“95% of all traders fail” is the most frequently cited statistic related to trading across the internet. However, no scientific study definitively confirms this figure. In fact, research suggests the actual failure rate may be even higher. In this article, we’ll share 24 surprising statistics uncovered by economic scientists who analyzed real broker data and trader performance. Many of these statistics clearly explain why most traders lose money.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Key Statistics About Trader Performance

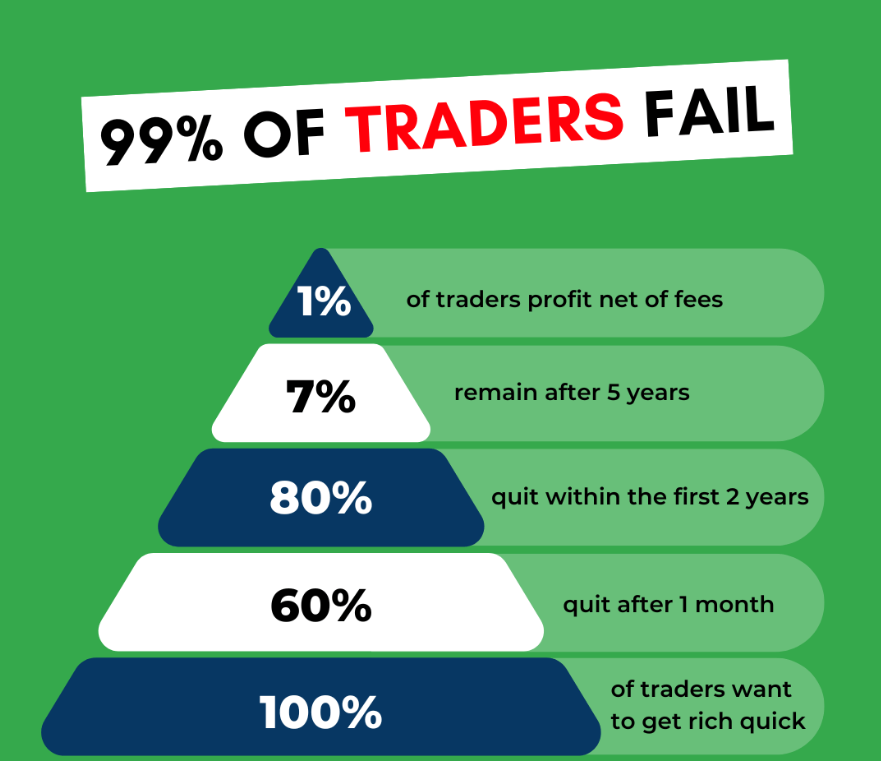

- 95% of traders fail.

- 80% of day traders quit within the first two years.

Among day traders, nearly 40% trade for only one month. After three years, just 13% remain active, and after five years, only 7% continue day trading.¹ - Traders sell winning trades 50% more often than losing ones.

About 60% of sales are winners, while 40% are losers.² - **Individual investors underperform market indexes by 1.5% annually; active traders underperform by 6.5%.**³

- **Only about 1% of day traders consistently make profits after fees.**¹

- **Traders with negative track records of up to 10 years continue trading, indicating a persistence even when signals suggest they lack skill.**¹

- **Profitable day traders make up only 1.6% of all traders yearly but account for 12% of total day trading activity.**¹

- **Profitable traders tend to increase their trading volume more than unprofitable ones.**¹

- **Lower-income individuals spend a higher proportion of their income on lottery tickets, with demand rising as income decreases.**⁴

- **Investors with a large gap between their current economic status and aspirations tend to hold riskier stocks.**⁴

- **Men trade more frequently than women; unmarried men trade more than married men.**⁵

- **Poor, young men in urban areas, especially minorities, invest more in stocks with lottery-like features.**⁵

- **Within income groups, gamblers tend to underperform non-gamblers.**⁴

- **Investors commonly sell winning investments but hold onto losers longer.**⁶

- **Trading volume in Taiwan dropped by about 25% after a lottery was introduced in 2002.**⁷

- **During periods of large lottery jackpots, individual investor trading declines.**⁸

- **Investors are more likely to repurchase stocks they previously sold for a profit than those sold at a loss.**⁹

- **Increased online search activity for a particular stock predicts higher returns over the following two weeks.**¹⁰

- **Individual investors trade more actively following successful trades.**¹¹

- **“Trading to learn” is no more rational or profitable than playing roulette for the individual investor.**¹

- The average day trader loses money significantly after accounting for transaction costs.

- In Taiwan, losses from individual investors amount to about 2% of GDP.

- Investors tend to overweight stocks in the industries where they work.

- Traders with higher IQs hold more mutual funds and a larger number of stocks, benefiting more from diversification.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Conclusion: Why Most Traders Lose Money

After reviewing these 24 statistics, it becomes clear why so many traders fail. Often, trading decisions are driven not by solid research, tested strategies, or disciplined journaling, but by emotions, entertainment, and unrealistic hopes of quick riches.

Traders frequently forget that trading is a profession requiring skills developed over years. Be mindful of your trading decisions and realistic about your expectations. Don’t expect to become a millionaire overnight, but recognize the opportunities that disciplined online trading offers.

At Tradeciety, we developed the Edgewonk trading journal, a powerful tool that helps traders track and analyze their trades to improve performance. Keeping a trading journal is a critical step toward becoming a professional trader and taking your trading seriously.

References

- Barber, Lee, Odean (2010): Do Day Traders Rationally Learn About Their Ability?

- Odean (1998): Volume, Volatility, Price, and Profit When All Traders Are Above Average

- Barber & Odean (2000): Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors

- Kumar: Who Gambles In The Stock Market?

- Barber, Odean (2001): Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment

- Calvet, Campbell & Sodini (2009): Fight or Flight? Portfolio Rebalancing by Individual Investors

- Barber, Lee, Liu & Odean (2009): Just How Much Do Individual Investors Lose by Trading?

- Gao & Lin (2011): Do Individual Investors Trade Stocks as Gambling? Evidence from Repeated Natural Experiments

- Strahilevitz, Odean & Barber (2011): Once Burned, Twice Shy: How Naïve Learning, Counterfactuals, and Regret Affect the Repurchase of Stocks Previously Sold

- Da, Engelberg & Gao (2011): In Search of Attention

- De, Gondhi & Pochiraju (2010): Does Sign Matter More Than Size? An Investigation Into the Source of Investor Overconfidence

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: