AI in Forex Trading: Redefining the Future of Finance

Have you ever wondered what would happen if artificial intelligence stopped being a distant concept from sci-fi movies and became an essential tool in our daily work and industries? Imagine a world where AI drives decision-making, enhances productivity, and transforms how we trade and invest. In the realm of finance—particularly forex—this is no longer imagination; it’s reality.

AI is revolutionizing how currency traders analyze data, execute trades, and manage risk. While technical analysis and market intuition have long been core to trading success, algorithms powered by AI now process massive data streams in real time. They make lightning-fast, data-driven decisions that are reshaping the trading landscape. The question is no longer if AI will impact forex trading—it already has. The real challenge is understanding how it will continue to transform the market and what traders must do to stay ahead.

Table of Contents

- AI in Forex Trading – Changing the Game

- AI Implementations Transforming Forex Trading in 2025

- Opportunities for Traders in 2025

- Risks and Challenges of AI Integration

- Preparing for AI-Driven Transformation

- What is AI in Forex Trading?

- Real-World Case Studies

- Regulatory Implications

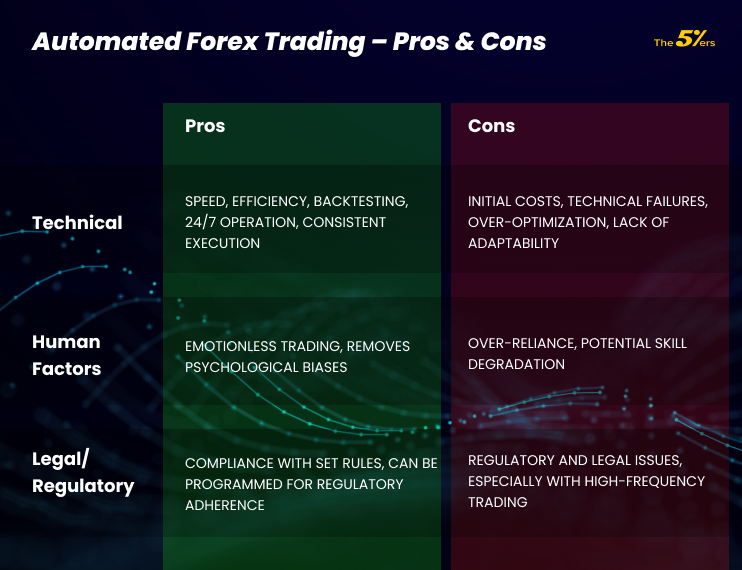

- Automated Forex Trading – Pros & Cons

- The Current and Future Impact of AI in Forex Trading

- Concluding Thoughts

AI in Forex Trading – Changing the Game

The integration of AI into forex trading is redefining the game entirely. It’s enhancing efficiency, boosting accuracy, and driving profitability like never before. While early AI-based systems were limited in scope, today’s advances in machine learning and big data have brought unprecedented sophistication.

Automated systems can now execute trades at lightning speed while eliminating emotional bias. AI-powered predictive analytics deliver deeper insights into market behavior, making precise forecasting of currency movements increasingly possible.

As AI continues to evolve through natural language processing and adaptive learning, its presence in forex becomes more powerful and accessible. By 2025, intelligent algorithms designed to optimize strategies, manage risk, and maximize profits will dominate the industry. Prop firms and traders leveraging these technologies will lead the next wave of market innovation—making mastery of AI-driven strategy a crucial edge for success.

Would you like me to make it slightly shorter and punchier (for a blog post intro) or keep it formal and detailed (for a whitepaper or guide)?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Risks and Challenges of AI Integration

While artificial intelligence (AI) has brought remarkable advancements to forex trading, it also introduces new risks and challenges that traders must carefully manage. One key concern is overreliance on AI systems—a dependency that can make traders vulnerable if they lose touch with their own analytical intuition. Blind trust in algorithms may cause traders to overlook crucial human judgment, leading to errors or misinterpretations during unpredictable market events.

Another major challenge lies in data quality and reliability. Since AI models depend heavily on data for training and execution, incomplete or inaccurate datasets can produce misleading forecasts, resulting in poor trading outcomes. Furthermore, the complex nature of AI systems makes them difficult to fully understand or interpret, often creating a “black box” problem where traders cannot easily explain how specific trading decisions are made.

Ethical and regulatory issues add another layer of complexity. Algorithmic bias within AI systems can lead to unfair advantages or distort market integrity. These risks underline the importance of responsible AI governance and regulatory oversight. New technologies must be implemented with transparency, fairness, and accountability in mind. For those new to the field, resources such as Trading Forex for Beginners emphasize understanding both the ethical and regulatory implications of AI integration to promote equitable trading environments.

Preparing for an AI-Driven Transformation

As the forex market becomes increasingly AI-driven, traders must evolve alongside it. The first step toward thriving in this new era is building a strong understanding of AI technology and how it reshapes market analysis and decision-making. Investing in modern AI-powered platforms that provide advanced analytics can significantly enhance trading performance. Participating in specialized training programs and workshops focused on AI trading is another effective way to stay competitive.

However, preparation goes beyond technology—it requires a foundation of high-quality data management. Since AI systems rely on accurate, organized, and relevant data, traders should prioritize effective data governance practices to improve system outcomes. Another challenge is human resistance to change, both personally and organizationally. Encouraging a culture of innovation and consulting with AI specialists can help traders and institutions adapt more smoothly to the evolving landscape.

What Is AI in Forex Trading?

Artificial intelligence in forex trading refers to the use of advanced algorithms to process vast amounts of market data, uncover patterns, and predict future currency movements. In essence, AI amplifies traditional analysis by delivering deeper insights at speeds that far surpass human capabilities.

At the heart of AI’s application in forex is machine learning—systems that learn from historical data, identify relationships, and adapt to changing market behavior. Instead of relying on static rules, AI continuously improves through experience, refining predictions and enhancing strategic decision-making. Beyond analytics, AI also enables automated trading, executing orders at lightning speed, managing risks in real time, and optimizing strategies with minimal human intervention. This combination of precision, speed, and automation minimizes emotional bias and boosts trading efficiency.

Real-World Case Studies

AI’s impact on forex trading is no longer theoretical—it’s visible in real results. For example, XTX Markets, founded by Alex Gerko, employs sophisticated machine learning models to analyze vast datasets and forecast price fluctuations across global financial markets. These systems handle trading volumes exceeding $250 billion per day, highlighting how AI enhances efficiency and market accuracy.

Similarly, the rise of AI-powered trading bots in both forex and cryptocurrency markets demonstrates the technology’s versatility. These bots analyze data in real time, adapt to changing market conditions, and execute trades with exceptional precision. Many traders report increased profitability thanks to these systems’ ability to detect subtle patterns and act without hesitation. Leading financial institutions are also deploying AI to assess market sentiment, predict currency shifts, and improve trade execution reliability.

Regulatory Implications

With the growing integration of AI in forex trading, regulatory oversight has become essential. Authorities worldwide are actively working to establish clear frameworks for AI use. For instance, in December 2024, the U.S. Commodity Futures Trading Commission (CFTC) issued an advisory mandating that all AI-based trading systems comply with the Commodity Exchange Act. Compliance has now become a non-negotiable part of any AI-driven trading operation.

Legal Considerations

Trading firms must maintain detailed records of how their AI systems function, including decision-making processes, algorithmic logic, and transaction logs. AI systems must also adhere to anti-fraud and anti-manipulation standards to preserve market integrity. The Financial Industry Regulatory Authority (FINRA) recommends regular reviews and audits to ensure AI tools are transparent, compliant, and free from exploitative practices.

Compliance and Governance Frameworks

To remain compliant, firms should develop AI governance frameworks that include continuous monitoring, independent auditing, and transparency measures. Regular testing helps identify algorithmic bias or technical flaws early, fostering trust between regulators, institutions, and traders. A structured compliance framework ensures that AI’s integration strengthens—not threatens—the integrity of the forex market.

Would you like me to make this version shorter for a blog/web page (more reader-friendly and concise) or keep it in this detailed, professional format (ideal for reports or educational articles)?

Automated Forex Trading – Advantages and Drawbacks

The rise of automated forex trading powered by artificial intelligence (AI) has transformed how traders approach the market, offering both significant opportunities and notable challenges.

One of the main advantages of automation is its ability to remove emotional bias from trading decisions. AI-based systems execute trades based on pre-defined algorithms, ensuring discipline, consistency, and objectivity. This helps eliminate impulsive moves often driven by fear or greed.

Another strength lies in speed and data processing capability. AI can analyze massive amounts of market data within milliseconds, identifying profitable opportunities far faster than human traders. This efficiency is especially valuable in high-frequency trading (HFT), where split-second timing can make or break a trade.

However, reliance on automation also comes with risks. Technical glitches, system bugs, or network failures can result in unintended trades or losses. Without human oversight, AI systems may also struggle to interpret unexpected market events that require contextual understanding or intuition. Additionally, vulnerabilities in the programming can expose systems to potential exploitation or errors.

Types of AI Forex Trading Bots

Within the sphere of automated forex trading, several types of AI-powered trading robots, also known as Expert Advisors (EAs), are widely used:

- Scalping Bots: Designed to capture small market movements, these bots open and close numerous trades within short timeframes to accumulate incremental profits.

- Arbitrage Bots: These algorithms identify and capitalize on price discrepancies for the same asset across different markets, seeking low-risk profit opportunities.

- News Trading Bots: Using AI and natural language processing (NLP), these systems analyze economic news releases and market sentiment to make trading decisions during periods of volatility.

Platforms like MetaTrader 4 and MetaTrader 5 rely heavily on such EAs, allowing traders to scale operations efficiently while maintaining precise control over trading parameters. Yet, while they enhance efficiency, they also require careful monitoring to avoid overreliance and potential technical pitfalls.

The Current and Future Impact of AI in Forex Trading

Artificial intelligence is no longer a futuristic concept—it’s an integral part of the modern forex ecosystem. Today’s AI tools enhance data analysis, predictive modeling, and trade automation, allowing traders to process vast volumes of market data and uncover patterns invisible to the human eye. These capabilities lead to improved accuracy, more effective strategies, and faster decision-making in an increasingly competitive market.

Looking ahead, AI’s role in forex trading will continue to expand dramatically. Advanced machine learning models capable of dynamically adapting to market fluctuations will enable even sharper forecasting and strategy optimization. Emerging innovations in natural language processing (NLP) will allow AI systems to assess global news feeds and social media sentiment, improving contextual awareness and predictive accuracy.

Traders who adopt and adapt to these technologies will hold a distinct competitive advantage. Incorporating AI tools into trading practices enables more informed analysis, proactive risk management, and rapid response to market changes. Staying updated on AI developments and strategically investing in reliable tools will be key to thriving in the evolving landscape of forex trading.

Final Thoughts

AI has firmly established itself as a transformative force in forex trading, reshaping how traders analyze data, forecast trends, and execute strategies. Its ability to process real-time information and eliminate emotional biases empowers traders to make more rational and precise decisions.

Looking to the future, expect even greater advancements in machine learning and NLP. These innovations will make AI systems more adaptive, predictive, and responsive to global market shifts. For traders, the path forward is clear: embracing AI is not merely an advantage—it’s a necessity. Integrating AI tools into trading frameworks enhances analysis, responsiveness, and long-term consistency, ensuring competitiveness in the rapidly advancing world of forex trading.

Would you like me to adapt this version for a website blog post (shorter and more conversational) or keep it in this formal, publication-style format (ideal for whitepapers or educational content)?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: