The Forex market is the largest and most liquid financial market in the world, with traders exchanging over $7.5 trillion every single day. This open marketplace provides countless opportunities for traders to profit from fluctuations in exchange rates. While there are numerous currency pairs available, the ones with high volatility are particularly attractive to traders aiming for significant returns. So, which currency pairs are the most volatile? Some of the top choices include USD/TRY (US Dollar/Turkish Lira), GBP/JPY (British Pound/Japanese Yen), NZD/JPY (New Zealand Dollar/Japanese Yen), USD/MXN (US Dollar/Mexican Peso), and USD/BRL (US Dollar/Brazilian Real). In this article, we’ll explore the most volatile currency pairs, examine the factors driving their volatility, and discuss strategies for trading them effectively.

Table of Contents

- The Most Volatile Currency Pairs

- Understanding Currency Volatility

- Key Factors Influencing Currency Volatility

- How Forex Volatility is Measured

- Navigating Volatile Currency Pairs

- Trading High Volatility vs. Low Volatility Pairs

- Closing Thoughts

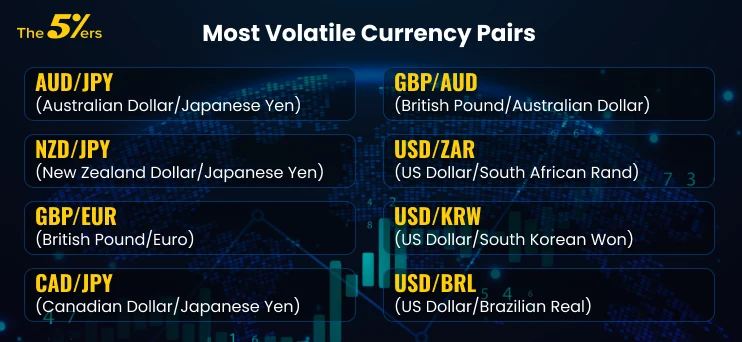

The Most Volatile Currency Pairs

Certain currency pairs stand out for their extreme volatility, offering traders the potential for substantial profits. Below, we examine some of the most volatile pairs and the reasons behind their price movements.

GBP/USD (British Pound/US Dollar)

Commonly known as “Cable” due to historical telegraph links between London and New York, GBP/USD is famous for its large price swings. Factors driving its volatility include:

- Brexit: The UK’s departure from the European Union has created ongoing uncertainty, causing sharp fluctuations.

- Monetary Policy: Interest rate decisions from the Bank of England and the US Federal Reserve strongly influence price movement.

- Economic Data: Key indicators like GDP growth, employment figures, and inflation in both countries affect the pair’s volatility.

USD/JPY (US Dollar/Japanese Yen)

USD/JPY is highly responsive to global economic conditions and market sentiment. Its volatility stems from:

- Interest Rate Differentials: Differences between the Bank of Japan’s ultra-low rates and the US Federal Reserve’s policy drive price swings.

- Safe-Haven Status: The Japanese yen often sees increased demand during periods of global uncertainty.

- Economic Reports: US trade balances and Japan’s industrial production figures impact the pair significantly.

EUR/USD (Euro/US Dollar)

As the most traded currency pair in the world, EUR/USD reacts to multiple factors:

- ECB Policy: Decisions from the European Central Bank on interest rates and monetary policy heavily influence price movements.

- US Economic Data: Reports such as non-farm payrolls and GDP growth drive volatility.

- Geopolitical Events: Political developments in the US and Eurozone can result in rapid market shifts.

GBP/JPY (British Pound/Japanese Yen)

Known as the “Dragon,” GBP/JPY is infamous for its dramatic price swings due to:

- Interest Rate Differentials: Monetary policies of the Bank of England and the Bank of Japan often diverge, fueling volatility.

- Brexit Impact: News surrounding Brexit continues to affect this pair.

- Market Sentiment: The pair is extremely sensitive to changes in global risk appetite.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD pair is heavily influenced by commodities and global economic conditions:

- Commodity Prices: Australia’s export-driven economy makes this pair responsive to fluctuations in commodity markets.

- Interest Rate Decisions: Moves by the Reserve Bank of Australia significantly affect the pair’s direction.

- Economic Data: Key economic indicators from both countries, such as employment and trade balances, also contribute to volatility.

If you want, I can also rework the rest of your article on volatility, trading strategies, and risk management into a fully polished, professional version that’s ready for publishing. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Understanding Currency Volatility

Currency volatility refers to the extent to which exchange rates fluctuate over a specific period. High volatility indicates large price swings, while low volatility suggests more stable prices. Several factors contribute to currency volatility, including economic indicators, political developments, interest rate differences, and overall market sentiment. Traders often prefer highly volatile currency pairs because they offer the potential for significant profits, though they also carry higher risk.

Key Factors Influencing Currency Volatility

Economic Indicators: Macroeconomic data such as GDP growth, employment rates, inflation, and trade balances have a major impact on currency prices. Deviations from forecasted figures—whether positive or negative—can trigger substantial price movements.

Geopolitical Events: Political instability, elections, policy shifts, or international conflicts can dramatically affect currency valuations. Traders closely monitor news and geopolitical developments to gauge their potential impact.

Interest Rate Differentials: Differences in interest rates between countries influence currency demand. Rising interest rates can attract investment, boosting a currency’s value, while falling rates may lead to capital outflows and depreciation.

Market Sentiment: Traders’ perceptions of the economy and global political events shape currency volatility. Market sentiment is often influenced by news, rumors, and speculative trading.

How Forex Volatility is Measured

Forex volatility measures how much the price of a currency pair fluctuates over time. Understanding and quantifying volatility is essential for making informed trading decisions. Cross-currency pairs, which do not directly involve the US Dollar, can display unique volatility patterns that traders must consider. Common methods to measure volatility include:

Historical Volatility: This reflects actual past price fluctuations, calculated using historical price data. Typically, it involves determining the standard deviation of returns for a given currency pair over a set period.

Implied Volatility: Derived from currency option prices, implied volatility reflects the market’s expectations for future price swings. Unlike historical volatility, it is forward-looking and influenced by sentiment and upcoming economic events.

Average True Range (ATR): ATR measures the average range between high and low prices over a specified period, usually 14 days. It’s a practical tool for gauging price movement, setting stop-losses, and identifying breakout opportunities.

Bollinger Bands: These consist of a moving average with two standard deviation lines plotted above and below. Widening bands indicate higher volatility, while narrowing bands suggest lower volatility.

Standard Deviation: A statistical measure of how dispersed values are from the mean. In forex, it measures the variation in a currency pair’s returns over a period.

Volatility Index (VIX): Though primarily tied to the stock market, the VIX offers insights into market uncertainty, which can influence forex conditions. A high VIX reflects increased risk, often affecting currency movements.

Dealing with Volatile Currency Pairs

Trading highly volatile currency pairs requires a well-thought-out strategy and deep understanding of market dynamics. Key guidelines include:

Risk Management:

- Set Stop-Loss Orders: Protect capital by automatically closing positions at predetermined levels.

- Position Sizing: Scale positions according to account size and risk tolerance.

- Diversify Trades: Spread exposure across multiple pairs to reduce the impact of adverse moves.

Technical Analysis:

- Analyze Price Patterns: Identify formations such as head-and-shoulders, double tops, and flags to anticipate future moves.

- Monitor Indicators: Tools like moving averages, RSI, and Bollinger Bands help track trends and volatility.

- Use Fibonacci Retracement: Determine potential support and resistance levels.

Fundamental Analysis:

- Follow Economic Data: Track central bank announcements and economic indicators to anticipate market moves.

- Stay Current: Monitor geopolitical developments to forecast sentiment-driven price changes.

- Evaluate Interest Rate Policies: Interest rate differences help predict future currency demand.

Psychological Discipline:

- Stay Calm: Avoid impulsive trades driven by emotional reactions.

- Have a Plan: Stick to a well-defined trading plan to maintain focus.

- Accept Losses: Recognize that losses are part of trading, and learn from them to improve performance.

Use of Technology:

- Trading Platforms: Modern platforms provide real-time data, charting tools, and automated trading options.

- Algorithmic Trading: Pre-programmed algorithms execute trades efficiently, reducing emotional bias.

- Monitor News Feeds: Stay updated with live news for timely market insights.

Trading volatile currency pairs can be highly rewarding when approached with knowledge, discipline, and the right tools.

We Trade Forex – Come trade with us!

If you want, I can also rephrase the next section on “High vs. Low Volatility Trading” to make it concise and professional while keeping it engaging for readers. Do you want me to do that?

Trading Currency Pairs: High Volatility vs. Low Volatility

Trading currency pairs with high volatility versus low volatility requires different strategies and risk management approaches. Understanding these differences is essential for aligning your trading style with your risk tolerance and financial goals.

High Volatility Currency Pairs

High-volatility pairs, such as USD/TRY (US Dollar/Turkish Lira) and GBP/JPY (British Pound/Japanese Yen), can experience significant price swings over short periods. Their movements are often driven by geopolitical events, economic data releases, and interest rate differentials.

Advantages:

- Potential for Substantial Profits: Rapid price movements provide opportunities for quick gains, making these pairs ideal for day traders and scalpers.

- Dynamic Trading Environment: High-volatility pairs are perfect for traders who thrive in fast-paced, active markets.

Disadvantages:

- Higher Risk: The same price swings that create profit opportunities can also lead to large losses if the market moves against your position.

- Psychological Stress: Trading these pairs requires discipline and emotional control to avoid impulsive decisions under pressure.

Low Volatility Currency Pairs

Low-volatility pairs, such as EUR/USD (Euro/US Dollar) and USD/CHF (US Dollar/Swiss Franc), tend to have more stable and predictable price movements. They are influenced by steady economic conditions and less frequent geopolitical disruptions.

Advantages:

- Lower Risk: Smaller price fluctuations reduce the potential for major losses, making these pairs suitable for conservative traders.

- Predictable Market Behavior: Stability allows for more reliable technical analysis and supports long-term trading strategies.

Disadvantages:

- Limited Profit Potential: Smaller price movements mean fewer opportunities for large gains.

- Less Excitement: Traders who prefer fast-paced action may find low-volatility pairs less engaging.

Closing Thoughts

Choosing between high and low volatility currency pairs depends on your risk tolerance and trading objectives.

- High-volatility pairs like USD/TRY and GBP/JPY can offer substantial profits, but they require strong psychological discipline, effective risk management, and constant awareness of economic and geopolitical events that may trigger sudden price swings.

- Low-volatility pairs such as EUR/USD and USD/CHF provide a more stable trading environment, making them ideal for conservative traders seeking predictability. They require less frequent monitoring, allow for clearer long-term strategies, and support a calmer, more controlled trading experience.

Ultimately, the decision comes down to whether you prioritize short-term profit potential with higher risk or steady, predictable returns with lower stress. Understanding your goals and temperament will help you select the volatility level that best suits your trading style.

If you want, I can combine this with the previous sections on currency volatility and make a single, fully cohesive article ready for publication. It would read smoothly from start to finish and include all strategies, examples, and tips. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: