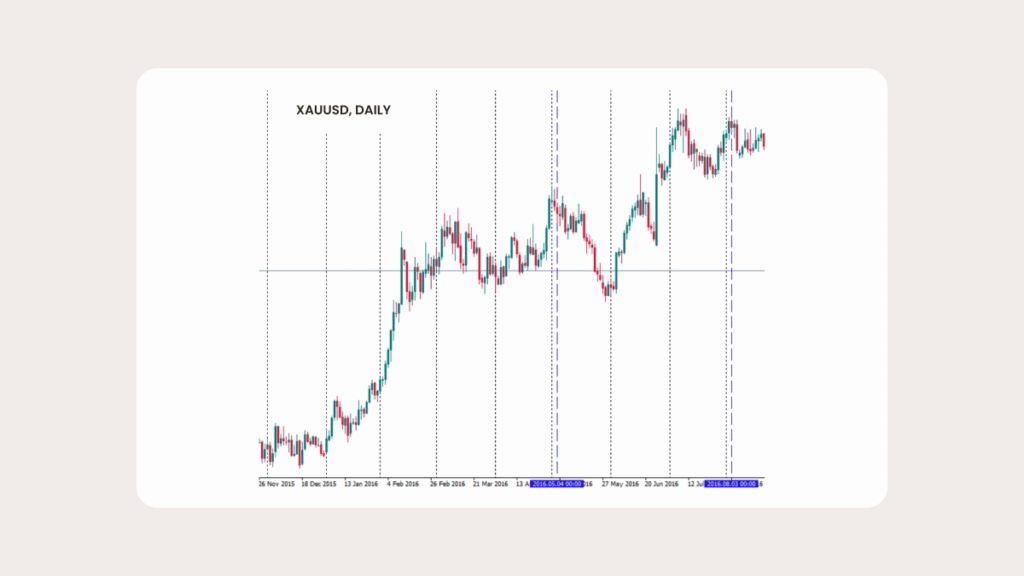

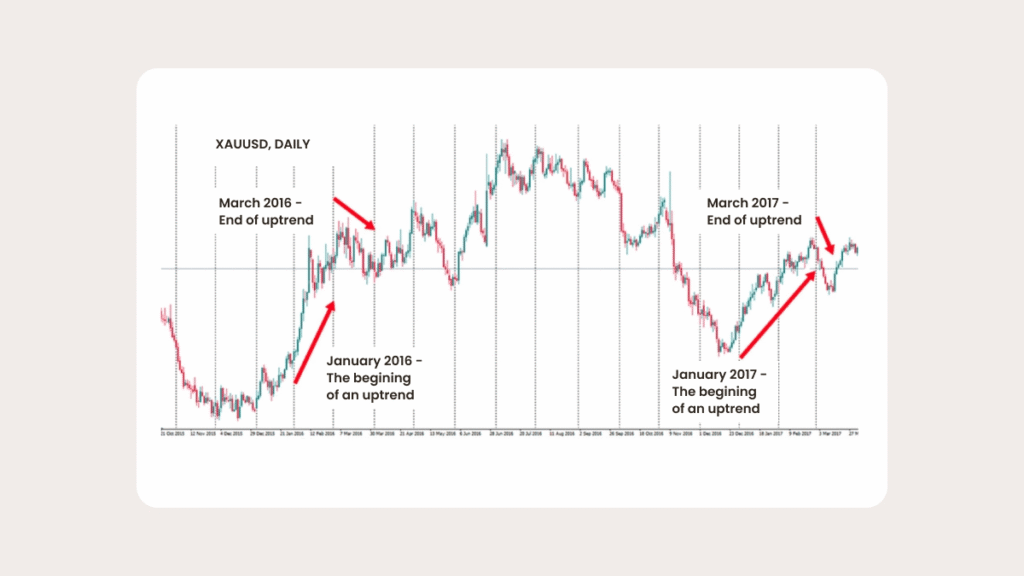

Seasonal trading strategy

Seasonal Patterns in Gold Trading

Gold often follows seasonal trends, showing strength at certain times of the year and weakness at others. Historically, prices tend to rise in the first quarter and sometimes toward year-end, though this doesn’t occur every year. Remember: past performance does not guarantee future results. Other factors, including inflation, interest rates, and geopolitics, can also influence seasonality.

A typical seasonal approach:

- Consider buying gold during historically strong months, such as January and February.

- Confirm signals using indicators like RSI, MACD, and candlestick patterns.

- If the trend aligns with the seasonal pattern, consider a long position.

- Take profits before the end of February, as March historically tends to be weaker for gold.

Optimal Trading Times

Spot gold prices are often anchored around the daily LBMA auctions, which take place at 10:30 and 15:00 GMT (or 09:30 and 14:00 GMT during daylight saving time). These benchmarks guide institutional trades, and prices can be volatile immediately afterward.

The London-New York session overlap (12:00–16:00 GMT) usually offers the highest liquidity and most consistent price movement. Always manage risk carefully, as gold is highly volatile.

Risk Management Tips

Gold’s sharp price swings make risk management critical:

Use leverage wisely:

- Retail traders in the EU/UK are limited to 1:20 leverage; offshore accounts may allow up to 1:500. High leverage can quickly wipe out an account.

Set stops according to volatility:

- Use the Average True Range (ATR) to gauge appropriate stop-loss distances.

Position sizing example:

- With a $10,000 account risking 1% ($100) and a $5 stop, trade 0.2 lots of XAUUSD (0.1 lot = $10 per $1 move).

Monitor overnight costs:

- Swaps or rollovers reflect interest rate differences between gold (non-yielding) and the funding currency. These can add up for multi-day positions.

Control emotions:

- Stick to your plan. Predefine entries, stops, and targets. Avoid chasing losses.

Trade Mechanics and Costs

Pip/Tick Value:

- XAUUSD is quoted in USD per ounce. On many platforms, $0.01 = 1 pip.

- 1 lot = 100 oz → $1 move = $100

- 0.10 lot = 10 oz → $1 move = $10

- 0.01 lot = 1 oz → $1 move = $1

Margin Requirements:

- Example: $4,000/oz × 1 lot (100 oz) = $400,000 contract value.

- With 1:20 leverage, margin = ~$20,000.

Spreads & Commissions:

- Typical spreads: $0.10–$0.30/oz.

- Some brokers charge $6–$10 per round-turn trade.

Overnight Swaps:

- Long positions usually incur small costs; shorts may sometimes earn a small credit.

Common Mistakes

- Trading immediately after news releases (CPI, NFP, Fed rates) without waiting for confirmation.

- Ignoring real yields, which strongly influence gold’s long-term trend.

- Using excessive leverage, exposing accounts to sharp swings or gaps.

- Relying solely on correlations (USD or AUD) without observing price action.

- Treating seasonality as a guarantee; always confirm with charts.

- Ignoring optimal trading windows, leading to low liquidity and choppy markets.

FAQs

Trading hours: Gold trades nearly 24/5, with peak activity during London and New York sessions and LBMA auctions.

Minimum trade size: Many brokers allow micro lots (0.01 lot = 1 oz), ideal for beginners.

Why gold reacts to news: Reports like CPI, NFP, and Fed decisions affect inflation, yields, and the dollar, all of which influence gold. Initial moves can be volatile, so waiting for market direction is safer.

Glossary

- XAUUSD: Gold priced in USD; 1 XAU = 1 troy ounce.

- LBMA Fix: London Bullion Market Association’s twice-daily benchmark price.

- DXY: US Dollar Index, measuring USD against major currencies; gold often moves inversely.

- Real yields: Inflation-adjusted bond yields; lower real yields boost gold appeal.

- Rollover: Overnight financing cost or credit for holding a position past market close.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: