Candlestick patterns help traders quickly understand market sentiment, and the Harami candlestick is one of the most recognizable formations. It’s easy to identify and often serves as an early indication of a potential trend reversal. The Harami shows when momentum begins to fade — signaling that buyers or sellers may be losing control — making it a valuable tool for identifying entry and exit points or setting risk parameters.

This guide provides a complete overview of the Harami candlestick pattern, explaining both bullish and bearish variations. You’ll discover how the pattern forms, what it signifies, the market psychology behind it, and how traders can apply it effectively through proven strategies and real-world examples.

We’ll also touch on how reputable brokers like Dominion Markets emphasize tight spreads and effective risk management tools — essential features for traders who rely on candlestick setups to guide their decisions.

What Is the Harami Candlestick?

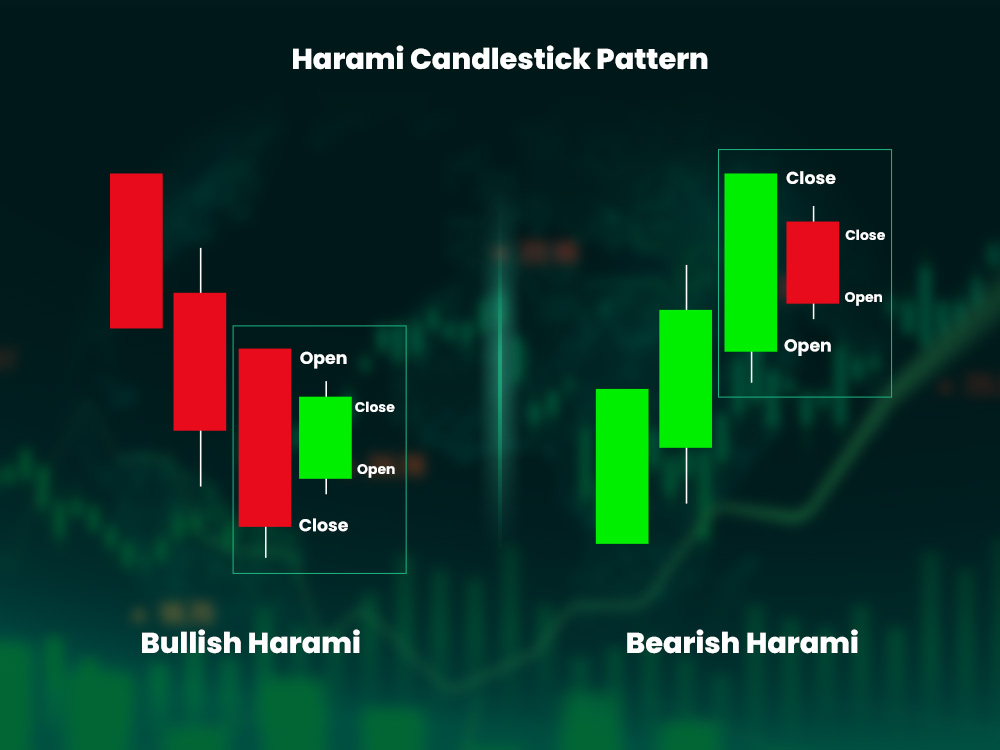

The term “Harami” comes from Japanese, meaning “pregnant.” The Harami candlestick pattern, also called the pregnant candlestick, visually resembles a mother and child — where the first candle represents the dominant market move, and the second smaller candle forms within it, showing hesitation or loss of momentum.

Typically, the first candle is large, reflecting strong directional strength, while the second candle is smaller and completely contained within the first, signaling indecision in the market.

The Harami pattern always consists of two candles:

- Candle 1: A strong move in the direction of the prevailing trend, showing clear control by buyers or sellers.

- Candle 2: A much smaller candle that fits within the first one’s body, suggesting that momentum is fading and control is weakening.

When this smaller candle appears, it signals a potential pause or shift in sentiment. The driving side of the market is losing conviction, which is why the Harami pattern is often seen as an early reversal signal, hinting that a change in trend may be approaching.

Why the Harami Candlestick Pattern Matters

Market trends change when one side begins to lose control — buyers drive prices higher, sellers push them lower, and when momentum fades, the opposing side gains strength.

The Harami candlestick pattern captures this exact transition, making it a valuable signal for traders. It’s important because:

- It reveals that the current trend is weakening.

- It indicates a potential shift in market direction.

- It provides traders with an early warning to reassess their positions.

While the Harami isn’t the strongest reversal pattern on its own, it becomes far more reliable when combined with confirmation tools such as volume spikes, RSI divergence, or key support and resistance zones. These additional signals help traders filter out false setups and turn the Harami from a simple chart pattern into a practical, actionable trading tool.

Bullish Harami Candlestick Pattern Explained

The bullish harami forms during a downtrend, signaling that selling pressure may be weakening and buyers are beginning to step in.

Structure:

- Day 1: A long red (bearish) candle closes near its lows, showing strong seller control.

- Day 2: A smaller green (bullish) candle forms entirely within the body of the previous red candle.

This pattern indicates that sellers are losing momentum while buyers are cautiously entering the market.

Psychology Behind the Bullish Harami

On the first day, sellers dominate the market. On the second day, the price stabilizes instead of continuing to fall — a sign that bearish strength is fading. This hesitation often catches sellers off guard and gives buyers confidence to re-enter. If the following session confirms bullish momentum, a trend reversal may begin.

How to Trade the Bullish Harami Pattern

- Aggressive Entry: Enter a long position near the close of the second candle. Place a stop-loss below the lowest low of the two candles. (Learn more in our guide on setting stop-losses in forex trading.)

- Conservative Entry: Wait for the next candle to close above the high of the bullish harami for confirmation before entering long.

The bullish harami setup is most effective when it forms near strong support zones or in oversold market conditions, where the probability of a reversal is higher.

Bearish Harami Candlestick Pattern Explained

Bearish Harami Candlestick Pattern Explained

The bearish harami forms during an uptrend, signaling that buying momentum may be fading and sellers could soon regain control.

Structure:

- Day 1: A long green (bullish) candle closes near its highs, showing strong buyer dominance.

- Day 2: A smaller red (bearish) candle forms completely within the body of the first candle.

This pattern suggests that the strong upward momentum is weakening. If sellers confirm with continued downside movement, a trend reversal is likely underway.

Psychology Behind the Bearish Harami

On the first day, buyers are firmly in control, driving prices higher. By the second day, the market struggles to continue its rise — a clear sign of hesitation. Sellers recognize this weakness and begin to step in. If the price breaks lower afterward, bearish sentiment takes over, marking the start of a potential downtrend.

How to Trade the Bearish Harami

- Aggressive Entry: Enter a short position near the close of the second candle. Place a stop-loss above the highest high of both candles.

- Conservative Entry: Wait for the next session and enter short only if price breaks below the low of the harami formation for confirmation.

The bearish harami is more reliable when accompanied by rising volume during the reversal or when RSI indicates overbought conditions.

Real Example: Bullish Harami Pattern

Real Example: Bullish Harami Pattern

Let’s take Gold/USD as an example in a clear downtrend. One session closes with a long red candle, confirming strong selling pressure. The following session forms a small green candle — a bullish harami — entirely contained within the body of the red candle. Meanwhile, the RSI indicates oversold conditions. On the next day, price breaks above the green candle’s high, confirming bullish momentum.

A trader enters a long position, places a stop-loss just below the red candle’s low, and benefits from the rebound as gold gains several dollars per ounce over the week. (For more detailed guidance, see our article on forex trading strategies for gold.)

Final Thoughts

The harami candlestick pattern is straightforward yet highly effective when applied with context and discipline. Traders using platforms such as Dominion Markets can enhance their results by combining this setup with advantages like tight spreads, fast execution, and access to advanced tools on platforms like MetaTrader 5 (MT5) — allowing for greater precision in real-world trading.

In essence:

- The bullish harami warns that selling pressure may be easing, giving traders a chance to prepare for a potential rebound.

- The bearish harami suggests buying strength is weakening, hinting that a downward turn might follow.

By identifying these formations, waiting for confirmation, and applying sound risk management, traders can make the harami pattern a reliable component of their technical trading strategy.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: