everage Trading for Beginners: Your Fast Track to Big Gains—or Quick Lessons

Leverage trading is especially eye-catching for beginners. The idea is simple: start with a small amount of money and control a much larger position. Profits can come quickly—but so can losses.

Many new traders focus only on the potential upside and overlook the risks. Understanding both sides before you start is crucial.

This guide explains leverage trading for beginners in clear terms: what it is, how it works, where the risks lie, and how to avoid common mistakes. If you’re asking “what is leverage?” or want forex leverage explained simply, you’re in the right place.

For those ready to trade responsibly, platforms like Dominion Markets provide fair rules, transparent pricing, and strong risk management tools to help you stay in control. They offer raw spreads from 0.1 pips for tighter costs and better entries, and leverage up to 500:1 for experienced, careful traders—enough power to maximize opportunities without overextending. This makes it a smart option for beginners learning the ropes of leverage trading.

Start Your Trading Journey Today

Signup

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

What Is Leverage Trading for Beginners?

What Is Leverage Trading for Beginners?

Leverage trading for beginners means using borrowed funds to take positions larger than the money you actually have in your account. You only need to provide a small portion of the trade, called margin.

For example, if you want to trade $10,000 worth of a currency pair with 10:1 leverage, you only need $1,000 in your account. The broker covers the remaining $9,000.

Another example:

- Deposit: $500

- Leverage: 20:1

- Trade size: $10,000

This illustrates the power of leverage—it can amplify profits, but also magnify losses if the market moves against you.

Here’s how leverage trading typically works for beginners:

- You deposit a small amount (your margin).

- The broker multiplies your buying power.

- You open trades larger than your deposit.

- Small market moves affect the entire position.

- Profits and losses are based on the full trade size, not just your margin.

So if you’ve wondered “what is leverage?” or wanted forex leverage explained in simple terms, this is a practical example. Beginners may also benefit from reading our guide on forex trading for beginners.

What Is Margin in Leverage Trading?

Margin is the money you must have in your account to open a trade. It represents your stake—your “skin in the game”—while the broker lends the rest.

Example:

- Trade size: $50,000

- Leverage: 25:1

- Margin required: $2,000 (your deposit)

- Broker covers: $48,000

If the trade gains 2%, your profit is $1,000—a 50% return on your margin. But if the market moves against you by 2%, you lose $1,000—half your margin gone quickly.

In practice, for beginners:

- Margin is your upfront deposit.

- It determines how large a position you can open.

- It limits how far a trade can move against you.

- If losses reach your margin, the broker may close the trade.

- If losses exceed your margin, you could owe more unless your account has negative balance protection.

Learning to manage margin effectively is one of the most important skills in leverage trading for beginners.

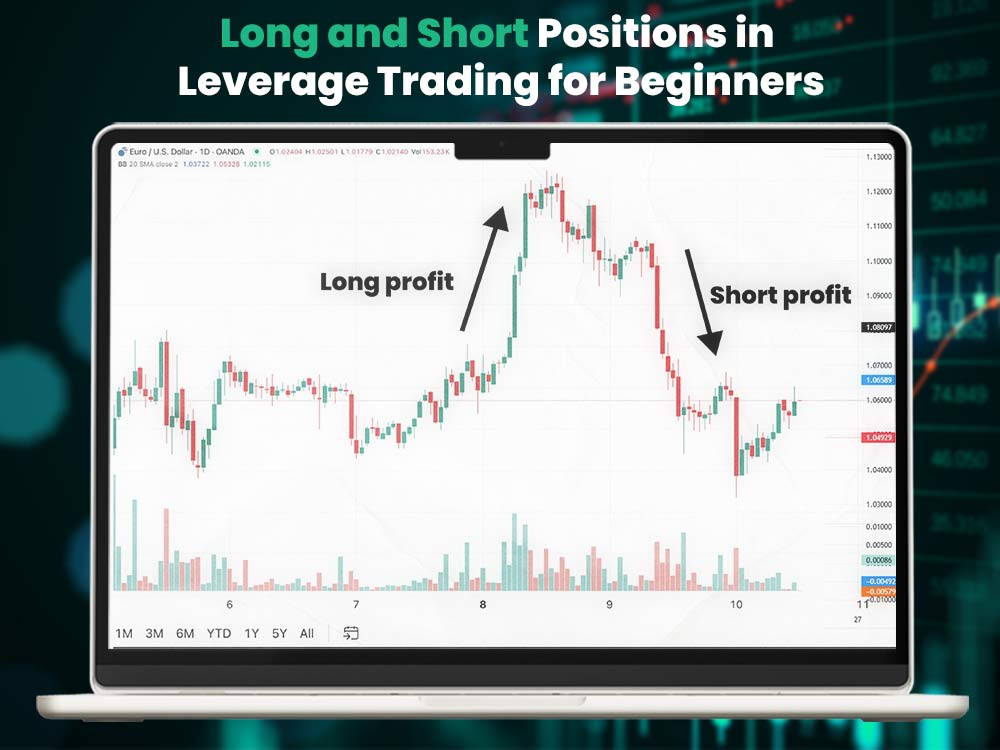

Long and Short Positions in Leverage Trading for Beginners

Long and Short Positions in Leverage Trading for Beginners

In leverage trading, you can make profits whether the market moves up or down—if you position your trades correctly.

- Going long means buying first, anticipating the price will rise. You later sell at a higher price to lock in gains.

- Going short means selling first, expecting the price to fall. You later buy back at a lower price to profit.

Example – Going Long:

- Trade: EUR/USD at 1.1000 with 10:1 leverage

- Price rises to 1.1050 → 50-pip gain

- With a $1,000 margin, your profit could be around $500, depending on position size

Example – Going Short:

- Trade: EUR/USD at 1.1000

- Price drops to 1.0950 → 50-pip gain

Key Takeaways:

- Long = buy low, sell high

- Short = sell high, buy low

- Both strategies allow you to trade market trends in either direction

- Leverage amplifies both profits and losses

- Success depends on predicting the market direction accurately

Regardless of your strategy, leverage affects all trades. That’s why having clear entry, exit, and risk management rules is critical. Beginners should also use brokers with proper risk tools and protection, especially when trading with high leverage. Following these strategies helps minimize unnecessary losses.

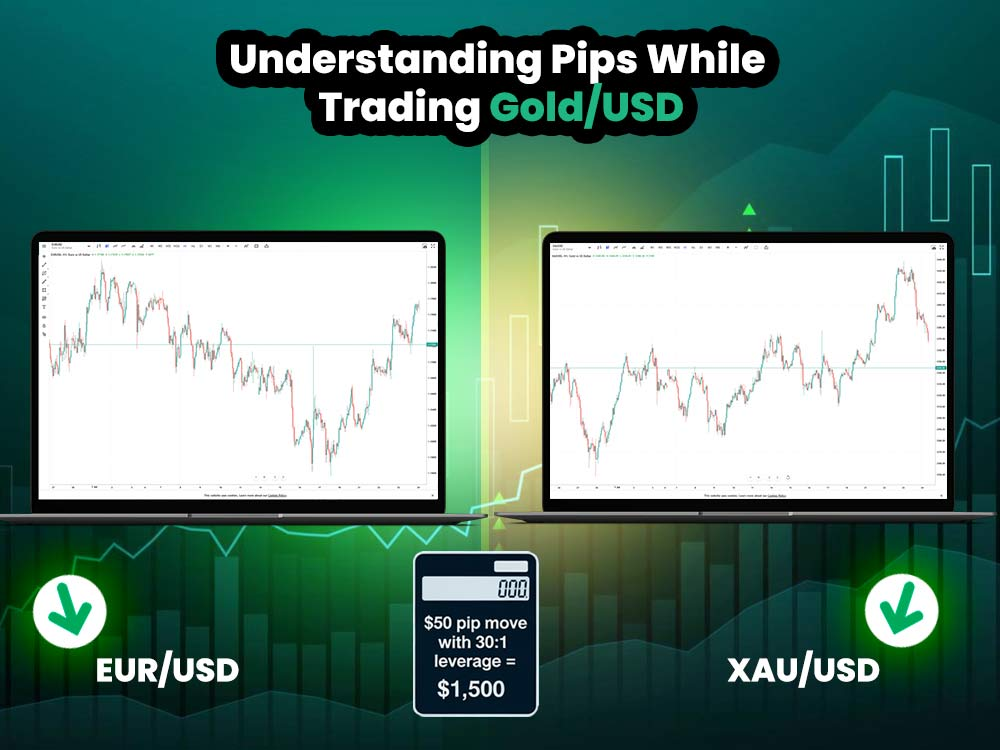

Understanding Pips While Trading Gold/USD

A pip is the smallest unit of price movement in forex. For most currency pairs, it’s 0.0001. For commodities like gold, pip sizes can differ depending on your broker.

Example – EUR/USD:

- Moves from 1.1000 to 1.1005 → 5 pips

Example – Gold (XAU/USD):

- Moves from 1925.50 to 1926.00 → 50 pips if each $0.01 counts as a pip

While pips may seem small, with leverage they have a big impact on your profits and losses. Beginners can benefit from our guide on “what is a pip” to understand its role in trading.

If you want, I can also rephrase the next section on managing risk and leverage to keep the flow beginner-friendly. Do you want me to do that?

Understanding Pips While Trading Gold/USD

Let’s break it down with an example:

- Assume one pip is worth $1.

- A 50-pip move would equal $50.

- With 30:1 leverage, that $50 movement could turn into $1,500—either as profit or loss, depending on the trade direction and size.

Here’s how pips and leverage interact in beginner trading:

- Small price movements can translate into significant gains or losses.

- Pip value depends on the asset and the lot size.

- Commodities like gold often move in larger increments than currencies.

- Leverage magnifies the financial impact of each pip.

- Always know your pip value before entering a trade.

Understanding how pip changes affect your trades is essential for beginners to maintain control while trading with leverage.

Risk Management Tools for Beginners

Leverage can amplify losses quickly. A single poorly timed trade can deplete your margin in minutes. For example:

- You open a $20,000 gold trade with 20:1 leverage.

- Your margin is $1,000.

- Gold drops 1.5% → you lose $300.

- A few more small moves, and your margin is nearly gone.

If your margin falls too low, you may receive a margin call, requiring additional funds or automatic trade closure by your broker. In fast-moving markets, losses can even exceed your deposit, leaving you owing money.

Key risks for beginners in leverage trading:

- Thin margins: Small losses accumulate quickly.

- Volatile markets: Sharp moves can trigger instant losses.

- No stop-loss: Leaving trades open can escalate losses.

- High leverage: Even minor market fluctuations have a big impact.

This is why risk management is crucial. Knowing the dangers of high leverage trading before diving in can protect both your account and your confidence.

Common Mistakes Beginners Make in Leverage Trading

Even with proper tools, beginners often stumble. Typical errors include:

- Over-leveraging without understanding exposure

- Ignoring stop-loss orders

- Trading impulsively instead of following a plan

- Misjudging pip value and position size

Avoiding these mistakes is key to trading safely and building experience with leverage.

If you want, I can rephrase the next section on “Leverage Trading Strategies for Beginners” in the same clear, beginner-friendly style. Do you want me to do that next?

Understanding Pips While Trading Gold/USD

Here are the most common mistakes beginners make when trading with leverage:

- Using maximum leverage: Just because your broker offers 500:1 doesn’t mean you should use it. High leverage leaves very little room for error.

- Ignoring market trends: Trading against the trend without solid analysis usually leads to losses.

- Skipping stop-losses: Without stop-losses, your downside is unlimited. Always protect your trades.

- Overtrading: Too many trades too quickly drains capital and focus.

- Chasing losses: One bad trade followed by larger trades can compound losses. Stick to your plan.

- Poor position sizing: Risking too much on a single trade is dangerous. Keep trade sizes consistent.

Avoiding these mistakes is essential for mastering leverage trading as a beginner. Take it slow, stay consistent, and keep your strategy simple.

Choosing the Right Leverage as a Beginner

How much leverage you use is one of the most important decisions for new traders:

- Start small: 5:1 or 10:1 lets you learn without taking extreme risks.

- Build experience: Once consistent, consider 20:1 or 30:1.

- Avoid extremes: Leverage above 50:1 increases the chance of blowing your account.

- Match your style: Day traders and swing traders may use different levels.

The focus should be on control, not speed. For beginners, the right leverage ratio helps you stay in the game longer. Platforms like Dominion Markets make this easier with flexible leverage up to 500:1, raw spreads from 0.1 pips, and safety tools like negative balance protection—allowing control without sacrificing performance.

Leverage Regulations You Need to Know

Different regions impose leverage limits to protect traders, especially beginners:

- U.S.: Maximum 50:1 on major currency pairs.

- UK/EU: Maximum 30:1 for retail traders.

- Australia: Similar limits to Europe.

These rules are designed to reduce risk. Even if you have access to higher ratios outside these regions, using them is not always wise. Smart leverage trading for beginners prioritizes safety over size.

Can You Really Win at Leverage Trading?

Yes—but only if you approach it carefully. Leverage trading for beginners can be profitable, but it’s not a shortcut to wealth. Key steps to succeed:

- Develop a simple, repeatable trading strategy.

- Control your risk on every trade.

- Use stop-loss and take-profit orders consistently.

- Practice on a demo account before trading with real money.

Many new traders fail early. Those who succeed treat trading like a disciplined business, not a gamble.

Final Thoughts on Leverage Trading for Beginners

Leverage is a powerful tool—it can magnify gains, but it can also wipe you out quickly.

Stick to the basics:

- Start with low leverage.

- Trade with the trend.

- Protect every trade.

- Manage your margin carefully.

Choosing a broker that supports responsible trading makes a difference. Dominion Markets offers raw spreads from 0.1 pips, up to 500:1 leverage, and protections like negative balance safeguards—helping beginners trade safely while still accessing leverage.

Leverage trading for beginners can be safe and rewarding if approached with discipline and the right tools.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: