As a retail Forex trader, you’ve likely heard of Decentralized Finance (DeFi). But do you know exactly how DeFi is reshaping the Forex markets? DeFi platforms enable peer-to-peer currency exchanges with minimal reliance on banks and brokers, potentially reducing transaction costs and increasing market accessibility. For retail traders, this can translate into greater transparency and efficiency in trading.

Benefits of Blockchain Technology in Forex

Blockchain technology underpins DeFi by recording transactions in a secure, tamper-proof ledger, enhancing trust and reducing the risk of disputes or fraud. Smart contracts automate and secure trading processes, minimizing human error and further lowering costs.

Challenges of DeFi in Forex

However, the rise of DeFi also brings challenges, including heightened market volatility and regulatory uncertainty. Traditional financial institutions may need to adapt by integrating DeFi features to stay relevant. While DeFi has the potential to make financial markets more inclusive and efficient, its associated risks and evolving regulations require careful navigation.

Table of Contents

- What is Decentralized Finance (DeFi)?

- Overview of Decentralized Finance

- Key Components of DeFi

- Comparative Analysis: DeFi vs. Traditional Finance

- Traditional Finance Under Pressure

- DeFi’s Impact on Forex Trading

- Challenges Facing DeFi Adoption

- Future Outlook of DeFi

- Final Reflections on DeFi’s Revolutionary Impact on Forex Markets

What is Decentralized Finance (DeFi)?

If you’re wondering what DeFi actually is, it’s a decentralized financial system that connects users directly via blockchain, bypassing traditional banks and agents. DeFi represents a significant shift in today’s financial landscape, offering low-cost financial services on a global scale. Traders and financial professionals are encouraged to embrace this smarter, technology-driven financial environment and explore the opportunities it presents.

Overview of Decentralized Finance

DeFi is an advanced financial technology benefiting both institutions and individuals. At its core, DeFi leverages blockchain to offer decentralized trading systems that provide clear advantages over traditional finance.

Blockchain Technology

Blockchain acts as a digital ledger and the backbone of DeFi platforms. It ensures secure, transparent, and traceable transactions without intermediaries. For retail Forex traders, this decentralization enables direct market participation, lower costs, and faster settlement times, challenging the dominance of traditional trading platforms.

Smart Contracts

Smart contracts, powered by blockchain, automate trading strategies. They execute trades or hedge positions automatically when predefined conditions are met, enhancing precision and reducing the need for constant monitoring.

Tokenization

Tokenization in DeFi allows traders to access digitized versions of fiat currencies. This enables seamless currency exchanges on decentralized platforms, eliminating the need for traditional brokers and allowing traders to execute transactions directly.

Key Components of DeFi

Decentralized Finance (DeFi) provides financial services designed to meet the needs of retail Forex traders. It streamlines traditional financial functions such as lending, borrowing, decentralized exchanges, and yield farming. By operating without intermediaries, DeFi enhances transparency and efficiency—critical factors for traders seeking to optimize returns.

Lending and Borrowing

Retail Forex traders can leverage platforms like Compound to lend their assets for interest or borrow against cryptocurrency collateral. Smart contracts ensure these transactions are secure and trustless. This is especially beneficial for international traders, as it eliminates the need for conventional credit assessments.

Decentralized Exchanges (DEXs)

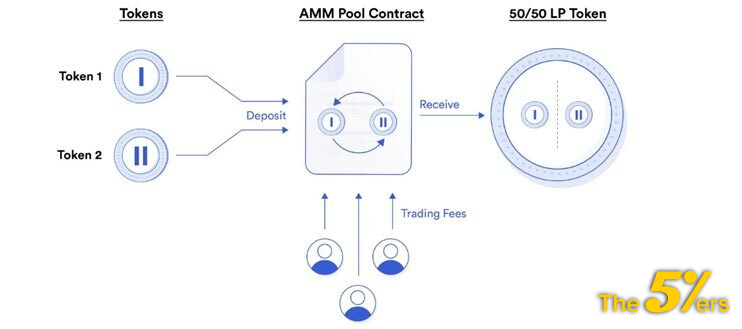

DEX platforms, such as Uniswap, enable peer-to-peer cryptocurrency trading without intermediary involvement. These exchanges use the Automated Market Maker (AMM) model, which relies on user-supplied liquidity pools to facilitate market-making. This approach makes DEXs more accessible, transparent, and secure compared to traditional exchanges.

Yield Farming

Yield farming, also known as liquidity mining, is a key innovation in DeFi. Users provide liquidity to protocols in exchange for rewards, often in the form of tokens. This mechanism not only incentivizes participation but also drives ecosystem growth by encouraging liquidity sharing, making it a major factor in DeFi adoption.

Ethereum’s Role in the DeFi Ecosystem

Ethereum, powered by smart contracts, serves as the backbone of the Decentralized Finance (DeFi) ecosystem. Its decentralized architecture and extensive developer community make it the foundation for most DeFi projects. Ethereum supports a wide range of applications, from lending and borrowing to decentralized exchange (DEX) platforms, enabling complex financial transactions. As such, Ethereum plays a critical role in driving DeFi innovation and scalability.

Comparative Analysis: Decentralized Finance (DeFi) vs. Traditional Finance

DeFi has the potential to transform the financial technology landscape by addressing several long-standing limitations of centralized finance, including high costs, limited transparency, and restricted financial inclusivity.

Transparency and Accessibility

DeFi provides unprecedented global access to financial services. Unlike traditional banks, which often impose stringent requirements and exclude segments of the population, DeFi platforms operate on public blockchains accessible to anyone with an internet connection and a digital wallet. Transactions are recorded on secure, immutable ledgers, allowing users to verify activities independently without intermediaries.

Cost and Efficiency

For retail Forex traders, DeFi can significantly reduce costs by eliminating intermediaries such as brokers and banks, allowing direct and cost-effective trading. Additionally, DeFi platforms benefit from shorter settlement times due to smart contracts, which execute automatically when predefined conditions are met. Whereas traditional loans or trades might take days to process, similar transactions on DeFi platforms can be completed in minutes. The combination of lower fees and faster settlements makes DeFi an attractive and efficient alternative, simplifying financial operations for users.

Risks and Security

Despite its advantages, DeFi carries unique risks, including vulnerabilities in smart contracts that can directly impact trades. Traders must carefully evaluate the security of the platforms they use, as coding bugs or exploits can result in significant financial losses—similar to risks in traditional Forex trading. While traditional finance benefits from regulatory oversight and greater stability, DeFi pushes the boundaries in innovation, accessibility, and operational efficiency, offering a complementary but risk-aware alternative.

Traditional Finance Under Pressure

Banks and brokers are facing growing challenges as DeFi reshapes the financial landscape. To remain relevant, traditional institutions are exploring blockchain integration, forming partnerships with DeFi platforms, and diversifying their services despite operational hurdles.

Adoption of Blockchain and DeFi Partnerships

Leading financial institutions are leveraging blockchain to enhance transparency and operational efficiency. For instance, Goldman Sachs has adopted blockchain technology to manage transactions and digital assets, while JPMorgan’s Onyx platform enables near-instant settlements via blockchain. Collaborative initiatives are also underway, such as top banks working with fintech firms like R3 to develop trade finance solutions on the Corda blockchain.

Banks are also launching tokenized products and lending services to compete with decentralized platforms. BNY Mellon, for example, has invested in fintech companies like Fireblocks to ensure secure digital asset custody. Additionally, FX markets are increasingly integrating blockchain to streamline cross-border payments, making them faster and more cost-effective.

Regulatory Challenges and Compliance

Despite blockchain adoption, regulatory uncertainties remain a significant obstacle. The decentralized nature of blockchain often conflicts with traditional compliance frameworks, creating friction between innovation and regulation. Financial institutions face ongoing challenges related to anti-money laundering (AML), data privacy, and cross-border compliance. Consequently, banks are cautiously balancing innovation with strict adherence to regulatory standards.

DeFi’s Impact on Forex Trading

Cost and Efficiency

DeFi offers retail Forex traders a way to reduce costs by removing intermediaries such as brokers and banks. Trades can be executed more directly, with lower fees and faster settlement times. However, these benefits come with new risks, including smart contract vulnerabilities and market volatility.

Accessibility

Unlike traditional Forex markets, which operate during specific hours, DeFi platforms are available 24/7, allowing traders to react to market changes in real-time. Platforms like Uniswap enable direct wallet-to-wallet trading, removing the need for intermediaries and reducing transaction costs.

Liquidity Pools

Liquidity pools provide stable trading conditions with minimal slippage and allow trading of both fiat and cryptocurrency pairs. This increases efficiency, reduces costs, and makes trading accessible for novice traders. Participants can also earn rewards by contributing to liquidity pools, promoting community engagement and inclusivity in Forex trading.

Reduced Intermediaries

DeFi platforms facilitate peer-to-peer transactions, eliminating brokers and middlemen. This not only speeds up trades but also reduces costs. Decentralized exchanges such as SushiSwap exemplify this model, enabling users to trade currencies directly with each other.

Risks of DeFi

While DeFi introduces opportunities, it also carries risks. Smart contract vulnerabilities can lead to hacks and financial losses, cryptocurrency price volatility can disrupt liquidity pools, and the lack of regulation means there is no formal protection for investors.

Challenges Facing DeFi Adoption

Regulatory Hurdles

Regulators are concerned that DeFi could be exploited for financial crimes such as money laundering and fraud. The decentralized nature of transactions complicates AML and know-your-customer compliance. Reports, including those from the U.S. Department of the Treasury, highlight DeFi vulnerabilities that could enable illicit activity. International regulatory initiatives, such as those in Australia, further underscore the need for robust compliance mechanisms that balance innovation with legal oversight.

Cybersecurity Issues

Smart contract exploits, such as the $2 million Unizen protocol hack, illustrate the potential financial and reputational damage DeFi platforms face. Blockchain transactions are immutable, making recovery from exploits extremely difficult. Platforms must prioritize security audits and continuous improvements to protect users and their assets.

Volatility and Scalability

DeFi tokens’ price volatility can discourage investors and create instability on platforms. Maintaining sufficient liquidity is challenging, leading to slippage and higher transaction costs. Scalability is also a concern, as network congestion from increased users can slow transactions and raise fees. Solutions such as Layer-2 scaling and stable liquidity mechanisms are essential to address these challenges.

If you want, I can also condense this into a concise, easy-to-read version for a blog or report while keeping all the key insights. Do you want me to do that?

Future Outlook of Decentralized Finance (DeFi)

DeFi’s innovative technology, growing adoption, and potential for long-term development position it as a transformative force in the financial industry.

Integration with Traditional Finance

The relationship between DeFi and traditional finance is shifting from competition toward collaboration. Financial institutions are increasingly recognizing the benefits of integrating DeFi solutions into their operations. This has led to the emergence of hybrid financial models that aim to combine the efficiency and accessibility of DeFi with the security and regulatory compliance of conventional systems.

Technological Advancements

Advances in AI and blockchain are helping to address some of DeFi’s current challenges. AI enhances transaction security, detects fraud, optimizes transaction flows, and predicts network congestion. Meanwhile, Layer-2 solutions, such as Ethereum rollups, improve scalability by enabling faster, low-cost transactions. Cross-chain interoperability also allows different DeFi platforms to connect with each other and traditional financial systems, increasing accessibility and overall usability.

Final Reflections on DeFi’s Impact on Forex Markets

For retail forex traders, DeFi represents a revolutionary shift, offering faster, more cost-effective, and convenient trading options while giving individuals greater control over their financial activities. It fosters innovation for traders and developers, reduces reliance on intermediaries, and extends financial services to regions with limited access to traditional banking. As awareness of DeFi’s potential grows, traditional financial institutions are increasingly exploring hybrid models that combine the strengths of both DeFi and conventional finance.

However, while DeFi offers significant opportunities, traders and institutions must remain cautious. Security risks, regulatory uncertainties, and technological limitations continue to pose challenges that require careful navigation.

If you want, I can also combine all your DeFi sections into a single, cohesive, professional article suitable for publishing while keeping it readable and engaging. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: