How to Calculate Leverage in Forex for Safer Trading

Understanding how to calculate leverage in forex is essential for every trader. It shows your true market exposure and helps you manage risk before opening a trade. Skipping this step often leads to using more borrowed capital than intended, which can result in rapid losses.

This guide breaks down leverage calculation in simple terms. You’ll learn the formulas, see practical examples, and discover tools to make the process easier. We’ll also explain how to calculate margin requirements and pip values, giving you more control over every trade.

Brokers like Dominion Markets offer flexible leverage up to 500:1, tight spreads starting at 0.1 pips, transparent conditions, and a fair evaluation process. This environment makes it easier to apply your leverage knowledge while trading responsibly.

What Leverage Means in Forex

Leverage allows you to control a larger position than your actual account balance by borrowing funds from your broker. This borrowed power lets you amplify potential profits—but it also increases risk, which is why understanding and calculating leverage is so important.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

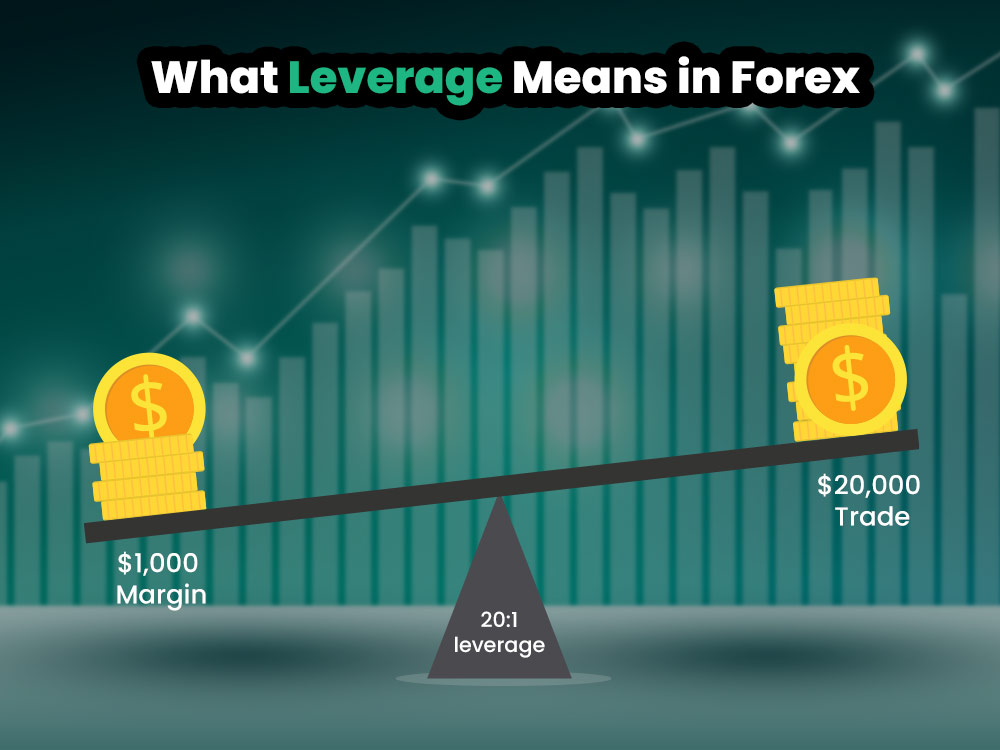

What Leverage Means in Forex

Leverage allows you to control a larger position than your account balance. For example, with $1,000 and 50:1 leverage, you could open a trade worth $50,000. You only need to put up a small portion of that amount as margin, while your broker provides the rest. Learning how to calculate leverage in forex is essential—it shows exactly how much borrowed capital you’re using and helps make the concept of forex leverage practical and easy to understand, as we explain in detail in another blog.

The Connection Between Margin and Leverage

- Margin: The amount you need to deposit to open a trade.

- Leverage: The ratio between the total trade size and the margin required.

What Leverage Means in Forex

To calculate leverage in forex, use this formula: Leverage=Total Trade ValueMargin Used\text{Leverage} = \frac{\text{Total Trade Value}}{\text{Margin Used}}Leverage=Margin UsedTotal Trade Value

For example, if your trade is worth $20,000 and you use $1,000 as margin, your leverage is 20:1. Understanding how to calculate leverage, margin, and pip values in forex helps you see how even small changes in margin can impact your overall exposure.

Why Leverage Can Be Risky

Leverage amplifies both profits and losses. When the market moves in your favor, gains grow quickly—but losses do too if it moves against you.

Example of high leverage risk:

- At 100:1 leverage, a 1% price move against you can wipe out your account.

- At 10:1 leverage, that same 1% move would only reduce your balance by 10%.

This is why calculating leverage in forex is about more than numbers—it’s essential for protecting your account.

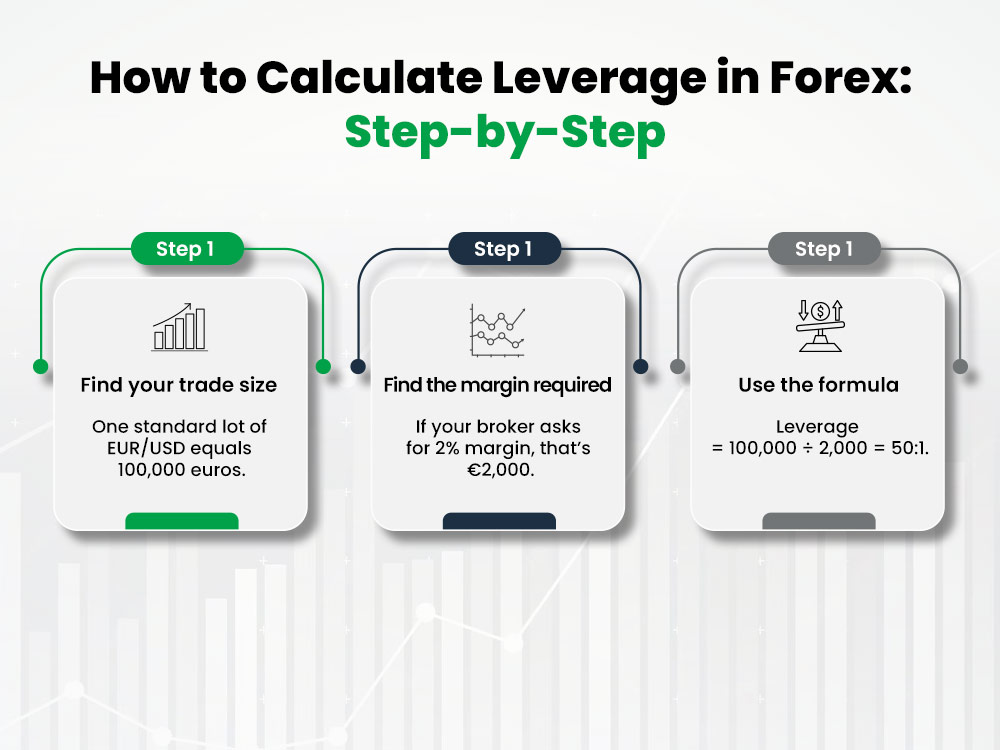

How to Calculate Leverage in Forex: Step-by-Step

How to Calculate Leverage in Forex: Step-by-Step

To calculate leverage in forex, you need to know:

- Account balance – The amount of money in your trading account.

- Trade size – The total value of the position you want to open.

- Margin required – The deposit your broker requires to hold that position.

- Lot size – The units of the base currency in the trade.

Step 1: Determine Your Trade Size

One standard lot of EUR/USD equals 100,000 euros.

Step 2: Determine the Margin Required

If your broker requires a 2% margin, you need €2,000.

Step 3: Apply the Formula

Leverage=Trade SizeMargin=100,0002,000=50:1\text{Leverage} = \frac{\text{Trade Size}}{\text{Margin}} = \frac{100,000}{2,000} = 50:1Leverage=MarginTrade Size=2,000100,000=50:1

This shows your actual exposure. This method works for major pairs, cross pairs, or any instrument, and ties into strategies discussed in our guide on high leverage forex brokers.

Examples of Different Leverage Levels

Two traders each have $5,000:

- Trader A uses 100:1 leverage to open a $500,000 trade.

- Trader B uses 10:1 leverage to open a $50,000 trade.

A 1% price movement:

- Trader A loses $5,000 → entire account wiped.

- Trader B loses $500 → account mostly intact.

This illustrates why understanding leverage, margin, and pip values is essential before executing trades.

Using a Leverage Calculator

While you can calculate leverage manually, a Leverage Calculator speeds up the process. Input:

- Currency pair

- Account currency

- Trade size

- Margin

The tool outputs your leverage ratio and effective leverage, helping you visualize your exposure in real time.

Example:

- Account: €1,000

- Trade: 0.5 lot EUR/USD (50,000 units)

- Margin: €50

- Effective leverage = 50,000 ÷ 50 = 1,000 (brokers may display ~20:1 depending on contract size and conversions)

Safe Leverage Levels

- Scalpers: 20:1 – 30:1, exiting trades quickly

- Swing traders: usually under 5:1 to weather larger moves

- Beginners: 2:1 – 3:1 to learn without overexposure

Start low and gradually increase leverage as your skill and confidence grow.

How Regulations Affect Leverage

Leverage limits vary by region:

- US: 50:1 for major pairs, 20:1 for others

- EU/UK: 30:1 for major pairs

- Japan: 25:1 for retail traders

- Australia: 30:1 for major pairs

Knowing how to calculate leverage, margin, and pip values allows you to adjust trades according to these rules and align leverage with your chosen currency pairs.

Tips for Using Leverage Safely in Forex Trading

- Always calculate the actual exposure before opening a trade.

- Start with small leverage ratios until you gain experience.

- Pair leverage with solid risk management: stop-losses, position sizing, and account protection.

- Use tools like leverage calculators to avoid errors.

This approach ensures you can trade confidently while controlling risk.

Tips for Using Leverage Safely in Forex Trading

Always Know Your Numbers

Before opening any trade, double-check your leverage. Never guess. Understanding how to calculate leverage in forex helps prevent unexpected losses.

Limit Your Risk Per Trade

Most traders risk only 1–3% of their account on a single trade. This keeps your balance protected and reduces the impact of losing trades.

Use Stop-Loss Orders

A stop-loss automatically closes a trade if it moves too far against you, helping limit losses.

Monitor Total Exposure

Even multiple small trades can add up to high overall leverage. Keep track of your total exposure to avoid overextending your account.

Adjust Leverage for Volatility

Currency pairs with large swings require lower leverage to manage risk effectively. This helps avoid the dangers of high leverage trading.

Understand Maximum vs. Effective Leverage

- Maximum leverage: The highest leverage your broker allows.

- Effective leverage: The actual leverage based on your open trades and margin.

Example: If you have $10,000 and trade $50,000, your effective leverage is 5:1. Knowing the difference is essential for using leverage responsibly.

Why Beginners Struggle with High Leverage

New traders often see high leverage as a shortcut to profits, forgetting that losses are magnified as well. Without knowing how to calculate leverage in forex properly, they take oversized trades. A few wrong moves can wipe out their account.

High leverage can also encourage impulsive trading. Skipping strategy and planning increases losses faster than they can recover. Guidance on leverage trading for beginners is crucial to avoid these pitfalls.

Incorporate Leverage into Your Trading Plan

Leverage should support your plan, not drive it. Experienced traders combine leverage knowledge with rules for:

- Entry and exit points

- Position sizing

- Maximum total risk

- Maximum allowed leverage per trade

This ensures trades are controlled and risk is managed systematically.

Practical Example: Step-by-Step Calculation

Suppose you have $2,000 and want to trade GBP/USD. Your broker requires 5% margin:

- Full lot size: 1 lot = 100,000 GBP

- Margin for 1 lot: 5% = 5,000 GBP (~$6,250 USD)

- Trade choice: You opt for 0.2 lots (20,000 GBP)

- Margin required: 1,000 GBP (~$1,250 USD)

- Leverage: Trade size ÷ Margin = $25,000 ÷ $1,250 = 20:1

This demonstrates how small adjustments in lot size and margin affect leverage and risk.

For more guidance, check our guide on choosing the best forex leverage to trade safely and use leverage effectively.

Why Lower Leverage Still Matters

Using lower leverage doesn’t mean you’re limiting your potential profits. Once you understand how to calculate leverage, margin, and pip values in forex, you can still:

- Trade multiple currency pairs with smaller positions

- Hold trades longer to capture larger market moves

- Gradually add to winning trades

Lower leverage helps protect your account from sudden losses and allows you to stay in the market longer.

Key Takeaways

- How to calculate leverage in forex: Trade Value ÷ Margin Used

- Always check both maximum and effective leverage

- High leverage comes with high risk

- Use leverage calculators for speed and accuracy

- Combine leverage management with a solid trading plan

- Match leverage to your trading style and account size

Final Thoughts

Learning how to calculate leverage in forex is one of the most important skills for any trader. It gives you control, keeps risk manageable, and helps prevent account wipeouts.

Whether you’re figuring out how to calculate leverage in forex trading or learning to calculate leverage, margin, and pip values, the approach is the same: know your numbers, keep leverage within safe limits, and make it an integral part of your plan.

When applied correctly, leverage becomes a controlled tool rather than a risk. Brokers like Dominion Markets, offering up to 500:1 leverage, 0.1-pip spreads, and transparent trading conditions, make it easier to trade with calculated risk.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: