How to Trade Using Tweezer Top and Tweezer Bottom Candlestick Patterns

Traders have a variety of tools to help make better-informed decisions, and candlestick charts are among the most popular. Candlesticks visually represent an asset’s price movement over a set period, with green indicating bullish movement and red indicating bearish. By forming patterns, candlesticks help traders spot trends and potential reversals, making them a key part of technical analysis (TA).

Tweezer patterns are among the simpler candlestick signals and require no advanced tools to identify. While they don’t guarantee market reversals, they can provide early warning that a trend may be losing momentum. Let’s explore what Tweezer patterns are, how to recognize them, and how to trade using them.

What Are Tweezer Candlestick Patterns?

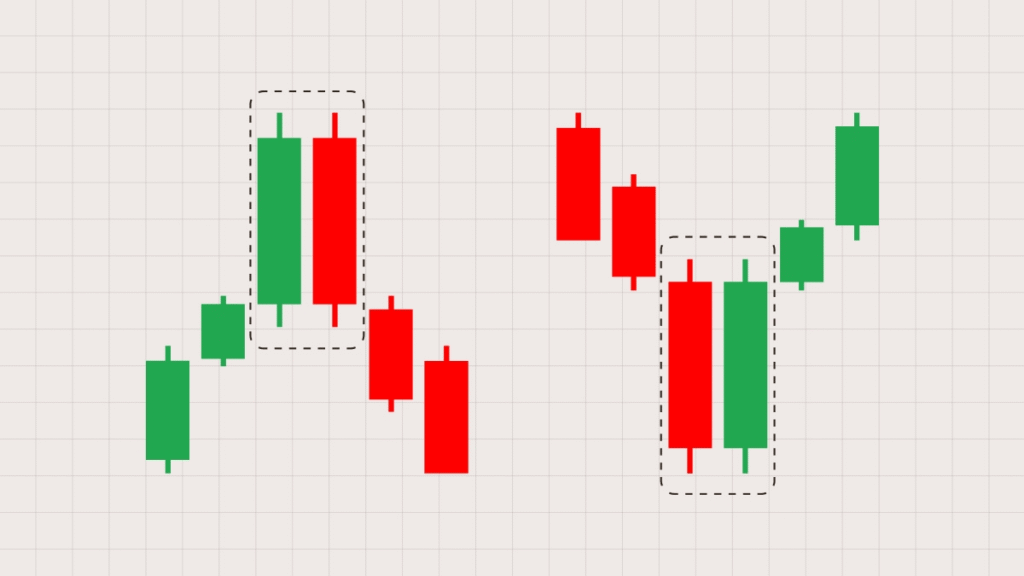

Tweezer patterns are candlestick chart formations that signal potential trend reversals. They occur when the market struggles to move beyond a specific price level, forming two consecutive candles with nearly identical highs or lows.

The name comes from the resemblance of the two side-by-side candles to a pair of tweezers. Steve Nison popularized them in Japanese Candlestick Charting Techniques.

A Tweezer Top forms when two consecutive candles reach the same or very similar highs, while a Tweezer Bottom forms when two candles hit similar lows. Exact matches aren’t necessary; small differences of a few pips are acceptable. The similarity can appear in wicks, open/close levels, or a combination of both. Candle color doesn’t matter—what counts is the shared level of price rejection.

These patterns can appear at the top of an uptrend or the bottom of a downtrend, signaling that the trend is losing strength. Prices hit a level, bounce off, and struggle to break through. While Tweezer patterns don’t guarantee reversals, they serve as an early warning that momentum is shifting. Traders often combine them with other tools to confirm trends.

Tweezer Tops vs. Tweezer Bottoms

Tweezer patterns are rejection signals, indicating that the price has tested a level and failed to break through.

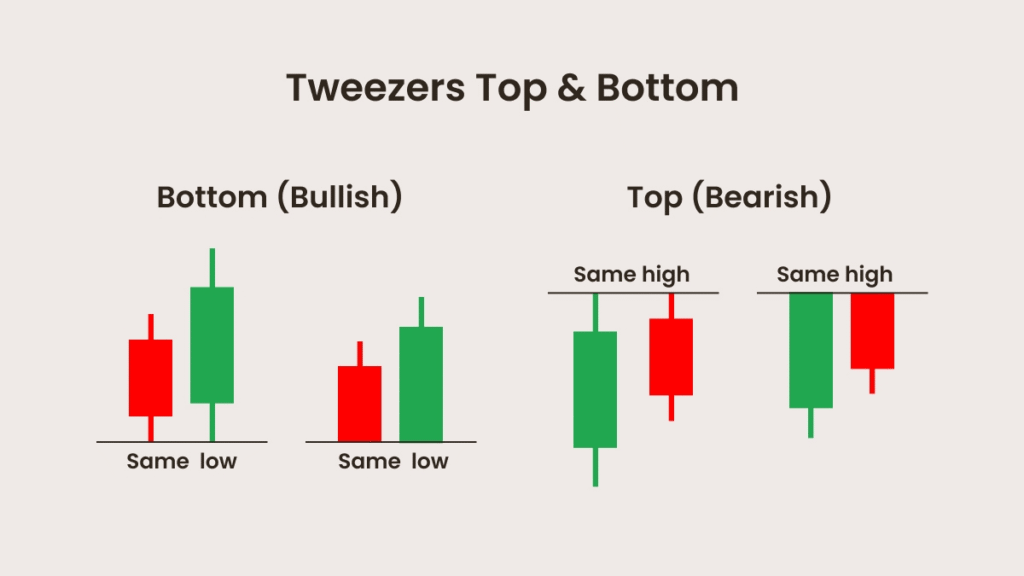

- Tweezer Top: Appears after an uptrend, suggesting a potential downward reversal. The first candle is usually bullish (green), showing buyers still in control. The second candle reaches the same high (or close to it) but is pushed back down by sellers. Candle color is less important than the fact that the resistance held. If the next candle closes lower, it strengthens the bearish signal.

- Tweezer Bottom: Appears after a downtrend, indicating a possible upward reversal. The first candle is usually bearish (red). The second candle tests the same low (or nearly the same) but rejects higher. Candle color doesn’t matter here—what matters is the shared support level. A bullish candle following the Tweezer Bottom that breaks above the pattern range can signal the start of a new upward trend.

| Pattern | Appears After | Matching Price | Signal |

|---|---|---|---|

| Tweezer Top | Uptrend | Highs | Bearish reversal |

| Tweezer Bottom | Downtrend | Lows | Bullish reversal |

Tweezers vs. Similar Candlestick Patterns

Tweezer patterns share similarities with other candlestick formations, but the key difference is speed. Tweezers indicate an immediate rejection at a critical price level, while other patterns usually signal slower, more gradual reversals.

- Tweezer Top or Bottom:

Two consecutive candles with nearly identical highs or lows. This signals that the price has hit a barrier and is starting to hesitate. - Double Top or Bottom:

Takes longer to develop, with two highs or lows separated by a pullback. This shows a prolonged tug-of-war before the market reverses. - Engulfing Pattern:

Also formed by two candles, but the second completely engulfs the first. This pattern signals a shift in control rather than matching highs or lows, showing one side overtaking the other. - Morning Star or Evening Star:

Three-candle formations. The first continues the trend, the second shows indecision, and the third confirms the reversal. The directional change is slower compared to a Tweezer pattern.

How to Spot a Tweezer Candlestick Pattern

Identifying a Tweezer pattern is straightforward—no complex indicators or lines needed. Simply look for two consecutive candles:

- Tweezer Top: The highs of both candles are equal or nearly equal.

- Tweezer Bottom: The lows of both candles are equal or nearly equal.

- The second candle must show a rejection at that level (fail to break through). Candle color doesn’t matter; the focus is on the shared price level and the rejection.

Candlestick patterns are influenced by timeframe. On very short timeframes like 1-minute charts, random price movements create “noise,” generating patterns that often don’t mean much. Tweezers are more reliable on longer timeframes—like 4-hour, daily, or weekly charts—because they better reflect actual buyer and seller activity, signaling potentially larger moves.

Not every pair of aligned highs or lows qualifies as a strong Tweezer. The second candle should show a reaction to the first, such as a price reversal or struggle to break through. This indicates a shift in control from buyers to sellers, or vice versa.

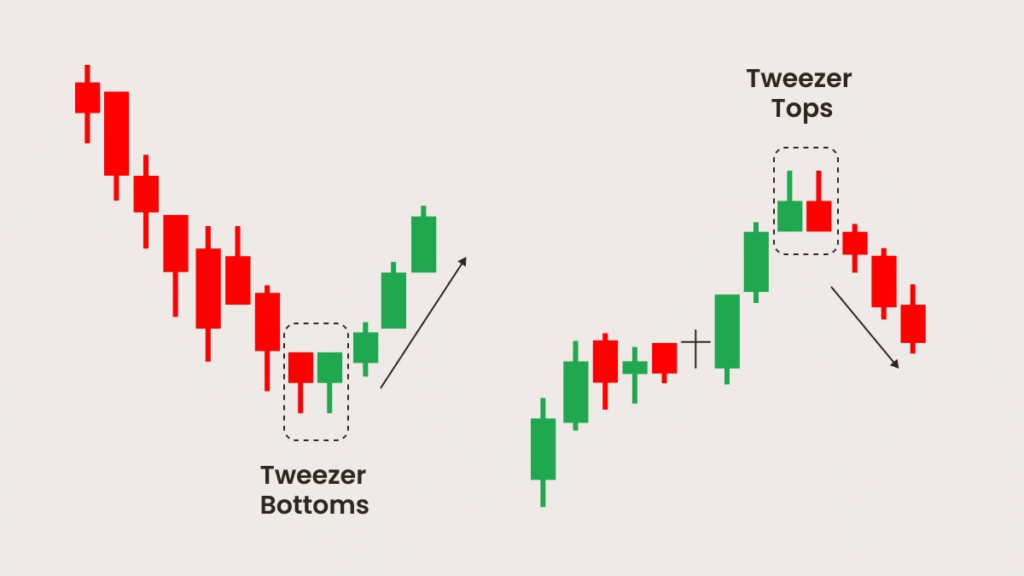

Context is crucial. Tweezers are most effective when they form at clear resistance or support levels, near trendlines or Fibonacci levels, and during a recognizable uptrend or downtrend. Patterns forming in the middle of a sideways range are less meaningful and often should be ignored.

Using additional indicators like the Relative Strength Index (RSI) can increase reliability. If a Tweezer Top forms in an overbought market, or a Tweezer Bottom appears in an oversold market, it strengthens the likelihood of a reversal.

The best way to get comfortable spotting and trading Tweezer patterns is through practice in a demo account.

Checklist and Detection Rules

Before trading a Tweezer pattern, use this quick checklist to filter out weak setups:

- Candle Match

Two consecutive candles should have equal or nearly equal highs (Tweezer Top) or lows (Tweezer Bottom). The second candle must reject the level, moving in the opposite direction. - Trend Context

Tweezer Tops appear after uptrends, and Tweezer Bottoms after downtrends. Avoid trading Tweezers in sideways or choppy markets. - Key Levels

The pattern should form near important support, resistance, or Fibonacci zones—not in the middle of a range. - Candle Quality

Both candles should have clear wicks reaching the same high or low to indicate rejection. The second candle should close strongly in the opposite direction, signaling a shift in control. - Confirmation

Wait for the next candle to close beyond the pattern before entering a trade. Additional signals from RSI, MACD, or volume can strengthen the setup.

Entry Strategies for Tweezer Patterns

Trading Tweezers is relatively straightforward, but using supporting indicators increases the probability of success.

- Identify the Trend

Ensure there’s a clear upward or downward trend. Ignore Tweezers forming in sideways markets. - Wait for Confirmation

When a Tweezer forms, do not enter immediately. Wait for the next candle:

- Tweezer Top: The next candle should drop below the pattern, confirming bearish momentum.

- Tweezer Bottom: The next candle should rise above the pattern, confirming bullish momentum.

- Place the Trade

- Tweezer Top: Enter a short position, anticipating a price drop. Set a stop-loss just above the pattern’s high.

- Tweezer Bottom: Enter a long position, aiming to profit from a price bounce. Set a stop-loss just below the pattern’s low.

- Take Profit

Set targets at nearby support or resistance levels, or exit when you feel comfortable. Tools like RSI and the order book can help identify logical exit points.

Confirmation and Invalidation

Confirmation

A Tweezer is confirmed when the next candle moves in the expected reversal direction:

- Tweezer Top: The next candle closes below the pattern’s low, showing sellers taking control.

- Tweezer Bottom: The next candle closes above the pattern’s high, showing buyers gaining control.

Stronger confirmation occurs when the candle has a large body, higher volume, or supporting indicators such as RSI divergence.

Invalidation

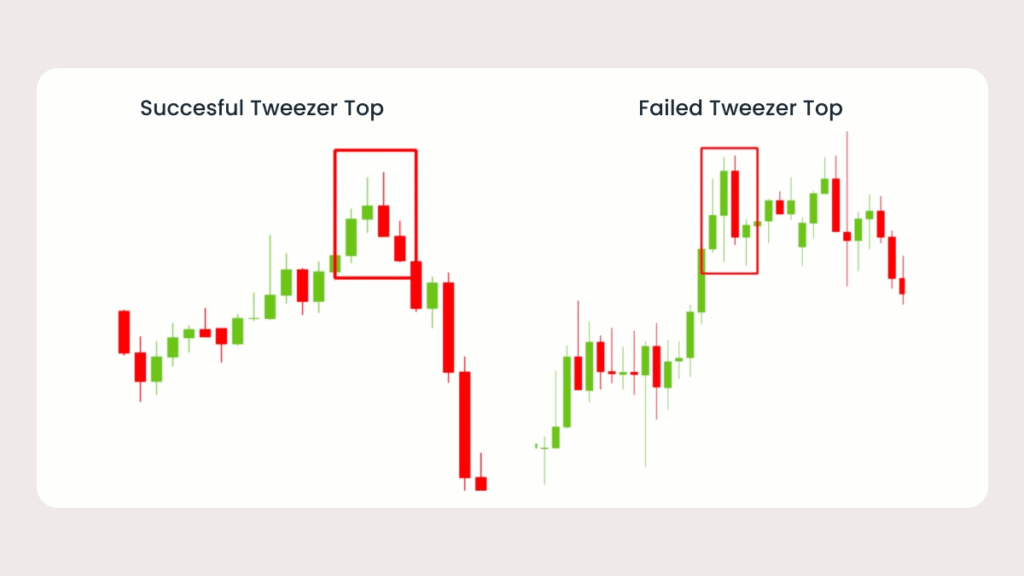

A Tweezer fails if price breaks beyond the pattern:

- Tweezer Top: Fails if the next candle makes a new high.

- Tweezer Bottom: Fails if the next candle makes a new low.

Failed Tweezers reveal where real momentum lies. They can guide stop-loss placement or even indicate a trade in the opposite direction, as failed Tops often suggest renewed bullish strength, while failed Bottoms signal continued selling pressure.

Common Mistakes to Avoid

- Trading Too Early: Don’t buy or sell as soon as the Tweezer forms. Wait for the confirmation candle to avoid false signals.

- Ignoring Context: Tweezers are more reliable near significant support/resistance or trendlines, especially after a strong rally or drop.

- Trading Against the Trend: Entering trades against a strong prevailing trend increases the risk of failure.

- Skipping Stop-Losses: Always use a stop-loss to protect your account in case the trade fails.

- Rushing Into Trades: Sometimes it’s better to miss a trade than to enter late and risk a fake-out. Patience is key—trade the right setups, not every signal.

Tweezer Outcomes in Practice

Not every Tweezer leads to a clean reversal. Some succeed, while others fail and become trend continuations.

- Successful Tweezer Top: Price rallies into resistance, forms two equal highs, second candle rejects lower, and the next candle confirms with a bearish close.

- Failed Tweezer Top: Two equal highs form, but the next candle breaks higher, invalidating the pattern and showing buyers are still in control.

- Successful Tweezer Bottom: Price falls to support, forms two equal lows, second candle rejects higher, and the next candle confirms with a bullish close.

- Failed Tweezer Bottom: Two equal lows form, but the next candle breaks lower, invalidating the pattern and indicating continued selling pressure.

If you want, I can also condense this into a visual “Tweezer Trading Cheat Sheet” with rules, entries, stops, and confirmations for quick reference while trading. It would make it extremely easy to follow in real-time. Do you want me to make that?Attach

Search

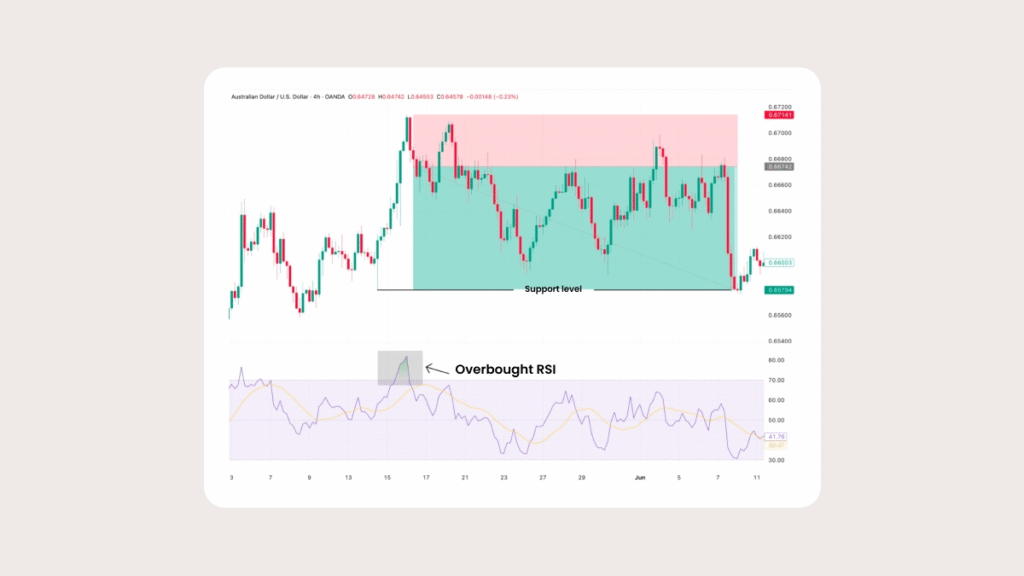

Tweezer Top example

Let’s go through an example. Suppose you’re observing the 4-hour AUD/USD chart. The price has been climbing steadily. Suddenly, two candles appear with nearly identical highs. The first candle is bullish, while the second opens at the same high but then turns bearish and closes lower.

This forms a Tweezer pattern. Next, you look for confirmation. The RSI reads above 70, indicating the pair is overbought—supporting the possibility of a reversal.

The following candle opens and falls below the lows of both Tweezer candles. This becomes your signal to enter a short position. Place a stop-loss just above the highs of the Tweezer candles to manage risk, and set a profit target at the next support level.

If, instead, the price had broken above the Tweezer highs, the setup would be invalid. This is why positioning your stop beyond the pattern’s extreme points is crucial.

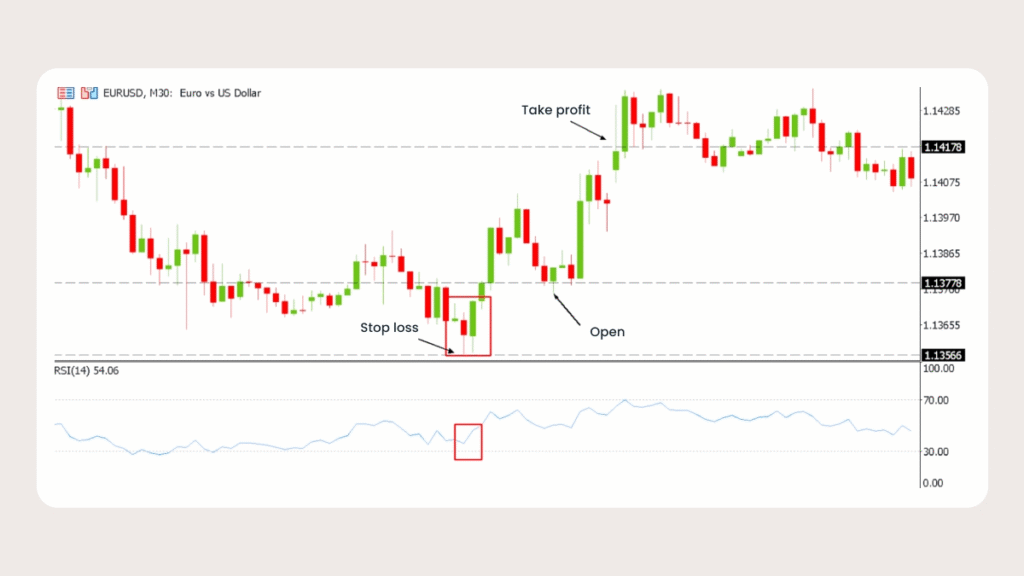

Tweezer Bottom example

On this 30-minute EUR/USD chart, the price has been trending downward. Suddenly, two candles appear with nearly identical lows (highlighted in the upper red box). The first candle is bearish, testing support, while the second turns bullish after failing to push lower.

This forms a Tweezer Bottom at a key support level. The RSI is approaching oversold territory (see lower red box), which adds weight to the possibility of a reversal.

The next candle breaks above the Tweezer range, providing confirmation. This is your signal to enter a long position. Place a stop-loss just below the shared lows to manage risk, and set a take-profit target near the next resistance level.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: