Have you ever wondered why institutional traders often seem one step ahead in the Forex market? The secret frequently lies in understanding Smart Money Concepts (SMC). While retail traders tend to rely on traditional indicators, SMC focuses on the footprints left by large financial institutions. This method provides a deeper, more nuanced perspective on currency market behavior.

This article will break down the essential terminology of SMC, offering a detailed look at Order Blocks, Fair Value Gaps (FVG), and Liquidity. These three pillars form the foundation of this powerful trading approach, delivering insights crucial for serious traders or those aiming for instant funding.

Table of Contents

- What Are Smart Money Concepts?

- Order Blocks: The Footprints of Institutional Orders in Forex

- Fair Value Gaps (FVG): Identifying Market Imbalances

- Liquidity in Trading: Powering Institutional Moves

- Break of Structure (BOS): Reading Market Shifts

- Point of Interest (POI): Pinpointing Entry Zones

- SMC Tools: Lux Algo and Other Indicators

- Decoding SMC: The Path to Informed Trading

- Conclusion: Mastering Smart Money Concepts

What Are Smart Money Concepts?

Before diving into the details, it’s important to understand the overarching Smart Money Concept rule. At its core, SMC is about spotting where and how major financial institutions are influencing the market. These institutions move vast amounts of capital, leaving detectable traces behind.

Unlike retail traders who react to price movements, smart money creates them. By analyzing their accumulation and distribution phases, liquidity grabs, and strategic order placements in Forex, you can anticipate potential price shifts instead of merely responding to them. The rules of SMC aren’t rigid—they serve as a framework to interpret institutional activity and uncover behaviors that often go unnoticed in conventional trading.

Order Blocks: The Footprints of Institutional Orders in Forex

When a large institution aims to buy or sell a significant amount of a currency pair, it can’t simply place a single massive order—it would cause the price to spike dramatically. Instead, institutions distribute their trades strategically, sometimes even temporarily moving the price in the opposite direction to fill their desired positions at better levels. This strategy creates what is known as an Order Block.

What is an Order Block?

An Order Block is a specific candlestick—or cluster of candlesticks—where smart money has likely placed significant buy or sell orders. These blocks often precede strong, sustained market moves in the opposite direction. They indicate areas where demand or supply has been absorbed and are frequently revisited as support or resistance zones during later price action.

How to Identify Order Blocks

- A bearish candle often signals a bullish Order Block, and a bullish candle indicates a bearish Order Block.

- These candles typically precede an impulsive price move and often feature large bodies, reflecting high volume.

- Price frequently returns to retest the Order Block, either as support or resistance, because unfilled institutional orders may still be present.

Recognizing these patterns allows traders to anticipate potential price movements and better align with the actions of institutional players.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

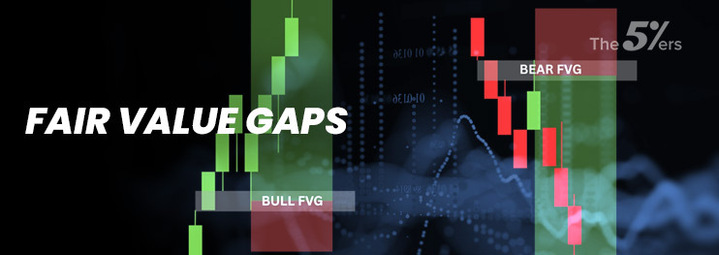

Fair Value Gaps (FVG): Market Imbalance and Efficiency

Forex markets naturally aim for efficiency. When prices move sharply in one direction, they can leave behind areas of imbalance where buyers and sellers haven’t fully interacted. These zones, where “fair value” was skipped, are known as Fair Value Gaps (FVG).

What is a Fair Value Gap (FVG)?

An FVG is a price gap caused by an imbalance between buying and selling pressure. On a candlestick chart, it typically appears as a three-candle pattern: the high of the first candle and the low of the third candle (or vice versa) do not overlap the wicks of the middle candle. This gap reflects a rapid price movement without proper consolidation or sufficient liquidity, often occurring during high-impact Forex news events. FVGs highlight areas of fast, one-sided market action.

Why Are FVGs Important?

FVGs often act as magnets for price. Institutional traders tend to push prices back into these gaps to “fill” the imbalance, mitigating previous positions or capturing additional liquidity. Price often retraces to an FVG before resuming the original trend or reversing. Understanding FVGs allows traders to anticipate potential pullbacks and target strategic entry or exit points.

Liquidity in Trading: Fueling the Institutional Engine

What is liquidity in trading?

Liquidity refers to the ease of buying or selling an asset without significantly impacting its price. In SMC, liquidity is the fuel that powers institutional trading. Large traders rely on liquidity to execute sizable orders efficiently, minimizing slippage in the process. In the high-volume Forex market, liquidity is essential.

Where Is Liquidity Found?

Liquidity tends to accumulate where retail stop-loss orders and pending orders are concentrated. Common liquidity pools include:

- Equal Highs/Lows: Price bouncing off the same level repeatedly often signals clustered stop-loss orders.

- Trendlines: Stop losses often gather above or below major trendlines.

- Previous Swing Highs/Lows: Significant prior highs and lows are typical targets for liquidity collection.

- Order Blocks and FVGs: Approaching these zones can trigger new orders and stop-loss placements, creating additional liquidity.

The “Liquidity Grab”

Smart money will often drive prices toward these liquidity pools to trigger stop-loss orders, providing the necessary counter-orders to fill large positions. For example, if institutions plan to buy a large volume of a currency pair, they may push the price downward to sweep clustered sell stop orders. Once these stops are triggered, filling their buy orders becomes easier, effectively orchestrating a move. Recognizing liquidity grabs is crucial, especially for short-term strategies like 1-minute scalping, where precision can prevent falling into traps.

Break of Structure (BOS): Understanding Market Shifts

Another key SMC concept is the Break of Structure (BOS), which helps traders interpret market trends and shifts.

What is a Break of Structure?

A BOS occurs when price breaks beyond a significant swing high during an uptrend, or a notable swing low during a downtrend. This indicates trend continuation, as institutional flow is actively pushing the price in the same direction. BOS serves as confirmation that the current trend remains intact.

BOS vs. Change of Character (CHOCH)

While a BOS signals trend continuation, a Change of Character (CHOCH)—also called a “Change of Trend”—signals a potential trend reversal. A CHOCH occurs when price breaks a counter-trend swing point, potentially marking a shift in overall market direction. Distinguishing between BOS and CHOCH is critical for accurately interpreting market shifts and confirming reversals.

Point of Interest (POI): Targeting Key Entry Zones

By combining the core SMC concepts, traders can identify Points of Interest (POIs)—critical areas where institutional activity is likely to occur.

What is a Point of Interest (POI)?

A POI is a zone on the chart where multiple SMC elements converge, signaling a high probability of institutional reaction. Often, it is formed by an unfilled Order Block, a Fair Value Gap within an Order Block, or alignment with a major liquidity zone. POIs may also coincide with significant market structure levels in a Forex pair. Essentially, these are areas where smart money is most likely to act.

How to Use POIs

Traders identify POIs carefully and wait for price to revisit these areas to anticipate reactions or reversals. POIs serve as potential entry or exit points because they represent zones where smart money may intervene again. They offer high-probability setups for Forex trading, but success depends on patient observation and accurate identification.

SMC and Tools: Lux Algo and Indicators

At its core, SMC is about understanding institutional behavior, not relying solely on indicators. That said, tools exist to help traders visualize these concepts. SMC indicators can highlight Order Blocks, Fair Value Gaps, and liquidity zones on charting platforms. A popular example is Lux Algo Smart Money Concepts, which assists in spotting these areas.

While such tools are helpful, they are aids—not substitutes for a deep understanding of the principles. Relying solely on an indicator without grasping the underlying concepts can lead to misinterpretation and poor trading decisions. Indicators should complement your knowledge, not replace it. This is especially important as AI and automation become more common in trading; they should enhance your analysis, not replace conceptual understanding.

Decoding Smart Money Concepts: The Path to Informed Trading

Mastering Order Blocks, Fair Value Gaps, and liquidity is essential for navigating institutional trading. These are not just chart patterns—they are the footprints of smart money, revealing strategic moves and intentions. By integrating these concepts into your analysis, you can develop a more sophisticated and potentially profitable approach to Forex trading.

Success with SMC requires dedication, practice, and patience, but the insights gained can significantly elevate your trading strategy. SMC provides a structured framework to understand the market, anticipate moves, and make informed decisions rather than reacting blindly to price action.

Conclusion: Mastering Smart Money Concepts

Grasping the terminology and core principles of Smart Money Concepts (SMC) allows you to approach the Forex market from a perspective closely aligned with institutional activity—far more insightful than following retail sentiment alone. By thoroughly understanding Order Blocks, Fair Value Gaps, and Liquidity dynamics, you equip yourself with powerful tools to identify high-probability trade setups and make well-informed decisions.

The key is not merely memorizing definitions, but comprehending the logic behind institutional moves. This understanding enables you to navigate the market alongside the smart money, rather than being swept away by its momentum. Mastery of SMC is essential for success in any disciplined trading strategy and can even open doors to opportunities like instant funding by demonstrating a clear analytical edge.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: