Forex Trading: Key Benefits and Why Traders Flock to It

Forex trading attracts millions of participants worldwide, with approximately $7.5 trillion changing hands daily. It’s the largest financial market and plays a vital role in global commerce.

In this guide, you’ll explore the main advantages of Forex trading, what sets this market apart, how it compares to others, and why so many traders are drawn to it every day.

Risk Reminder

Before diving into the benefits, it’s important to acknowledge the risks. Forex trading allows the use of leverage, meaning you can control large positions with a small investment. While leverage can amplify profits, it also increases losses. A successful trade can grow your account quickly, but a losing trade can reduce it just as fast. Smart traders always use stop-loss orders, manage trade sizes carefully, and avoid risking money they can’t afford to lose.

Core Benefits of Forex Trading

The Forex market is where individuals and companies exchange currencies. It facilitates international payments, investments, and trade. For example, when someone sends money abroad or a business purchases products from another country, the transactions go through the Forex market.

Forex has become a preferred market for traders of all levels for several reasons:

- Easy to start: You can begin trading with any amount of capital.

- Low costs: Most brokers don’t charge commissions; they earn from the spread (the difference between buying and selling prices). Some brokers, like FBS, don’t charge extra fees at all.

- Accessible to all budgets: Whether you have $100 or $1 million, you can trade using the same strategies.

- Simple mechanics: Forex trading is straightforward, as you always trade in currency pairs. You can profit whether prices rise or fall.

Essential Forex Terms for Beginners

- Pip: The smallest price change in a currency pair, usually shown in the fourth decimal place (e.g., EURUSD moving from 1.1000 to 1.1001 = 1 pip).

- Lot: A standard lot equals 100,000 units of the base currency. Beginners can trade mini lots (0.1) or micro lots (0.01) for smaller positions.

- Spread: The difference between the bid and ask price, which varies by pair, broker, and market conditions.

- Margin: Funds held by your broker when trading with leverage. It acts as a deposit to support your position.

- Base / Quote: Each currency pair has a base currency (first, e.g., EUR in EURUSD) and a quote currency (second, e.g., USD). The price indicates how much of the quote is needed to buy one unit of the base.

Forex prices respond to real-world economic events, such as interest rate changes, inflation data, and employment reports.

How much does it really cost to trade Forex?

Understanding Forex Trading Costs

People often describe Forex as “low-cost” or even “commission-free.” While that can be true in some cases, there are still costs traders should be aware of:

- Spreads: The most common cost, representing the difference between the bid and ask price. Tighter spreads mean cheaper trades, but they can widen during major news events or periods of low market activity.

- Commissions: Some brokers don’t include all fees in the spread. Instead, they may charge a small commission per lot traded.

- Swap / Overnight Fees: Keeping a position open overnight can result in either a small credit or debit, depending on the interest rate difference between the two currencies in the pair.

- Slippage: Occasionally, your trade may not execute at the intended price, especially in fast-moving markets, leading to slightly worse entry or exit levels.

- Other Fees: These vary by broker and may include charges for deposits, withdrawals, or inactivity if you don’t trade for a while.

Being aware of these costs early helps you calculate your true break-even point and compare brokers more confidently.

Advantages of Forex Compared to Other Markets

Forex offers several benefits over markets like stocks or cryptocurrencies, particularly in flexibility and accessibility. Here’s a quick comparison:

| Feature | Forex | Stocks | Crypto |

|---|---|---|---|

| Trading hours | Open 24 hours, Monday to Friday, following global time zones | Open only during exchange hours (e.g., 9:30 AM – 4:00 PM, NYSE) | Open 24/7 |

| Leverage | High leverage available (up to 1:3000; in the US, max 1:50) | Usually limited (1:2 or 1:5) | Up to 1:200 depending on the platform |

| Liquidity | Very high; trades execute quickly even in large volumes | Moderate; depends on the stock and trading volume | Varies depending on the coin |

| Volatility | Influenced by news and global events | Driven by company news and economic data | Often affected by hype and market sentiment |

| Trading fees | Generally no extra fees | Fee per trade applies | Most platforms charge a fee |

| Margin requirements | Flexible; varies by broker and account type | Usually higher and stricter | High; varies by platform |

| Where it’s traded | Decentralized, OTC (over-the-counter) | Centralized, official exchanges | Mostly online platforms |

Profit Potential and Liquidity

Liquidity is what keeps the Forex market flowing smoothly. Major currency pairs, such as EUR/USD or USD/JPY, are highly active, allowing trades to execute almost instantly—even for large positions.

High liquidity also reduces trading costs by tightening spreads. When major markets like London and New York overlap, price movements become more pronounced, creating opportunities for fast trades.

The Forex market operates through a global network of banks and electronic trading systems, which distributes liquidity across multiple platforms. This ensures trades can happen efficiently, with buyers and sellers always ready, so traders can respond quickly to market changes.

Major economic events—like job reports, inflation data, or breaking news—can trigger significant price swings. Forex combines deep liquidity with low trading costs, and traders are rarely stuck in positions. You can also use automatic orders to lock in profits or limit losses.

Institutional vs. Retail Trader Behavior

Institutional traders

- Focus on timing, structure, and liquidity.

- Often trade during quieter periods (e.g., when the Asian session starts or the New York session closes) to avoid sudden price swings.

- Test key price levels before major data releases, executing well-planned strategies.

Retail traders

- Tend to trade more impulsively, reacting to price movements.

- Often enter during busy market hours, such as London or New York sessions.

- May overreact to price changes, generating false signals.

Understanding who is on the other side of the trade can provide an advantage. Institutions typically aren’t chasing breakouts—they’re waiting for premature moves from retail traders to gain an edge.

24/5 Market Access and Flexibility

Forex trading is adaptable to any schedule. Whether you have a full-time job or prefer trading at unconventional hours, the market accommodates your lifestyle:

- Early riser? Trade during the Tokyo session.

- Looking for fast action? The London/New York overlap offers the highest activity.

- Limited time? Use 4-hour charts and alerts.

- Late-night trader? Focus on the Sydney or Asian sessions.

Operating 24 hours a day, five days a week—from Sunday evening to Friday afternoon—Forex lets you trade when it suits you.

A market timetable can help you see when each trading session is most active, making it easier to plan the best times to trade.

Forex Trading Hours and Seasonal Changes

Forex trading hours can shift throughout the year. During the transitions for daylight saving—typically between March and April, and again between October and November—different countries adjust their clocks at different times. This can affect session overlaps. For instance, the London–New York overlap may start an hour earlier, or Asian markets might open slightly earlier or later, depending on your location.

Additionally, keep an eye on weekend gaps. Prices often close on Friday and reopen on Sunday at a different level, sometimes significantly higher or lower than the previous close.

Benefits for Beginners vs. Experienced Traders

Forex trading offers advantages for both newcomers and seasoned traders, though the benefits differ.

For Beginners

- Simple to learn: buying and selling currencies.

- Abundant free resources, courses, and tutorials.

- Demo accounts to practice risk-free.

- Start small with micro lots to build confidence.

For Experienced Traders

- Fast trade execution and support for automated strategies.

- Ability to trade larger volumes with precision.

- Plan trades around key events, such as interest rate decisions or inflation reports.

- Use hedging and integrate strategies with other markets.

Hedging to Manage Risk

Hedging allows traders to reduce potential losses by taking opposite positions in correlated currency pairs. For example, you might short EUR/USD while going long on GBP/USD. When these pairs typically move together, losses on one position can be offset by gains on the other.

However, correlations aren’t fixed. Major news, interest rate changes, or market stress can disrupt relationships between pairs, so it’s important to monitor them continuously.

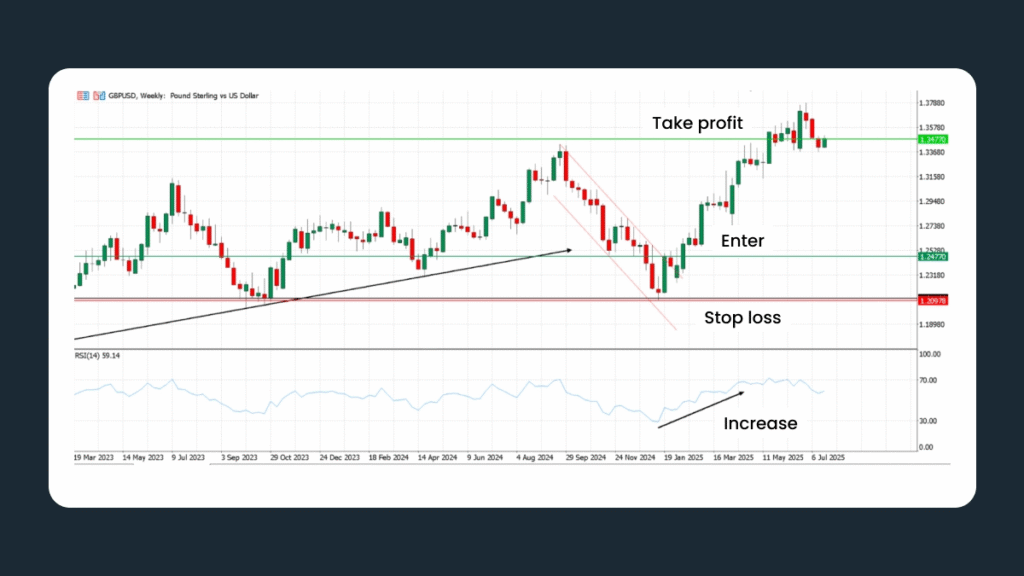

Real-Life Example of Profit Potential

(Here you can insert your practical example demonstrating how a trade could generate profit.)

A trader spots a bullish flag on EUR/USD near the 1.21178 resistance level. Shortly after, the ECB releases dovish signals, reinforcing the trade idea. Acting on this, the trader enters at 1.2477 and exits at 1.3477—a 1000-pip gain. Using 0.5 lots on a $1,000 account with 1:50 leverage, this trade yields a $500 profit.

However, the setup could have unfolded differently. If the ECB’s dovish signals were already priced in, EUR/USD might have reversed sharply instead of breaking higher. With a stop-loss 50 pips below the entry, the trade would close automatically, resulting in a $250 loss (0.5 lots × $10 per pip). On a $1,000 account, that’s a 25% drawdown—a stark reminder of how leverage amplifies both profits and losses. Without a stop-loss, the position could continue to lose, potentially wiping out most or all of the account.

With proper timing and disciplined risk management, even small accounts can generate meaningful profits with FBS—no large investment required.

Which Currency Pairs to Trade?

Understanding Forex Pairs

Not all currency pairs are the same, so traders often divide them into three main categories for clarity:

Majors

These are USD pairs paired with currencies like EUR, GBP, and JPY. They are the most heavily traded, offering high liquidity and the lowest spreads, which is why beginners often start with them.

Minors

Minor pairs don’t include the USD but involve other major currencies, such as EUR/GBP or AUD/JPY. While they still have good trading volume, spreads are typically wider than majors. These pairs can still provide solid trading opportunities.

Exotics

Exotic pairs combine a major currency with one from a smaller or emerging market, like USD/TRY or EUR/SEK. These pairs can move quickly and are harder to predict. They usually have higher spreads and carry greater risk.

It’s also important to consider market sessions. JPY and AUD pairs are most active during the Asian session, while EUR and GBP pairs gain momentum during European hours. Many traders begin with majors for simplicity, then gradually explore minor pairs as they gain experience.

Risk Management: Balancing Rewards and Risks

Forex can be highly profitable if you manage risk wisely. Before entering a trade, decide how much you’re willing to lose, always use a stop-loss, and ensure the trade is worth taking.

Limit your risk per trade to just 1–2% of your account. Avoid trading during quiet periods, such as late Fridays or after the Asian session, and never let emotions drive your decisions. High leverage can amplify both profits and losses, so use it cautiously.

Leverage limits vary by region:

- EU/UK: Retail traders can use up to 1:30.

- US: The limit is 1:50.

- Offshore brokers may offer extreme leverage (1:500 or 1:1000), but even a small price move can wipe out your account.

Forex provides the tools, but your discipline determines your success. Treat trading as a long-term journey, not a shortcut to quick gains.

Tools and Education to Support Your Trading

Modern trading platforms do more than execute trades. For instance, FBS allows you to:

- Set price alerts for key levels.

- Add technical indicators like moving averages or RSI.

- Follow market news in real time.

- Access trading signals and sentiment data to see how others are positioned.

Beginners should start with a demo account to practice risk-free. Gradually work through tutorials, like those offered by FBS Academy, which cover everything from essential terms to example strategies. This approach builds skills and confidence before moving to live trading.

Your Next Step in Forex Trading

Forex is highly accessible, flexible, and adaptable to your schedule and trading style. It offers low costs, significant opportunities, and a market that reflects global trends.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: