Financial markets never stand still. Their constant movement creates a continuous stream of opportunities, and those who can identify and act on them stand to profit. While many investors focus on long-term strategies, there is an alternative approach: short-term trading. Specifically, short-term Forex trading capitalizes on rapid price movements in currency pairs. Its fast-paced nature and potential for quick gains make it especially appealing to traders who enjoy actively engaging with the market.

This article aims to lay the foundation for navigating this dynamic world. Beyond the basics, we will address critical questions such as who should engage in short-term Forex trading, how to develop effective strategies, and the common pitfalls to avoid. We will also compare this trading style with other financial instruments, emphasizing the careful balance between opportunity and risk that defines successful short-term trading.

Table of Contents

- Understanding the Global Currency Exchange

- Decoding the Forex Market: Essential Concepts for Traders

- The Diverse Landscape of Forex Trading Styles

- Why People Choose Short-Term Forex Trading

- Challenges and Risks of Short-Term Forex Trading

- Laying the Groundwork: Getting Started

- Understanding “Short” in Forex: A Simplified Concept

- Key Market Concepts

- Your Journey into Short-Term Forex Trading

Understanding the Global Currency Exchange

To begin, it’s important to understand the basics. Many traders ask: what defines a short-term trade? A short-term trade involves buying and selling currency pairs within a brief timeframe, typically ranging from minutes to a few days. The goal is to profit from rapid fluctuations in price rather than long-term economic trends.

A Different Mindset: Technical vs. Fundamental

Short-term trading relies heavily on technical analysis. Traders use charts, indicators, and patterns to anticipate short-term price movements. This contrasts sharply with long-term traders, who focus on fundamental analysis—macroeconomic factors such as interest rates, inflation, and political stability. Short-term traders, by contrast, prioritize immediate price action and market sentiment, aiming to exploit quick shifts rather than long-term trends.

The key distinction between short-term and long-term trading lies in both the holding period and the objective. Short-term trading seeks rapid profits over hours, days, or weeks, whereas long-term investing targets gradual growth over months or years.

Defining the Timeframes

The duration of trades often confuses beginners. Short-term trading typically refers to trades held for less than a year, but in Forex, many strategies operate over much shorter periods—from intraday sessions to a few weeks. A single short-term trade can last anywhere from minutes to several months, provided margin requirements are met.

The Many Names of Short-Term Trading

For newcomers, terminology can be confusing. Short-term trading encompasses several styles, including day trading, swing trading, and scalping. Despite differences in execution, all of these approaches share one key characteristic: active engagement with the market.

Is Forex Built for Short-Term Trading?

Many beginners wonder if Forex is suitable for short-term trading. The answer is a resounding yes. The Forex market is highly conducive to short-term strategies due to its high liquidity, 24/5 operating hours, and frequent price volatility. These characteristics allow traders to enter and exit positions quickly, capitalizing on rapid price movements. In short, Forex provides an ideal environment for short-term traders seeking opportunities around the clock.

Decoding the Forex Market: Key Concepts for Traders

Before diving into short-term Forex trading, it’s essential to grasp the fundamental building blocks of the market.

Currency Pairs, Pips, and Lots

In Forex, you don’t trade individual currencies—you trade them in pairs, such as EUR/USD. The first currency in the pair is the base currency, and the second is the quote currency. The price shows how much of the quote currency is needed to buy one unit of the base currency.

The smallest price movement is called a pip (Percentage in Point). Understanding pips is crucial because they determine your profit or loss. For example, if the EUR/USD moves from 1.2500 to 1.2501, that’s a one-pip change.

Forex trades are also divided into different lot sizes:

- Standard Lot: 100,000 units of the base currency

- Mini Lot: 10,000 units of the base currency

- Micro Lot: 1,000 units of the base currency

The Double-Edged Sword of Leverage

Leverage is often called a double-edged sword. It allows you to control a much larger position than your account balance would normally permit, magnifying potential profits. However, the same leverage can amplify losses just as quickly.

The amount of money required to maintain a leveraged position is called margin. While leverage is a powerful tool, it must be used carefully and always combined with a disciplined risk management strategy.

Who Moves the Market?

The Forex market is decentralized, but its movements are largely driven by major players. Central banks, large commercial banks, and institutional investors have the most influence. Retail traders, like individual investors, participate as well, but their effect on overall price movement is relatively small.

Trading Around the Clock: The 24/5 Advantage

One of Forex’s biggest advantages is its 24/5 trading hours. The market is open from Sunday night to Friday night and operates across major sessions: Tokyo, London, and New York. The overlap of these sessions often leads to increased liquidity, which in turn creates ideal opportunities for short-term traders to enter and exit positions quickly.

The Diverse Landscape of Forex Trading Styles

Short-term Forex trading is far from one-size-fits-all. Different strategies suit different personalities, risk tolerances, and time commitments. The main types of short-term trading include scalping, day trading, swing trading, and momentum trading.

Scalping

Scalping is the most intense form of short-term trading. Scalpers aim to profit from tiny, rapid price movements—sometimes in just seconds. This high-frequency strategy focuses on small, repeated gains. It requires tight spreads and high trading volumes to generate meaningful profits.

Day Trading

Day trading is a popular entry point for beginners. This style involves opening and closing all positions within the same trading session, avoiding overnight risk. Day traders must monitor the market constantly, make quick decisions, and stay fully focused. It’s a highly active approach and a straightforward way to start in short-term trading.

Swing Trading

Swing trading targets currency movements over several days to a few weeks. Traders look for “swings” in the market, often using technical indicators such as moving averages or RSI to time entries and exits. Swing trading strikes a balance between the fast pace of day trading and the slower, long-term perspective of investing.

Momentum Trading

Momentum trading involves riding strong price trends, regardless of the timeframe. Traders focus on currencies experiencing high buying or selling pressure. This style can be highly effective for short-term traders who want to capitalize on active market momentum.

Choosing the Right Style

So, which trading style is best for the short term? There is no single answer. The best approach depends on your personal preferences, risk tolerance, capital, and the time you can dedicate. Day traders need to monitor the market constantly, while swing traders can check in less frequently.

Why Traders Choose Short-Term Forex Trading

Short-term Forex trading appeals to many because of its unique advantages:

- Potential for Quick Profits: Traders can see faster returns on their capital, accelerating account growth.

- Active Engagement: The constant need for decision-making provides intellectual challenge and excitement.

- Flexibility: Short-term traders are not bound to long-term market trends and can profit regardless of broader market direction.

- Opportunities in Any Market: Traders can profit in rising or falling markets using strategies such as short selling.

- Rapid Learning: Short-term trading provides immediate feedback, helping traders quickly assess their discipline, strategy, and market understanding.

Challenges and Risks of Short-Term Trading

Despite its appeal, short-term trading comes with significant challenges:

- Leverage Risk: Leverage can amplify gains but also magnify losses.

- Emotional Discipline: Fast-paced decision-making under pressure can be stressful.

- High Transaction Costs: Frequent trading can lead to accumulated spreads and commissions, which reduce profits, particularly for high-frequency strategies.

Success requires careful planning, discipline, and a clear understanding of market dynamics.

Laying the Groundwork: Getting Started

Before trading with real money, preparation is essential. Key steps include:

- Determine Your Starting Capital: The amount depends on your trading style and broker. Forex does not have the U.S. stock market’s PDT rule, and some brokers allow accounts as low as $100. However, it’s always best to begin with a demo account to practice without financial risk.

- Choose the Right Broker and Platform: Look for low fees, reliable execution, advanced charting, real-time data, and customizable tools for active trading.

- Education and Practice: Understand core concepts such as leverage, liquidity, and volatility. Short-term Forex trading is a skill that requires significant preparation and ongoing learning.

- Keep a Trading Journal: Track trades, analyze performance, and learn from both successes and mistakes.

By combining education, practice, and careful planning, traders can build the foundation for consistent short-term Forex trading success.

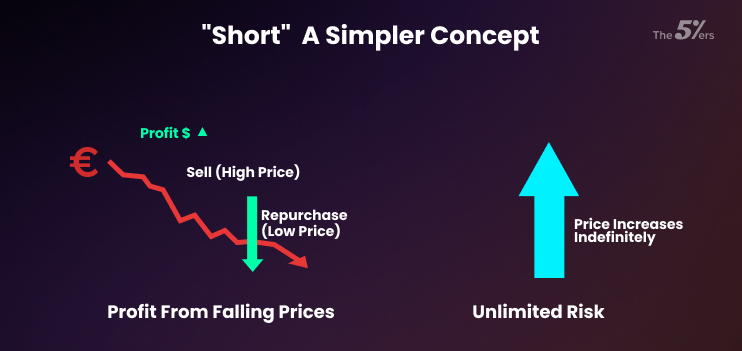

Understanding “Short” in Forex: A Simplified Concept

To excel in short-term trading, you need to grasp how traders profit—not just when a currency pair rises, but also when it falls. The ability to make money during a decline is a powerful tool in any trader’s arsenal. This is where the concept of short selling comes in. In Forex, short trading typically refers to short selling—a strategy where traders aim to profit from a currency pair’s decline.

The Mechanics of Short Selling

For beginners, the question often arises: “What is short trading?” In Forex, short trading or short selling works like this:

- You sell a currency pair, anticipating its value will drop.

- Later, you repurchase it at a lower price.

- The difference between the selling and repurchase prices is your profit.

Simply put, short selling allows you to benefit from a currency pair’s falling price.

A Practical Short-Term Trading Example

Consider a simple scenario: You sell EUR/USD at 1.1000 and repurchase it at 1.0950. The difference, measured in pips, represents your profit. Short selling is especially effective with highly liquid, volatile currency pairs like EUR/USD or GBP/JPY, which frequently experience significant price movements.

The Risk of Short Selling

While short selling offers profit potential, it comes with theoretical unlimited risk. If the currency pair’s price rises instead of falling, you may have to repurchase at a much higher price to close your position. Careful risk management is therefore essential when employing short-selling strategies.

Key Market Concepts

Before diving into short-term Forex trading, understanding a few fundamental concepts is crucial:

Liquidity: Measures how easily a currency pair can be bought or sold. High liquidity often leads to tighter spreads and faster execution but does not guarantee price stability.

Volatility: Indicates how much a currency pair’s price fluctuates. Greater volatility creates more trading opportunities but also increases risk. Tools like the Average True Range (ATR) can help measure and plan for volatility.

Order Types: Different orders allow you to manage trades effectively.

- Market Order: Executes immediately at the current price.

- Limit Order: Executes at a specific price you set.

- Stop-Loss Order: Automatically closes your position if the price moves against you, limiting potential losses.

Spreads and Commissions: These are the costs of trading. The spread is the difference between the buy and sell price, while commissions are fees paid to the broker. For high-frequency trading, these costs can accumulate quickly.

Market Hours: Unlike the stock market, Forex is open 24 hours a day, five days a week (Sunday evening to Friday evening). This round-the-clock access allows traders to respond to global events and news, making short-term trading more dynamic.

Starting Your Journey in Short-Term Forex Trading

We’ve now covered the essential foundations: what short-term trading is, its different styles, and the concept of short selling. Remember, short-term trading is a skill that requires dedication, continuous learning, and practice.

The best way to start is with a demo account. This lets you experience the market, test strategies, and build confidence—all without risking real money.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: