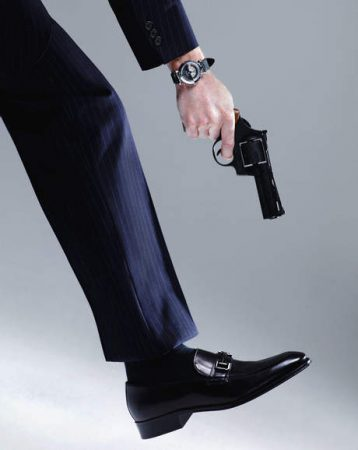

How often have you wanted to kick yourself for exiting a trade early, only to watch it move in your favor after it hit your stop loss? Or felt the frustration of giving back recent profits on a trade you knew was a bad idea before entering it?

Trading can be one of the most frustrating professions in the world—if you let it. Just like in tennis, the fewer “unforced errors” you make, the better your results. The worst way to lose money in the market is by making mistakes you already know you shouldn’t. We’re all guilty of these mistakes from time to time, but the key is to minimize them so you can tilt the odds of trading success in your favor.

Unforced Errors Can Wreck Your Trading Account

In tennis, an unforced error is a simple mistake that gives the point to your opponent. In trading, unforced errors are equally avoidable—they include making poor trades, over-trading, or risking too much. Unlike tennis, where small physical miscalculations can happen, unforced trading errors are almost always preventable through discipline and logic.

Trading is challenging enough without adding unnecessary mistakes. Avoid doing things you know are wrong—the market will punish you enough as it is.

How to Eliminate Unforced Trading Errors

Reducing unforced errors requires conscious effort and discipline. Here’s how to get started:

- Don’t exit trades prematurely. Closing a trade before it hits your pre-determined stop loss is almost always a mistake. Let your trade play out. Doing otherwise implies arrogance and ignorance—assuming you know “for sure” what the market will do next. Trust your strategy and give it a chance to work.

- Stick to your trade plan and gut call. Avoid second-guessing trades that fit your method. Consistency builds your trading edge; wavering leads to random, unprofitable actions.

- Manage your risk properly. Over-leveraging or risking too much per trade is one of the quickest ways to sabotage your account. Focus on trading only when your edge is present and keep risk manageable.

- Focus on skill, not profits. Obsessing over rewards and profits diverts your attention from what truly matters: risk management, discipline, and mastering your strategy. Profits will follow naturally once your process is sound.

- Use higher time frames. Avoid analyzing charts under one hour. Lower time frames are noisy, unpredictable, and often lead to unnecessary stress and mistakes.

- Stop over-analyzing unnecessary variables. Trading news or chasing minor indicators often wastes time and increases mistakes. Trust your price action and trading strategy—it already reflects the market’s variables.

- Follow your trading plan and track your progress. A simple checklist or trading journal can keep you disciplined. Include your strategy, risk rules, and reminders to avoid mistakes. Over time, these actions will become habits, significantly reducing unforced errors.

Conclusion

Most traders fail due to unforced errors. If you can get out of your own way and let your trading strategy do the work, you dramatically improve your chances of success. Overcoming these mistakes requires conscious effort, discipline, and a clear, mastered trading method. By focusing on your process rather than impulsive actions, you stop being your own worst enemy in the markets.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: