Margin Call in Forex: How to Stop It from Draining Your Account

Forex trading can grow a small account quickly—but it can also wipe it out just as fast. One of the biggest threats to your capital is a margin call.

If you’re a beginner, understanding margin calls is essential before putting any money on the line. At brokers like Dominion Markets, traders can manage this risk effectively by using reliable forex indicators and risk management tools. With smart planning and disciplined setups, you can trade confidently without pushing your account to the brink.

This guide covers everything you need to know about margin calls—what they are, why they happen, how to calculate them, and most importantly, how to avoid them.

What Is a Margin Call in Forex?

A margin call in Forex is a warning from your broker that your account equity has dropped too low to support your open positions.

Your equity equals your account balance plus or minus any unrealized profits or losses from active trades. When this equity gets too close to the used margin, your broker issues a margin call. This alert signals that your protective buffer is nearly gone, and if market conditions continue moving against you, your trades could be closed automatically.

In short, a margin call means your trading account is in danger. If you don’t take action—like adding more funds or reducing your open positions—the broker will initiate what’s called a stop-out. During a stop-out, the broker automatically closes your losing trades, typically starting with the largest ones, until your account meets the required margin level again.

Why Margin Calls Occur in Forex Trading

Why Margin Calls Occur in Forex Trading

1. Price moves against your position:

Even a small adverse price movement can quickly reduce your account equity. As equity drops, your free margin shrinks, pushing you closer to a margin call.

2. Margin requirements increase:

If your broker raises margin requirements, your open positions will suddenly need more margin to stay active. This leaves less available margin in your account and raises the risk of a margin call.

In both cases, the issue is the same—your account no longer has enough equity to support your existing trades. That’s why margin calls are critical warnings. They signal that your margin level is falling and your free margin is nearly exhausted. It’s a clear alert that your risk exposure is too high and immediate adjustments are needed before your broker starts closing trades.

This is especially important for traders using short-term strategies like scalping, where rapid market movements can quickly drain margin and trigger a call.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025:

How a Margin Call Works in Forex

Here’s a simple breakdown of the process:

- You start with $1,000 in your trading account.

- You open a position that requires $300 in margin.

- That leaves you with $700 in free margin.

If your broker’s margin call level is 30%, you can calculate the margin call point using this formula:

Minimum account value = Margin used ÷ (1 – Maintenance margin requirement)

In this example:

$300 × 30% = $90

So, when your equity falls close to $90, your broker will issue a margin call.

That’s how quickly it can happen—just a small unfavorable price move can reduce your equity enough to trigger a call. The smaller your free margin, the closer you are to that danger point. This is why proper position sizing and constant monitoring of your equity are essential.

Understanding Margin Level

Brokers use your margin level (%) to determine when to issue a margin call. The formula is:

Margin Level (%) = (Equity ÷ Used Margin) × 100

When this level reaches the broker’s margin call threshold—often 100%—you’ll receive a warning and may be restricted from opening new trades.

If your margin level keeps dropping to the stop-out level, typically around 50%, the broker will begin closing your positions, starting with the most unprofitable ones, until your account stabilizes.

Monitoring your margin level regularly helps you stay in control and avoid forced trade closures.

Example: How Small Price Moves Can Trigger a Margin Call

Small Price Moves Can Trigger a Margin Call

Here’s an example that illustrates the risk of using oversized positions:

- Account balance: $10,000

- Trade: Buy 80 mini lots of EUR/USD with 1% margin

- Used margin: $8,000

- Free margin: $2,000

In this setup, each pip movement is worth $80. A 25-pip loss would wipe out your $2,000 in free margin. Once you factor in the spread, even a 22-pip move against your position could trigger a margin call.

This example highlights how quickly large position sizes can drain your account and why managing trade size is crucial for survival.

Margin Call vs. Stop-Out in Forex

It’s essential to understand the difference between these two terms:

- Margin Call: A warning from your broker that your equity has dropped too low. You won’t be able to open new trades until your margin level improves.

- Stop-Out: An automatic action taken by the broker, closing your losing positions to prevent your account from going negative.

In short, a margin call gives you time to act—a stop-out doesn’t.

Start Your Trading Journey Today

Sign Up Now

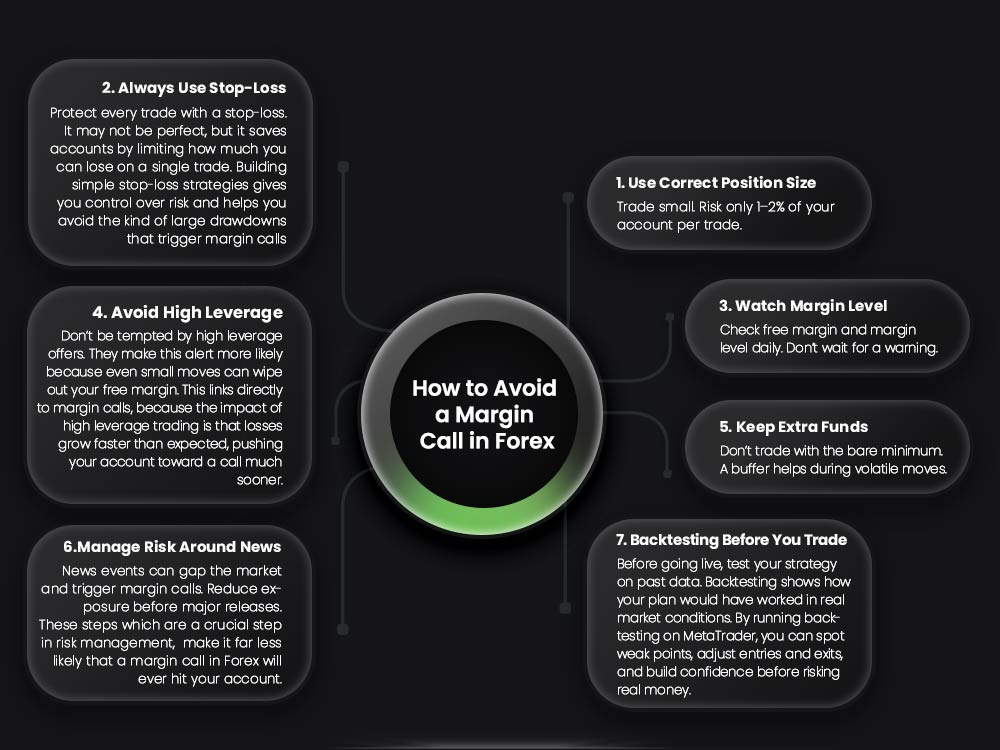

How to Avoid a Margin Call in Forex

How to Avoid a Margin Call in Forex

1. Use Proper Position Sizing

Keep your trade sizes small. Risk no more than 1–2% of your account balance on a single trade. This keeps losses manageable and prevents large drawdowns that could lead to a margin call.

2. Always Set a Stop-Loss

Every trade should have a stop-loss in place. It’s not a guarantee against loss, but it limits potential damage and protects your account. Developing simple, consistent stop-loss rules gives you greater control over your risk and helps prevent equity from falling too far.

3. Monitor Your Margin Level

Make it a habit to check your free margin and margin level every day. Don’t wait for your broker’s warning—stay ahead of potential issues.

4. Avoid Excessive Leverage

High leverage may look attractive, but it magnifies both profits and losses. Even small price swings can quickly erode your free margin and trigger a margin call. Use conservative leverage to keep your trades sustainable.

5. Maintain a Cash Buffer

Never trade with the bare minimum margin. Keeping extra funds in your account provides a cushion during volatile periods, helping you stay in trades longer without hitting a margin call.

6. Manage Risk During News Events

Major economic announcements can cause sudden market gaps. Reduce position sizes or avoid trading around high-impact news releases to prevent unexpected losses.

These practices are essential components of forex risk management and make margin calls far less likely.

7. Backtest Before Going Live

Test your trading strategy on historical data before risking real capital. Backtesting—using platforms like MetaTrader—reveals weaknesses, refines your entry and exit points, and builds confidence in your approach under real market conditions.

What to Do If You Receive a Margin Call

- Add Funds: Depositing more money increases your equity and restores free margin.

- Close Some Trades: Reduce your open positions to lower the used margin and free up space in your account.

Ignoring a margin call is dangerous—the next step is a stop-out, where the broker automatically closes your trades, and you lose control of which positions are liquidated.

Common Mistakes That Trigger Margin Calls

Common Mistakes That Lead to Margin Calls

Avoid these common habits that often result in a margin call in Forex:

- Taking oversized positions

- Holding too many trades at once

- Trading without a stop-loss

- Adding to losing positions (“averaging down”)

- Trading impulsively during major news events

These practices quickly reduce your free margin and significantly increase the risk of a margin call.

Quick Tips to Stay Safe

- Keep your margin level above 200% whenever possible

- Risk only a small percentage of your account per trade

- View free margin as your safety cushion

- Cut losses early instead of hoping for a reversal

- Focus on steady, consistent growth rather than chasing fast profits

Following these tips greatly lowers your chances of facing a margin call. Choosing the right currency pairs also helps—pairs with smoother movement and lower spreads give you more control over risk and account stability.

Final Thoughts

A margin call in Forex isn’t random—it’s the direct result of risky trading decisions and poor risk management.

By understanding how to calculate margin requirements, keeping your positions small, and always using stop-loss orders, you can avoid it entirely.

The objective is simple: stay in the market for the long term. Smart, disciplined management protects your capital and keeps you trading sustainably.

At Dominion Markets, traders benefit from tight spreads and even 0.0 pip pricing, helping reduce costs and giving your trades more room to breathe before margin pressure becomes a concern.

Start Your Trading Journey Today

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Free Crypto Signals Subscribe via Telegram

Free Forex Signals Subscribe via Telegram

Free VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) Subscribe via Telegram

Free Trading Acoount Open With ORON LIMITED Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices)

Open Account

Not profitable? Don’t worry! Join our copy trading system where we provide lower risk returns. Benefits of Joining Us:

-Lesser Risk as lot size is minimal

-Higher returns (approx. 5% to 10% monthly)

-Easy Deposit and Withdrawal with USDT using crypto wallets

-Lesser Drawdown

-Instant Support

-Invest Now and get guaranteed returns with us. DM us for more info❤️

-Start Now

*Copy Trading is free but we charge some percentage of profit as fees.*

Full VIP signals performance report for September 22–26, 2025: