A trader might have a great year where their strategy performs exceptionally well, only to find that the same approach underperforms the following year. Why does this happen? The answer often lies in market volatility. This article will explain why monitoring volatility is essential and how adjusting your stops and profit targets according to changing volatility can protect your risk/reward profile.

The key idea is simple: as market volatility shifts, your approach to stop losses and profit targets should shift with it.

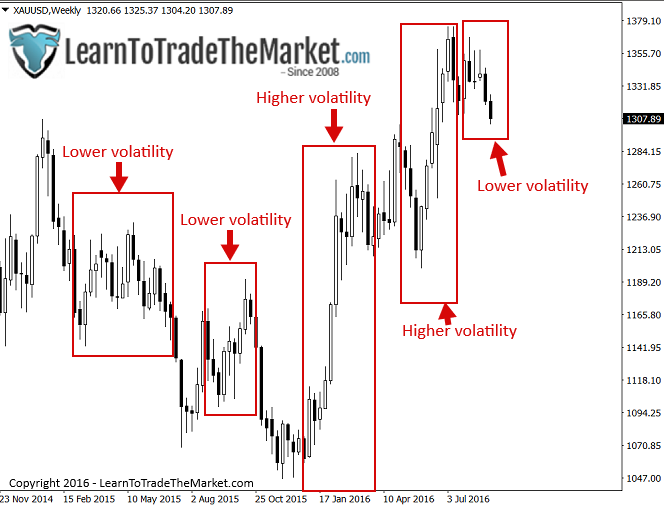

Volatility Phases

Markets go through different phases of volatility. At times, price movements are large, daily or weekly ranges expand, and momentum is high. Other times, markets calm down, daily and weekly ranges shrink, and volatility drops. If your risk/reward settings remain static during these changes, you may run into problems.

If you’ve been profitable for a period but suddenly find targets aren’t being hit—or losses are larger than expected—it may be because your money management hasn’t adapted to the current volatility.

As volatility increases or decreases, your stop losses and profit targets should adjust accordingly. For example, during periods of low volatility, the market may seem sluggish, but the reality is that price movements are simply smaller. To stay in line with the market dynamics, your stops and targets need to be tighter than during high-volatility periods.

Consider this example: if you normally trade with a $40 target and a $20 stop, and suddenly your profit targets are missed while losses grow disproportionately, the problem is likely that you didn’t adapt your strategy to match the reduced volatility. As volatility changes, so does the potential risk/reward of each trade.

Failing to adjust stops and targets can lead to frustration and unnecessary losses. Similarly, if your profit targets aren’t adapted to the current market conditions, you may miss opportunities that would have been achievable with properly scaled targets.

Volatility is dynamic—it changes month to month and quarter to quarter. Compare the market today to a year ago, and you’ll see that the range and pace of price movements may be very different. Your money management should reflect these current dynamics, not the conditions of years past.

For example, if the average weekly and daily price range has shifted by 50%, your stops and profit targets should be adjusted roughly in proportion.

By observing how the market transitions from high volatility with large daily moves to periods of low volatility with smaller moves, you can proactively adapt your risk and reward settings. Properly aligning your money management with changing market conditions is essential for consistent trading performance.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

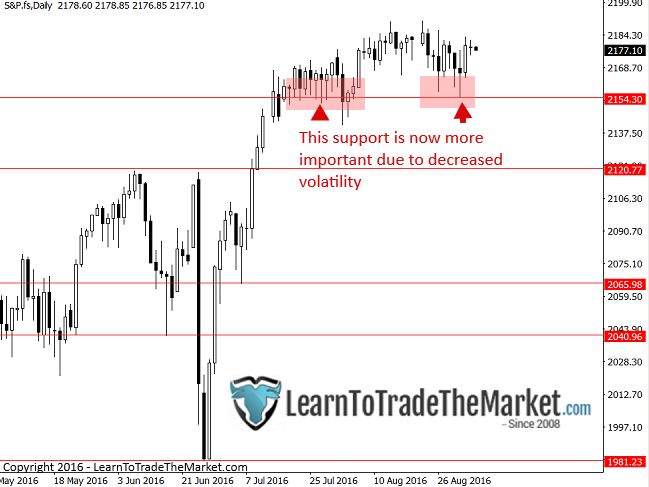

Horizontal Levels Shift with Volatility

If you’ve read my articles on drawing support and resistance or placing stops and targets like a professional trader, you already know how crucial these levels are for managing trades. What I didn’t cover in those lessons is that as market volatility changes, nearby support and resistance levels shift as well.

You might be thinking about the ATR (Average True Range) and how it factors in. While ATR is a useful tool for gauging recent market volatility, it should not replace horizontal levels when setting stops and targets. Support and resistance remain the most reliable points to base stop losses on—they act as natural barriers in the market.

When volatility rises or falls significantly, it’s essential to consider the most recent support and resistance levels before entering a trade. For example:

- Increased volatility: Stops should be placed further away from current prices to account for larger price swings.

- Decreased volatility: Stops can be set closer to current prices, reflecting smaller daily movements.

Remember, any adjustment to your stop loss should also trigger a recalculation of your position size if you want to maintain a consistent per-trade risk in dollar terms.

Conclusion

We can’t approach the market as if it’s static—markets are constantly evolving and dynamic. As traders, being aware of market volatility is essential. Every time you analyze the market, you should make it a habit to observe volatility and adjust your stop losses, profit targets, and position sizes to match these changing conditions.

Understanding and responding to shifting market dynamics comes from mastering price action. That’s exactly what I aim to help you achieve: learning to trade using price action so that interpreting changing volatility becomes second nature. Once you truly grasp how to read price action, adapting to evolving market conditions will be effortless.

To deepen your understanding and refine your trading skills, explore my price action trading course and members’ community.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: