Forex pairs consist of two different currencies, and trading them involves a simultaneous transaction of buying one currency while selling the other.

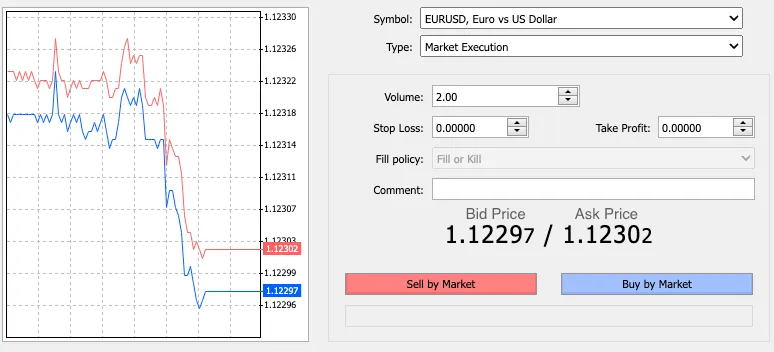

How to read forex quotes

A currency pair is made up of a base currency (the first) and a quote currency (the second). The exchange rate indicates how much of the quote currency is required to purchase one unit of the base currency.

For example, if the EUR/USD pair is trading at 1.12302, it means 1.12302 USD is needed to buy 1 EUR.

On platforms like Deriv MT5, CFD brokers typically display two prices for each currency pair: the bid price (for selling) and the ask price (for buying). The difference between these two prices is known as the spread, which essentially represents the transaction cost for opening or closing a trade.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Classification of Currency Pairs

Currency pairs are grouped according to their trading volume and the economic significance of the currencies involved.

Major currency pairs include the most widely traded currencies globally. These pairs typically offer higher liquidity and tighter spreads due to their popularity among traders. Below is a list of the major pairs available for CFD trading on Deriv.

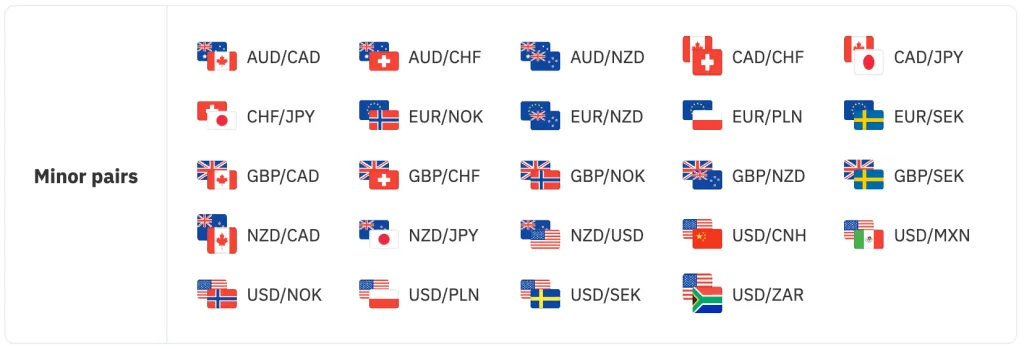

Minor Currency Pairs

Also called “crosses,” minor currency pairs feature major currencies in either the base or quote position but typically exclude the US dollar. Compared to major pairs, minors generally have slightly wider spreads and lower liquidity. Below is a list of minor pairs available for CFD trading on Deriv.

Exotic Currency Pairs

Exotic pairs combine a major currency with the currency of a smaller or emerging-market economy. These pairs tend to have lower liquidity and wider spreads compared to major and minor pairs. Below is a list of exotic pairs available for CFD trading on Deriv.

Grasping the fundamentals of currency pairs is essential for successful forex trading. By understanding the variations in liquidity and spreads among major, minor, and exotic pairs, traders can make more informed decisions and improve their chances of profitable trades.

You can gain hands-on experience with these spreads by trading risk-free using a demo account, preloaded with virtual funds.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: