Risk-to-Reward Ratio in Forex: Simple Guidelines for Smarter Trade Entries

Every forex trade involves balancing potential profit against possible loss. The key metric for this is the risk-to-reward ratio (R:R)—a simple yet powerful tool that guides better trade decisions.

While many traders focus on indicators or signals, the most successful ones prioritize mastering this ratio. Traders at Dominion Markets benefit from tight spreads and fast execution, which make it easier to apply precise risk-to-reward strategies. This ratio is essential for long-term success and keeps emotions from driving your trades.

Here’s a closer look at what the risk-to-reward ratio is and how to use it to improve your entries.

What Is the Risk-to-Reward Ratio in Forex?

The risk-to-reward ratio compares how much you’re willing to risk versus the potential profit you aim to achieve. It underpins every trading strategy—whether scalping, swing trading, or long-term positioning.

Formula: R:R=Entry Price – Stop LossTake Profit – Entry Price\text{R:R} = \frac{\text{Entry Price – Stop Loss}}{\text{Take Profit – Entry Price}}R:R=Take Profit – Entry PriceEntry Price – Stop Loss

Example:

- Entry: 1.1000

- Stop Loss: 1.0950

- Take Profit: 1.1100

- Risk: 50 pips

- Reward: 100 pips

- Risk-to-Reward Ratio: 1:2

This means you risk 1 unit to potentially gain 2. Understanding this simple calculation is what separates disciplined traders from gamblers. For more on precise entries, see our guide comparing buy stop vs buy limit orders.

Why the Risk-to-Reward Ratio Matters

The risk-to-reward ratio allows you to remain profitable even if you lose a significant portion of your trades.

Example with a 1:2 ratio:

- 5 losing trades = –$500

- 5 winning trades = +$1,000

- Net Profit: +$500

You don’t need to win every trade; your wins just need to outweigh your losses. This is the key advantage of using the risk-to-reward ratio—it safeguards your account even when the market goes against you.

To see how position sizing and leverage affect this ratio, check out our guide on how leverage impacts forex trades.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Don’t Chase Unrealistic Forex Ratios

Avoid Chasing Unrealistic Forex Ratios

Many traders assume that higher risk-to-reward ratios are always better, targeting extreme levels like 1:5 or 1:6. However, this approach can backfire.

Here’s why:

- Tight stop losses are more likely to be triggered by normal market fluctuations.

- Extremely wide profit targets may never be reached before the market reverses.

While a 1:5 ratio may look appealing on paper, it often fails in real-world trading. A more realistic and consistent ratio, such as 1:2 or 1:3, tends to perform better across hundreds of trades.

For insights on how leverage affects this, check out 1:100 vs 1:500 leverage comparisons.

Choosing the Right Risk-to-Reward Ratio in Trading

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

How to Pick the Right Risk-to-Reward Ratio in Trading

Your optimal ratio depends on your trading style and the market’s behavior. Here’s a simple breakdown:

- Scalping trades – Short-term setups usually work with 1:1 or 1:1.5.

- Day trading – Medium-term setups often suit around 1:2.

- Swing trading – Longer-term trades can target 1:3 or higher.

Always let the market dictate your ratio; don’t force it. A risk-to-reward ratio only works when it aligns with your chart structure, time frame, and market volatility. For beginners, studying support and resistance levels can help fine-tune entries.

Leverage also influences this balance, as it affects position size and margin control. Choosing the right leverage can help maintain a better risk-to-reward balance—check out guides on optimal leverage in forex trading for insights.

Example: Gold (XAU/USD) Trade

Let’s illustrate with a practical scenario.

Scenario 1:

Example: Gold (XAU/USD) Trade

- Entry: $1,800

- Stop Loss: $1,790

- Take Profit: $1,830

→ Risk-to-reward ratio: 1:3

Scenario 2:

Example: Gold (XAU/USD) Trade

- Entry: $1,800

- Stop Loss: $1,750

- Take Profit: $2,000

→ Risk-to-reward ratio: 1:4

The first setup is more practical for short-term trades. The second setup seems appealing but could take weeks to reach its target. Savvy traders focus on realistic, achievable goals rather than distant dreams—especially when designing an XAU/USD strategy that balances timing and potential reward.

Rules for Smarter Trade Entries Using the Risk-to-Reward Ratio in Forex

- Always Set Stop Loss and Take Profit

Never enter a trade without predefined levels. This locks in your risk-to-reward ratio before the market moves. The stop loss defines your maximum loss, while the take profit sets your reward target. Knowing how to use stop losses effectively keeps your trades controlled and emotions in check. - Keep Risk Per Trade Consistent

Most traders risk 1–2% of their account per trade. For example, on a $5,000 account, risk no more than $100 per trade. This approach allows you to manage losses calmly, even during a losing streak. - Use Market Structure for Stops and Targets

Place stops below strong support or above resistance, and set targets near zones where price frequently reacts. This ensures your risk-to-reward ratio is based on logic, not guesswork. - Skip Weak Setups

If a trade doesn’t offer a favorable risk-to-reward ratio naturally, don’t take it. Successful traders win by avoiding poor opportunities. - Track Every Trade

Record ratios, wins, and losses. After 50 trades, patterns emerge, helping you see whether 1:2 or 1:3 setups suit your strategy best. You can also backtest using tools like the MT5 Simulator.

Win Rate vs. Risk-to-Reward: Finding the Balance

A strong risk-to-reward ratio alone isn’t enough; your win rate matters too.

| Win Rate | Ratio | Profit Outcome (10 Trades, $100 Risk) |

|---|---|---|

| 40% | 1:3 | +$200 |

| 50% | 1:2 | +$200 |

| 70% | 1:1 | +$400 |

Profitability comes from balancing your win rate and risk-to-reward ratio. You don’t need both to be perfect, but they must complement each other.

How Risk-to-Reward Builds Emotional Discipline

Using the ratio isn’t just math—it’s mindset. Knowing your risk and reward in advance prevents emotional reactions. You stop chasing losses, accept small losses calmly, and trust that your next big win will cover them. This disciplined approach separates professional traders from impulsive ones.

Common Mistakes When Applying Risk-to-Reward Strategies

- Ignoring Spread and Commission: Trading costs affect your real ratio, especially for small targets.

- Moving Stop Loss: Altering your stop after entry destroys the planned ratio. Accept the loss as initially defined.

- Using the Same Ratio for Every Trade: Adjust for market volatility and chart structure.

- Not Testing Your Strategy: Backtest at least 100 trades to identify statistically profitable ratios.

Advanced Tip: Track Your Expectancy

Your goal isn’t just a high risk-to-reward ratio—it’s positive expectancy.

Expectancy Formula: \text{Expectancy} = (\text{Win%} \times \text{Average Win}) – (\text{Loss%} \times \text{Average Loss})

Example:

- Win 50% of trades with a 1:2 ratio

- Win side: 0.5 × $200 = $100

- Loss side: 0.5 × $100 = $50

- Expectancy: +$50 per trade

This calculation shows your real trading edge, helping you refine your risk-to-reward approach.

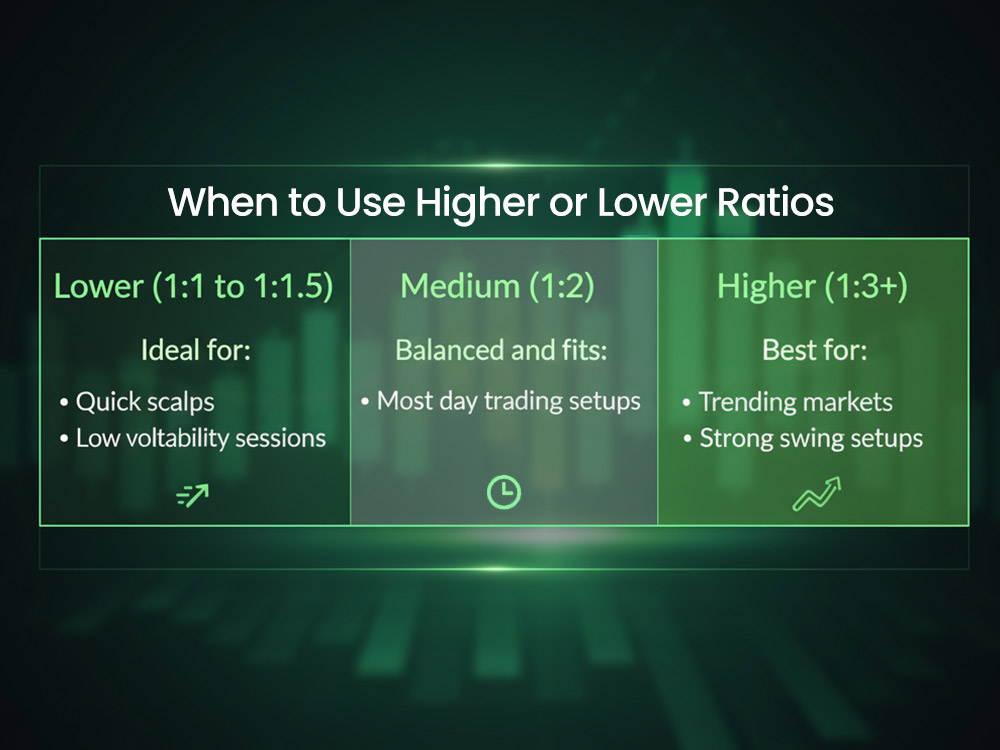

When to Use Higher or Lower Ratios

Your choice of ratio should depend on trade setup, market conditions, and time horizon. A higher ratio (like 1:4) works for long-term trades with clear trends, while lower ratios (1:1 or 1:2) suit short-term or more frequent entries.

I can also rephrase the “When to Use Higher or Lower Ratios” section with practical examples and visuals to make it clearer if you want. Do you want me to do that?

When to Use Higher or Lower Risk-to-Reward Ratios

- Lower Ratios (1:1 to 1:1.5): Best suited for quick scalps or low-volatility sessions.

- Medium Ratios (1:2): Balanced, fitting most day trading setups.

- Higher Ratios (1:3+): Ideal for trending markets or strong swing trades.

The “best” ratio depends on your personality, patience, and trading system. There’s no universal number—it’s about what you can consistently execute.

If you trade with a smaller account, leverage can significantly influence how fast your balance grows—or declines. For guidance, see which leverage is most suitable for small accounts.

How to Improve Your Risk-to-Reward Ratio Without Changing Your Strategy

- Enter Closer to Support or Resistance

Tighter stops with the same targets instantly improve your ratio. - Trail Your Stop as Price Moves

Lock in profits while keeping your risk-to-reward ratio favorable mid-trade. - Take Partial Profits

Close part of your position at 1:1 and let the remainder run to 1:2 or 1:3. This hybrid method smooths your equity curve. - Focus on Fewer, High-Quality Setups

Avoid overtrading. The best setups often align with high-probability risk-to-reward opportunities.

Final Thoughts

The risk-to-reward ratio isn’t just another trading concept—it’s a survival tool. It adds structure to every trade, protects your capital, and improves decision-making.

Follow these simple rules to make it second nature:

- Plan trades before entering.

- Let market structure define your ratio.

- Keep risk per trade small.

- Track results and maintain discipline.

Success in forex isn’t about being right all the time—it’s about making more when you’re right than what you lose when you’re wrong. Mastering the risk-to-reward ratio gives you this edge.

For traders looking to apply these principles on a precise platform, Dominion Markets offers 0.1 spreads, fast execution, and flexible risk management tools that support disciplined trading with clear risk-to-reward setups.

FAQ: Risk-to-Reward Ratio in Forex

- What is a good risk-to-reward ratio in forex trading?

- Can I use the same ratio for every trade?

- Why is the risk-to-reward ratio important?

- How can I improve my risk-to-reward ratio?

- Is a 1:1 ratio sufficient for beginners?

Start Your Trading Journey Today

If you want, I can also rework the FAQ section into concise, reader-friendly answers for faster understanding. Do you want me to do that?

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: