What Is an Order Block in Forex? A Beginner’s Guide to Smart Money

Introduction

Trading forex can be challenging. Prices move quickly, and many traders struggle to keep pace. Large institutions—like banks, hedge funds, and other major players—drive much of the market with trades worth millions. These big orders often dictate where price moves next.

Retail traders, who trade much smaller amounts, can benefit by spotting the “footprints” left by these institutions. One way to track these footprints is through order blocks. For traders seeking low-cost trading conditions, brokers like Dominion Markets provide tight 0.1-pip spreads and raw pricing, making it easier to trade around these zones.

Understanding order blocks helps you identify where smart money is active. This guide explains what an order block is in forex, why it matters, and how to trade it.

What Is an Order Block in Forex?

An order block is a price zone where large traders have placed clusters of buy or sell orders, rather than a single massive trade. Institutions use this method to prevent sudden price spikes that could affect their entry.

When these large orders hit the market, they leave a visible mark on charts. Price often reacts strongly around these zones—resulting in sharp moves, sudden drops, or brief pauses before a breakout.

In simple terms: an order block is a footprint of smart money. Understanding them allows traders to analyze charts the way institutions do.

Why Institutions Use Order Blocks

Big players cannot place huge orders all at once. Doing so would push the price sharply and alert other traders. Instead, they split orders into smaller pieces, which accumulate in specific zones on the chart.

By studying order blocks, retail traders can identify these high-activity areas. When price reacts to these zones, it often indicates where large institutions have entered or defended positions, offering traders insight into potential high-probability trades.

Why Order Blocks Matter

For retail traders, order blocks highlight where major players act. These zones often align with traditional support and resistance levels, and price tends to react when revisiting them.

Key benefits of trading with order blocks:

- Identify areas of high interest for large traders.

- Spot potential reversals or strong price moves.

- Use them to set better stop losses and take profits.

- Improve trade timing when combined with other technical tools.

By observing order blocks, you can align your trades with smart money and make more informed decisions.

Start Your Trading Journey Today

Signup

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Different Types of Order Blocks in Forex

Types of Order Blocks in Forex

In forex trading, order blocks come in several forms, each influencing price behavior in different ways.

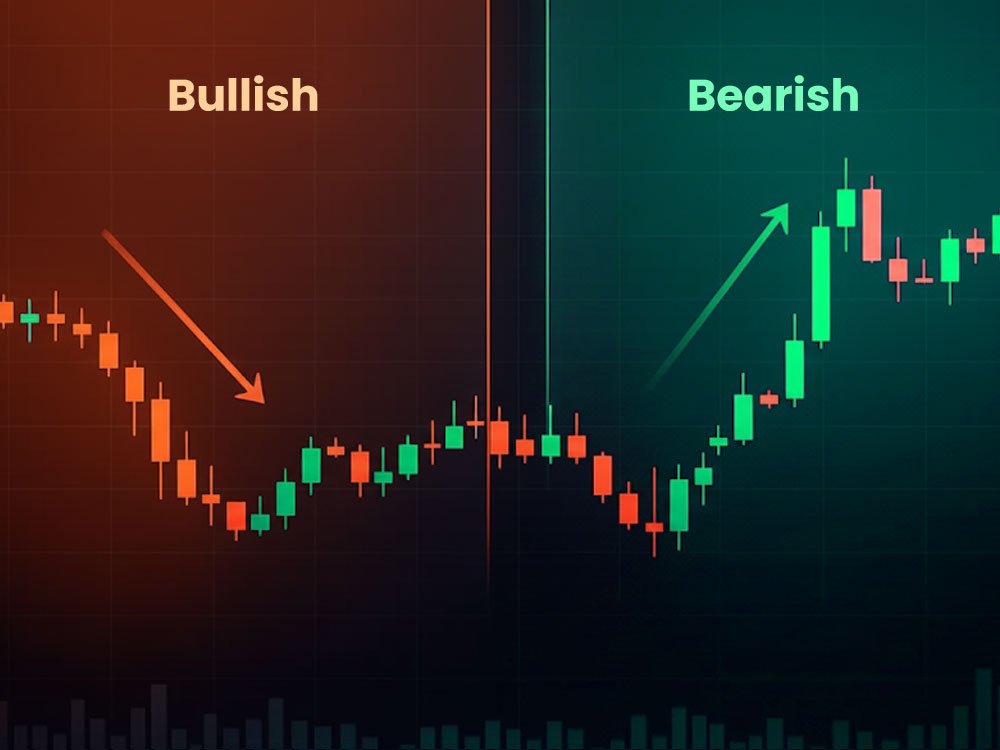

Bullish Order Block

- Appears after a price decline.

- Indicates significant buying activity by large traders.

- Acts as a support zone.

- Price often rebounds when it returns to this area.

Bearish Order Block

- Appears after a price rise.

- Marks where heavy selling occurred.

- Serves as a resistance zone.

- Price often drops when it revisits this level.

Breaker Block

- Forms when price breaks through a previous block.

- The old block may reverse its role: support can become resistance, or vice versa.

Rejection Block

- Occurs when price attempts to break a block but fails.

- Shows strong pushback from large traders.

- Often signals false breakouts.

Vacuum Block

- Represents areas with minimal trading activity.

- Price moves quickly through these zones, creating imbalances.

- These gaps can attract price back later to fill them.

Understanding these types of order blocks helps traders recognize patterns on forex charts and trade with greater confidence.

Next: How to Identify Order Blocks in Forex

How to Identify Order Blocks in Forex

Recognizing order blocks takes practice, but there are clear signs traders can watch for:

1. Strong Move After a Zone

Look for areas where price pauses briefly before making a sharp move—up, down, or a breakout. That pause often marks an order block.

2. Clusters of Candles

Identify groups of candles trading in a tight range before a strong move. The last bullish or bearish candle before the surge typically defines the block.

3. Volume Clues

High volume often signals smart money activity. Tools like On-Balance Volume, Volume Price Trend, or Klinger indicators can confirm strong activity around the block.

4. Liquidity Sweeps

Institutions often push price beyond previous highs or lows to trigger stop orders and collect liquidity before reversing. Spotting this behavior often points to a valid block.

5. Price Imbalance

Rapid moves away from a zone leave thinly traded areas. These gaps or imbalances reinforce the significance of the block.

6. Support and Resistance

Blocks often align with strong support or resistance levels. Repeated bounces at a level may indicate an order block. Support/resistance indicators and focusing on the best forex pairs for trading can help validate these zones.

Mastering identification requires patience and consistent observation.

Valid vs. Weak Order Blocks

Not all blocks carry the same weight.

Valid Order Block:

- Shows a liquidity sweep before formation.

- Has a sharp move creating imbalance.

- Has not yet been retested.

Weak or Fake Block:

- Lacks a liquidity grab.

- Shows smooth, weak movement afterward.

- Already retested or filled.

- Little reaction when price returns.

Understanding this distinction improves results when using order block strategies.

How to Trade Order Blocks

Step 1: Identify the Block

Use higher timeframes (4-hour or daily) for stronger signals. Mark the last bullish or bearish candle before the big move and draw the zone.

Step 2: Wait for Price to Return

Patience is key. Enter only when price revisits the block.

Step 3: Look for Confirmation

Watch for:

- Reversal candlestick patterns (engulfing, hammer, shooting star).

- Long wicks indicating rejection.

- Strong support or resistance holding.

Step 4: Enter the Trade

- Bullish block holds → consider long.

- Bearish block holds → consider short.

Step 5: Place Stop Loss

Protect your trade:

- Long → stop below the zone.

- Short → stop above the zone.

Step 6: Take Profit

Target the next support/resistance level or use a risk-reward ratio, commonly 2:1.

Step 7: Manage Risk

Never risk more than you can afford. Combine blocks with trendlines, RSI, MACD, or other indicators for higher probability setups.

This structured approach combines the theory of order blocks with practical trading skills, helping traders align with smart money movements.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Examples of Using Order Blocks

Example 1: Bullish Block

- Price drops into a support zone.

- A tight cluster of candles forms.

- Price rallies sharply upward afterward.

- When price returns to the same zone, it often bounces again.

- Traders can consider buying with a stop placed below the block.

Example 2: Bearish Block

- Price climbs into a resistance area.

- A small pause occurs before a steep decline.

- This pause defines the bearish block.

- Later, when price retests the zone, it drops again.

- Traders can sell with a stop placed above the block.

Example 3: Breaker Block

- Price breaks through a previous bullish block.

- That zone later acts as resistance.

- Traders may short when price revisits it.

- For more details on trade entries, see our guide on Buy Stop vs Buy Limit.

Common Mistakes to Avoid

New traders often misuse order blocks. Watch out for:

- Labeling every candle cluster as a block.

- Ignoring volume and liquidity signals.

- Trading blocks on very low timeframes.

- Entering trades without confirmation.

- Skipping stop-loss placement.

Avoiding these errors helps you trade smarter. Traders using fast setups may also benefit from learning about scalping strategies in forex.

Order Blocks vs. Supply and Demand Zones

Order blocks and supply-demand zones can look similar, as both indicate areas where buyers or sellers are strong. The difference lies in focus:

- Supply/Demand Zones: broader areas where price reversed previously.

- Order Blocks: narrower zones tied to institutional activity.

Many traders combine both for more reliable setups.

When Order Blocks Work Best

Order blocks tend to be more effective under certain conditions:

- In markets with strong liquidity.

- During clear trends.

- On higher timeframes.

- When confirmed by other indicators or signals.

They are less reliable:

- During major news events.

- In choppy, sideways markets.

- On very low timeframes.

Risk Management With Order Blocks

Always combine order block trading with proper risk management. Use stop-loss orders, monitor position sizes, and avoid overleveraging to protect your account while trading these zones.

Risk Management With Order Blocks

No trading setup is foolproof. Even order blocks can fail, which makes solid risk management essential. For more on avoiding large losses, see our guides on leverage trading strategies for beginners and margin calls in forex.

Risk Management Tips:

- Place stop-loss orders just beyond the block.

- Only risk a small portion of your account per trade.

- Set realistic profit targets.

- Avoid chasing trades if the block has already been tested.

- Track your trades and refine your approach over time.

Remember: trading is about survival first, profits second.

The Role of Smart Money

Order blocks originate from the concept of smart money—the large, informed traders who move the markets. By recognizing their footprints, retail traders can align with market strength instead of trading against it.

You don’t need to know the exact reason behind their trades. The blocks they leave provide clues on where the market might react. Following these cues is about alignment, not imitation. This mindset is crucial to mastering order block trading in forex.

Practicing With Order Blocks

Reading theory alone isn’t enough. Practice is key. Here’s how:

- Backtest on historical charts. Mark zones and study price reactions.

- Start with higher timeframes for clearer signals.

- Use demo accounts to practice live setups without risk.

- Keep a trading journal for every block trade. Record what worked and what didn’t.

The more you practice, the sharper your ability to spot and trade order blocks. For structured testing, see our guide on backtesting in MetaTrader. Beginners can also review our forex trading basics guide to build a solid foundation.

Key Takeaways

- An order block marks where institutions place large trades.

- They act as support or resistance and can trigger strong moves.

- Valid blocks show liquidity sweeps, sharp moves, and no prior retests.

- Combine order blocks with other tools and always manage risk.

Conclusion

Order blocks are powerful tools that highlight where big money is active. Learning to read them improves entries, exits, and risk management.

For beginners:

- Focus on spotting blocks first.

- Observe price behavior.

- Confirm setups with other indicators.

- Keep trade sizes small until confidence grows.

High leverage can amplify results but also increases risk. Brokers like Dominion Markets offer raw spreads, tight 0.1 pips, and 500:1 leverage, helping traders implement order block strategies efficiently when used responsibly.

Smart money drives the market. By understanding what an order block is in forex, you trade alongside institutions rather than against them.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: