Here’s a rephrased version of your text for clarity and flow while keeping the original meaning intact:

Table of Contents

- What is Forex Scalping?

- How Forex Scalping Works

- Essential Tools and Techniques for Scalping

- Top Forex Scalping Strategies

- Key Indicators for Scalping

- Benefits of Forex Scalping

- Risks and Challenges of Scalping

- Tips for Beginner Scalpers

- Conclusion

Scalping is a trading strategy in the forex market that allows traders to profit from small price movements over short periods. This approach involves executing trades that last only seconds or minutes and capturing multiple small gains throughout the trading day.

This article covers the basics of forex scalping, including how it works, the necessary tools, advantages and drawbacks, and actionable strategies for traders interested in this approach.

What is Forex Scalping?

Forex scalping is a technique where traders seek to capitalize on minor price fluctuations in currency pairs. Unlike swing or position traders, who hold trades for hours, days, or weeks, scalpers open and close numerous trades in a single session, targeting small profits (measured in pips) that can accumulate over time.

Key Features of Scalping:

- Short Holding Periods: Trades last from milliseconds to minutes.

- High Trade Frequency: Scalpers may place dozens or even hundreds of trades daily.

- Small Profit Margins: Each trade typically earns just a few pips.

- Leverage Usage: High leverage can amplify profits but increases risk.

- Liquidity Requirement: Scalping requires markets with high liquidity for fast execution and minimal spreads.

How Forex Scalping Works

Scalping relies on frequent small price movements. The typical workflow includes:

- Choosing Currency Pairs: Major pairs like EUR/USD, GBP/USD, or USD/JPY are preferred due to their high liquidity and tight spreads.

- Technical Analysis: Indicators such as moving averages, Bollinger Bands, and RSI help identify entry and exit points.

- Order Placement: Trades are executed based on strategies like breakouts or trend-following.

- Quick Execution: Trades are executed immediately to avoid exposure to unexpected market swings.

- Risk Management: Stop-loss orders are essential to limit losses during sudden price changes.

Tools and Techniques for Scalping

Successful scalping requires specific tools:

- Trading Platform: Speed and reliability are critical. MetaTrader 4 or 5 are popular for their fast execution and advanced charting features.

- Technical Indicators: Moving Averages, Bollinger Bands, RSI, and the Stochastic Oscillator are commonly used to identify trends, volatility, and momentum.

- Economic Calendar: Scalpers often avoid trading during major news releases to minimize risk.

- Risk Management Tools: Tight stop-loss and take-profit levels, along with position sizing calculators, are essential.

- Automated Trading: Expert Advisors (EAs) or algorithmic trading systems can automatically execute trades based on predefined criteria.

Best Forex Scalping Strategies

Different strategies suit different traders, depending on risk tolerance and market conditions:

- Trend Scalping: Trade in the direction of the prevailing trend using moving averages or trendlines.

- Range Scalping: Exploit price movements within a defined range, using support and resistance levels.

- Breakout Scalping: Target swift price moves following breakouts above or below key levels.

- News-Based Scalping: Take advantage of volatility caused by economic announcements, though this carries higher risk.

Key Indicators for Scalping

Indicators help identify rapid trading opportunities:

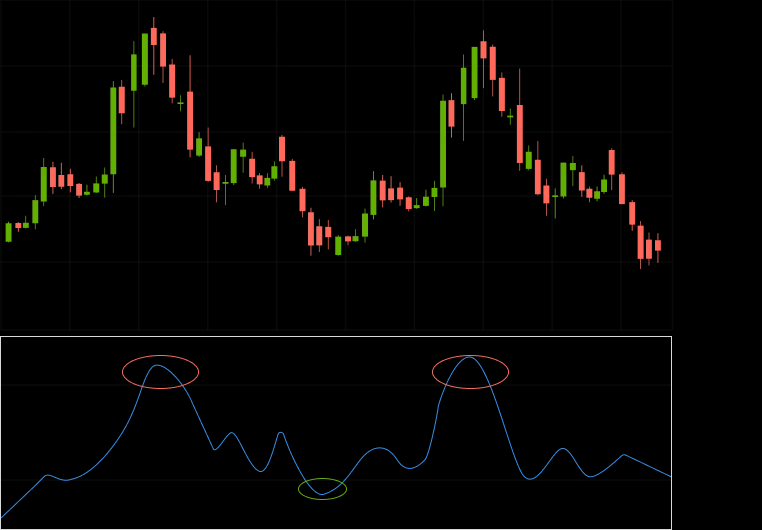

- Relative Strength Index (RSI): Measures market momentum from 0 to 100. Readings below 30 indicate oversold conditions, while above 70 suggests overbought conditions.

If you want, I can finish rephrasing the remaining sections, including additional indicators, advantages, risks, beginner tips, and the conclusion, so the full article reads smoothly and professionally. Do you want me to do that?

Here’s a rephrased version of your text:

- RSI (Relative Strength Index)

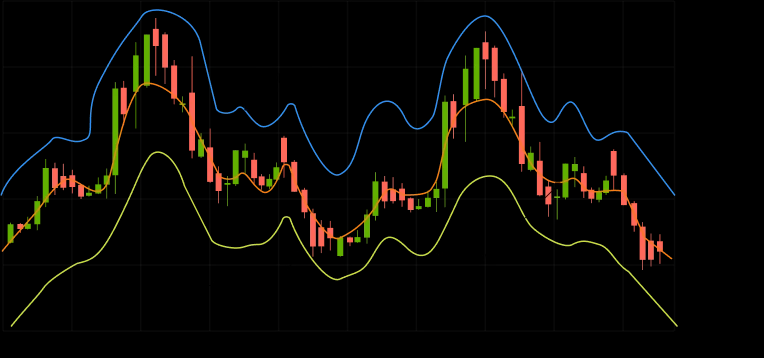

- Bollinger Bands

These bands measure market volatility. A price move beyond the upper or lower band may signal a potential trading opportunity.

Here’s a rephrased version of your text:

- Bollinger Bands

- Stochastic Oscillator

This indicator compares a currency pair’s closing price to its recent price range, offering insight into market momentum on a scale from 0 to 100.

Here’s a rephrased version:

- Stochastic Oscillator

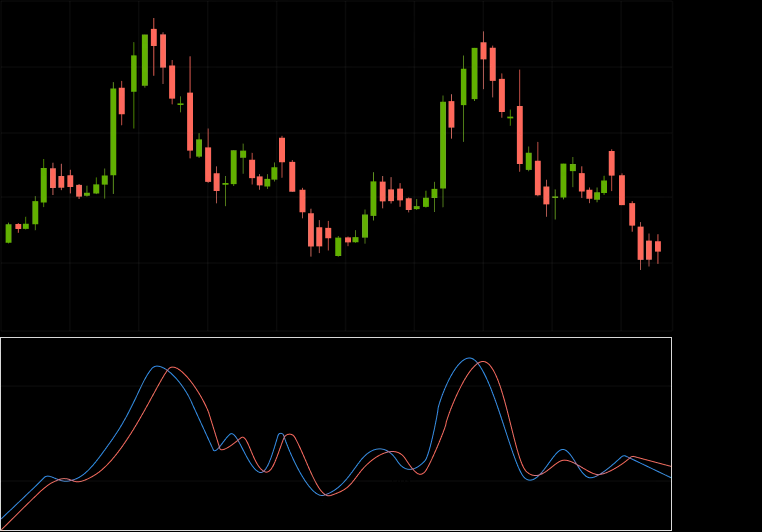

- Moving Averages

Crossovers of moving averages can indicate potential trend reversals, while the MACD (Moving Average Convergence Divergence) helps spot new trading opportunities.

Here’s a polished rephrasing of your text:

Moving Averages

Scalping can also be done without indicators. Some traders prefer using price action, analyzing candlestick patterns that often provide clues about imminent price movements.

Advantages of Forex Scalping

Forex scalping offers several benefits that attract active traders:

- Quick Profits: Scalpers can capture rapid gains without holding positions overnight.

- Limited Exposure: Short trade durations reduce the risk of unexpected market events.

- High-Frequency Opportunities: Frequent trades allow multiple small profits throughout the day.

- Ideal for Active Traders: This strategy suits traders who thrive in fast-paced markets.

- Compounding Small Gains: Many small, consistent profits can accumulate into substantial returns over time.

Challenges & Risks of Forex Scalping

Scalping also comes with unique challenges and risks:

- High Stress: The rapid pace can be mentally and physically taxing.

- Transaction Costs: Frequent trades incur spreads and commissions that can eat into profits.

- Speed Reliance: Success depends on fast decision-making and execution; slow platforms or connections can cause missed opportunities.

- Leverage Risk: While leverage can amplify gains, it also increases potential losses.

- Market Noise: Short-term price movements can be unpredictable and influenced by random fluctuations, making outcomes harder to forecast.

Forex Scalping Tips for Beginners

- Choose a Reliable Broker: Look for tight spreads, low commissions, and fast execution.

- Start Small: Practice with a demo account or small positions to refine your strategy.

- Focus on Liquid Pairs: Stick to popular currency pairs for better liquidity and lower costs.

- Set Realistic Goals: Target small, consistent gains instead of chasing large profits.

- Maintain Focus: Scalping requires full attention; minimize distractions.

- Optimize Your Setup: Use high-speed internet and multiple monitors to monitor the market efficiently.

- Review Performance: Regularly analyze trades to identify strengths and areas for improvement.

Conclusion

Forex scalping is a dynamic and demanding strategy that can yield quick profits by taking advantage of small price movements. It requires technical skill, discipline, and the right tools, but carries inherent risks. Traders should approach it cautiously, understanding their risk tolerance and market conditions.

With a structured plan and focus on consistent execution, scalpers can determine if this approach aligns with their trading goals.

If you want, I can also condense this into a shorter, punchy version ideal for an article or blog post without losing key points. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: