Table of Contents

- What is a Forex Chart?

- Types of Forex Charts and How to Read Them

- Benefits of Using Forex Charts

- Conclusion

The first step in successful trading is understanding how to read Forex charts. These charts are essential tools for traders of all experience levels. Patterns within Forex charts provide valuable insights into market behavior and price movements. By learning to recognize and interpret these patterns, traders can gain a significant advantage when applying pre-planned trading strategies. Forex charts help traders make informed decisions before executing trades. In this article, we’ll explore Forex charts, the different types, and how to read them effectively.

What is a Forex Chart?

A Forex chart visually represents price movements in the foreign exchange market over time. These charts track changes in currency prices, allowing traders to identify trends, potential reversals, and continuation patterns.

By connecting key price points such as highs, lows, and consolidation levels, Forex charts form visual patterns. Over time, these patterns often repeat, providing traders with insights into potential trading opportunities and helping them make data-driven decisions.

Types of Forex Charts and How to Read Them

There are several types of Forex charts, but the most commonly used include:

1. Line Charts

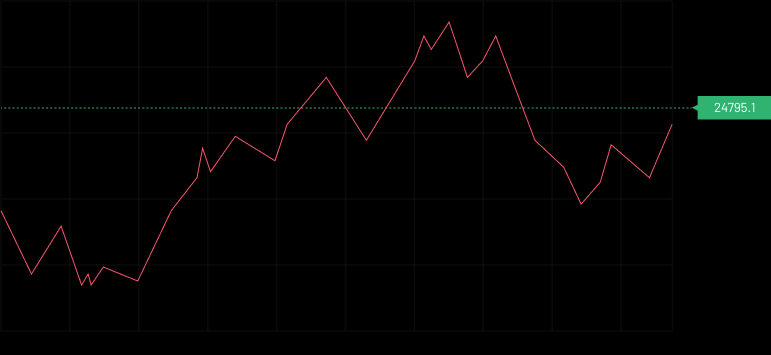

Line charts are the simplest type of Forex chart. They connect selected price points with a continuous line, typically using opening or closing prices. The line moves from left to right, illustrating the highs and lows of price movements.

While line charts may not provide as much detailed information as other chart types, they are useful for visualizing historical price trends and identifying basic patterns in the market.

If you want, I can continue rephrasing the sections on Candlestick Charts, Bar Charts, their advantages, and conclusion in the same clear and polished style. Do you want me to do that?

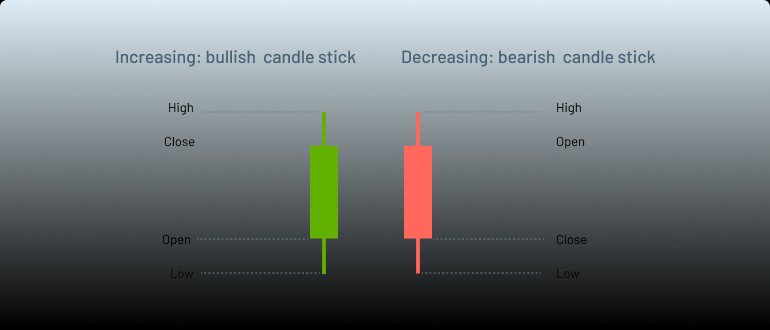

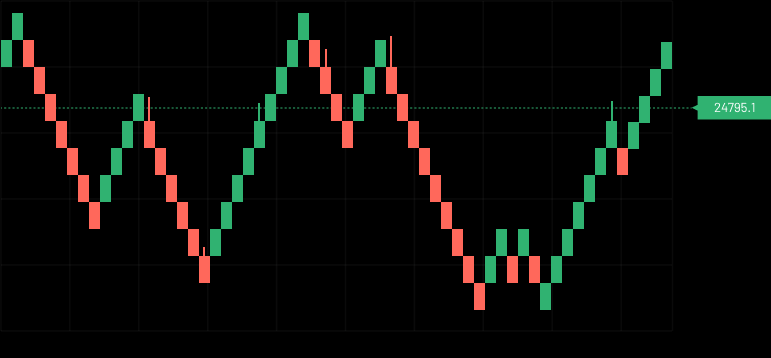

Candlestick Charts

Japanese candlestick charts were developed by Munehisa Honma at the Dojima Rice Exchange and have become one of the most widely used tools in technical analysis today. Traders around the world rely on candlestick charts to deepen their understanding of Forex price movements.

Candlestick charts provide the same key information as bar charts, including the trading range and market sentiment—whether bullish or bearish—by tracking the high, low, opening, and closing prices for a specific period.

What sets candlestick charts apart is their ability to illustrate where most trading activity has occurred during that period through the “body” of each candle. Many Forex trading strategies focus on the patterns, wicks, and bodies of these candlesticks, making them invaluable for spotting trends, reversals, and potential trading opportunities.

If you want, I can also rephrase the sections for Bar Charts, Advantages of Forex Charts, and Conclusion in the same style so your article flows smoothly. Do you want me to do that?

A green candlestick typically indicates that the currency pair’s price rose during the selected time period, closing higher than it opened. Conversely, a red candlestick signals that the price fell, closing below its opening value. Each candlestick also reflects four key price points for the currency pair, which are defined as follows:

- Open: The price at the beginning of the time period.

- Close: The price at the end of the time period.

- High: The highest price reached during the period.

- Low: The lowest price traded during the period.

If you want, I can also rephrase this section into a more trader-friendly, easy-to-read format with examples for better clarity. Do you want me to do that?

What Are Dojis?

A doji, often represented as a small cross or plus sign, forms when a currency pair’s opening and closing prices are equal or nearly equal. This pattern indicates that neither buyers nor sellers have gained sufficient control over price movement, reflecting market indecision. On its own, a doji is considered neutral and carries limited significance. However, when it appears within an existing uptrend or downtrend, it can signal a potential trend reversal.

I can also create an even simpler, beginner-friendly version if you want it for a guide. Do you want me to do that?

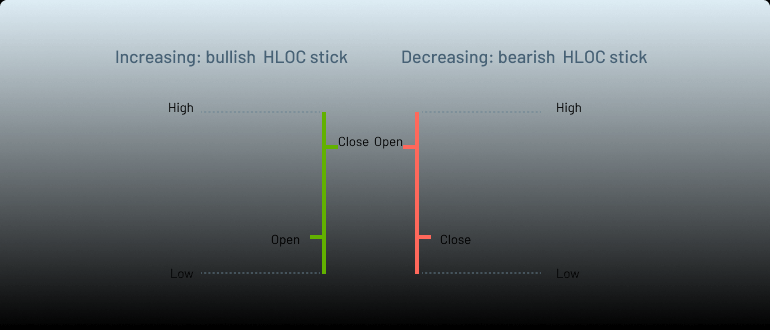

Bar Charts

A bar chart is a type of forex chart that illustrates the price activity of a currency pair over a specific period. Unlike line charts, bar charts provide more detailed information about price movements, which is why they are often called OHLC charts, representing Open, High, Low, and Close prices. For example, on a five-minute chart, each bar shows the opening and closing prices for that five-minute interval, as well as the highest and lowest prices reached.

Bar charts are widely favored by forex traders because they not only help identify market direction but also allow for a detailed analysis of price fluctuations. For traders who need more insight than a line chart offers, the OHLC bar chart is an excellent starting point.

In essence, bar charts present the same information as candlestick charts but in a different visual format. Each bar represents:

- The left tick: the opening price

- The right tick: the closing price

- The top of the vertical line: the highest price

- The bottom of the vertical line: the lowest price

The color of the bar reflects price movement during the period: red indicates the closing price is lower than the opening price, while green indicates the price has risen.

If you want, I can also create a more concise, beginner-friendly version of this for quick guides. Do you want me to do that?

Heikin Ashi

The Heikin Ashi chart is a variation of the candlestick chart designed to provide a clearer view of market trends. The term “Heikin Ashi,” meaning “average bar” in Japanese, reflects its method of using average price data to create a smoother, more consistent trend line. By reducing the noise and fluctuations common in standard candlestick charts, Heikin Ashi charts make it easier to identify the overall market direction.

Heikin Ashi charts are particularly useful in trending markets, helping traders follow the trend and make more informed decisions about entry and exit points. While they resemble traditional candlesticks, they differ in that the bars are based on averaged prices rather than actual open and close prices. The open price is derived from the midpoint of the previous bar, and the close price is calculated from the average price of the current bar.

This averaging produces smoother transitions between bars, making it easier to spot long-term trends. However, since the bars do not reflect actual open and close prices, many traders use Heikin Ashi charts alongside standard candlestick charts for confirmation.

If you want, I can also make a short, beginner-friendly version of this that explains Heikin Ashi in just a few sentences. Do you want me to do that?

Renko

Renko charts differ from most forex charts, which are based on price and fixed time intervals, by focusing solely on price movement. The term “Renko” comes from the Japanese word renga, meaning “brick,” which reflects how price changes are represented as brick-like blocks. A new “brick” only forms when the price moves by a specified amount, regardless of time.

By filtering out minor fluctuations, Renko charts highlight pure price movements with minimal noise. Traders often use them to identify key support and resistance levels and to spot clear trends, ignoring smaller price swings that might obscure the overall market direction.

If you want, I can also make a more concise, beginner-friendly version suitable for quick learning. Do you want me to do that?

Advantages of Forex Charts

It is essential for traders to understand the different types of forex charts, as they offer several key benefits:

- Visual Representation: Charts provide a clear visual depiction of price movements, making it easier to identify trends and patterns.

- Entry and Exit Points: Forex charts help traders pinpoint optimal entry and exit levels for trades.

- Historical Data: They allow analysis of past price movements, offering insights into potential future swings over various timeframes.

- Market Sentiment: Chart patterns reflect trader psychology and market mood, often revealed through sharp price movements.

- Support for Fundamental Analysis: When combined with fundamental analysis, charts can help confirm trade entry and exit decisions.

Conclusion

Charts are an essential tool in forex technical analysis, helping traders understand both historical and current price dynamics. Mastering how to read various types of charts—such as line, bar, candlestick, Heikin Ashi, and Renko—is crucial for successful trading.

Each chart type provides a different level of detail: line charts reveal basic trends, while candlestick and Heikin Ashi charts offer deeper insights into price action. Traders should align their strategy with the chart type they use, as different charts are better suited for specific approaches, whether it’s long-term trend analysis or short-term intraday scalping.

If you want, I can also condense this into a shorter, more reader-friendly version for beginners. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: