From Cautious to Confident: Choosing the Right Forex Leverage

Leverage allows you to trade with more capital than you actually have, turning small gains into significant profits—but it can also wipe out your account in seconds. Even a minor market move against your position can erase your funds, and if a trade moves past your stop-loss, you might owe more than you deposited. It’s fast, unforgiving, and often irreversible.

Selecting the right broker is crucial for improving your chances of success. Dominion Markets offers low-latency execution and tight spreads, helping minimize the effects of slippage and market volatility. Accurate order fills and competitive pricing make it easier to manage trades, even when using leverage. While no broker can eliminate risk, trading on a reliable platform like Dominion Markets equips you with the tools to handle it more effectively.

Forex trading can be thrilling—but it comes with real risk. One of the most important decisions a trader makes is how much leverage to use. The right choice allows you to manage risk while growing your account steadily. The wrong choice can wipe out weeks or even months of progress. With high leverage, even a tiny market swing can cause significant losses.

For traders who value precision and cost-efficiency, Dominion Markets stands out. Their ultra-low spreads and tight pip pricing allow for cleaner trade entries and exits, reducing the impact of slippage. This is particularly important for scalpers and day traders, where every pip counts. Dominion also provides fast execution, transparent fees, and strong support—tools that help traders focus on strategy rather than obstacles.

Now, let’s explore how to select the right leverage for your trading style, skill level, and risk tolerance.

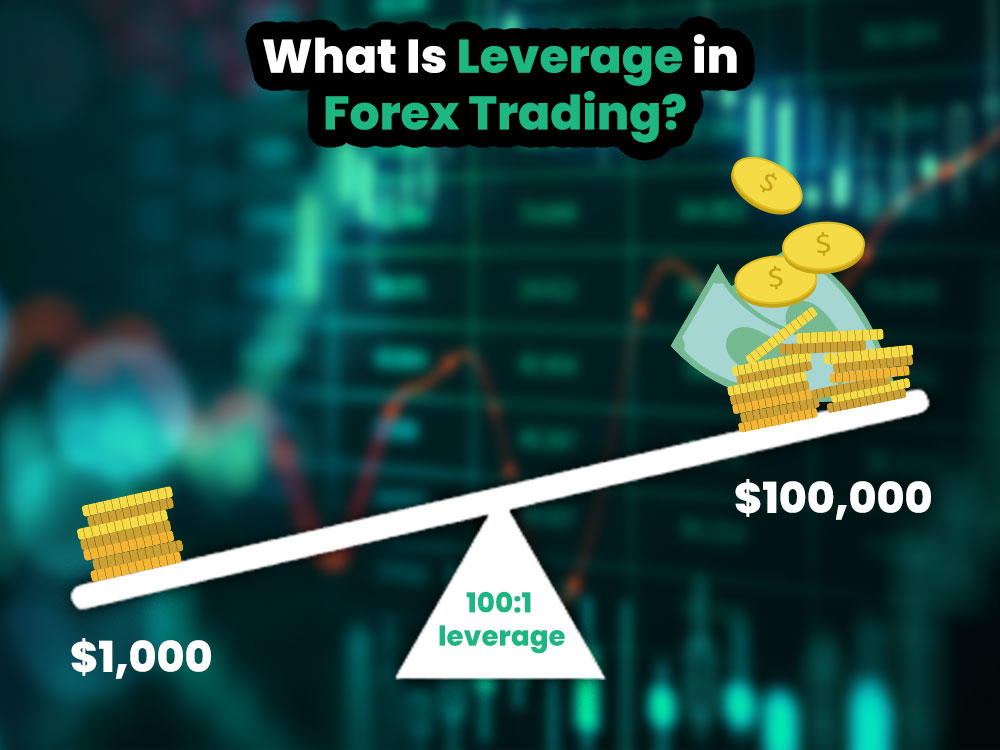

What Is Leverage in Forex Trading?

Leverage lets you control a larger position than your account balance by borrowing funds from your broker. For example, with 100:1 leverage, you can control $100,000 in the market with only $1,000 of your own capital. This magnifies both potential gains and potential losses, making it essential to understand and manage leverage carefully.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Bigger Losses

Using leverage can amplify your profits—but it also magnifies losses. A trade moving just a few points in your favor can feel exciting, but if it moves against you, the impact can be equally dramatic. The larger your position size, the more each pip affects your account. Understanding this balance is essential for managing the risks of high-leverage trading.

Leverage is simply a tool. Like any tool, it can work for you—or against you. The key is knowing how to use it wisely.

Why Leverage Matters in Forex Trading

High leverage offers the potential for quick gains—but it can wipe out your account just as quickly. Even a small move against your position may trigger a margin call, where your broker closes your trade to limit losses. This could result in losing your entire invested amount for that trade.

Leverage amplifies both potential rewards and potential risks. Choosing the right leverage level is therefore crucial. If you’re unsure, check out our article on forex leverage explained, which simplifies the concept and helps you make smarter trading decisions.

Common Leverage Levels in Forex Trading

Forex brokers provide a range of leverage options, including:

- 1:1 (no leverage)

- 10:1

- 20:1

- 50:1

- 100:1

- 200:1

- 500:1

Some brokers, like Dominion Markets, offer up to 500:1 leverage. For experienced traders who can manage risk effectively, this provides flexibility to scale trades without needing a large account balance. It’s a powerful tool when used with discipline.

However, high leverage isn’t suitable for everyone. Most beginners should avoid it until they gain experience. If you’re considering higher ratios, check our guide to high leverage forex brokers to compare options and make informed choices.

Start Small and Trade Safely

Begin with low leverage, focus on learning, and prioritize risk management. This approach helps you build confidence and stay in the market longer while minimizing the chance of costly mistakes.

Start Your Trading Journey Today

Signup

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Overtrading

If you’re new to forex, it’s wise to keep your leverage low—around 5:1 or 10:1.

Lower leverage gives you more room for error and lets you focus on learning without risking your entire account. For example, if you want to trade XAU/USD (Gold vs. US Dollar) with a $1,000 account and 5:1 leverage, you control a $5,000 position. That’s enough to participate in the market, but a $10 move against you won’t wipe out your account. This approach lets you gain experience while keeping losses manageable.

Many beginners lose money because they start with too much leverage. Big profit potential is tempting, but rushing in often leads to quick losses. Trading successfully takes time—you need to understand not just entry and exit points, but also timing, position size, and managing emotions.

If you’re starting out, prioritize control over speed. You’ll learn more, lose less, and develop smarter trading habits.

For extra guidance, check our article on forex trading for beginners, which covers the essentials and helps you build a solid foundation.

Start small. Stay safe.

Understand Margin

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Pressure to Act Quickly

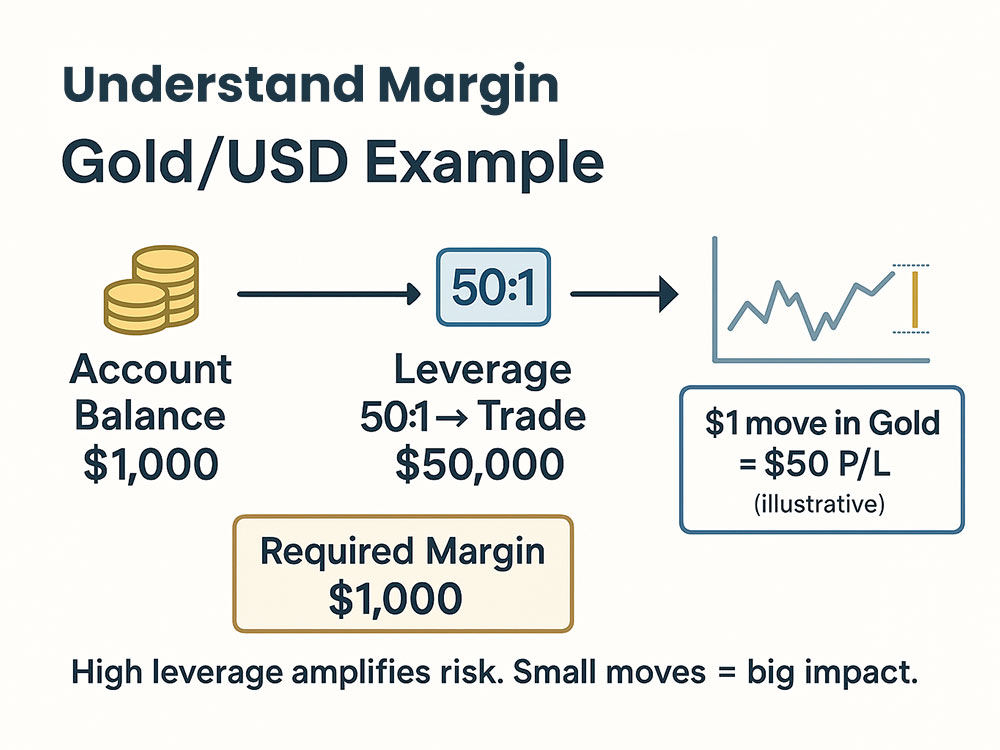

Margin is the amount of money your broker requires to open a trade.

For example, with 50:1 leverage, you only need 2% of the total trade size. So, trading a $100,000 lot would require just $2,000 in margin.

If the market moves against you and your balance drops too low, your broker may automatically close the trade to protect the borrowed funds. For instance, if you’re trading Gold/USD and it moves $20 against your position, that impact can be significant if you’re overleveraged.

This is where forex indicators come in handy. Tools like RSI, MACD, and moving averages can provide signals to enter or exit trades, helping you identify potential risks before they turn into losses.

Margin and leverage go hand in hand—understanding both is essential before trading.

Real vs. Offered Leverage

Your broker might advertise 100:1 leverage, but that doesn’t mean you have to use the full amount.

Real leverage is how much you’re actually using. It’s calculated as your total trade size divided by your account balance.

For example:

- If your account has $10,000 and you open a $20,000 trade, your real leverage is 2:1.

- If you increase the trade to $50,000, your real leverage becomes 5:1.

It’s easy to let leverage creep up unintentionally, especially with multiple open trades. Always monitor your real exposure, not just the maximum leverage offered. Using less than the maximum can protect your account, and smart traders only use the leverage they need.

Match Leverage to Your Trading Style

Your trading style should guide your leverage decisions:

- Scalpers: Open many small trades throughout the day, often using higher leverage to capture quick moves. Tight spreads and discipline are crucial, as losses can hit fast.

- Swing traders: Hold trades for several days, aiming for larger price swings. They usually use moderate leverage to handle normal market fluctuations and rely on indicators like RSI and moving averages.

- Position traders: Stay in trades for weeks or months, focusing on long-term trends. They keep leverage low to manage risk, emphasizing patience over speed.

Choose leverage that fits how you trade, not what seems exciting or risky. Your advantage comes from consistency, not size.

Use Stop-Loss Orders

Limited Risk Management Options

Regardless of the leverage you use, controlling your risk is essential.

Always use a stop-loss order. This automatically closes your trade when losses reach a level you can handle. It gives you control and prevents small setbacks from turning into big ones.

For example, if you’re trading EUR/USD aiming for a 20-pip gain, you might set a stop-loss at 10–15 pips. If the market moves against you, the trade closes automatically—you accept the loss and move on without guessing or hoping for a reversal.

Developing this habit prevents minor losses from snowballing and reduces stress while your trades are open.

Good risk management is what distinguishes consistent traders from gamblers. Even when using high leverage, a stop-loss acts as a safety net. It’s particularly effective with major currency pairs like EUR/USD, USD/JPY, or GBP/USD, which offer high liquidity and tighter spreads. These pairs tend to move more predictably with common indicators, making them ideal for controlled trading with well-placed stop-losses.

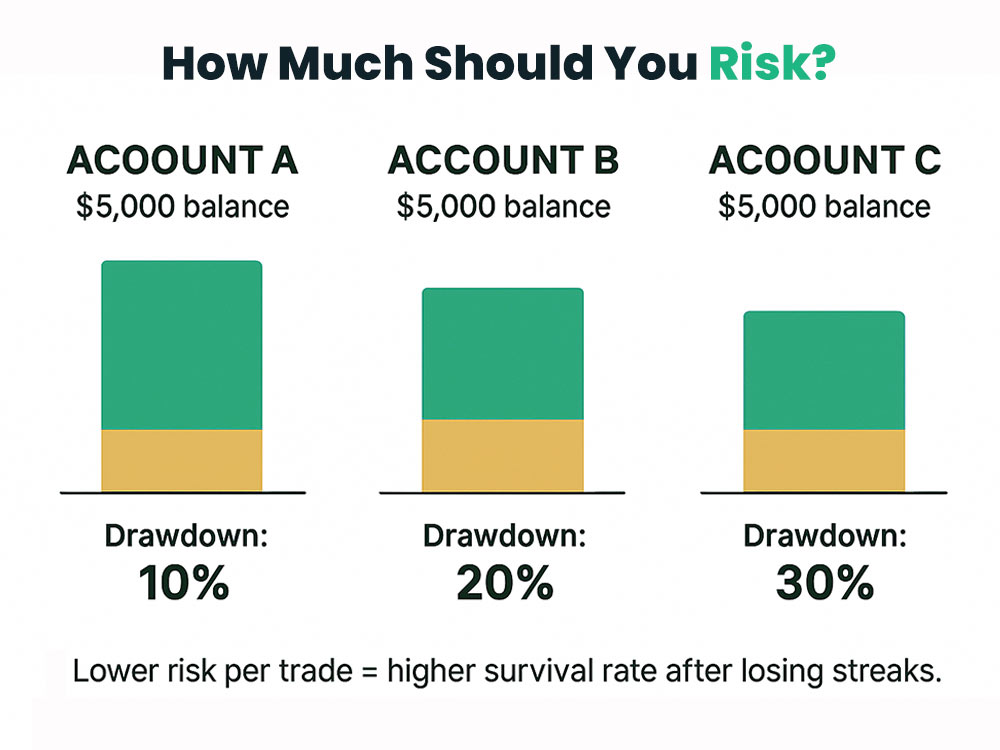

How Much Should You Risk?

How Much Should You Risk?

A widely recommended rule is to risk no more than 1% to 3% of your account on any single trade.

For example, if your account has $5,000, that means risking $50 to $150 per trade. This approach keeps you in the game even after a few losses and prevents a single trade from derailing your progress.

Many beginners underestimate how quickly high leverage can work against them. Overexposing your account without proper risk management can cost more than just money—it can damage your confidence and derail your trading journey.

Broker Leverage Isn’t a Recommendation

Just because a broker offers 500:1 leverage doesn’t mean you must—or should—use it. When managed correctly, high leverage can provide flexibility: you can scale into trades faster, use less capital, and react quickly to small market moves with tight stops.

It’s simply an option—you decide how much to apply. Many experienced traders use only a fraction of the available leverage, but disciplined traders can make higher ratios work. For instance, a scalper might use 500:1 on a short EUR/USD breakout with a 5-pip stop. The key is control, not fear or greed.

Using High Leverage with Confidence

Start with a demo account to practice your strategy and test different leverage levels. Platforms like MetaTrader 5 allow you to trade live prices, track your performance, and experiment with stop-losses, position sizing, and indicators—all without risking real money.

Try trading several pairs under different leverage settings. This hands-on experience helps you understand how all the pieces fit together, so when you move to a live account, it feels like a controlled step forward—not a risky leap.

Review Your Trades

Analyze your past trades:

- Were your losses too large?

- Was your leverage too high?

- Were your stop-losses too wide or entries mistimed?

Mistakes are normal. What matters is learning from them. Track your trades, note your thought process, and record your setups. Over time, patterns will emerge, helping you make smarter, more consistent decisions.

Final Thoughts

Choosing the right leverage is about control, not chasing profits.

- Start small and use only what you need.

- Build habits that protect your capital first, then grow your confidence gradually.

- Focus on steady progress, not what other traders are doing.

As you gain experience, you can adjust your leverage. Platforms like Dominion Markets offer high leverage up to 500:1 along with tight spreads from 0.1 pips, giving you room to trade efficiently without putting your account at unnecessary risk.

Focus on discipline, practice, and smart risk management—and your trading journey will have a solid foundation.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: