Best Leverage for Small Accounts: Turning a Small Balance into Growth

If you’re trading with a small account, you’ve probably wondered: What is the ideal leverage for small account trading?

Choosing the right leverage can be the difference between steadily growing your funds or losing them in a matter of days. Many beginners are tempted to use high leverage, hoping to turn $10 into $1,000 overnight. Without a solid strategy, this approach usually leads to a wiped-out account.

This guide explains the best leverage practices for small accounts, the dangers of over-leveraging, and how beginners can safely grow their capital.

At brokers like Dominion Markets, traders can access leverage up to 500:1, but only with strict risk management. Combined with tight 0.1 pip spreads and fast execution, disciplined trading can still protect your account even in high-leverage conditions.

What Is Leverage in Trading?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

What Is Leverage in Trading

Leverage allows you to control more money than you actually have in your account. Essentially, your broker lends you extra buying power, enabling you to open positions larger than your deposit. On small accounts, even moderate leverage can have a big impact.

While some brokers offer ratios up to 500:1, these require careful risk management. Only use high leverage if you have a solid plan, set stop-losses, and monitor your margin closely. Keep an eye on spreads and execution speed, because even small delays or wider spreads can significantly affect a small account. For a deeper dive, check out our full guide on forex trading leverage explained.

Example of leverage in trading:

- With $100 and no leverage, you can trade $100.

- With 1:10 leverage, you control $1,000.

- With 1:100 leverage, you control $10,000.

Think of leverage like a car jack: it lets you lift more than you could alone, but if it slips, the weight can crush you. In trading, that “slip” could be a small price move, a slow execution, or a wider spread. High leverage amplifies both gains and losses, which is why many beginner guides caution against using excessive leverage too early.

Why Choosing the Best Leverage for a Small Account Is Crucial

Why Choosing the Right Leverage for a Small Account Matters

Many brokers advertise extreme leverage, like 1:500 or 1:1000. At first, it seems like an easy way to turn a tiny account into big profits.

But the reality is harsh: the higher the leverage, the faster your account can be wiped out. Even a 1% adverse market move can erase a small balance with extreme leverage. Factors like sudden spreads widening or slight execution delays can make things worse. In short, high leverage magnifies gains—but it also makes losses devastating and often unexpected.

Why Small Accounts Tempt Traders Into High Leverage

If you start with $10, $30, or $100, it’s tempting to “go big” with leverage:

- $10 at 1:10 leverage → $100 buying power

- $10 at 1:500 leverage → $5,000 buying power

The second option looks exciting, but a mere 0.5% move against you can wipe out the account. That’s why the best leverage for a small account is never the maximum your broker offers. The goal is to protect your capital first. For more details, see our guide on choosing the best forex leverage to avoid common pitfalls.

Survival First, Profits Later

Successful traders prioritize staying in the game over chasing quick wins.

For micro and small accounts, the primary goal is survival while building skill. Using safe leverage allows time to learn, grow, and compound your balance. It also cushions against common errors, like holding trades too long or misplacing stop-losses. With lower pressure from margin calls, you can focus on skill development rather than panic management.

Many experts recommend keeping leverage 1:10 or lower for micro and small accounts.

Best Leverage for Small Accounts by Balance

Leverage should scale with account size. A $20 account cannot be managed like a $500 or $1,000 account. Smaller balances leave little room for mistakes, so leverage must reflect that. Here’s a practical guideline:

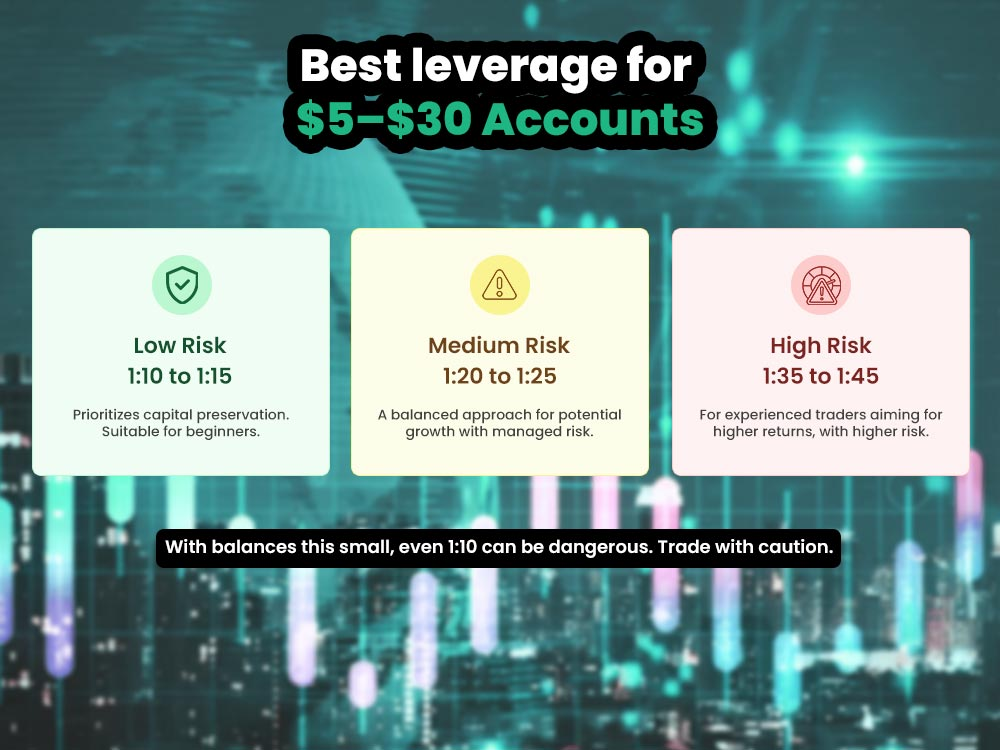

$5–$30 Accounts:

- Low risk: 1:10–1:15

- Medium risk: 1:20–1:25

- High risk: 1:35–1:45

Even 1:10 can feel risky with very small accounts, so trade carefully and always prioritize capital preservation.

Recommended Leverage by Account Size

$5–$30 Accounts:

- Low risk: 1:10–1:15

- Medium risk: 1:20–1:25

- High risk: 1:35–1:45

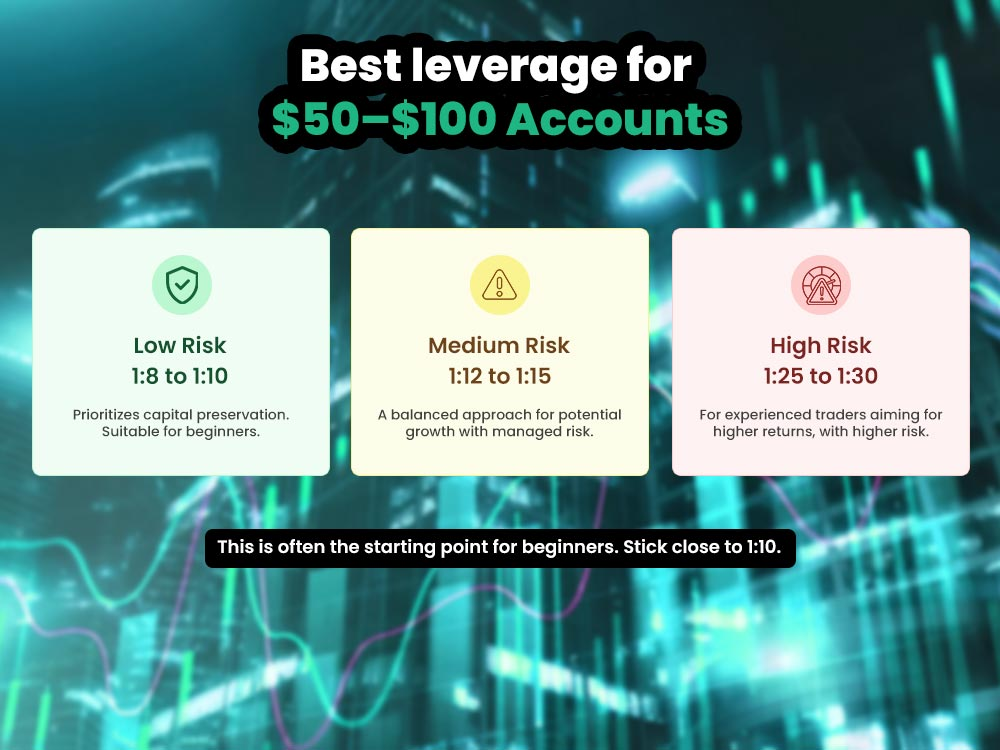

$50–$100 Accounts:

- Low risk: 1:8–1:10

- Medium risk: 1:12–1:15

- High risk: 1:25–1:30

For beginners, starting around 1:10 is usually the safest approach.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Recommended Leverage by Account Size

$50–$100 Accounts:

- Low risk: 1:8–1:10

- Medium risk: 1:12–1:15

- High risk: 1:25–1:30

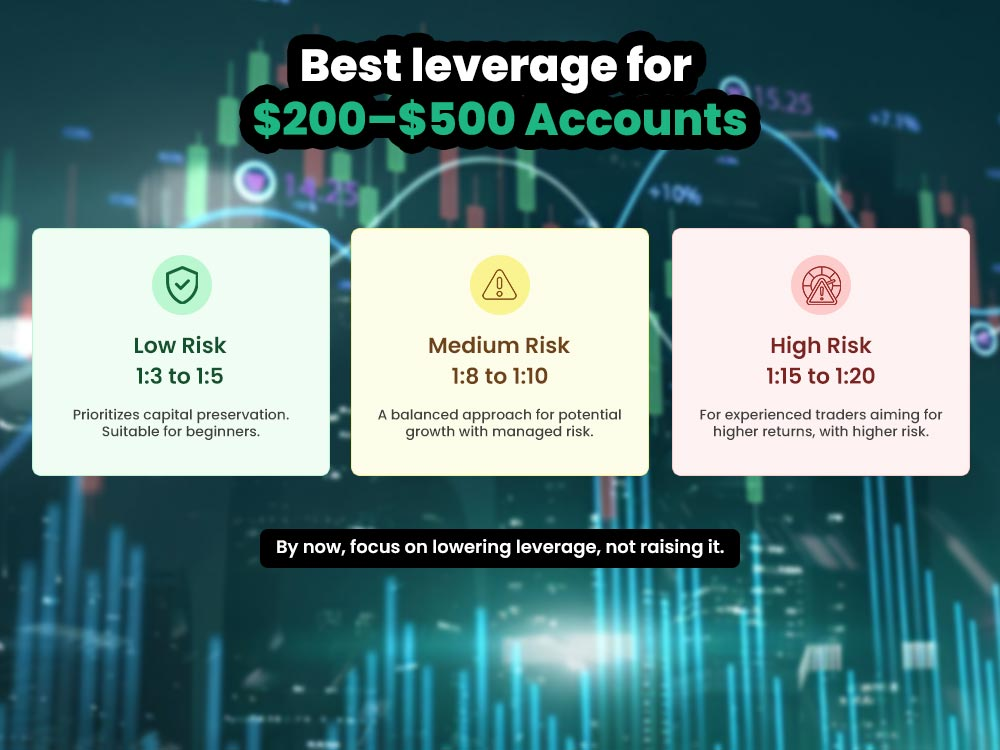

$200–$500 Accounts:

- Low risk: 1:3–1:5

- Medium risk: 1:8–1:10

- High risk: 1:15–1:20

At this stage, the priority should be reducing leverage rather than increasing it.

Recommended Leverage by Account Size

$200–$500 Accounts:

- Low risk: 1:3–1:5

- Medium risk: 1:8–1:10

- High risk: 1:15–1:20

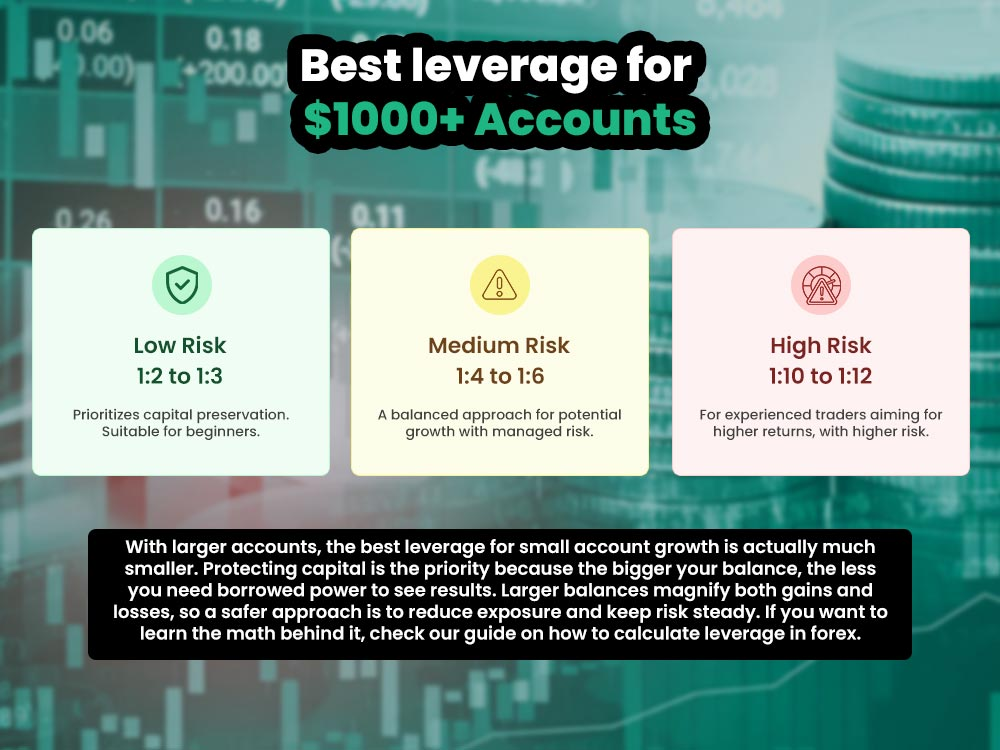

$1,000+ Accounts:

- Low risk: 1:2–1:3

- Medium risk: 1:4–1:6

- High risk: 1:10–1:12

For larger accounts, the most effective leverage for steady growth is lower. Preserving capital becomes the main focus because bigger balances don’t require as much borrowed power to achieve meaningful results. Higher balances amplify both gains and losses, so a cautious approach—reducing exposure and maintaining consistent risk—is wiser. For the detailed calculations behind this strategy, see our guide on computing leverage in forex trading.

Best Leverage for $1,000+ Accounts

Leverage by Experience for Beginners

Your level of trading experience is just as important as your account size when deciding leverage.

- Year 1: 1:2–1:5

- Year 2: 1:6–1:15

- Year 3: 1:16–1:25

- Year 4+: Only increase leverage if consistently profitable

This gradual approach keeps risk in check and aligns with advice from seasoned traders: maintain low leverage until you can trade successfully without major losses.

Risk Management for Small Accounts

Leverage is only half the equation—risk management is equally critical.

Key rules for small accounts:

- Risk 1–2% per trade (e.g., $1–$2 on a $100 account)

- Always use stop-loss orders to prevent one trade from wiping your account

- Stick to micro lots (0.01) for better control

- Keep margin above 300%; below 100% risks a margin call

- Avoid overtrading; quality setups beat quantity

Even with the right leverage, poor habits—like skipping stops, overtrading, or chasing losses—can quickly drain an account. High leverage amplifies these mistakes, so discipline is essential.

Demo Accounts: Practice Safely

Before trading real money, test your strategy and leverage on a MetaTrader 5 demo account.

- Match your demo balance to your planned real account (e.g., $50)

- Use your intended leverage (e.g., 1:10)

- Track performance for at least a month

Demo trading builds safe habits without emotional pressure, making the transition to real money smoother.

Growing Small Accounts into Bigger Ones

Follow a disciplined plan to turn small balances into meaningful growth:

- Start with $50–$100

- Use 1:10 leverage

- Risk 1–2% per trade

- Focus on high-quality trades, not quantity

- Compound profits gradually

Example:

- Gain 5% per month on $100 → $5/month

- After 1 year → ~$180

- After 2 years → ~$325

- After 3 years → ~$590

Adding occasional deposits accelerates growth. Small, consistent gains—rather than risky bets—turn tiny accounts into substantial ones. Over time, you can experiment with higher leverage ratios like 1:100 or 1:500, but only after understanding how each setting affects risk and returns.

Common Mistakes with Leverage

Even experienced traders can slip if they misuse leverage. Common pitfalls include:

- Using excessive leverage too soon

- Ignoring stop-loss orders

- Overtrading or chasing losses

- Trading without a clear plan

Avoiding these mistakes is the fastest path to consistent, sustainable growth.

Who Should Use 1:100 vs 1:500 Leverage

Beginners often fall into common traps:

- Using the maximum leverage just because the broker allows it

- Risking 20–50% of their account on a single trade

- Adding to losing trades

- Ignoring stop-loss orders

- Trading too many currency pairs at once

Even the “best leverage” for micro accounts won’t save you if these mistakes happen.

Why Brokers Promote High Leverage

If high leverage is risky, why do brokers offer it?

High leverage attracts new traders with the promise of fast profits. A 1:1000 offer looks tempting, and many sign up without fully understanding the risks. Brokers earn from spreads and commissions, so more trading means more profit for them. Some market themselves as the “best forex brokers” by highlighting high leverage, giving traders the perception of flexibility and opportunity.

This doesn’t make them bad—but it does mean you need to protect yourself. Just because 1:1000 is available doesn’t mean it’s the right leverage for growing a small account.

The Psychology of Leverage

Leverage isn’t just math—it’s mental.

- High leverage fuels greed and fear: it makes small market moves feel huge and can lead to panic or impulsive decisions.

- Low leverage provides calm and control: it lets you focus on the trade rather than the emotional swings.

That’s why the best leverage for beginners isn’t about chasing big wins—it’s about preserving balance.

Quick Checklist: Best Leverage for Small Accounts

- Start with 1:10 or lower

- Risk 1–2% per trade

- Trade micro lots (0.01)

- Focus on fewer, high-quality setups

- Compound profits gradually

Whether you have a $50 micro account or $100, this approach works.

Final Thoughts

Leverage is a tool—like a hammer, it can build or destroy.

The best leverage for a small account isn’t the maximum allowed—it’s the one that keeps you safe while supporting steady growth. For most beginners, that’s 1:10, striking a balance between opportunity and risk.

High ratios like 1:500 or 1:1000 can be useful, but only if you have the education, discipline, and experience to handle them. For beginners, starting small and controlled is the safest path. Over time, as skills and confidence grow, higher leverage can become a tool rather than a trap.

Growing a small account is not about overnight gains—it’s about patience, discipline, and smart risk management.

A key step is choosing a reliable broker. Dominion Markets offers up to 500:1 leverage, tight 0.1 spreads, and fast, dependable execution—giving small account traders the environment to grow confidently.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: