1:100 Leverage vs 1:500 – The Key Advantage You Might Be Overlooking

Forex trading allows you to control large positions with relatively small amounts of capital, thanks to leverage. Brokers offer various leverage levels, and one common debate among traders is 1:100 leverage vs 1:500.

At first glance, the choice may seem simple—but the difference is more significant than most realize. The leverage you select affects how you trade, the level of risk you take, and the potential profits (or losses) you can experience.

This guide breaks down 1:100 vs 1:500 leverage in straightforward terms. You’ll learn how each level works, the risks involved, and how to select the right one for your trading style. For context, brokers like Dominion Markets provide up to 500:1 leverage with tight spreads, giving disciplined traders both cost efficiency and greater flexibility in managing positions.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Forex Leverage Explained: What Leverage Really Means

Forex Leverage Explained: Understanding What Leverage Really Means

Leverage is essentially borrowed capital from your broker that lets you control positions much larger than your own funds.

- With 1:100 leverage, every $1 of your money controls $100 in the market.

- With 1:500 leverage, every $1 controls $500.

Leverage amplifies both profits and losses. Even small market moves can create significant outcomes—positive or negative. For a deeper dive, check out our full guide on forex leverage explained.

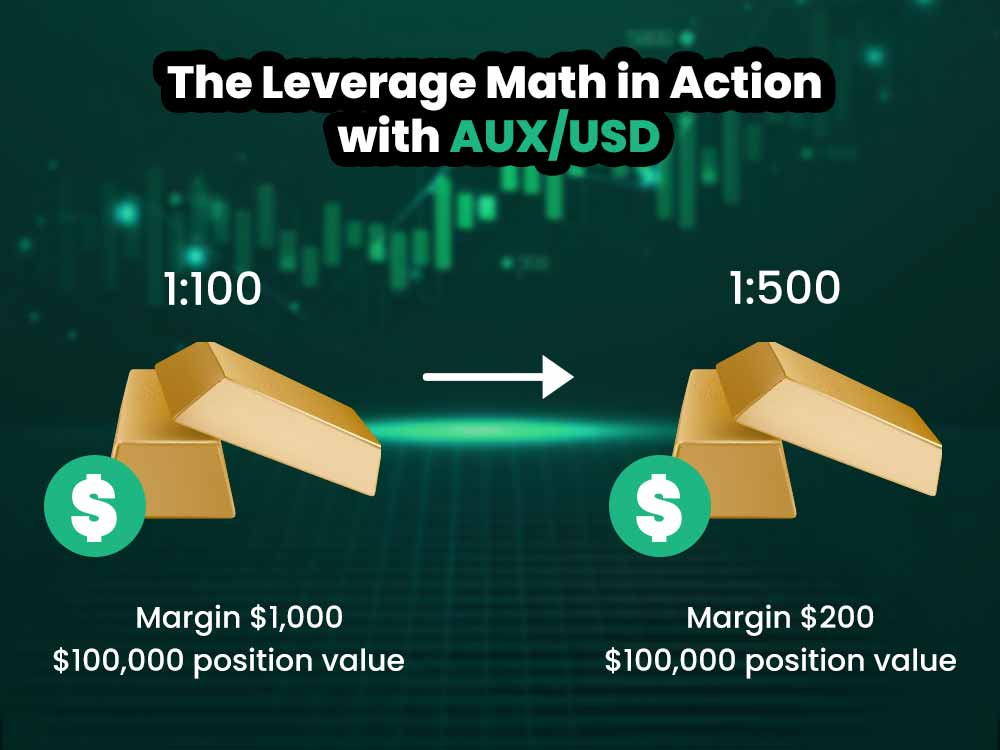

Leverage in Action: Example with XAU/USD (Gold/USD)

Consider trading a standard lot in Gold/USD, where one lot equals 100 ounces of gold. If gold is priced at $1,000 per ounce, the total position value is $100,000.

1:100 leverage

- Margin required: 1% of the trade value

- To open a $100,000 position, you need $1,000

1:500 leverage

- Margin required: 0.2% of the trade value

- To open the same $100,000 position, you need only $200

This example highlights how leverage reduces the capital needed to trade while increasing both potential gains and risks.

What Leverage Means in Forex

Leverage creates a margin gap that lets traders control larger positions with less capital. This is why comparing 1:100 leverage vs 1:500 is an important decision. For gold traders, combining the right leverage with a strong XAU/USD strategy helps balance profit potential with risk management.

Why Traders Opt for Higher Leverage

With 1:500 leverage, you can:

- Risk less capital per trade

- Spread your account across multiple positions

- React quickly to market changes without tying up too much margin

For example, with $1,000 in your account:

- 1:100 leverage: Open one standard lot and have no margin left

- 1:500 leverage: Open the same lot and still keep $800 free margin

If you’re unsure which suits your style, see our guide on choosing the best forex leverage for practical advice.

The Risk of High Leverage

Higher leverage comes with faster-growing risks. Even a small market move against you—like 20 pips on a large trade—can quickly wipe out a significant portion of your account. Many traders fail with 1:500 because they treat it as permission to go all-in. For more, check our post on the risks of high leverage.

1:100 Leverage vs 1:500 – Key Differences

The main difference between 1:100 and 1:500 leverage lies in margin requirements and trading flexibility:

- 1:100 leverage: Requires more capital to open trades. This naturally slows down account swings, limits overexposure, and encourages careful planning—but offers less flexibility.

- 1:500 leverage: Requires less margin, freeing up your account for multiple trades, scaling positions, or keeping a safety buffer. It allows longer holding during market swings if positions are managed responsibly.

| Feature | 1:100 Leverage | 1:500 Leverage |

|---|---|---|

| Margin for $100k lot | $1,000 | $200 |

| Risk of overtrading | Lower due to higher margin | Higher if discipline is lacking |

| Flexibility | Limited | High |

| Best for | New or cautious traders | Skilled, disciplined traders |

Both can work if used wisely. 1:100 acts like a guardrail, slowing account swings and encouraging careful risk management. 1:500 gives speed and freedom, but demands discipline—overextending can produce fast losses as easily as gains.

1:100 – Safer Option for Beginners

1:100 limits trade sizes naturally, providing enough power for meaningful gains while keeping exposure in check. For beginners, this makes 1:100 leverage a solid starting point. Learn more in our guide on leverage trading for beginners.

1:500 – Flexible Tool for Experienced Traders

For seasoned traders, 1:500 offers:

- Margin freedom

- Ability to scale into trades

- Options to hedge positions or run multiple setups

Scalpers often favor it for opening and closing many trades in short periods.

Real Trade Example: 1:100 vs 1:500

Here’s a comparison of how the same account behaves under different leverage settings:

[Example scenario can follow based on XAU/USD or other trades]

This highlights how leverage choice shapes risk, flexibility, and potential profits.

Real Trade Example – 1:100 vs 1:500 Leverage in Practice

1:100 Leverage:

- Open 0.5 lots

- Margin used: $500

- Free margin: $500

- A 10-pip move = $50

1:500 Leverage:

- Open 0.5 lots

- Margin used: $100

- Free margin: $900

- A 10-pip move = $50

The pip value remains the same in both cases. The key difference is the amount of free margin available to safeguard your trades.

Why Margin Acts as a Safety Net

Margin isn’t just a requirement to open a trade—it’s a buffer against forced liquidation. It provides a cushion between your active positions and your broker closing trades when losses mount.

With 1:500 leverage, you retain more free margin, allowing you to weather short-term swings or pullbacks without triggering a margin call. This extra room gives trades a chance to recover if your analysis proves correct. With 1:100 leverage, the safety buffer is smaller, so price moves can threaten your position more quickly.

The Psychology of High Leverage

Leverage shapes trader behavior. High leverage can create a false sense of security, tempting traders to take larger positions or more trades than planned. Low leverage encourages selectivity and discipline, which helps prevent rash decisions.

Disciplined traders treat 1:500 leverage as if it were 1:100, using the extra margin as a safety cushion rather than an excuse to risk more.

Regulation and Leverage Limits

Some regions enforce leverage caps to protect retail traders:

- U.S.: Maximum 1:50 on major pairs

- EU: Maximum 1:30

These limits aim to prevent large losses for less experienced traders.

Outside regulated areas, brokers may offer up to 1:500 leverage, leaving the responsibility entirely on the trader. High leverage can be powerful if used wisely, but without discipline, it can quickly turn against you.

Check our guide on high leverage forex brokers to see which providers offer these options and how to pick one suited to your style.

Using 1:500 Leverage Safely

- Risk 1% or less per trade

- Always set stop-loss orders

- Keep most of your margin free

- Treat trades as if using lower leverage

- Use position size calculators

Using 1:100 Leverage Effectively

- Avoid maxing out margin

- Focus on high-quality setups

- Be patient with account growth

- Maintain a trading journal

Who Should Use Which: 1:100 vs 1:500

- 1:100 Leverage: Best for beginners or cautious traders. The higher margin requirement acts as a natural brake, encouraging careful position sizing and slower trading.

- 1:500 Leverage: Best for experienced, disciplined traders. Offers more flexibility, extra free margin, and the ability to run multiple strategies without tying up capital.

Both can work, but the key is discipline, risk management, and understanding your margin.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

Who Should Use 1:100 vs 1:500 Leverage

The True Advantage of 1:100 vs 1:500

The real benefit of 1:500 leverage isn’t necessarily bigger profits—it’s the extra room it provides to manage trades effectively.

Having more free margin allows you to hold positions longer, make adjustments, and reduce the risk of being stopped out prematurely. You can dive deeper into managing leverage safely in our guide on how to calculate leverage in forex.

Final Thoughts

Leverage is simply a tool. Choosing between 1:100 and 1:500 depends on your experience, strategy, and level of discipline.

- Beginners: 1:100 offers structure and built-in risk control.

- Experienced traders: 1:500 can act as a flexible safety net—if used carefully.

For traders seeking competitive trading conditions, brokers like Dominion Markets provide up to 500:1 leverage along with tight spreads. This setup can lower trading costs and allow skilled traders to manage multiple positions without tying up excessive capital.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: