The Rise of Central Bank Digital Currencies and Their Impact on Forex Trading

The global financial landscape is undergoing a profound transformation, driven largely by the rapid adoption and exploration of Central Bank Digital Currencies (CBDCs). Retail Forex traders must navigate this evolving terrain, seeking a thorough understanding of these digital currencies, their implications, and the potential impact on trading strategies and market dynamics.

Table of Contents

- Understanding Central Bank Digital Currencies

- Retail vs. Wholesale CBDCs: Key Differences

- The Driving Forces Behind Global CBDC Development

- Leading CBDC Initiatives Around the World

- Implications for the Forex Market: Opportunities and Challenges

- Risks and Challenges of CBDCs

- The Decline of Traditional Fiat Currencies

- The Future of Forex Trading in a CBDC Era

- Effects on Commercial Banks

- Regulatory and Implementation Challenges

- Conclusion: Preparing for the Future of Forex Trading

Understanding Central Bank Digital Currencies

To grasp the evolving financial landscape, traders and investors need to answer a fundamental question: What is a Central Bank Digital Currency?

A CBDC is the digital form of a nation’s sovereign currency, issued and regulated directly by its central bank. Unlike decentralized cryptocurrencies, which operate on distributed ledgers without central authority, CBDCs are fully centralized and backed by the government’s credit.

CBDCs are designed to coexist with traditional fiat currency, providing a faster, more secure, and efficient digital alternative for transactions. Beyond convenience, they modernize payment systems, enhance financial inclusion, and give central banks new tools to implement monetary policy.

The digital nature of CBDCs also allows for programmability. Features like smart contracts and automated transactions could transform financial trading by increasing speed and efficiency. For instance, forex trades could be executed automatically based on predefined market conditions, reducing the need for manual intervention and enabling complex transactions like real-time settlements and automated margin calls.

Retail vs. Wholesale CBDCs

CBDCs are generally categorized into retail and wholesale architectures, each serving distinct purposes:

| Aspect | Retail CBDCs | Wholesale CBDCs |

|---|---|---|

| Target Audience | Individuals and businesses | Financial institutions |

| Primary Use Case | Everyday transactions (e.g., paying bills, buying goods) | Interbank transfers and large-scale financial payments |

| Examples | Bahamas’ Sand Dollar | Canada’s wholesale CBDC tests |

Retail CBDCs aim to simplify everyday transactions and improve financial inclusion, particularly for the unbanked. By providing broad access to digital currency, retail CBDCs foster greater economic participation.

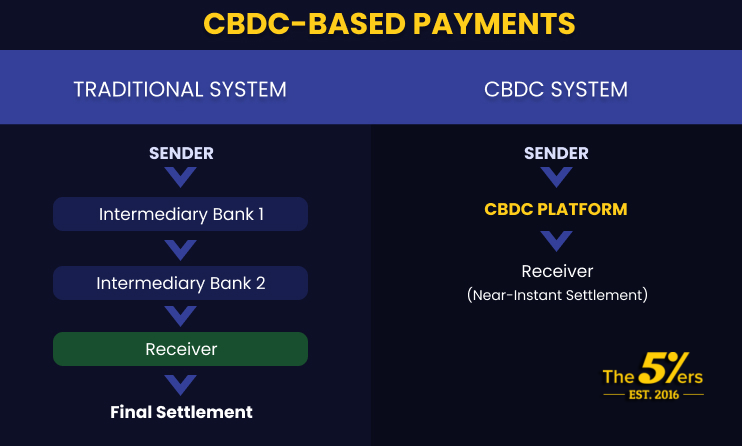

Wholesale CBDCs focus on high-value interbank transactions. They streamline settlement processes, reduce reliance on intermediaries, and accelerate payment efficiency. Understanding these distinctions is crucial for evaluating their impact on market liquidity, transaction speed, and trading strategies.

Drivers of Global CBDC Development

Central banks are pursuing CBDCs for multiple reasons:

- Financial Inclusion: Expanding access to banking in underbanked regions.

- Decline of Physical Cash: Providing a digital alternative to maintain monetary control.

- Cross-Border Payments: Making international transfers faster, cheaper, and more transparent.

- Competition with Private Cryptocurrencies: Offering a regulated, stable digital alternative backed by central banks.

Leading CBDC Initiatives

Several countries are pioneering CBDC development, providing insights into the potential impact on global finance:

- China’s Digital Yuan (e-CNY): Tested extensively in cities and showcased during the 2022 Winter Olympics, highlighting its potential in domestic and international trade.

- Bahamas’ Sand Dollar: The first national CBDC, designed to improve financial inclusion.

- Nigeria’s eNaira: Facilitates easier transfers and reduces cash dependency.

- European Digital Euro: Aims to streamline transactions across the EU and strengthen financial infrastructure.

- United States: The Federal Reserve is exploring CBDCs to modernize payments and maintain global competitiveness.

Globally, 134 countries, representing 98% of the world’s economy, are actively researching or developing CBDCs, underscoring their growing importance.

Impact on the Forex Market

CBDCs are poised to reshape the Forex market, offering both opportunities and challenges:

- Efficiency and Transparency: Streamlined compliance, reduced transaction fees, and more transparent markets.

- Liquidity and Volatility: Central banks could influence liquidity and exchange rate stability depending on adoption rates and regulations.

- Cross-Border Transactions: Interoperable CBDCs can make international settlements faster, cheaper, and more transparent, as demonstrated by projects like mBridge.

- New Trading Instruments: The rise of digital currency derivatives and structured products requires traders to adapt and learn new instruments and risks.

- Geopolitical Implications: CBDCs may shift global currency dynamics, impact trade, and challenge the dominance of traditional reserve currencies like the US dollar, creating both risks and opportunities for traders.

CBDCs are not just a technological innovation—they are a strategic shift in global finance. For Forex traders, staying informed about developments, understanding the nuances of retail and wholesale CBDCs, and adapting strategies to leverage these changes will be critical for success in a rapidly evolving market.

If you want, I can also rework the rest of your sections into a smooth, concise, and professional guide, making it suitable for publication or a trading-focused report. This would include the risks, bank impacts, regulatory issues, and future trends.

Do you want me to do that?

Navigating the Complexities: Risks and Challenges of CBDCs

While Central Bank Digital Currencies (CBDCs) promise numerous benefits, they also introduce a range of complex risks and challenges that require careful consideration.

Privacy concerns are among the most significant. The potential for government surveillance and misuse of user data raises questions about confidentiality and personal financial security. Cybersecurity risks are equally critical; system breaches, data theft, and cyberattacks could threaten the stability and integrity of CBDC systems.

Widespread adoption of CBDCs may also reduce demand for traditional fiat currencies, disrupting conventional banking systems. This could lead to disintermediation, higher borrowing costs, and changes in liquidity. Additionally, implementing CBDCs presents regulatory and technical challenges, including the need for global coordination, interoperability standards, and substantial infrastructure costs. Addressing these challenges is essential for smooth integration within the international financial system. These issues directly affect commercial banks, whose roles will be further examined below.

The Decline of Non-CBDC Fiat Currencies

As CBDCs gain traction, traditional fiat currencies could face declining demand:

- Global Competition: Countries with widely accepted, technologically advanced CBDCs may see higher demand for their digital currencies. Conversely, nations without CBDCs could experience reduced demand for their fiat. For example, a globally adopted digital yuan could challenge the US dollar’s dominance in international trade and forex markets.

- Pressure on Smaller Economies: Smaller nations may struggle to compete with larger economies’ CBDCs, potentially reducing their influence in the forex market.

These shifts could affect trader confidence. Privacy and cybersecurity concerns may deter the use of CBDCs, while declining fiat demand introduces uncertainty. Forex traders will need to carefully monitor the stability and value of currencies in countries slower to adopt digital alternatives.

The Future of Forex Trading in a CBDC-Driven World

The Forex market is approaching a transformative phase, fueled by the rise of CBDCs. These digital currencies may become central to trading, depending on technological infrastructure, regulatory frameworks, and public trust. Forex brokers must adapt by:

- Integrating CBDCs into trading platforms

- Enhancing cybersecurity measures

- Leveraging blockchain and AI technologies to optimize trading strategies, risk management, and client services

Impact on Commercial Banks

CBDCs could significantly reshape commercial banking:

- Disintermediation: Banks may lose deposits as individuals and businesses prefer holding CBDCs. Reduced deposits could limit lending, impacting liquidity in the forex market.

- Higher Borrowing Costs: With fewer deposits, banks may raise loan interest rates, potentially slowing economic growth and affecting currency values. Such disruptions introduce uncertainty into forex trading, requiring traders to assess changes in currency stability and liquidity.

Opportunities vs. Challenges in CBDC Forex Trading:

| Opportunities | Challenges |

|---|---|

| Lower transaction costs for currency trades | Adapting to evolving market dynamics |

| Enhanced efficiency in cross-border transactions | Regulatory uncertainties |

| Introduction of new instruments like digital currency derivatives | Reduced arbitrage opportunities |

Regulatory and Implementation Challenges

Effective CBDC adoption requires robust regulatory frameworks, yet several challenges persist:

- Global Coordination: Cross-border interoperability is essential to ensure smooth international transactions. A lack of coordination could fragment markets and increase trading costs.

- High Implementation Costs: Establishing and maintaining CBDC infrastructure is expensive, especially for smaller economies. High costs may slow adoption and create uneven global diffusion.

Forex traders should monitor how governments tackle regulatory and technical challenges, as these will shape the future of global currency markets.

Closing Thoughts: Embracing the Future of Forex Trading

A CBDC-driven financial ecosystem represents a fundamental restructuring of global monetary dynamics. Forex traders must move beyond passive observation, actively anticipating regulatory changes and technological advancements before they disrupt market equilibria.

Success requires understanding the interplay between CBDC adoption and market variables such as currency valuations, liquidity, and volatility. Traders can leverage these insights for strategic arbitrage and profitable trades.

By augmenting traditional analytical tools—like economic calendars—with real-time CBDC adoption data, traders can anticipate market shifts and identify emerging trends. In this transformative era, proactive innovation is key. Those who harness the efficiencies of CBDC-driven markets will not merely survive—they will help define the future of digital finance.

If you want, I can also condense the entire CBDC Forex guide into a streamlined, professional version under 2,500 words that’s ready for publication or distribution. This would retain all key points but make it far more concise and reader-friendly.

Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: