“For beginner traders, the temptation to use high leverage to boost profits can be strong. However, leverage is a powerful tool that also carries significant risk. So, how do you determine the optimal leverage for a small account? Let’s explore!”

Trading with leverage carries a high risk of losing your entire invested capital. Always trade responsibly.

Leverage: Benefits and Risks

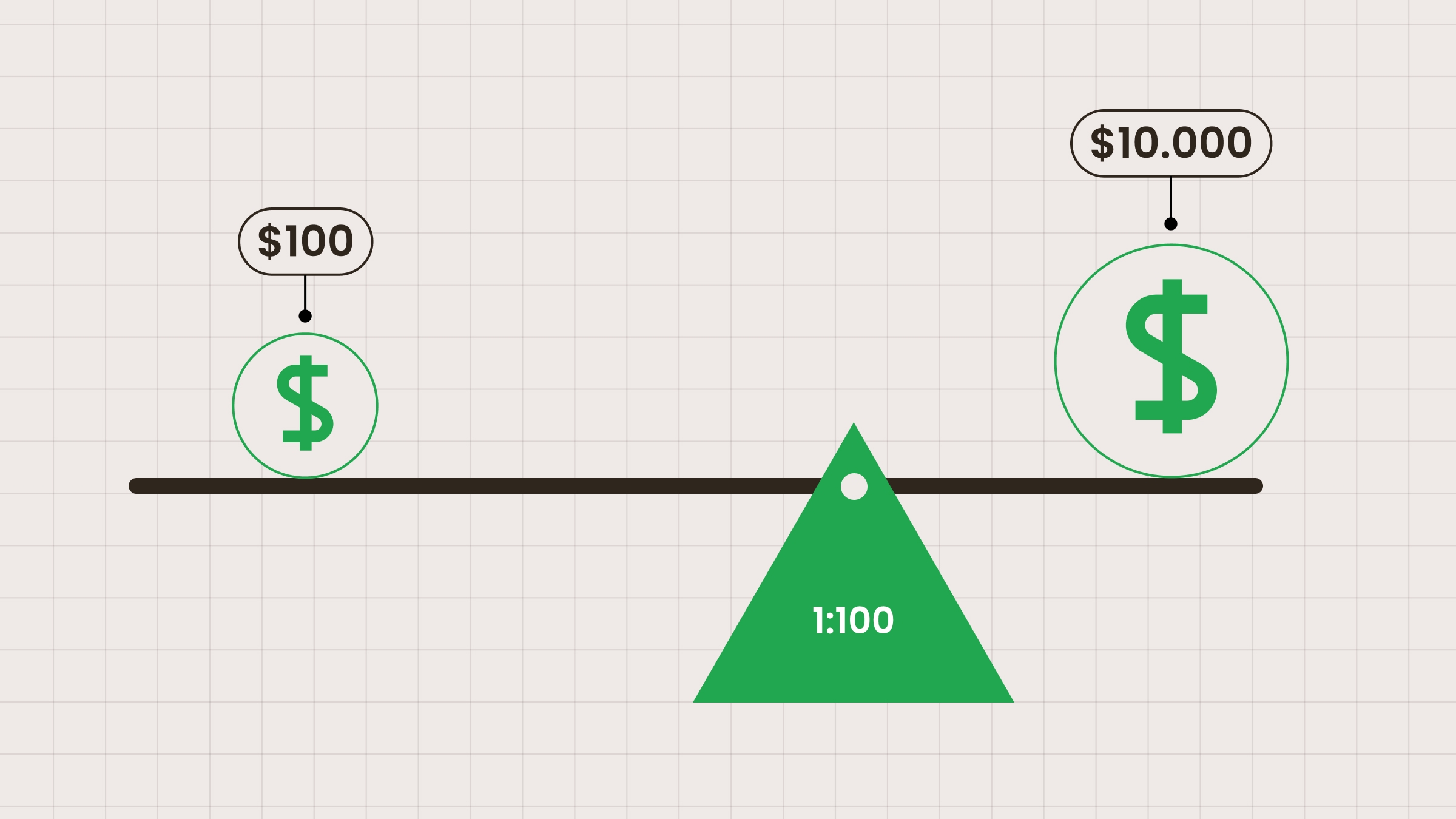

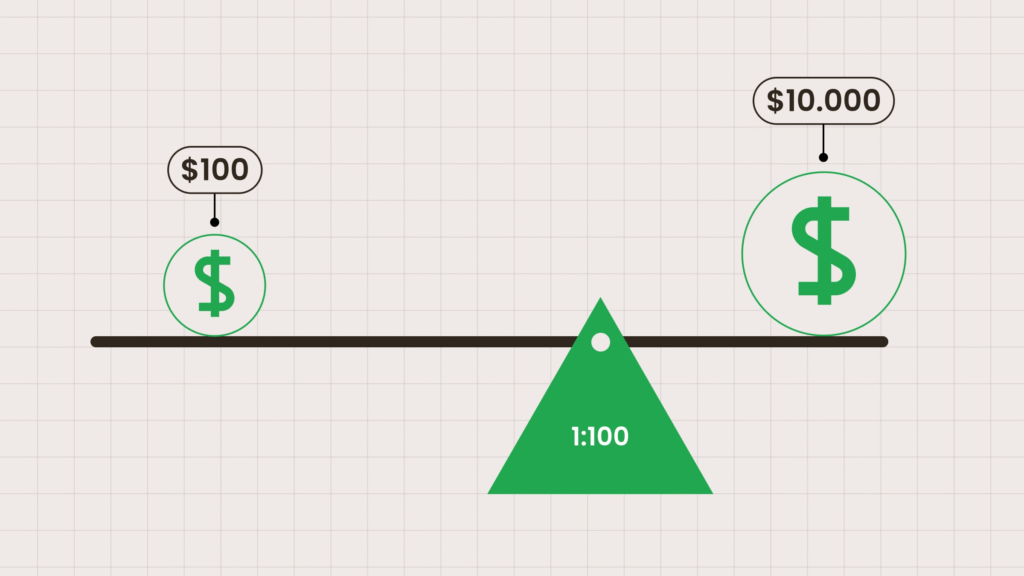

Leverage lets you control larger positions with a relatively small deposit, called margin. Essentially, you’re borrowing money from your broker to increase your trade size. For example, with only $10 in your account and 1:50 leverage, you can control a $500 position. Remember: while leverage can amplify profits, it also magnifies losses.

Margin is the portion of your account funds your broker holds to open a leveraged position. Think of it as a security deposit that allows you to trade a larger amount than your actual balance.

For instance, if you want to trade 0.01 lots (1,000 units) of EURUSD using 1:50 leverage, the required margin would be $20 (1,000 ÷ 50). That means you need at least $20 in your account to open the trade.

Risks of Trading with Leverage:

- Amplified losses: Small market moves can lead to significant losses.

- Margin calls: If the market moves against you, the broker may automatically close your position.

- Account wipeout: A single high-leverage trade can deplete your entire balance.

- Overtrading: Easy access to leverage can tempt traders into impulsive or excessive trades.

- Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

- Free Crypto Signals Subscribe via Telegram

- Free Forex Signals Subscribe via Telegram

- Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

- Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

- Open Account

- Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

- -Lesser Risk as lot size is minimal

- -Higher returns (approx. 5% to 10% monthly)

- -Easy Deposit and Withdrawal with USDT using crypto wallets

- -Lesser Drawdown

- -Instant Support

- -Invest Now and get guaranteed returns with us. DM us for more info❤️

- -Start Now

- *Copy Trading is free but we charge some percentage of profit as fees.*

- Full VIP signals performance report for September 22–26, 2025:

- View Full Performance Report

Common beginner mistakes when using leverage:“

Common Leverage Mistakes

- Over-leveraging: Using extreme leverage like 1:500 or 1:1000 may feel exciting, but even a small 1–2% move against you can wipe out your account. Start smaller—leverage around 1:10 or 1:20 is safer until you show consistent results.

- Trading without a stop-loss: One unexpected spike can erase weeks of progress. Always set a stop-loss before entering a trade.

- Chasing losses: Doubling your position to recover a loss usually accelerates account depletion. Instead, reduce position size or take a break to reset.

- Ignoring margin levels: Some traders don’t notice when their margin falls close to 100%, which triggers automatic trade closures. Aim to keep your margin above 300% for safety.

Choosing the Right Leverage

Key considerations:

- Experience: Beginners should start small. Only increase leverage after achieving consistent profits.

- Account size: Resist the temptation to use high leverage on tiny balances. Leverage like 1:500 can quickly destroy a small account.

- Risk tolerance: Lower leverage reduces risk per trade. Example guidance:

| Account size | Low risk | Medium risk | High risk |

|---|---|---|---|

| $5–$50 | 1:10 | 1:15 | 1:20 |

| $100 | 1:15 | 1:25 | 1:30 |

| $500 | 1:20 | 1:30 | 1:40 |

| $1000+ | 1:25 | 1:40 | 1:50 |

Regulatory limits:

- EU/UK: max 1:30 for retail traders

- US: max 1:50

- Offshore brokers: sometimes up to 1:500–1:1000 (very risky)

Leverage by Instrument Type

Markets vary in volatility, so adjust leverage accordingly. Use lower leverage in fast-moving markets and higher leverage for steadier instruments.

| Instrument | Volatility | Suggested leverage |

|---|---|---|

| Major FX pairs (EURUSD, GBPUSD) | Low–Moderate | 1:10–1:20 |

| Minor or exotic FX pairs | Moderate–High | 1:5–1:10 |

| Gold (XAU/USD) | High | 1:5–1:10 |

| Indices (US500, NASDAQ) | High | 1:5–1:10 |

| Crypto (BTC/USD, ETH/USD) | Very High | 1:2–1:5 |

Leverage by Trading Style

Your leverage choice should fit your trading approach:

- Long-term/position trading: 1:5–1:10. Lower leverage gives trades room to move over days or weeks without risking the account.

- Swing trading: 1:10–1:20. Medium-term trades require some leverage but still manageable risk.

- Day trading: 1:20–1:50. Shorter trades allow slightly higher leverage, but extreme leverage (1:100+) is risky for beginners.

For beginners with small accounts ($10–$50), 1:10 is generally optimal—it balances risk and opportunity.

Calculating Safe Position Size

Match position size to risk and leverage. For example, with a $10 account using 1:20 leverage, your buying power is $200—but you should only risk 1–2% per trade. A safe trade might be 0.08 lots with a 50-pip stop-loss.

Sample position sizing table:

| Account | Risk % | $ Risk | Stop-loss (pips) | Pip value (EUR/USD, 0.01 lot = $0.10/pip) | Position size |

|---|---|---|---|---|---|

| $10 | 5% | $0.50 | 50 | $0.10 | 0.01 lots |

| $30 | 2% | $0.60 | 40 | $0.10 | 0.0015 lots |

| $50 | 1% | $0.50 | 40 | $0.10 | 0.00125 lots |

Adjust risk by account size:

| Account | Risk % | $ Risk | Stop-loss | Position size | Risk level |

|---|---|---|---|---|---|

| $10 | 5% | $0.50 | 50 | 0.01 lots | High |

| $10 | 2% | $0.20 | 40 | 0.005 lots | Medium |

| $25 | 2% | $0.50 | 50 | 0.01 lots | Medium |

| $25 | 1% | $0.25 | 40 | 0.006 lots | Low |

| $50 | 1% | $0.50 | 40 | 0.012 lots | Low |

| $50 | 0.5% | $0.25 | 30 | 0.008 lots | Very low |

Using smaller position sizes and conservative leverage helps protect your account while you build experience.

Key Steps for Safe Trading

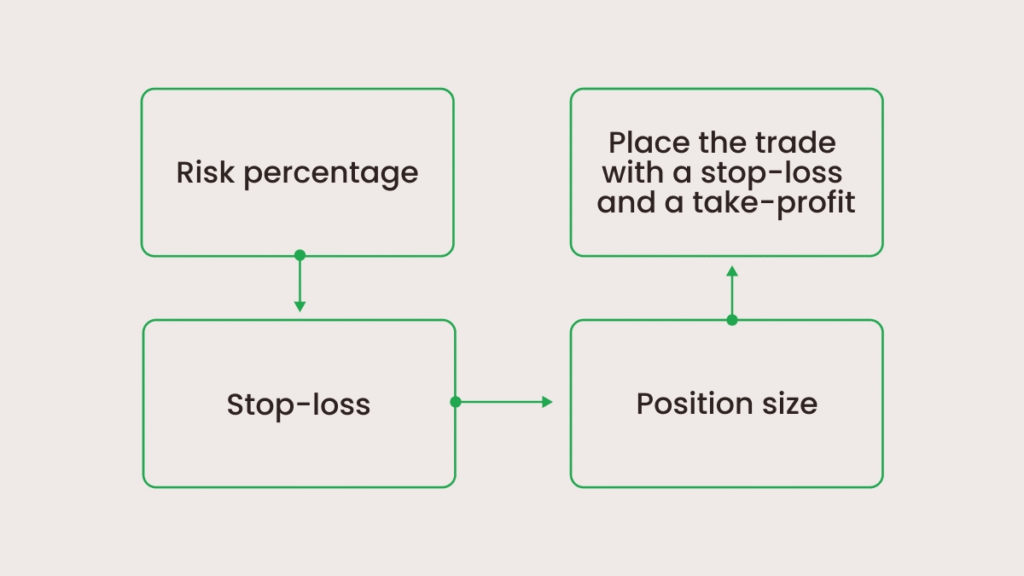

Risk percentage: Decide how much of your account you are willing to risk on a single trade. A common guideline is 1–2%, or up to 5% if you’re just testing your strategy.

Stop-loss: Determine the price level at which you will exit a trade if it moves against you. Base this on chart analysis or a fixed pip distance.

Position size: Calculate your lot size so that it aligns with your risk tolerance and stop-loss distance. Use a simple formula or a position size calculator.

Placing the trade: Enter your trade with a stop-loss and a take-profit in place. Following this systematic approach ensures you’re not guessing—every trade should follow the same repeatable process.

Use Risk Management Tools

Risk management is critical to preserving capital and avoiding large losses.

- Always use stop-loss orders to limit potential losses and take-profit orders to secure gains.

- Don’t risk more than 1–2% of your account on a single trade.

- Stick to micro lots (0.01) if your account is under $100.

Practice on a Demo Account

Before trading with real money, test your strategy using a demo account:

- Open a demo account with your broker, such as the FBS Demo Account in the FBS Personal Area.

- Use the same leverage you plan to trade with (e.g., 1:10).

- Practice setting stop-losses and managing lot sizes.

- Track your performance for at least 1–2 months to analyze results.

Learning to trade safely on a demo account helps you grow your capital responsibly.

Monitor Margin Level

Margin level = (Equity ÷ Used Margin) × 100%

- A safe margin level is above 300%.

- Between 100%–300% is a warning zone.

- Below 100%, your broker may start closing positions (margin call).

Example:

- Used margin: $100

- Equity: $300 → Margin level = 300% (safe)

- Equity: $150 → Margin level = 150% (caution)

- Equity: $100 → Margin level = 100% (danger)

Always aim to keep your margin level above 300% before opening new trades.

Margin-Based vs. Real Leverage

- Margin-based leverage shows how much margin your broker requires to open a trade.

- Real leverage reflects your actual exposure:

Real leverage=Total value of open positionsAccount equity\text{Real leverage} = \frac{\text{Total value of open positions}}{\text{Account equity}}Real leverage=Account equityTotal value of open positions

Example:

- Account balance: $100

- Trade worth $500 → Real leverage = 5:1

- Trade worth $1000 → Real leverage = 10:1

Review and Adjust Trades

Keep a trading journal and regularly review your performance. Adjust your leverage or position size if your account is at risk. Focus on consistent, small gains rather than chasing big wins.

Glossary

- Leverage: How much your trade size exceeds your capital.

- Margin: The portion of your account locked as collateral for a leveraged trade.

- Equity: Account balance plus/minus floating profit or loss from open trades.

- Used margin: Total margin currently tied to open trades.

- Margin level: (Equity ÷ Used Margin × 100%)—indicates risk of margin call.

- Stop-out: When the broker closes trades due to low margin level.

Ready to trade? Use beginner-friendly leverage with FBS to protect your capital and trade safely.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: