When trading in the forex market, it’s essential to understand key concepts such as reading currency pairs and interpreting chart patterns.

A currency pair shows the exchange rate between two currencies, indicating how much of the second currency is needed to purchase one unit of the first currency.

To start trading effectively, you need to know how to read the price charts of currency pairs.

What is a forex chart?

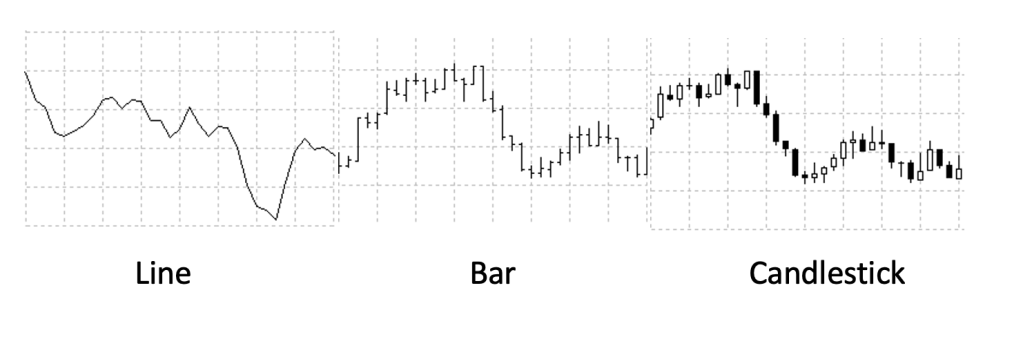

A forex chart visually represents the exchange rate of a currency pair over time. Each point on the chart reflects price movements during a specific period and helps traders identify trends and patterns. On Deriv MT5, you can view forex charts in three formats: candlestick charts, bar charts, and line charts.

If you want, I can also make a slightly more beginner-friendly version that’s easier to digest for new traders. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

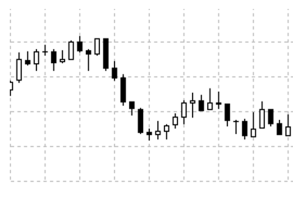

What is a candlestick chart?

A candlestick chart uses candlesticks to visually represent price movements in financial markets, showing the opening, closing, high, and low prices over a specific time period.

Each candlestick has three main components:

- Body: Displays the range between the opening and closing prices.

- Wicks or Shadows: Indicate the highest and lowest prices reached during the time frame.

- Colour: Shows market sentiment — bullish candles (closing price higher than opening price, often green or white) or bearish candles (opening price higher than closing price, often red or black).

Candlestick charts are widely used in forex trading because they offer more detail than line or bar charts, providing deeper insight into price movements and enabling more advanced trend analysis.

I can also create an even simpler, beginner-friendly version with examples of bullish and bearish candles if you want. Do you want me to do that?

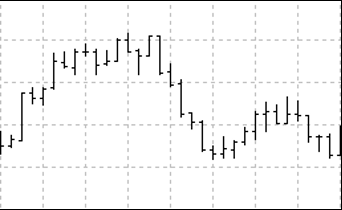

What is a bar chart?

A bar chart, also called a HLOC (high, low, open, close) chart, uses vertical bars to display trading activity over a specific time period. Unlike candlestick charts, bar charts do not have filled bodies, making them useful for traders who focus primarily on price movements.

Each bar has distinct elements:

- Top of the bar: Shows the highest price reached, representing the peak traders were willing to pay.

- Bottom of the bar: Shows the lowest price reached, indicating the lowest price traders were willing to accept.

- Left horizontal line: Marks the opening price, or where trading began during the period.

- Right horizontal line: Marks the closing price, or where trading ended during the period.

- Colour of the bar: Reflects price movement — green or white for an upward move (closing price higher than opening price) and red or black for a downward move (opening price higher than closing price).

Bar charts are often simpler than candlestick charts, with less visual clutter, making them a good choice for beginners and for straightforward trend analysis.

If you want, I can also condense this further into a short, easy-to-digest version for quick reading. Do you want me to do that?

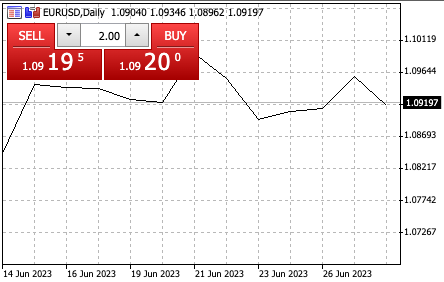

What is a line chart?

A line chart plots the closing prices of a forex pair over a selected time period, connecting them with a continuous line. By focusing solely on closing prices, it filters out intraday fluctuations like opening, high, and low prices. This makes line charts especially useful for spotting medium- to long-term trends and patterns.

A variation of the line chart is the mountain (or area) chart, which is similar but fills the area beneath the line with color. This shading emphasizes the overall trend rather than individual price points.

If you want, I can also combine the candlestick, bar, and line charts into one concise comparison guide for easy reference. Do you want me to do that?

Line charts provide the simplest way to track price movements over time. They are useful for spotting overall trends, filtering out market noise, and integrating tools like volume data or moving averages. They can also complement candlestick and bar charts for a more comprehensive analysis.

Conclusion

Once you’ve learned how to read forex charts, the next step is to explore technical indicators, fundamental analysis, and risk management strategies. These tools help in identifying trends, support and resistance levels, and various chart and candlestick patterns. Beginner traders can start by practising on a demo account to refine their analysis without risking real money. Open a risk-free demo account with Deriv today and explore the different chart types firsthand.

If you want, I can also rework the whole “How to read forex charts” section into a smoother, more concise guide that flows from chart types to trading practice. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: