📅 Monday, July 21

No major economic releases are scheduled to start the week. Markets will continue to monitor developments in trade negotiations and any shifts in U.S. tariff policy or international responses.

📅 Tuesday, July 22

• Fed Chair Powell Speaks

Chair Jerome Powell is set to speak ahead of the Federal Reserve’s July 30 FOMC meeting. With the Fed in its blackout period, he is unlikely to comment directly on policy. Still, investors will scrutinize his remarks for subtle cues on economic conditions or potential shifts in tone.

📅 Wednesday, July 23

• U.S. Existing Home Sales

June’s existing home sales are expected to remain largely flat, with a slight potential increase of 0–1%, keeping the annualized pace near 4.0–4.1 million units.

Given high mortgage rates and fragile housing demand, any significant deviation—especially alongside consumer sentiment data—could influence market sentiment.

📅 Thursday, July 24

• Flash Manufacturing PMIs (Germany, Eurozone, U.S.)

Markets will watch preliminary PMI data for early signs of manufacturing momentum or contraction:

- Germany: 49.4 (up from 49.0) – hinting at tentative stabilization

- Eurozone: 49.7 – soft overall but supported by Germany

- U.S.: Likely above 50 following June’s 52.9 – signaling domestic demand resilience

• ECB Interest Rate Decision

The European Central Bank is widely expected to hold rates steady. After eight cuts since 2024, the ECB appears to be pausing.

Key areas of focus during President Christine Lagarde’s press conference:

- Euro strength and its disinflationary effects

- Geopolitical risks from ongoing U.S. trade tensions

- Forward guidance on potential September policy moves

📅 Friday, July 25

• U.S. Core Durable Goods Orders

After a strong 0.5% increase in June, July’s core capital goods orders are expected to rise modestly by 0.1%. The report will provide insights into private sector investment and business spending. A weaker print may indicate cooling momentum, while an upside surprise could reinforce confidence in economic activity.

• U.S. Corporate Earnings

Earnings season ramps up with results from major companies:

- Alphabet (GOOGL)

- Tesla (TSLA)

- Intel (INTC)

Investors will monitor not only performance versus expectations but also forward guidance, margin trends, capex outlooks, inflation pressures, and global demand shifts.

📊 Technical Outlook

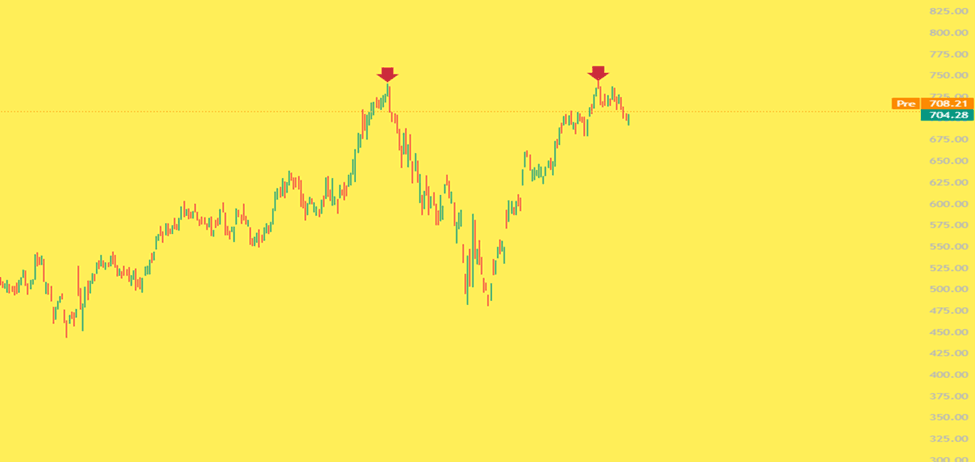

• Meta (META)

The daily chart shows a potential double top formation, with price rejection near all-time highs. Since peaking, the stock has trended lower in line with typical post-pattern behavior, suggesting short-term bearish sentiment.

While the long-term trend remains intact, a decisive move above 740 would challenge this setup and potentially invalidate the double top.

If you want, I can also compress this into a shorter, newsletter-style version that’s punchy and easier for readers to skim quickly. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

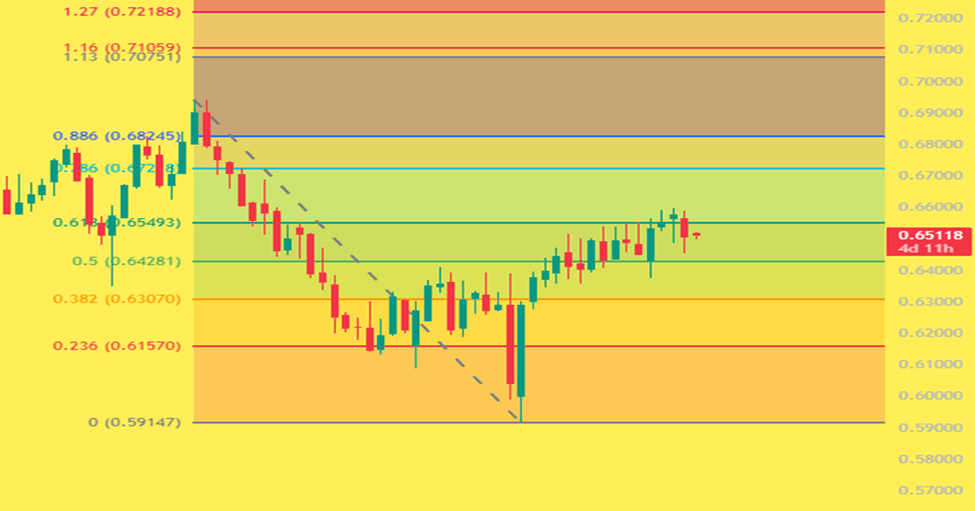

AUDUSD

The pair’s recent upward momentum shows signs of slowing, as last week’s price action formed a bearish weekly candle. This pause coincides with the 61.8% Fibonacci retracement, a level often viewed as a critical turning point.

Unless AUDUSD can reclaim and close above 0.6590 on the weekly chart, the technical outlook remains cautiously tilted to the downside. A sustained break above this level would challenge the current bearish bias and shift attention toward potential upside opportunities.

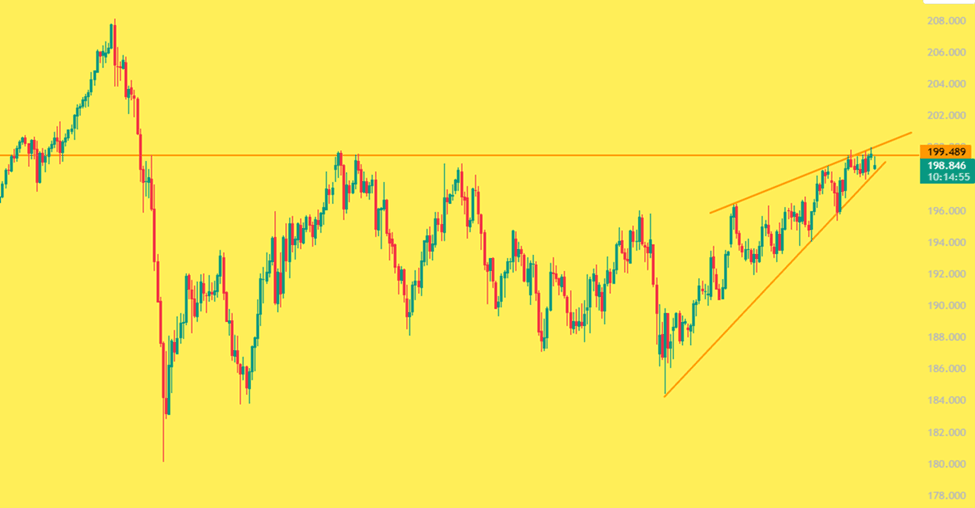

GBPJPY

The pair is once again approaching the 200 level, which has served as strong resistance several times, notably in July and October 2024. This area is now a critical zone to monitor for potential trend continuation or reversal.

On the downside, 198 is a key support. A sustained move below this level could cast doubt on the uptrend that has been in place since April 2025. Conversely, a break above 201 would signal a major technical shift and could pave the way for further upside momentum.

Disclaimer

This content is provided for informational purposes only and should not be considered investment advice. Trading in financial markets carries inherent risks. Ensure you understand these risks fully and consult an independent financial advisor if needed.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: